Written by: TechFlow

On May 27th, a little-known small stock stirred up massive waves in the Nasdaq trading hall.

SharpLink Gaming (SBET), a small gambling company with a market market cap of only just $10 million, announced the purchase 163,000 ETH through a $425 million private equity investment.

As soon as the news broke, SharpLink's stock price rocketed, rising by over 500% at one point.

Buying crypto might be becoming a new wealth code for boosting stock prices of listed companies.

The origin of the story is naturally MicroStrategy, the company that first ignited the battle, boldly betting on Bitcoin as early as 2020.

Over five years, it transformed from an ordinary tech company to a "Bitcoin investment Pioneer". In 2020, MicroStrategy's stock price was just over $10; by 2025, the stock had so370, with market value exceeding $100 billion.

Buying crypto not only expanded MicroStrategy's balance sheet but also made it the darling of the capital market.

In 2025, this trend continued to escalate.

From tech companies to retail small gambling enterprises, US-listed companies are using companies are using crypto crypto cryptopto to ignite a new engine of valuation.

What exactly is the secret behind growing market value by buying crypto p?

MicroStrategy: Abook Crypto Stock Integration

The rest of the translation follows the same principle, maintaining the specified translations for specific terms]On May 15, Addentax Group Corp (stock code ATXG), a Chinese textile and clothing company, announced plans to purchase 8,000 bitcoins and TRUMP coins through the issuance of common stocks. At the current bitcoin price of $108,000, the purchase cost will exceed $800 million.

In contrast, the company's total stock market capitvalue is only around $4.5 million,, the cost of purchasing coins is over 100 times its market market value.

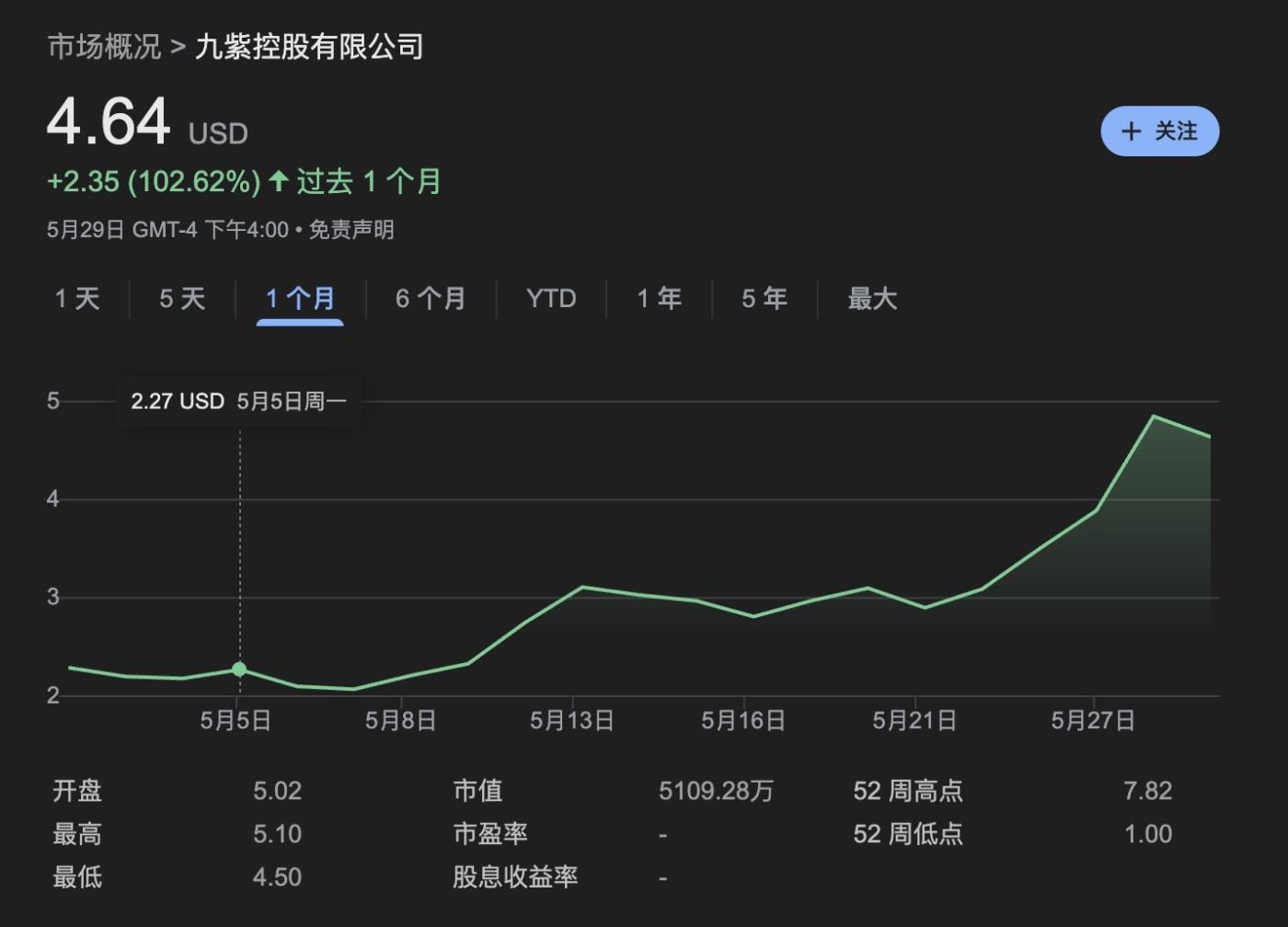

Almost at the same time, another Chinese company listed on US stocks, Jiuzi Holdings (stock code JZXN), also joined this bitcoin buying frenzy.

The company announced plans to purchase 1,ins in the next year, with a cost of over $100.

p p information showsui Holdings is a Chinese company focusing on new energy vehicle retail, established in 2019. The company's retail stores are mainly distributed in third and fourth-tier cities in China.The company total market value on Nasdaquis only around $50 million.

Stock prices are indeed rising, but the matching of company market value and bitcoin purchase is cost is key.

<Another Way of Breaking Out

>the risks, bitcoin buyingzy frenzy still has the possibility of becoming a new normal.In global inflation pressure and US and US dollar depreciation expectations continue, more and more companies are beginning to view bitcoin bitcoincoin and Ethereum as "anti-inflation assets". Japan's Metaplanet has already enhanced its market value through a bitcoin treasury strategy, and more US US listed companies are following to MicroStrategy's path faster.

In the big trend, cryptocurrencies are increasingly appearing in economic fields.

Is this the "out crypto people often talk about?

By comprehensive observation of current trends, the breaking out to mainstream mainly has two paths:

On the surface, stablecoins provide a stable mediumiums for crypto markets for payment, savings,,, and essence is an extension extension of US dollar he.Taking'S usexampleel, closely itsuer has close relationships with the US government,,, large of US Treasury as reserve assets, which only strengthglobal reserve currency status of of, also penetrates global crypto market through stablecoin circulation.

The other breaking out path is the company bitcoin buying mentioned mentioned earlier.

Companies buying speculative funds through crypto crypto narratives and push up stock prices, prices,, but except for a a few few leading companies, how much can the basic main business fundamentfundamentals be improved for later imitators remains a mystery.

Whether cryptocassets look more like a tool to continue continue or strengthen previous financial patterns, whether it's cutting leeks or financial innovation depends on which side of the table you're sitting on.