This article is machine translated

Show original

💎 08 Insights to Grasp When Investing in DePIN 2025

These are insights compiled by @jackvi810 from Messari's 8 infographics. If investing in #DePIN coins, you should carefully understand these 8 factors.

For example:

- Classification of DRNs and PRNs

- Valuation based on revenue

- Revenue model

- Expenses

Upside GM

@gm_upside

05-19

Anh em hold coin cùng hệ/cùng mảng hãy lưu ý!

I. Blockchain L1 $BTC $TON $APT $AVAX...

II. Hệ Solana $SOL $JUP $RAY $JTO...

III. Hệ Sui $SUI $WAL $DEEP...

IV. Mảng AI $TAO $WLD $FET...

V. ETH OG $UNI $MKR $AAVE...

VI. ETH L2 $OP $ARB $STRK...

VII. ETH Staking $LDO $RPL... x.com/gm_upside/stat…

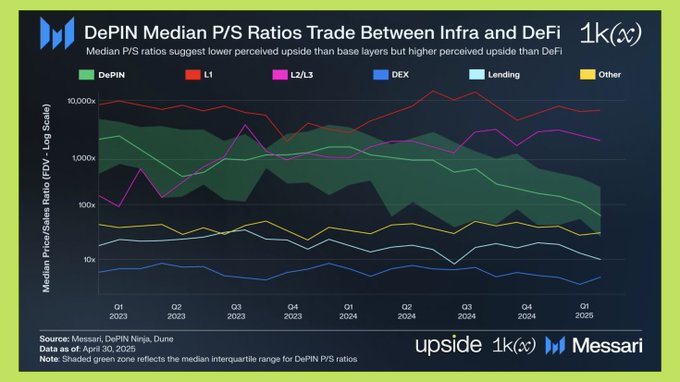

8. How is DePIN being valued compared to L1 and DeFi?

DePIN is positioned between L1 (Layer-1) and DeFi in terms of P/S ratio.

- Specifically, L1s like Ethereum and Solana have the highest P/S (around 1000x), thanks to a strong narrative about their fundamental Vai in the ecosystem.

In short

👉DRNs are priced higher than PRNs: DRNs Medium FDV $132M, PRNs $36M (3.5x), thanks to narrative AI/cloud, scalability, infrastructure costs $2K/year vs $300/year.

👉Revenue has a weak impact: Pearson correlation 0.36, revenue impacts pricing but liquidity

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share