After the release of the US CPI (Consumer Price Index) and PPI (Producer Price Index) last week — two important economic indicators affecting the Federal Reserve's monetary policy — traders and investors continue to monitor data that impacts cryptocurrencies.

The cryptocurrency market will track four US economic indicators this week as the impact of macro events on Bitcoin (BTC) continues to increase.

Top US Economic Data for the Crypto Market This Week

The following US economic data may affect sentiment towards Bitcoin and cryptocurrencies this week.

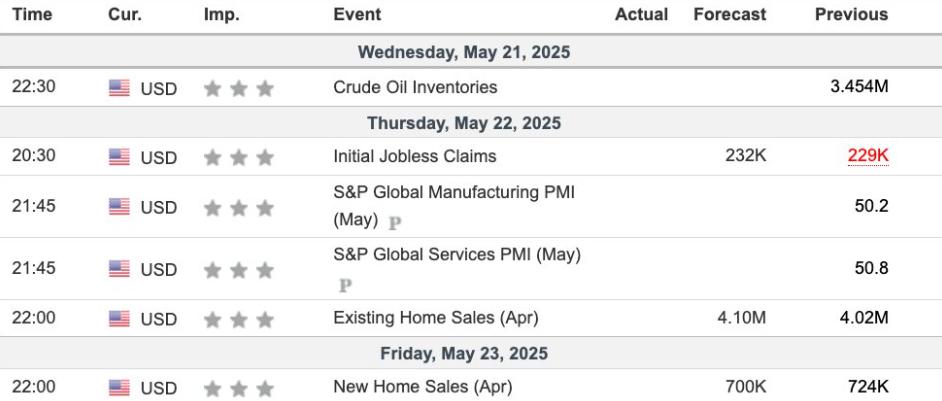

US Economic Indicators This Week. Source: Trading Economics

US Economic Indicators This Week. Source: Trading EconomicsInitial Jobless Claims

Initial jobless claims, reported weekly, measure the number of first-time unemployment benefit applicants. This indicator reflects the labor market health for the cryptocurrency market, influencing investor sentiment and monetary policy expectations.

"...A core labor market indicator can change market expectations about Fed policy," an indicator expert noted in a post.

Data on Trading Economics shows a consensus forecast of 232,000 after the previous figure was 229,000. This suggests economists predicted economic weakness last week, a sentiment that could drive cryptocurrencies if investors seek risk hedges amid uncertainty.

Conversely, initial jobless claims below 229,000 in the week ending 05/17 would signal a strong economy. This could strengthen the USD and pressure risky assets like Bitcoin, as it might lean towards potential monetary policy tightening.

In this context, cryptocurrency traders will monitor this data, expected to be released on Thursday, for potential volatility. It impacts USD strength and the Fed's interest rate decisions.

Recent trends show no signs of labor market stress, indicating stability despite tariff-related uncertainties.

Services PMI

Published monthly by S&P Global, the Services PMI measures activity in the US service sector. This US economic indicator covers sectors like transportation, finance, and hospitality.

For the cryptocurrency market, the Services PMI affects risk sentiment and USD momentum. A reading above 50 indicates expansion, while below 50 signals contraction.

Strong data, like the April Services PMI at 50.8, suggests economic resilience, potentially strengthening USD and reducing interest in speculative assets like Bitcoin. Conversely, weak data, potentially below the previous 50.8 or 50.0, could boost cryptocurrency prices by signaling a slowdown.

Cryptocurrency traders monitor this indicator for its impact on macroeconomic trends, as services represent a significant portion of US GDP.

With a forecast for May's preliminary PMI at 50.8, a drop below 50 could boost Bitcoin by highlighting economic weakness, especially amid tariff concerns.

The release on Thursday, 05/22, alongside manufacturing PMI and jobless claims, could increase volatility, especially if results differ from expectations.

Manufacturing PMI

Reported by S&P Global, the Manufacturing PMI measures activity in the US manufacturing sector. Like the Services PMI, a reading above 50 indicates expansion and below 50 signals contraction. For the cryptocurrency market, this indicator reflects industrial health and impacts USD strength and risk appetite.

Recent tariff policies have pressured manufacturing, with April's PMI decline related to supply chain disruptions. This has increased the attractiveness of cryptocurrencies as a risk hedge.

Cryptocurrency traders will monitor the preliminary PMI release on Thursday for directional signals, with forecasts near 49.8. A reading below this forecast could trigger a cryptocurrency price surge, signaling deeper economic challenges. However, if it exceeds 50, or the April 50.2 level, it might constrain cryptocurrency price increases.

"April 2025 PMI data shows manufacturing contracting (PMI 50.2) and services slowing (PMI 50.8), signaling tariff impacts and domestic demand weakness," a user noted on X (Twitter).

Existing Home Sales

The National Association of Realtors reports monthly existing home sales, tracking the annual rate of used home transactions.

The latest data shows an expected 700,000 home sales in April 2025, down from March's 724,000. For the cryptocurrency market, this indicator reflects consumer confidence and housing market health, indirectly shaping monetary policy and risk sentiment.

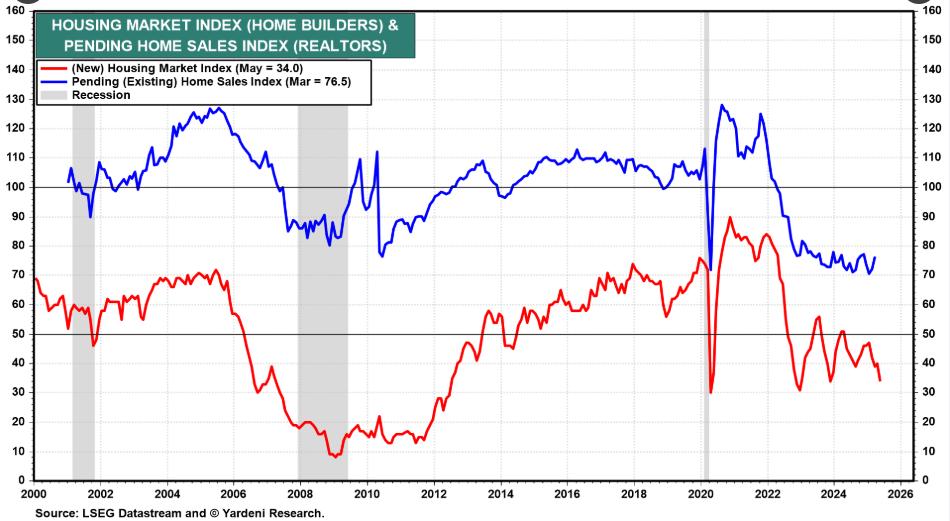

Existing and New Home Sales. Source: Rymond Inc on X

Existing and New Home Sales. Source: Rymond Inc on XA significant drop to 700,000 signals economic slowdown, potentially boosting cryptocurrencies as investors seek alternatives. This decline, combined with tariff pressures and high mortgage rates, could increase Bitcoin's attractiveness as a hedge, especially if coupled with weak PMI or Unemployment Claims.

"Current house sales volume in April is expected to reflect the housing market's response to high interest rates and limited supply," a user on X commented.

Conversely, if sales remain stable or exceed expectations, it could strengthen the USD, putting pressure on cryptocurrency prices as confidence in traditional markets increases.

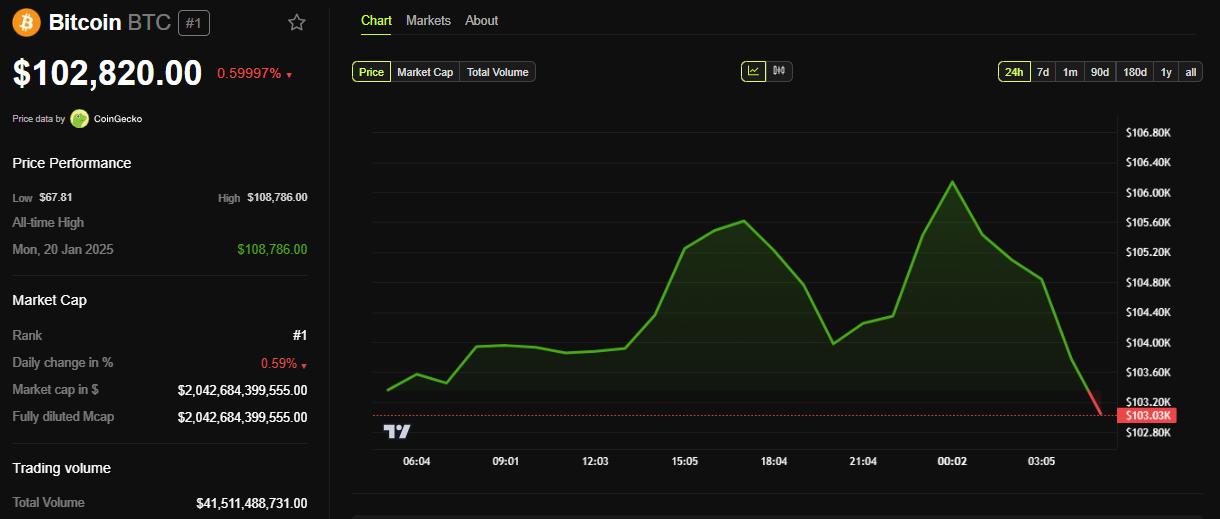

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Bitcoin (BTC) Price Performance. Source: BeInCryptoAt the time of writing, Bitcoin was trading at $102,820, down 0.5% over the past 24 hours.