Hyperliquid recently surpassed the trading volume of perpetuals exchange dYdX, reaching $1.5 trillion. Despite being a much newer platform, Hyperliquid's token buyback and lack of cash incentives have provided long-term stability.

To be fair, Hyperliquid has also been involved in much larger controversies, notably the delisting of JELLYJELLY to counter a short squeeze earlier this year. However, the platform has rebuilt its reputation and generated high trading volume.

Hyperliquid's Trading Volume Surpasses dYdX

Hyperliquid, a high-performance L1 trading blockchain, has achieved significant recent success. Earlier this month, it captured over 60% of the perpetuals trading market, and its HYPE token reached a three-month high shortly after.

Yesterday, analysts noticed that Hyperliquid's All-Time-High trading volume surpassed dYdX, and today it has reached $1.5 trillion.

dYdX is a decentralized perpetuals exchange that has been operating for five years, while Hyperliquid's platform was only launched in 2023.

However, the younger protocol has overtaken it. After launching its native token in 2021, dYdX began using it to refund trading fees to users, increasing trading volume. It then created excitement in the community around an unofficial "trading competition" with competitors.

In contrast, Hyperliquid did not rely on dYdX's incentive strategy. After its own TGE last year, it accumulated large volume through functionality, word of mouth, and product quality.

2024 is a peak year for crypto perpetuals trading, and the HYPE TGE capitalized on this timing. This approach seems to have proven more sustainable.

Additionally, Hyperliquid dedicates most of its trading fees to token buybacks, which dYdX only implemented a few months later, and to a lesser extent.

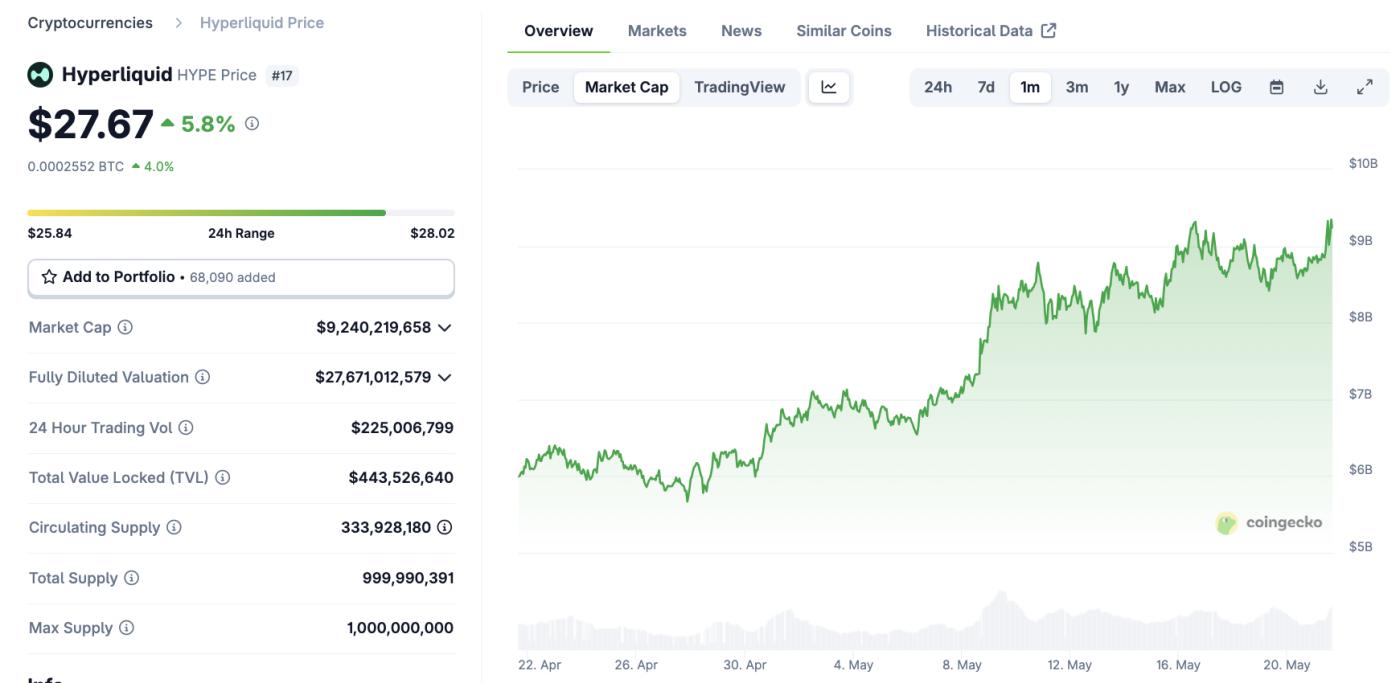

This has helped the company buy back 17% of the circulating HYPE tokens, providing significant advantages. Over the past month, HYPE's market capitalization has steadily increased to nearly $10 billion:

Hyperliquid (HYPE) Market Cap. Source: CoinGecko

Hyperliquid (HYPE) Market Cap. Source: CoinGeckoDespite its growth, Hyperliquid has also faced some major controversies. For example, it denied allegations of a security breach by the Lazarus Group despite clear on-chain evidence last year.

In March 2025, it caused a major scandal by delisting JELLYJELLY to counter a short squeeze. This led to market manipulation accusations and significant losses.

dYdX has not faced such a public scandal for many months, but Hyperliquid acted quickly to rebuild its reputation. So far, this seems to have been effective.

This morning, Hyperliquid also reached a new All-Time-High in open interest, exceeding $8 billion. If it can maintain this momentum, the exchange could build a strong leading position in the DeFi perpetuals market.