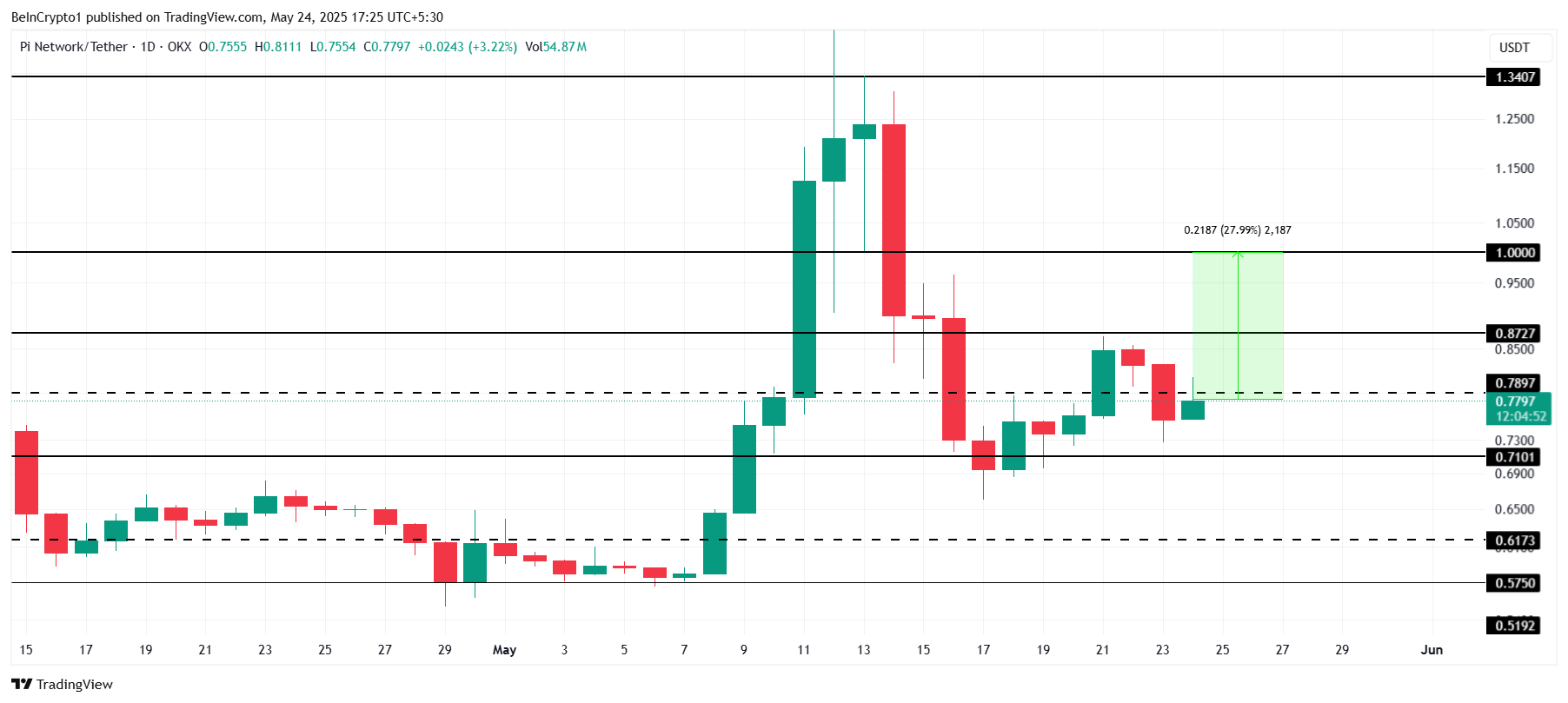

Pi Network (PI) is experiencing difficult times in its recent price movement. After falling below $1, the recovery of altcoins appears to be slowing down.

Unlike previous rebounds, the current market situation suggests that Pi Network may find it more challenging to recover to the $1.00 price level.

Pi Network, Decreasing Interest

The Average Directional Index (ADX) is currently at 32, significantly exceeding the 25 threshold. This figure indicates that the current trend is strengthening. In this case, the Pi Network trend is downward, reinforcing bearish sentiment among traders and investors.

Further evidence of this reinforced downtrend can be seen through the Parabolic SAR indicator. The dots positioned above the candlesticks signal a high probability of continued price decline, a classic indication. These technical indicators often encourage cautious trading behavior and can increase selling pressure.

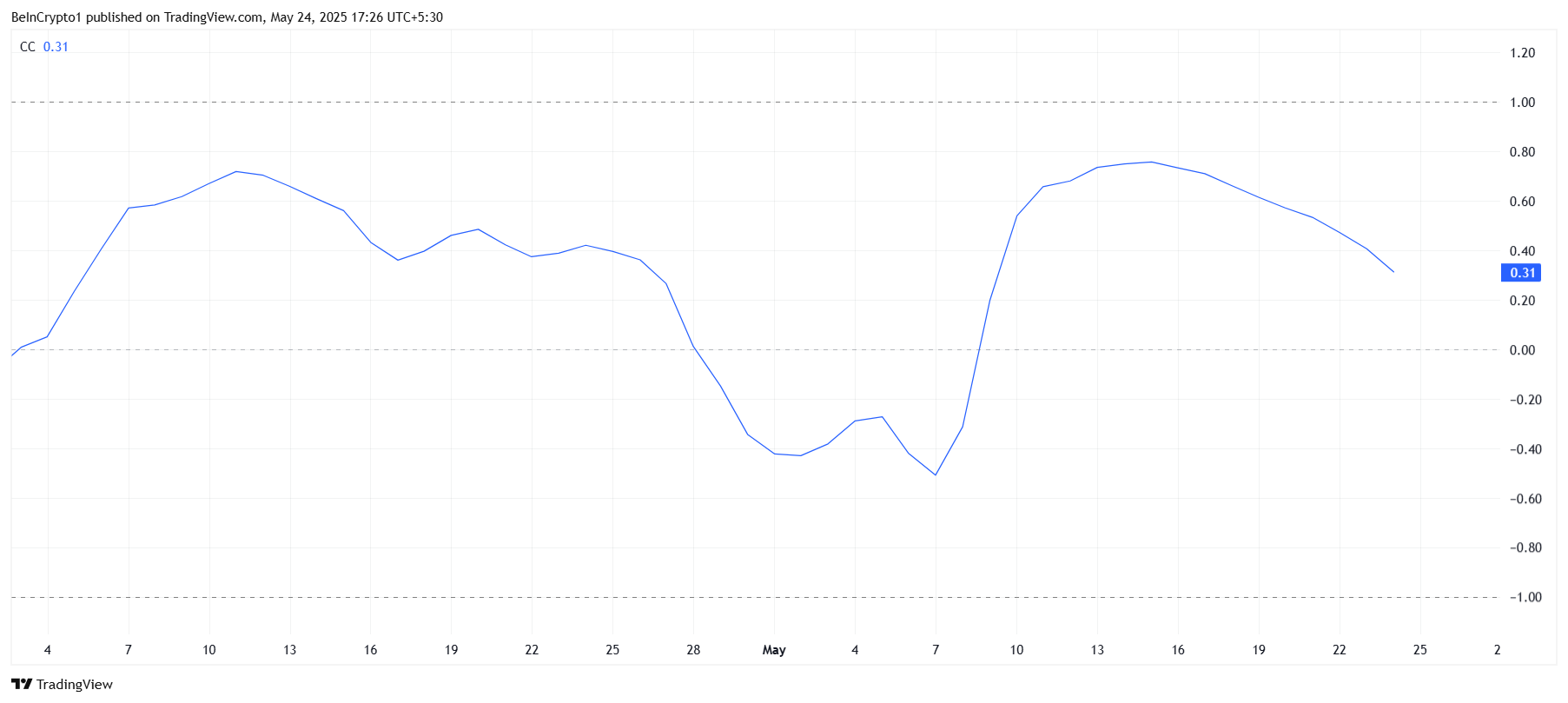

Pi Network's price correlation with Bitcoin is weakening, currently measured at 0.25 and continuously decreasing. This low and declining correlation suggests that PI is beginning to act independently rather than mimicking Bitcoin's movements.

This decoupling is significant. While Bitcoin has recently reached an all-time high (ATH) and may continue rising, Pi Network is unlikely to leverage Bitcoin's strong momentum due to different price dynamics.

The decline in correlation implies that PI may struggle to follow Bitcoin's upward trajectory.

PI Price, Upward Target

Currently priced at $0.77, Pi Network would need to rise approximately 28% to reach $1.00. Considering the strengthening downtrend and weakening correlation with Bitcoin, this price target appears ambitious in the short term.

Reinforced bearishness could weaken investor confidence and increase selling. If the price falls below the critical support level of $0.71, Pi could face additional decline, potentially dropping to $0.61. Such a decline would deepen the bearish outlook.

Conversely, if market conditions improve, Pi Network could break through resistance levels at $0.78 and $0.87. Surpassing these points could invalidate the current bearish logic and create new momentum toward the $1.00 price target.