summary

Over the past two years, Jito Tips have evolved from a niche tool for MEV extraction to the primary mechanism for transaction prioritization on Solana. Today, they account for the majority of non-base fees on the network and shape how users (from high-frequency traders to regular front-end users) compete for block space.

This report provides a data-driven analysis of how Jito Tips are being used, who is using them, and why. We analyze wallet-level behavior, protocol attribution, volatility response, and user segmentation—revealing that while tip usage is widespread , tip volume remains concentrated in high-value, latency-sensitive activities .

Key findings include:

Jito now accounts for more than 60% of total priority fees , up from about 10% in April 2023. Volatility doesn't increase the number of tip events - it increases the amount spent on tips. A small number of MEV-driven participants are responsible for the majority of tip volume, especially in PvP environments such as Pumpswap and Pump.fun . Increasingly, users are providing tips passively through the frontend , using small default tips for reliability - not advantage. Protocol-level attribution shows the changing dynamics of tip flows, with Raydium v4 being overtaken by newer platforms like Pumpswap as memecoin migrates away.

Jito has quietly become the invisible engine of Solana’s execution layer — not just as a competitive tool, but as a baseline capability. As adoption continues and integration deepens, its impact on how blockspace is priced and prioritized will only grow.

Jito Tip usage trends ( DATA )

Clear shift to Jito

One of the most consistent trends observed is the growing dominance of Jito Tips over native priority fees:

In April 2023, Jito Tips accounted for only about 10% of the SOL paid in priority fees. As of early 2025, Jito regularly exceeds 60% of total priority fee volume.

This suggests that Jito has become the preferred mechanism for transaction inclusion , especially among high-value or latency-sensitive participants, such as MEV participants.

Late 2024/Early 2025 Surge: Surge in Wallet Participation

Between late October 2024 and January 2025, the network not only saw an increase in fees, but also a sharp increase in the number of wallets providing tips through Jito .

It’s not just that MEV robots are paying more. The surge is driven by:

Jito Tips quickly integrates into wallets, aggregators, and Telegram bots A wave of new users passively providing tips via default settings Even ordinary users need faster inclusion of high throughput cycles

Jito effectively moved from a niche execution tool to the default inclusion layer for everyday users . Adoption skyrocketed — not from strategy, but from seamless UX design.

The peak occurred in January 2025 and then gradually decreased, which may be due to:

Memecoin speculation Seeker Experiment Volatility Cooling

Nonetheless, the impact was lasting: even as total fees returned to Q3 2024 levels, the number of wallets tipping via Jito per day more than doubled — signaling a broad behavioral shift that remains in place within the Solana UX.

Composition of Jito tip

We built a multi-layered attribution system: direct program ID checking, internal instruction parsing, and proximity-based inference. This allows us to confidently label the source protocol of most tips, even bundles with minimal context. This process involves four key stages:

Step 1: Collect Tip Transactions

We first collect all Solana transactions that sent SOL to known Jito tip wallet addresses during the selected time period. This forms the original dataset - the complete set of transactions involving Jito tip.

Step 2: Program Attribution Logic

Next, we determined the actual fees paid by each tip by identifying which DeFi program (if any) each tip is associated with. We applied a hierarchical attribution process with three layers:

Transaction-level attribution: We first examine the top-level instructions in each transaction to find known DeFi program IDs. Internal Instruction Attribution: If no match is found, we parse the internal instructions of the same transaction to find other program IDs. Signer-Block Proximity Heuristic:

In many cases, tip transactions contain only basic SOL transfers — no explicit programmatic interactions. This is because users often submit a Jito bundle that includes multiple transactions (e.g., swaps, mints, sniping) as well as a tip included in an incentive block.

To capture these indirect cases, we scanned other transactions signed by the same user in the same block. We then parsed the external and internal instructions of these nearby transactions to check for interactions with known DeFi programs. If found, we attributed the corresponding tips accordingly.

Step 3: Handling multi-program transactions

When a single tip transaction is associated with multiple program IDs, we evenly distribute the tip amount and transaction count across the identified protocols. This avoids double counting and ensures balanced attribution.

Step 4: Unattributed Transactions

Any tip transaction that cannot be reliably linked to a known DeFi program is classified as "other" . These cases generally include:

Custom contracts Novel or niche integration Tips triggered by fuzzy activities or tools

What the data shows ( DATA )

We analyzed four snapshots of Jito tip activity and compared:

Tip Events – The number of Jito tip transactions interacting with a given protocol. Tip Amount (SOL) – The total amount of SOL provided to Jito in transactions involving the protocol.

May 10-17, 2024

Raydium v4 dominates both tip events and total fee volume, accounting for the largest share of urgent transactions on Solana. jup_v6, Photon, and Meteora are clear performers, while a variety of smaller contracts make up the long tail. The large “Other” category highlights early expansion of unclassified MEV and bot activity.

October 10-17, 2024

Raydium v4 maintained its dominance in fee volume and moved up further in relative event count. jup_v6 and Pumpfun also moved up in both metrics, indicating increased intensity of use. Notably, Labeled_mev_bot_1 emerged as a visible contributor, and “Other” remained large – indicating growing activity from emerging or unidentified programs.

January 10-17, 2025

Raydium v4 still leads all categories, but at a reduced rate, while Pumpfun and Meteora gain momentum. The increase in diverse, low-frequency players (e.g., Bonkbot, Zeta, Photon) reflects the expansion of ecosystem usage. “Other” continues to shrink as more contracts are properly attributed.

April 1-8, 2025

Pumpfun surged to new highs in both tip event share and total fee volume, surpassing many previously dominant protocols. Pumpswap also emerged strongly, absorbing the majority of priority fees - most of which were previously associated with Raydium v4. Notably, Bloom Router gained significant traction during this period, becoming one of the top tippers by volume. Meanwhile, Jupiter v6 fell sharply in both event count and fee share, with network relevance dropping dramatically compared to the previous snapshot.

explain

Over time, the composition of Jito tips has changed — not only in terms of which protocols dominate, but also in terms of fragmentation and diversity in usage.

Tip Volume is tracking PvP activity

As Jito becomes more embedded in Solana’s transaction stack, tip flows increasingly track high-intensity, PvP-style environments. This is particularly evident in the rise of Pumpswap, which by April 2025 had absorbed a significant amount of Jito volume — much of which was previously attributed to Raydium v4.

This reflects a tectonic shift: Pump.fun tokens are maturing into tradable assets and being routed to Pumpswap, not Raydium. MEV — and tips — are following suit.

From Tactics to Default:

Initially used for precise timing of swaps and liquidations, Jito Tips are now also applied to infrastructure-level tasks: oracle updates, rebalancing, automation. The goal is not to win the race - it's to ensure reliability. For many protocols, Jito has become the default include path.

Competitive Inclusion and Distributed Reliability

Not all tips are created equal. Controversial, high-value transactions — such as sniping and liquidations — still drive the majority of tip volume, with bids sometimes exceeding hundreds of SOLs.

Meanwhile, long-tail use cases like order book maintenance and front-end defaults generate many small tips. Market making and hedging strategies rely on throughput and consistency, not dominance — providing just enough tips for smooth execution.

These broader models expand the base of people providing tips, but don’t shift volume much. Ultimately, fee pressure remains focused on volatility — and the users who care most about being first.

Impact of volatility on Jito Tip

To assess how traders adjust their fee strategies in volatile markets, we constructed a dataset that combines on-chain fee data with a custom composite volatility score. This score captures three dimensions of SOL price volatility:

Standard Deviation of Hourly Log Returns – Baseline Price Volatility Maximum 4-hour rolling standard deviation – short-term burst Intraday Peak Percent – Sudden high to low range move

Each day in the dataset consists of:

TIP_EVENTS– Provides the number of Jito tip transactionsTIP_VOLUME_SOL– Total amount of SOL paid in Jito TipsPRIORITY_FEE_SOL– Total amount of SOL paid through Solana’s native priority fee systemJITO_TIP_DOMINANCE– Total non-base fee share paid through Jito Tips

We then calculated Pearson correlations between these variables and daily volatility scores to measure behavioral responses.

What the data shows

TIP_EVENTSshows a very weak positive correlation with volatility (r = 0.05) .

→ This suggests that Jito Tips are not being used more frequently on volatile days – the number of trades with tips barely changes.

On the other hand, TIP_VOLUME_SOLhas a stronger correlation with volatility (r = 0.19) , indicating that more SOL is spent on tips during periods of volatility , even if the number of transactions (TIP_EVENTS) remains constant.JITO_TIP_DOMINANCEalso rises slightly with volatility (r ≈ 0.12), meaning that a higher proportion of marginal fees are shifted through Jito rather than the base Solana fee market.PRIORITY_FEE_SOLalso shows a modest positive correlation (r ≈ 0.15), meaning that traders do respond to volatility by paying more to obtain inclusion — via either mechanism.

explain

The weak correlation between volatility and TIP_EVENTS ( r = 0.05 ) suggests that the number of trades offering Jito tips does not increase meaningfully when the market is volatile. However, the stronger correlation with TIP_VOLUME_SOL ( r = 0.19 ) suggests that on volatile days, more SOL tips are offered per trade .

This means:

Baseline tippers (e.g., regular users and long-tail protocols) continue to tip at their usual levels, unaffected by market fluctuations. During periods of volatility, arbitrage opportunities expand and become more profitable, which means that searchers can afford higher tips . There may also be slightly more high-value opportunities , increasing competition for priority slots.

Additionally, JITO_TIP_DOMINANCE — the share of non-base fees paid through Jito — also shows a positive correlation with volatility (r = 0.12) . This means that, on average, when volatility increases, a larger share of execution fees flows through Jito rather than Solana’s native fee market .

During the volatility, user preferences appeared to subtly shift toward Jito , not through higher adoption rates, but through higher spend per transaction . In other words, users who already relied on Jito became more aggressive in their bids— suggesting that under conditions of uncertainty, they prefer reliability and execution guarantees .

In short, volatility doesn’t expand the base of people offering tips — it raises the stakes for those already competing . When Jito mattered most, it became more execution-centric, not because more people used it, but because those who did use it were willing to spend more for reliability, speed, and priority .

Tip User segmentation and prioritization

This section focuses on key user groups and their reasons for providing tips - although it does not cover every market segment used by Jito. To put things into context, there are approximately 13 million tip transactions per day, with approximately 12,500 SOLs spent on tips per day.

BonkBot Users

jito ~50,000 tx/day | 3K–5K wallets/day | 90–150 SOL/day in tips

Retail users who interact via Telegram bots like BonkBot. They rely on Jito to avoid getting pinched , not to get ahead of others. This group values time and protection , but is more cost-conscious than MEV bots. See activity here

Photon Users

80K–120K Jito tx/day | ~4K wallets/day | ~200–400 SOL/day in tips

These users appear to be routing exchanges through the Photon aggregator, and sometimes indirectly through third-party frontends. It is unclear if Photon itself submits the bundles, or if it is done by the clients, but the volume is significant. See activity here

Custom policy users

This accounts for approximately 12% of all Jito tip activity.

EOA interacts with custom built contracts to batch multiple DeFi calls - swaps, flash loan, liquidations, etc. This group operates similarly to MEV Seekers, but through programmable execution. These contracts often obfuscate logic and chain operations atomically, and often do pool-to-pool arbitrage, liquidations, or just swap in a specific way.

Memecoin Farmer

Behavior: Launch tokens → Simulate demand → Wait for real buyers → Use Jito to run away

Example Mint: Solscan link

Example Sell: Solscan link

A unique class of users has emerged in Pump.fun, Raydium, and Pumpswap — operating what amounts to an on-chain runaway factory. A typical playbook looks like this:

A wallet launches a new token, usually one of many created in quick succession. It uses Jito-tipped transactions to purchase the majority of supply to ensure liquidity control and initial pricing. It simulates organic activity by distributing tokens across a controlled network of wallets, triggering price movements and social signals. If genuine buyers start to come in, the wallet will aggressively sell its position - using a high tip to preemptively exit and avoid slippage. Often, even if there is no real buying, it will exit, unloading into thin liquidity the moment interest fails to materialize.

This group is highly automated, time-sensitive, and likely behind many of the dubious Pump.fun startups. They create hype, simulate demand, and use Jito to guarantee exit liquidity — turning speed into a runaway weapon.

NOTE: Other wallets may not follow this exact script, but use a similar strategy: create or acquire tokens early, simulate interest, and use a high tip exit to quickly unload.

Jito Tip Default User

These users conduct small DeFi transactions through applications such as Jupiter Exchange, Raydium, or other common front-ends, often without realizing they are using Jito tips. Because tips are integrated into many interfaces by default, these users benefit from faster inclusion and protection from MEV without having to consciously opt-in.

They represent a large group of regular users who prioritize convenience and reliability over fine-tuned strategies. Their transactions often include small, default tips, and while their individual impact is small, they contribute to a stable baseline of Jito usage, which keeps the system running smoothly in the background.

Sniper

Snipers fall into two categories: large-scale insiders who drop tips of 10-800 SOL to guarantee entry, and micro-cap bots that spray tiny tips across dozens of launches per day. Both rely on Jito to ensure inclusion at the top of the block — either for precision or probabilistic advantage. You can see examples of some of the largest sniper trades in the section below.

Order book and perpetual contract manager

These users interact with on-chain order books (e.g., Phoenix, OpenBook) and perpetual contract platforms (e.g., Zeta, Drift), using Jito tips to ensure best execution and active position management. They constitute a key class of participants focused on inventory balancing, hedging, and order maintenance .

This group currently accounts for about 10% of Jito tip transactions , although they account for a much smaller share of total tip volume . In previous months, they were even more prominent in terms of volume, but never in terms of total SOL spend - as their strategies tend to be frequent, lower-tip, and precision-focused .

Biggest Jito Deals

Here are some examples of different types of transactions where the Jito tip was exceptionally high — and how the results justified the expense.

Buy 5 million $TRUMP tokens at around $0.20, with a tip of 357 SOL

4JCQ2YWQjqBzXJb8tFKc659fnKLH1qpqK4GauS3ANdFyvJub6esZDaT5sSHhF3GU4TVqJp8LjDaqwb1JBgZpmxD9

We dug deeper into the transaction and found that Trump tokens were immediately sent to a wallet labeled ff.sol , which then distributed them to a large network of wallets. These wallets began selling tokens the same day, with prices ranging from $11 to $36 in the transactions we reviewed ( Example 1 , Example 2 , Example 3 ).

Under conservative assumptions — pricing all sales at just $20 — and backed by a one-time $100,000 Jito tip used to secure the initial allocation, the people behind the move could have walked away with more than $95 million in profits.

Kamino flash loan 50,000 SOL to generate a trading profit of 636 SOL, with a tip price of 547 SOL.

2zCXUjDmhKhHb4hh2UzT5XdsxEXD4cn7VjDAGSJBd6fH1at24UPjGUUFWLwyG1iZcFEC7nEMMiZ7q76KgrWRtqgM

This was a separate transaction that found an inefficiency between two pools of memecoin and arbitraged those pools, generating an instant profit of 89 SOL.

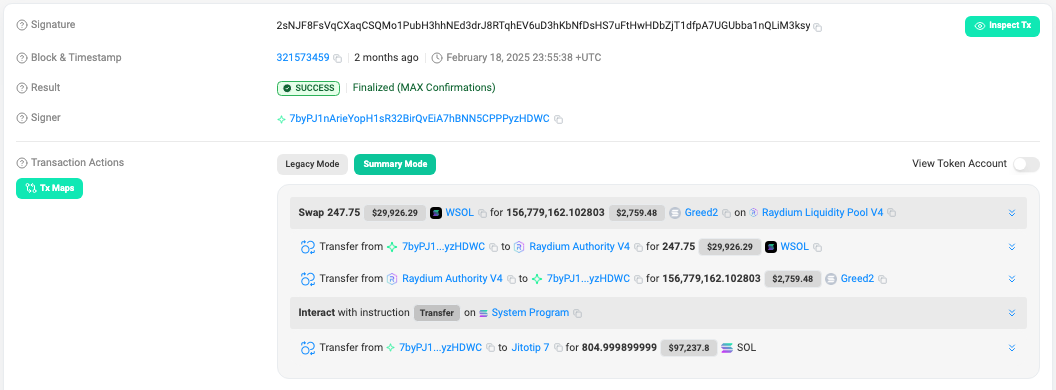

Purchase 156 million Greed2 at a price of 247 SOL tokens and a tip of 804 SOL

2sNJF8FsVqCXaqCSQMo1PubH3hhNEd3drJ8RTqhEV6uD3hKbNfDsHS7uFtHwHDbZjT1dfpA7UGUbba1nQLiM3ksy

Once the tokens were purchased, they began to be sold within 15 seconds. The tipper ended up with a net profit of ~1,400 SOL before the tip was taken into account, and a total net profit of ~600 SOL after the tip was deducted.

Purchase 148 million CURVE at a price of 200 SOL tokens and a tip of 851 SOL

2zCXUjDmhKhHb4hh2UzT5XdsxEXD4cn7VjDAGSJBd6fH1at24UPjGUUFWLwyG1iZcFEC7nEMMiZ7q76KgrWRtqgM

Once the tokens were purchased, they began to be sold within 2 seconds. Without taking the tip into account, the tipper ended up with a net profit of 867 SOL , and after deducting the tip, the total net profit was about 16 SOL.

Final Thoughts

Jito Tips are no longer a niche optimization — they have become the invisible scaffolding of the Solana fee market. What started as a tool for MEV seekers has evolved into a general purpose reliable inclusion system that powers everything from high-risk arbitrage to casual swaps.

Tip usage is deepening, not expanding: more and more users are passively providing tips, but most volume still comes from a small group of latency-sensitive participants who increase their tips during volatility. They spend more because the profits justify it.

Tip behavior is changing along two key axes:

• From tactics (winning slots) → to structure (ensuring inclusion)

• From Manual (custom logic) → To Environment (UX defaults and infrastructure hooks)

The rise of Jito marks a quiet but meaningful shift: inclusion is not guaranteed — it is obtained through competitive bidding. From MEV bundles to front-end exchanges, every transaction now carries a SOL to indicate urgency.

Tipping is more than just a tool — it’s becoming a coordination layer. Most tips today are not for critical status, but they are building muscle memory. When competition is fierce, Jito is already in place as the default bidding mechanism for block space.

source

https://www.helius.dev/blog/solana-mev-report https://flipsidecrypto.xyz/pine/jito-tip-metrics-UJOW\_T https://flipsidecrypto.xyz/studio/queries/760674e3-02c6-4e4a-982a-543b41656bfc https://sandwiched.me/sandwiches https://flipsidecrypto.xyz/studio/queries/6f97de1e-9297-48a3-8175-04082d576335 https://flipsidecrypto.xyz/studio/queries/7be2fb92-2b81-47ee-ab0b-18aea61a3f14 https://flipsidecrypto.xyz/studio/queries/6f97de1e-9297-48a3-8175-04082d576335

Original link: https://pineanalytics.substack.com/p/jitos-role-in-solana-deep-dive