4 of the 8 top DeFi protocols didn't exist three years ago:

Eigenlayer, Etherfi, Spark, and Ethena.

Now, they are among the top DeFi protocols by TVL.

Notice that all top 8 protocols are focusing on YIELD.

DEXes out of top 8: Uniswap, Curve, Pancakeswap... LPing due to IL isn't worth the risk?

Notable changes:

- Aave: 4th to 1st, TVL +315%

- Uniswap: 6th to 10th

- Curve: 4th to 19th, TVL -50% since 2022

- PCS: 5th to 24th, TVL -50%

- Convex: 8th to 35th

MakerDAO (Sky) lost the 1st spot but its first subDAO, Spark, is a success.

Binance staked ETH is now as big as Lido was 3 years ago.

Ethena is a beast: started growing again, soon to reach ATH TVL.

Perhaps TVL isn't the best metric to evaluate protocol success anymore?

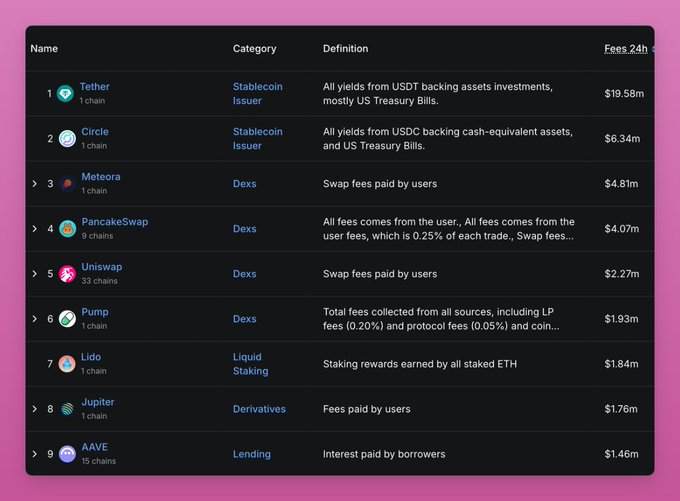

Maybe it's protocol fees? In which case DEXs do much better with PCS and Uniswap being top 4 and 5.

But maybe it's revenue or more importantly, holders' revenue?

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content