- Over 1 billion USD in stablecoins withdrawn from Binance as long-term investors reduce risk and limit exposure.

- Bitcoin individual investors are driving the upward momentum, while "whales" retreat, signaling a major market shift.

An underlying change is taking place.

Bitcoin (BTC) is maintaining near-record prices, while over 1 billion USD in stablecoins quietly withdraw from Binance. Long-term investors are reducing exposure and becoming more cautious at current price levels.

In contrast, small retail investors are actively participating, taking control and potentially maintaining the upward momentum.

Is market power shifting dramatically?

Liquidation Decline or Underlying Circulation?

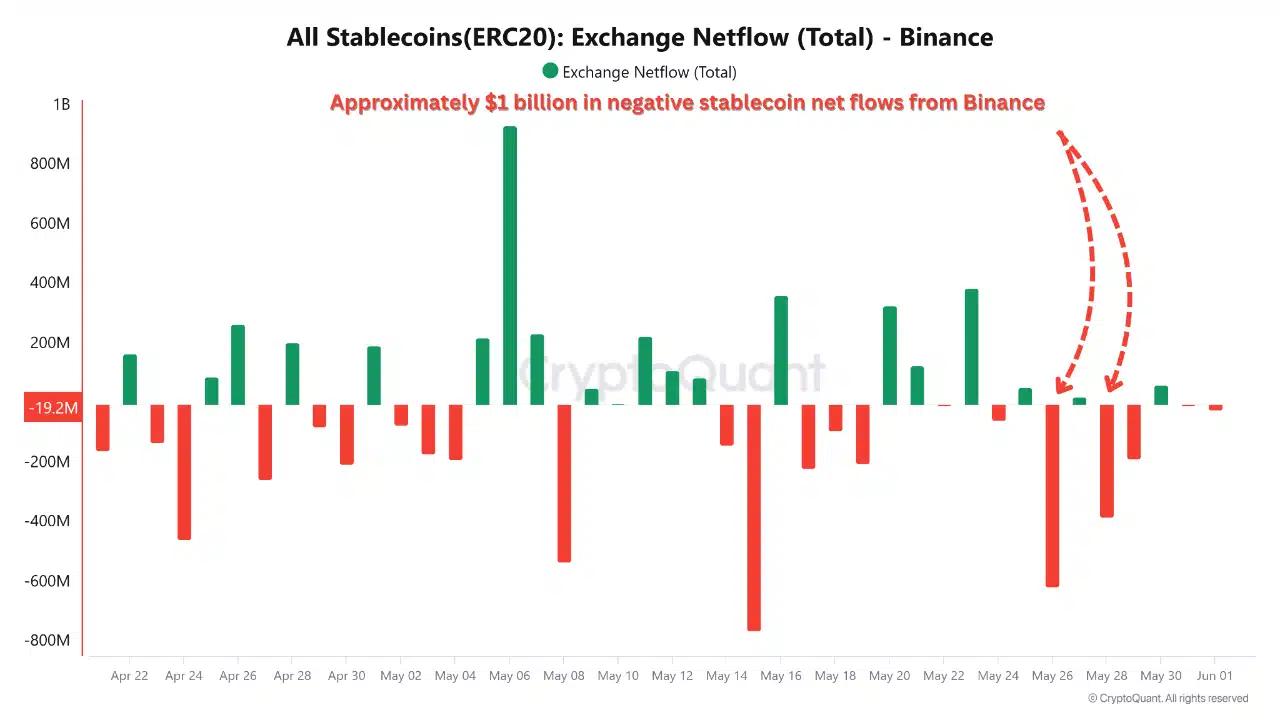

In May, Binance recorded over 1 billion USD in net stablecoin outflow, one of the largest liquidation fluctuations recently, as shown in the image below.

Source: CryptoQuant

Net stablecoin flow indicates purchasing power from exchanges, and this capital withdrawal typically represents large investors' caution. Although Bitcoin has exceeded 110,000 USD, the capital supporting the upward momentum is gradually decreasing.

Previous precedents suggest similar capital withdrawals could signal an adjustment phase or profit transformation.

Whether this is a sign of concern or a strategic pause by institutions, it's clear the current upward momentum has significantly changed.

Long-Term Investors Reduce Exposure

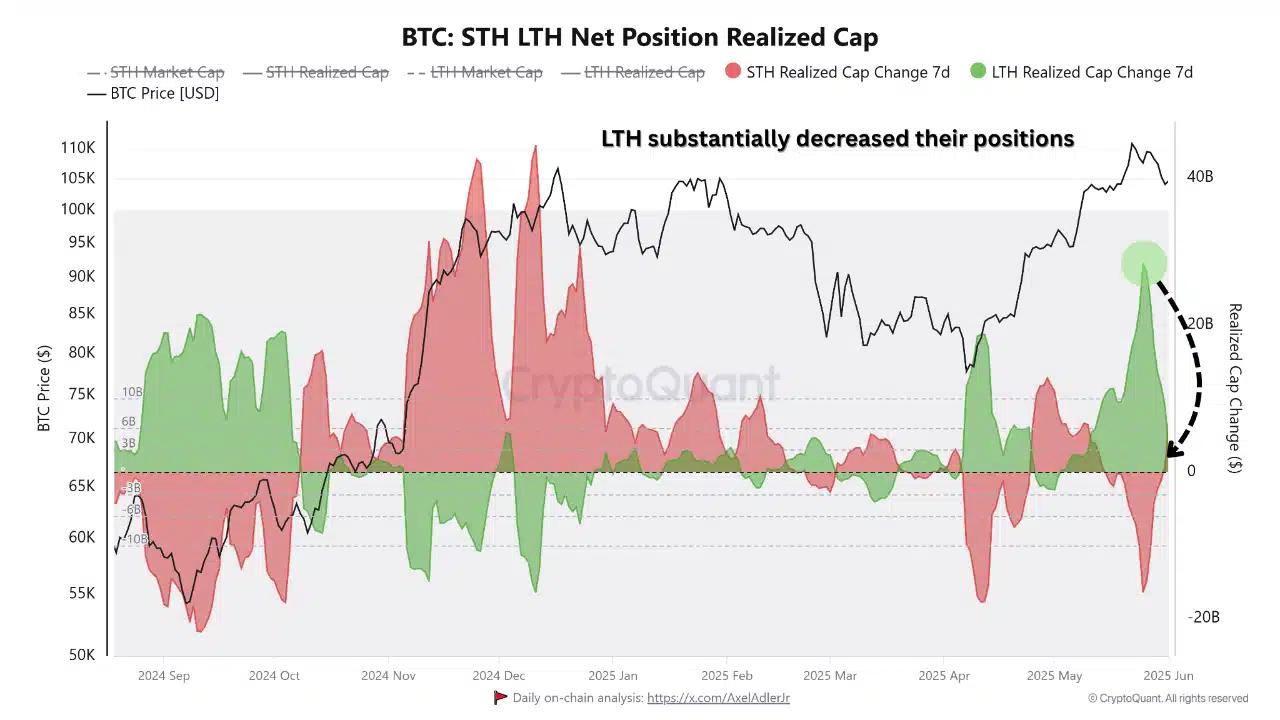

Bitcoin long-term investors have sharply reduced their net realized value, from 28 billion USD to just 2 billion USD.

The green accumulation wave has disappeared, replaced by a flat line – typically a sign of a distribution phase.

Source: CryptoQuant

These changes often precede local peaks or sideways periods, especially when short-term investors do not compensate for the withdrawal. This is a sign of smart investors reducing risk.

Prominent players no longer maintain tight positions as before.

Individual Investors Push Prices, Whales Reduce

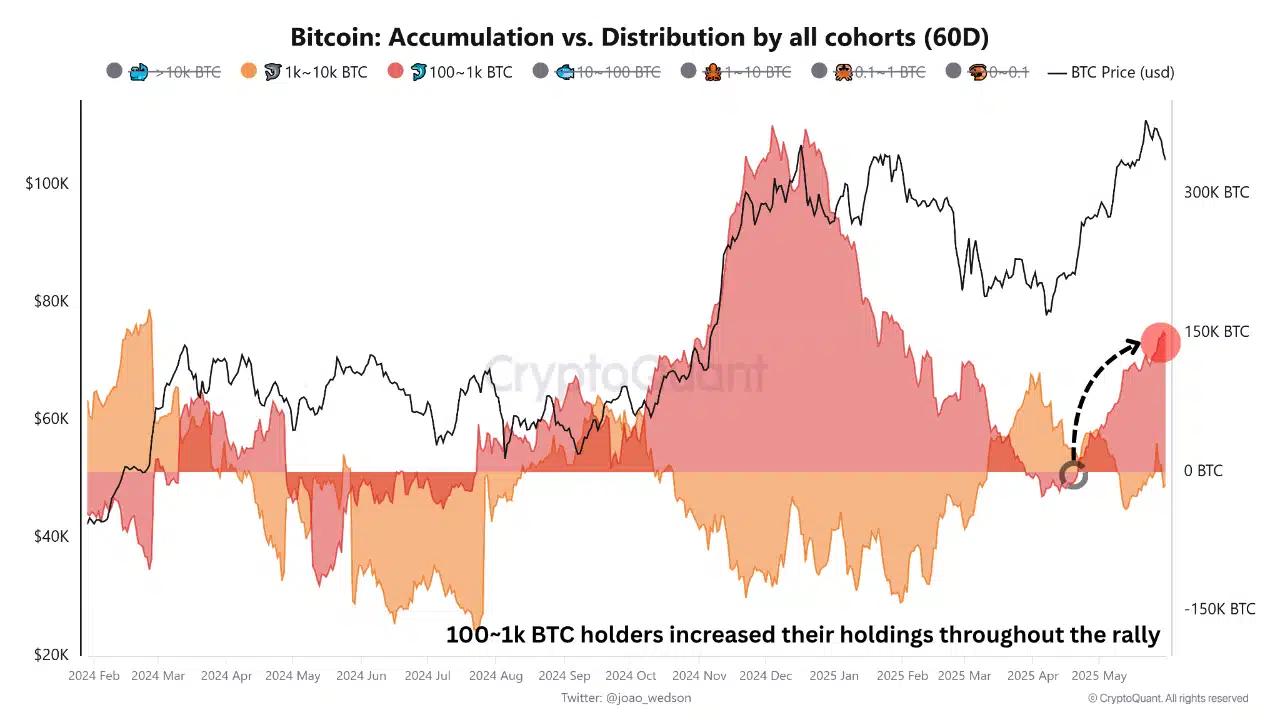

During Bitcoin's rise from 81,000 USD to 110,000 USD, wallets holding 1,000 to 10,000 BTC continuously distributed, showing strong profit-taking.

Source: CryptoQuant

In contrast, wallets holding 100 to 1,000 BTC have been net buyers, consolidating the upward momentum.

Recent data reveals a dominant shift: institutional investors are selling, while individual investors continue accumulating. This indicates the upward momentum is being led by retail investors, marking an important turning point in market dynamics.

As whale confidence weakens, the responsibility for maintaining the upward trend shifts to individual investors. However, the lack of institutional support makes the market potentially sensitive to fluctuations.

Control has been transferred—this is the race of individual investors, which may succeed or fail.

BTC: Transfer or Stopping Point?

Negative stablecoin flow, the decline of long-term investors, and divergent behavior among ownership groups suggest the upward momentum may be gradually depleting. The market might enter a cooling phase due to reduced new liquidation, or experience a price increase as small investors continue injecting funds.

This could also reflect a structural change: the emergence of a more distributed investor base.

However, risks remain. High-leverage individual investors and lack of institutional support could make the market vulnerable to sudden reversals, especially when facing macroeconomic difficulties or new regulations.

Whether this is a temporary pause or the market's peak remains unclear, but one thing is certain: the power balance has shifted.