Today, Bitcoin recorded an all-time high, causing waves across the cryptocurrency market. Many altcoins have risen.

One of the biggest beneficiaries is Ethereum (ETH). It has risen by more than 3% in the past 24 hours. This was driven by the resumption of bullish sentiment and a surge in futures market activity.

Ethereum Futures Market Recovery Signal... Traders Prefer Longing Positions

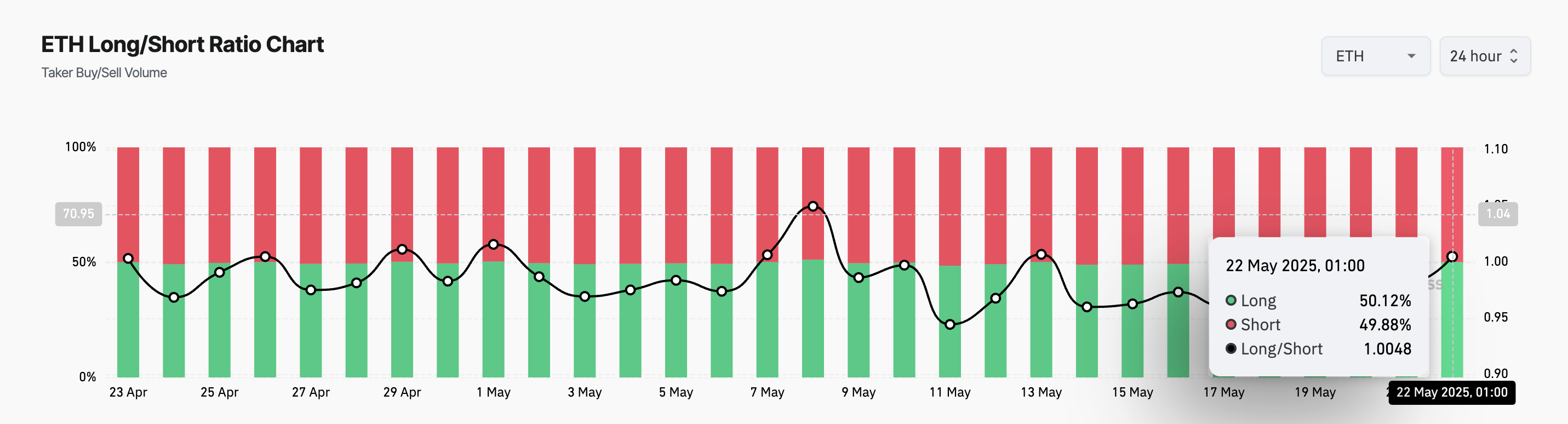

Demand for ETH Longing positions has overtaken Short positions. This is a phenomenon that has not occurred in 11 days. This indicates a notable change in trader positions. According to Coinglass, the ETH Long/Short ratio has exceeded 1. This indicates that more traders are betting on price increases. Currently, this ratio is 1.0048.

The Long/Short ratio measures the proportion of bullish (Long) and bearish (Short) positions in the market. When the ratio is below 1, it indicates that more traders are betting on price declines.

Conversely, when the ratio exceeds 1, as with ETH, Long positions outnumber Short positions. This indicates bullish sentiment and suggests that most traders expect the altcoin's value to rise in the short term.

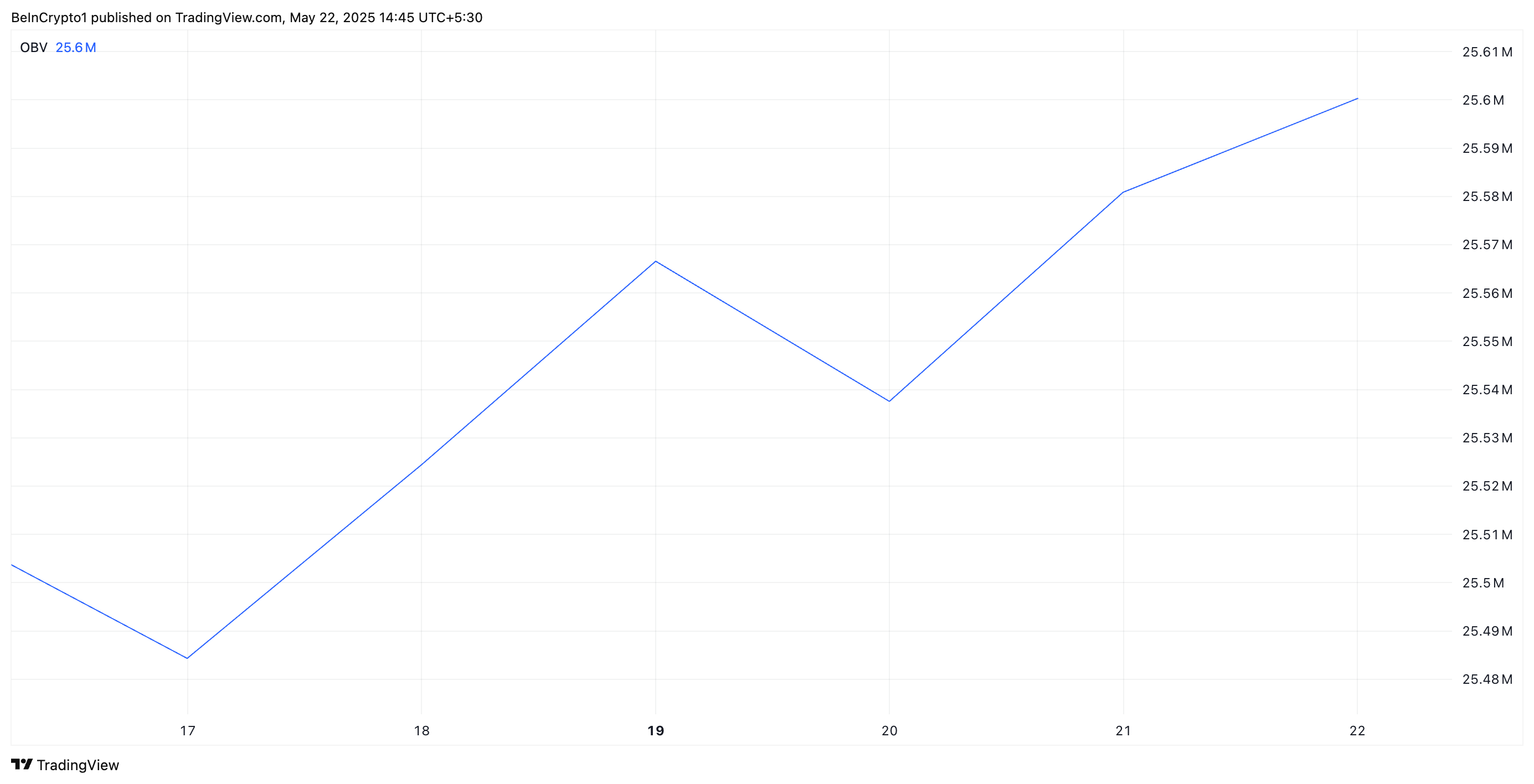

Additionally, the rising on-balance volume on the daily chart confirms the revival of demand for altcoins. This important momentum indicator is currently at 25.6 million.

On-balance volume (OBV) is a technical indicator that measures cumulative buying and selling pressure by adding volume on up days and subtracting volume on down days. A rising OBV indicates a strong increase in volume consistent with price movement. This suggests increasing confidence in ETH's upward trend.

This bullish narrative is further strengthened by expectations of Ethereum's upcoming protocol upgrade and increased institutional participation. In an interview with BeInCrypto, Lennix Lai, Global Chief Commercial Officer at OKX, noted that despite the SEC's delay in approving Ethereum staking ETFs, sentiment remains strong for major coins, which could further drive prices up.

"Despite the SEC's delay of ETH staking ETFs, the Ethereum narrative is clearly gaining attention. This could be driven by the upcoming upgrade (e.g., Fusaka) and bullish news of traditional financial institutions building Ethereum L2 to tokenize real-world assets (RWA)." – Lennix Lai, Global Chief Commercial Officer at OKX

Lai added at the exchange:

"ETH now accounts for almost 27% of spot trading volume, compared to 26.5% of Bitcoin. This completely reverses the dynamics when Bitcoin dominated 38% in April and Ethereum was less than 20%. This signals a clear rotation as traders reposition while Bitcoin consolidates near its all-time high. This is despite Bitcoin setting a new record of $111,730."

He described this trend as "very interesting".

Ethereum Bullish Above 20-Day Moving Average... Rally Towards $2,745

Currently, ETH is positioned above the 20-day Exponential Moving Average (EMA). This confirms the above bullish outlook. This indicator measures the asset's price over the past 20 trading days, giving more weight to recent prices.

When an asset trades above the 20-day EMA, it indicates short-term bullish momentum and suggests buyers are in control. This confirms ETH's price strength and provides a dynamic support level below $2,369.

If the rally strengthens, ETH could rise to $2,745.

However, if selling resumes, this bullish outlook will be invalidated. In that case, ETH's price could drop to $2,424.