Core Scientific (CORZ), Robinhood Market (HOOD), and Strategy Incorporated (MSTR) are drawing attention today. CORZ rose after appointing Elizabeth Crane to the board and strengthening its transition to AI infrastructure.

HOOD confirmed the acquisition of Wealthsimple for 250 million Canadian dollars to compete in Canada. MSTR purchased 7,390 BTC for 765 million dollars, increasing its total holdings to over 576,000 BTC, and is facing a class action lawsuit regarding its Bitcoin-centric strategy.

Core Scientific (CORZ)

Core Scientific (CORZ) closed with a slight 0.65% increase yesterday and was already up 5% in pre-market trading after appointing Elizabeth Crane to the board.

Crane has over 30 years of experience in investment banking and private equity, co-founding Moellis & Company and holding senior positions at UBS. She will play a crucial role as the chair of the audit committee in continuing Core Scientific's strategic transition to AI-related infrastructure.

Her appointment and Jordan Levy's chairmanship represent a critical moment in strengthening the leadership team amid the company's broad business focus and operational transformation.

CORZ's chart shows signs of new strength with a potential golden cross forming on the exponential moving average (EMA) line. Analyst opinions are overwhelmingly positive, with 16 out of 17 analysts rating the stock as "strong buy" or "buy", and a one-year target price averaging $18.28, indicating a potential 68.49% upside.

If momentum is maintained, the next major resistance level is $13.18 and could be tested in the short term.

However, investors should carefully watch support at $10.34. If it fails, the stock could retrace to $9.45 or even $8.49.

Robinhood (HOOD)

Robinhood officially announced a significant step in its Canadian expansion strategy by acquiring Toronto-based Wealthsimple for 250 million Canadian dollars.

The deal provides a 41% premium over Wealthsimple's last closing price and will bring Wealthsimple's 115-person team and established crypto brands like Bitbuy, Coinsquare, and Smartpay under Robinhood Crypto's umbrella.

The acquisition is expected to be completed in the second half of 2025 and is anticipated to significantly strengthen Robinhood's crypto presence in Canada.

Johan Kerbrat, an executive at Robinhood Crypto, recently emphasized the company's focus on tokenization and financial accessibility, highlighting how fractional assets like real estate could open markets previously inaccessible to everyday investors.

The company has submitted a 42-page proposal to the SEC to explore a federal framework for tokenized real-world assets, aiming to bring traditional financial markets on-chain with legally recognized asset-token equivalence.

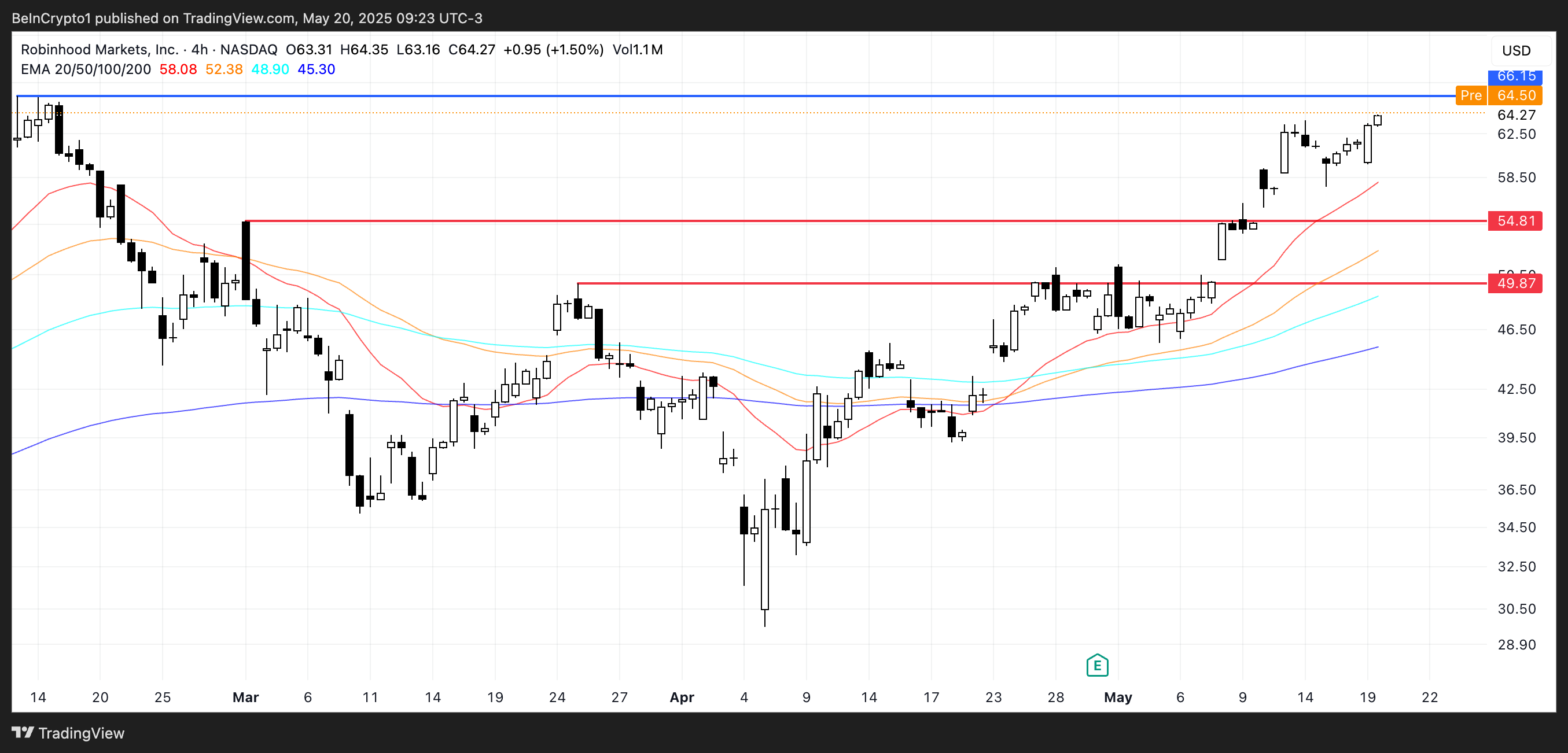

HOOD stock closed 4% higher yesterday and slightly up in pre-market trading, extending a remarkable 56% rally over the past 30 days. Technically, the stock's chart shows strong momentum, with short-term EMA lines clearly positioned above long-term trends, suggesting continued bullish sentiment.

The next major resistance is at $66.15, and breaking this could see HOOD enter uncharted territory, potentially surpassing $70 and setting new all-time highs.

Strategy Incorporated (MSTR)

Strategy (formerly MicroStrategy) added 7,390 BTC to its treasury, spending approximately 765 million dollars while Bitcoin was trading above $100,000.

With this latest purchase, total holdings reached 576,230 BTC, an asset bought for 40.2 billion dollars and now valued at over 59.2 billion dollars, reflecting approximately 19.2 billion dollars in unrealized gains. However, its aggressive Bitcoin strategy continues to face criticism.

The company is facing a class action lawsuit alleging misrepresentation of risks associated with its Bitcoin-centric investment approach, including CEO Michael Saylor.

Despite legal pressures, Strategy remains the largest corporate Bitcoin holder. Its Bitcoin-first approach has inspired similar financial strategies in Asia and the Middle East.

MSTR closed 3.4% higher yesterday and was down 0.47% in pre-market trading. The stock has risen almost 43% in 2025. Currently trading near a key support of $404, losing this could see it drop to $383.

If momentum returns, MSTR could rise to $437. Analyst opinions are strong—16 out of 17 rate it as "strong buy" or "buy". The one-year average target price of $527 suggests a 27.5% upside potential.