Welcome to the US Crypto News Morning Brief—where we provide the most important cryptocurrency information for today.

Enjoy a cup of coffee as we explore Bitcoin's position among top assets and the impacts of rising Treasury yields on Bitcoin. As investors increasingly lose confidence in US debt sustainability, concerns about deficit, and Bitcoin's appeal as a hyperinflation hedge grow, with the Federal Reserve (Fed) buying bonds signaling inflation concerns.

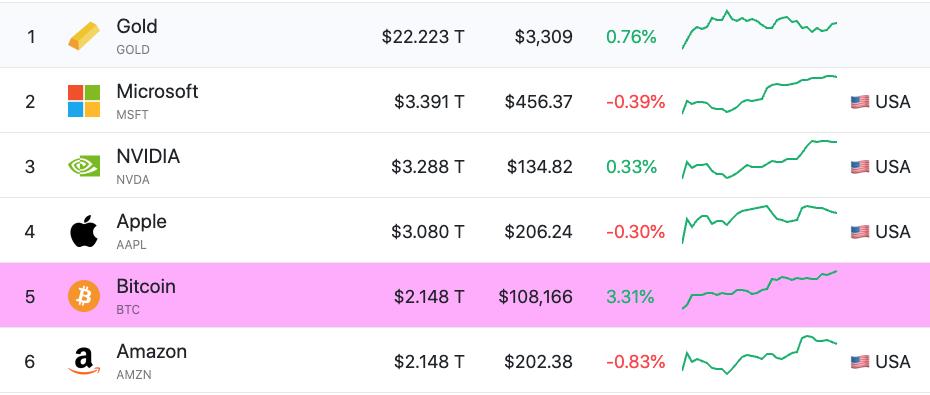

Cryptocurrency News of the Day: Bitcoin Surpasses Amazon and Google After Reaching ATH

A recent publication by US Crypto News reports that Bitcoin has surpassed Google in market capitalization rankings. At the time of writing, its market cap reached $1.86 trillion.

The latest data shows Bitcoin's market cap has increased to $2.16 trillion, rising 14% since 04/23. With this, Bitcoin has risen to the sixth position in market cap indices, surpassing Google and approaching Amazon.

"Bitcoin surpasses Google and is now the 6th largest asset on the planet, overtaking Alphabet (Google) with a market cap of over $2 trillion. BTC is now only behind Gold, Microsoft, Nvidia, Apple, and Amazon. This is not just a number—this is history in the making," wrote Bitward Investment's co-founder and COO, Dariusz Kowalczyk.

Assets by Market Cap. Source: Companies Market Cap

Assets by Market Cap. Source: Companies Market CapSentiment on X (Twitter) suggests Bitcoin is on track to surpass Amazon. This could happen soon, as there is only a small 2.7% difference in market cap between these two assets.

Other users are optimistic that Bitcoin might overtake gold and become the largest asset by market capitalization.

Indeed, this optimism is well-founded, as Bitcoin remains among the top assets that have reached the $1 trillion market cap threshold in record time.

Meanwhile, Bitcoin's growth is unsurprising, as its influence grows amid economic instability. For example, Bitcoin is emerging as a strong alternative in Japan as the country faces high inflation. Inflation in the country has reached 3.6%, now exceeding the US Consumer Price Index (CPI).

Additionally, a recent US Crypto News publication noted Bitcoin's emerging role as a risk hedge against US Treasury and Traditional Finance (TradFi).

"I think Bitcoin is a risk hedge against both TradFi and US Treasury risk… The number one purpose of Bitcoin in an investment portfolio is as a risk hedge against the current financial system, thanks to its decentralized ledger," said Geoff Kendrick, Head of Digital Assets Research at Standard Chartered, in a recent interview with BeInCrypto.

Robert Kiyosaki Says No One Wants US Bonds

In another development, Rich Dad Poor Dad author Robert Kiyosaki noted that a US Treasury bond auction failed on 05/20, with the Fed buying $50 billion of its own bonds.

"What happens if you throw a party and nobody shows up? That's what happened yesterday. The Fed held a US bond auction and nobody showed up. So, the Fed quietly bought $50 billion of its fake money with fake money," wrote Kiyosaki.

The famous economist said Columbia University Professor Charles Calomiris warned about this scenario in 2023. He cited investors' loss of confidence in US debt sustainability, which could drive inflation by increasing money supply.

Specifically, Kiyosaki predicts hyperinflation and financial collapse for many, while forecasting significant price increases for alternative assets.

"Good news. Gold will go to $25,000. Silver to $70. Bitcoin to $500,000 to $1 million," he added.

This sentiment emerges as these assets serve as inflation hedges amid concerns about increasing money supply. His $500,000 Bitcoin target aligns with Standard Chartered's forecast, also reported in a recent US Crypto News publication.

However, according to Kiyosaki, a broken monetary system is causing economic problems, with investors supporting stable currencies like gold or Bitcoin.

Chart of the Day

Bitcoin Reaches New ATH. Source: TradingView

Bitcoin Reaches New ATH. Source: TradingViewByte Size Alpha

Here's a summary of some cryptocurrency news in the US today: