The cryptocurrency market is a high-volatility environment where highs and lows change rapidly within a day. By tracking tokens that have set new all-time highs (ATH) and all-time lows (ATL), one can early detect bullish and bearish trends. Based on tokens with a market capitalization of over $10 million, this analysis summarizes the main tokens that have set new highs or lows within a day and diagnoses the market's recovery potential and trend by analyzing the correction rates of top market cap tokens and real-time domestic popular assets. [Editor's Note]

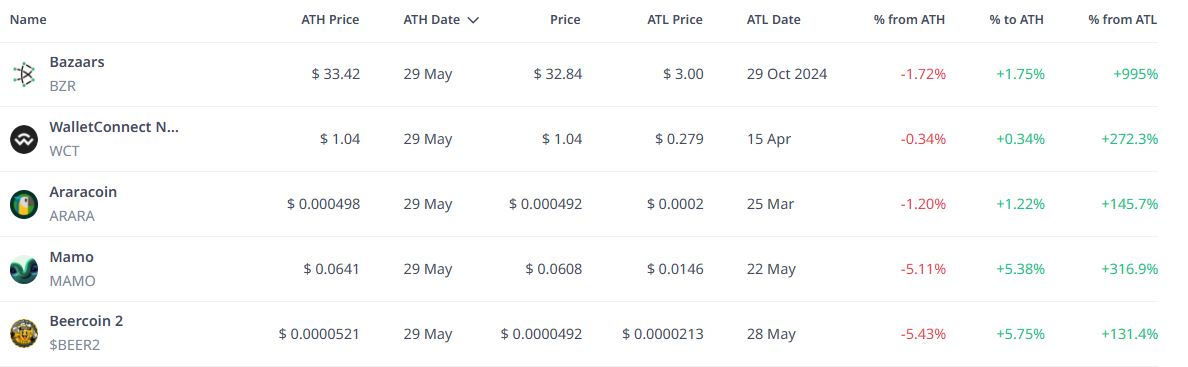

Tokens Renewing All-Time High (ATH)

① Bazaars(BZR): $33.42(ATH) → $32.84(Current) –1.72%

② WalletConnect Name Service(WCT): $1.04(ATH) → $1.04(Current) –0.34%

③ Araracoin(ARARA): $0.000498(ATH) → $0.000492(Current) –1.20%

④ Mamo(MAMO): $0.0641(ATH) → $0.0608(Current) –5.11%

⑤ Beercoin 2($BEER2): $0.000521(ATH) → $0.000492(Current) –5.43%

BZR, WCT, ARARA, MAMO, and BEER2 all renewed their all-time highs on May 29th and are currently experiencing a slight adjustment. Notably, Bazaars has shown a strong rebound, rising 995% from its all-time low of $3.00, while WalletConnect Name Service has recorded a cumulative increase of about 3.7 times its ATL.

Mamo and BEER2 also show price recovery trends with increases of +316.9% and +131.4% respectively after buying at the low point. However, most tokens have surged in a low liquidity environment, so the possibility of expanded correction should also be considered.

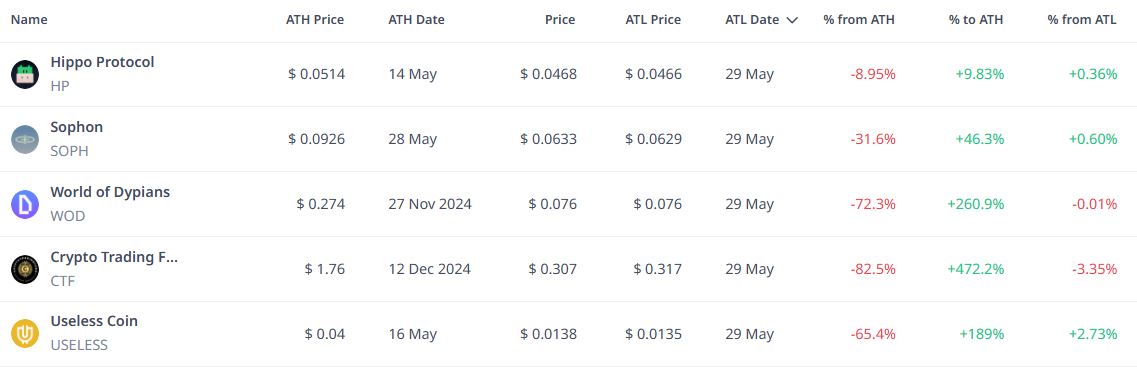

Tokens Renewing All-Time Low (ATL)

① Hippo Protocol(HP): $0.0466(ATL) → $0.0468(Current) +0.36%

② Sophon(SOPH): $0.0629(ATL) → $0.0633(Current) +0.60%

③ World of Dypians(WOD): $0.076(ATL) → $0.076(Current) +0.00%

④ Crypto Trading Fund(CTF): $0.317(ATL) → $0.307(Current) –3.35%

⑤ Useless Coin(USELESS): $0.0135(ATL) → $0.0138(Current) +2.73%

In addition, a total of 5 tokens including ▲Hippo Protocol ▲Sophon ▲World of Dypians ▲Crypto Trading Fund ▲Useless Coin have newly set ATLs. Most of these are down ▲–8.95%(HP) ▲–31.6%(SOPH) ▲–72.3%(WOD) ▲–82.5%(CTF) ▲–65.4%(USELESS) compared to their all-time highs.

Some tokens are showing technical rebound trends, but the rebound rates remain limited, mostly around 0.3~2%. Particularly, CTF continues to decline after a short-term sharp drop, remaining over 80% below its peak, showing an ongoing struggle between liquidity contraction and low-price buying sentiment.

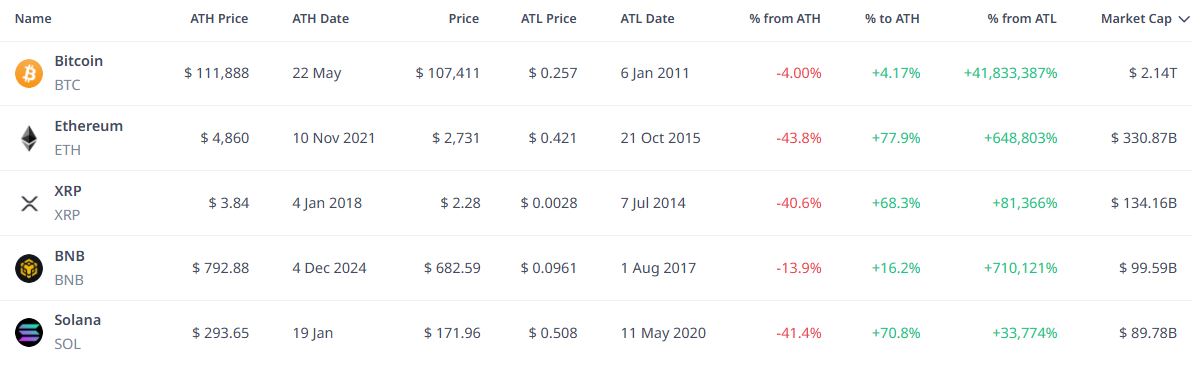

Top 5 Market Cap Tokens – ATH/ATL Status

① BTC: $107,411 | ATH $111,888 (–4.00%) | ATL $0.257 (+41,833,387%)

② ETH: $2,731 | ATH $4,860 (–43.8%) | ATL $0.421 (+648,803%)

③ XRP: $2.28 | ATH $3.84 (–40.6%) | ATL $0.0028 (+81,366%)

④ BNB: $682.59 | ATH $792.88 (–13.9%) | ATL $0.0961 (+710,121%)

⑤ SOL: $171.96 | ATH $293.65 (–41.4%) | ATL $0.508 (+33,774%)

The top 5 tokens are still in an adjustment phase of around 28% from their ATH. Bitcoin renewed its all-time high at $111,888 on the 22nd and is currently adjusting by 4%, with a cumulative return of about 41,830,000% from its ATL. Ethereum has dropped 43.8% from its peak but has increased over 6,488 times from its ATL. While XRP and Solana have dropped over 40% from their peaks, BNB maintains strength with a relatively low adjustment of –13.9%.

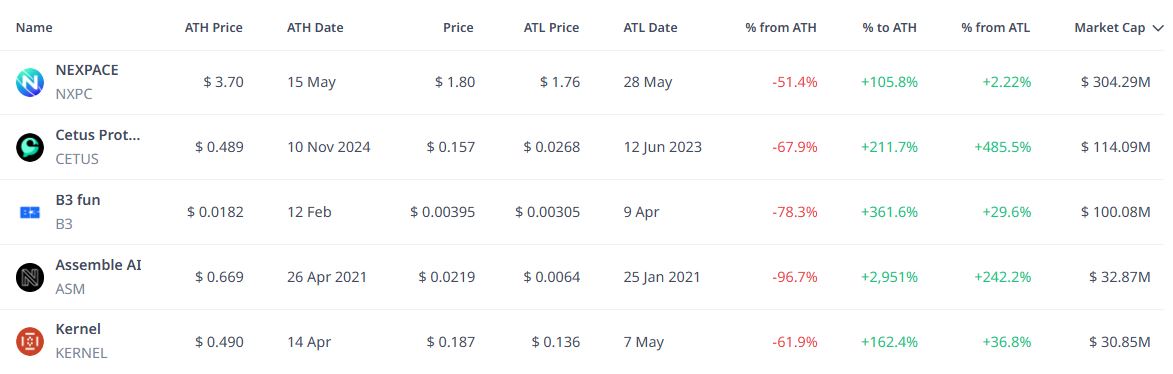

Real-Time Domestic Trending Tokens – ATH/ATL Status

① Assemble AI(ASM): $0.0219 | ATH $0.669 (–96.7%) | ATL $0.0064 (+242.2%)

② B3 fun(B3): $0.00395 | ATH $0.0182 (–78.3%) | ATL $0.00305 (+29.6%)

③ Cetus Protocol(CETUS): $0.157 | ATH $0.489 (–67.9%) | ATL $0.0268 (+485.5%)

④ NEXPACE(NXPC): $1.80 | ATH $3.70 (–51.4%) | ATL $1.76 (+2.22%)

⑤ Kernel(KERNEL): $0.187 | ATH $0.490 (–61.9%) | ATL $0.136 (+36.8%)

Most trending tokens in domestic communities are adjusted 50~90% from their ATH. Cetus Protocol and Assemble AI are notably recovering, rising +485% and +242% from their ATL respectively.

In contrast, NXPC and Kernel have dropped over 50% from their ATH, showing a slight rebound from short-term lows but no clear trend reversal. Particularly, B3 fun has recovered nearly 30% from its ATL despite low liquidity, but remains about 78% below its previous high, indicating a high-risk zone.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>