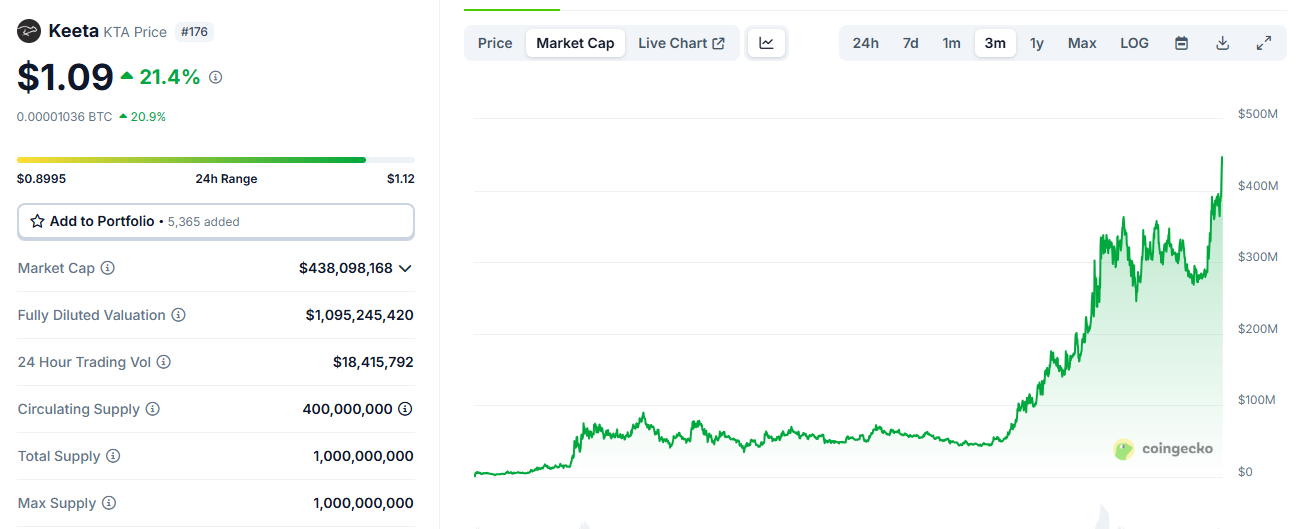

There is always a lot of surprise in the cryptocurrency market. When a previously unknown name - Keeta - suddenly burst into view as a dark horse, and its token KTA soared in price in a short period of time, and its market value once exceeded the 1.1 billion US dollar mark, setting a record high, it is hard not to be curious: What is the medicine in this gourd? Is it another short-lived capital carnival, or a new species with truly subversive power that is quietly knocking on the door of the times? Especially when Keeta's name is closely linked to the current hot RWA (real world asset) track, this curiosity adds a bit of depth. After all, the RWA narrative is being seen as the next industry outlet that may leverage trillions of traditional assets, and any "seed player" that emerges at this time will naturally be put under a microscope for careful scrutiny. Will Keeta be the answer worth looking forward to?

The discussion around Keeta is not limited to its technology itself. The investment endorsement of heavyweights such as former Google CEO Eric Schmidt has brought it a dazzling halo and capital pursuit. Its amazing performance claims, such as a processing capacity of up to 10 million transactions per second (TPS) and a settlement time of 400 milliseconds, have caused a huge sensation in the industry, but are also accompanied by cautious doubts from the technical community and market observers. Keeta's sudden rise seems to be the product of multiple factors such as the RWA craze, celebrity effect, bold technical narratives, and the crypto market's search for high-growth L1 alternatives. This "perfect storm" rise has not only brought about a rapid rise in market value, but also put it in the spotlight and faced more stringent reality tests. This article will delve into the technical characteristics, market positioning, challenges faced by Keeta Network, and its future prospects in the RWA field.

RWA Wave: The Next Stop for the Trillion-Dollar Market?

Before we analyze Keeta in depth, we need to understand its core battlefield - the tokenization of real-world assets (RWA). In the context of blockchain, RWA refers to digital tokens that represent tangible or intangible assets that exist in the real world. These assets range from real estate, commodities, artworks to bonds, carbon credits, etc. Its core concept is to use blockchain technology to give these traditional assets or physical assets a digital form, thereby building a bridge between the physical world, traditional finance and the digital economy.

The market potential of RWA tokenization is huge. According to industry analysis, the potential size of the RWA tokenization market is as high as trillions of dollars. As of December 2024, the RWA tokenization market size excluding stablecoins has reached 15.2 billion US dollars, and the total tokenization market size after including stablecoins is as high as 217.26 billion US dollars. It is even predicted that by 2034, the RWA tokenization market is expected to grow to 30.1 trillion US dollars. Behind this trend are the multiple core advantages brought by RWA tokenization:

- Enhanced liquidity : Unlocking intrinsic value by converting traditionally illiquid assets (e.g., real estate, private equity) into tokens that can be efficiently traded in secondary markets.

- Improved accessibility and fractional ownership : Through tokenization, high-value assets can be divided into smaller shares, lowering the investment threshold and enabling more investors to participate.

- Improve transparency and security : The distributed ledger nature of blockchain ensures that transaction records are tamper-proof and traceable, enhancing the transparency and security of asset ownership and transaction history.

- Improve efficiency and reduce costs : The application of smart contracts can automate complex processes such as asset transactions and dividend distribution, reducing dependence on intermediaries, thereby improving operational efficiency and reducing transaction costs.

Despite the promising prospects, the development of RWA tokenization is not smooth sailing and still faces many challenges. The uncertainty of the regulatory environment and the complexity of compliance are the first and foremost problems. Different laws and regulations in different jurisdictions have brought obstacles to the global circulation of RWA. In addition, how to ensure the accurate anchoring of the value of on-chain tokens and the value of real assets off-chain, the reliability and security of data provided by Oracle, the security vulnerabilities of smart contracts themselves, and the legal effect of tokenized ownership are all key links that need to be urgently resolved in the RWA track.

Nevertheless, there are many successful cases of RWA tokenization. For example, tokenized U.S. Treasury products have attracted a lot of attention from institutional funds, such as the BUIDL fund launched by BlackRock and the money market fund issued by Franklin Templeton on Avalanche. Dubai real estate developer DAMAC has partnered with MANTRA to tokenize $1 billion worth of assets (including real estate and data centers). Tether's gold-backed stablecoin XAUT also provides a convenient way for digital transactions of physical gold. These cases show that RWA is not only a theoretical concept, but is gradually being implemented and showing its transformative potential. The reason why the RWA narrative is so eye-catching is largely because it is seen as a bridge connecting the huge traditional financial (TradFi) world with the emerging crypto space. Focusing on RWA, especially projects like Keeta that emphasize compliance, aims to pave the way for institutional capital and mainstream users to enter the digital asset field. The active participation of financial giants such as BlackRock in tokenized treasury bonds is a strong proof of this trend. The success of the RWA track will greatly enhance the legitimacy and scale of the entire digital asset ecosystem, expanding it from being mainly based on speculation in crypto-native assets to accommodating a vast range of real-world value. Therefore, those Layer-1 public chains that can process RWA safely and compliantly undoubtedly occupy a strategic commanding height.

Keeta Network: A challenger born with a golden key

Keeta Network was born in such an era. Its official mission is to unify the global payment network, realize the efficient and compliant circulation of RWA, and strive to become the universal underlying infrastructure for all asset transfers. Keeta aims to break the bottleneck of traditional finance (TradFi) by providing nearly instant and low-cost cross-border payment solutions.

Keeta stands out from many emerging public chain projects largely due to its strong "halo effect". The most dazzling of these is the endorsement of former Google CEO Eric Schmidt. In 2023, Schmidt led Keeta's $17 million seed round of financing through his venture capital firm Steel Perlot and personally served as a project consultant. Schmidt once publicly stated: "Keeta's technology is several orders of magnitude higher in scalability and efficiency than existing solutions." The presence of this heavyweight has undoubtedly injected strong market confidence and media attention into Keeta. When Schmidt followed Keeta's official account on social media X, the price of KTA tokens soared, which shows how influential it is.

In terms of team composition, Keeta has also brought together members with relevant experience. Co-founder and CEO Ty Schenk is a software engineer who has previously been involved in the field of encrypted payments and is a former partner of Steel Perlot and CEO of LFG Payments. Chief Technology Officer Roy Keene was a core developer of Nano (formerly RaiBlocks). He left to create a new project because he wanted to change Nano's incentive mechanism and promote institutional adoption.

This strong background and team experience is like handing Keeta a "golden key", enabling it to obtain far more attention and resources than ordinary startups in the early stages of the project. However, this is also like a double-edged sword. While a prominent origin brings advantages, it also means that the market has extremely high expectations for it. Any technical flaws, roadmap delays, or gaps between promises and reality will be infinitely magnified and may lead to more severe criticism. If this "Google halo" is not supported by continuous actual results, its light may quickly dim. Keeta's subsequent development will become a typical case to observe how startup projects manage market expectations and realize grand visions under strong endorsements.

Under the hood: Keeta’s technical arsenal and compliance design

Keeta Network claims that its high performance and compliance characteristics stem from its unique technical architecture and design concept. Understanding these core components is the key to evaluating its potential.

Hybrid Engine: Decoding dPoS and Virtual DAG Architecture

Keeta's core consensus mechanism is said to be a hybrid architecture of delegated proof of stake (dPoS) and "virtual directed acyclic graph" (vDAG). The dPoS mechanism is known for its high efficiency and reaches consensus through a limited number of block producers, but this also brings potential centralization risks. The DAG structure, in theory, has the ability to handle high-concurrency transactions and can solve the bottleneck problem of linear confirmation of traditional blockchains, but it also faces challenges such as high computing overhead, complex confirmation rules, and specific attack vulnerabilities.

Keeta claims that its "virtual DAG" is an innovative design. According to Delphi Digital's analysis, in Keeta's design, each account maintains its own transaction chain (forming an independent DAG), and cross-account interactions are handled through "virtual links", which are metadata references that logically connect transactions on one account chain to corresponding transactions on another account chain, thereby achieving large-scale parallel processing. However, in its white paper and existing technical documents, it mainly stays at the elaboration of design concepts and goals, lacking more detailed implementation details and widely verified results on how to specifically overcome the inherent challenges of DAG and achieve its claimed 10 million TPS.

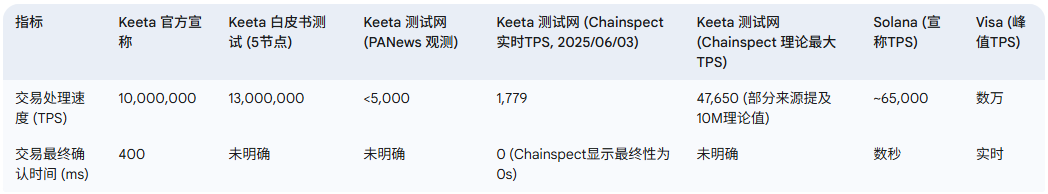

Keeta claims that its network can achieve a processing speed of 10 million transactions per second (TPS) and a final transaction confirmation time of 400 milliseconds. This number far exceeds centralized payment giants such as Alipay (peak of about 544,000 TPS), and is also far ahead of other high-performance public chains such as Solana (claimed to be about 65,000 TPS). However, this huge order of magnitude difference naturally aroused widespread doubts in the market. According to the test results in its white paper, Keeta reached a maximum of 13 million TPS in a test environment with only 5 nodes. Whether such a test environment has sufficient reference value remains in doubt. According to PANews' observation, the current TPS of Keeta test network is basically maintained below 5,000. The third-party data platform Chainspect also shows that the theoretical maximum TPS of Keeta test network is 47,000, and the real-time TPS fluctuates between 1210 and 1779. Keeta's official explanation for this is that the test network intentionally does not support unlimited scale expansion because there is no transaction fee, and a special test network will be set up for benchmarking in the future. In its white paper, Keeta attributes the high performance to factors such as the absence of a memory pool (mempool), client-guided validation skipping queues, two-phase voting to ensure speed and security, and the use of cloud servers (such as Google Cloud or AWS).

Comparison of Keeta's performance claims and observed data

This table intuitively compares Keeta’s core performance claims with multiple observational data, clearly reveals the gap between ideal and reality, and places it in the industry reference system for consideration.

KeetaScript and KeetaVM: The cornerstone of verifiable computing and custom rules

To support its strategic focus on compliance and RWA, Keeta introduced a new programming model, with KeetaScript and KeetaVM at its core. KeetaScript is a domain-specific language (DSL) designed for verifiable computation. Its main goal is to allow developers to define strict logical constraints, validation rules, and compliance conditions directly at the execution layer, rather than as an optional add-on.

Combined with KeetaVM (Keeta Virtual Machine), KeetaScript forms a technology stack optimized for formal verification. This design makes Keeta theoretically very suitable for application scenarios that require deterministic guarantees, such as zero-knowledge rollups, trustless bridges, and programmable RWA tools. The Keeta white paper also mentions that the network has an extensible permission system and native token functions, allowing asset issuers to control interactions with their tokens.

Born for compliance: rule engine, digital identity (X.509 certificate) and KYC/AML

Keeta puts compliance at the core of its architecture. Its built-in native token and rule engine allow participants to create and manage digital or real-world assets, and embed comprehensive control and compliance directly at the protocol level. This rule engine enables developers and enterprises to enforce asset-level compliance requirements, transfer conditions, and behavioral logic at the protocol level. Token issuers can set rules such as whitelists, transaction limits, specific authentication requirements, etc.

In terms of digital identity and KYC/AML (Know Your Customer/Anti-Money Laundering), Keeta claims that its design meets the strict regulatory and operational requirements of financial institutions. Its white paper explicitly mentions that the digital identity and KYC/AML compliance framework is implemented through X.509 digital certificates. This mechanism allows trusted KYC providers to issue secure digital certificates for user accounts. These certificates support instant verification on the network while being committed to protecting user privacy and maintaining high security standards.

Asset Tokenization on Keeta: How to Empower RWA

Keeta's architecture natively supports asset tokenization. Users can create tokens to represent any asset, trade between them, and unlock new liquidity. Although the specific step-by-step process of RWA tokenization on Keeta is not detailed in the public documentation, its core logic is to utilize its "built-in tokenization" function and "rule engine". This means that KeetaScript and the rule engine will be used to define the properties and compliance logic of these RWA tokens.

Keeta is considered an ideal platform for the transfer of stablecoins and real-world assets. Specific RWA use cases are more conceptual, such as "tokenized real estate, securities or commodities" or "on-chain credit and loans" as mentioned in its official Twitter.

Keeta’s design for RWA tokenization compliance attempts to balance regulatory requirements, user privacy, and system openness, which can be seen as a “compliance trilemma.” Through X.509 certificates and a system of trusted KYC providers, Keeta attempts to verify identity while minimizing data exposure to protect privacy. However, the “trusted provider” model itself introduces a degree of centralization or permission, which may be necessary for institutional-grade RWAs, but is different from the concept of DeFi, which is completely permissionless. The goal of KeetaScript and the rule engine is to embed compliance into the assets themselves, thereby enhancing their robustness. The success of Keeta’s entire set of compliance solutions will depend on its ability to strike a balance between meeting the needs of regulators and users, and whether its “trusted KYC provider” ecosystem can effectively expand and maintain credibility. This also reflects that the concept of “decentralization” itself is constantly evolving when interacting with highly regulated traditional systems.

KTA Token: The Fuel that Drives the Keeta Ecosystem

The KTA token is the native utility and governance token of the Keeta Network and plays a core role in the ecosystem for paying transaction fees, participating in network consensus (through staking), and governance voting.

Token Economics and Distribution Mechanism

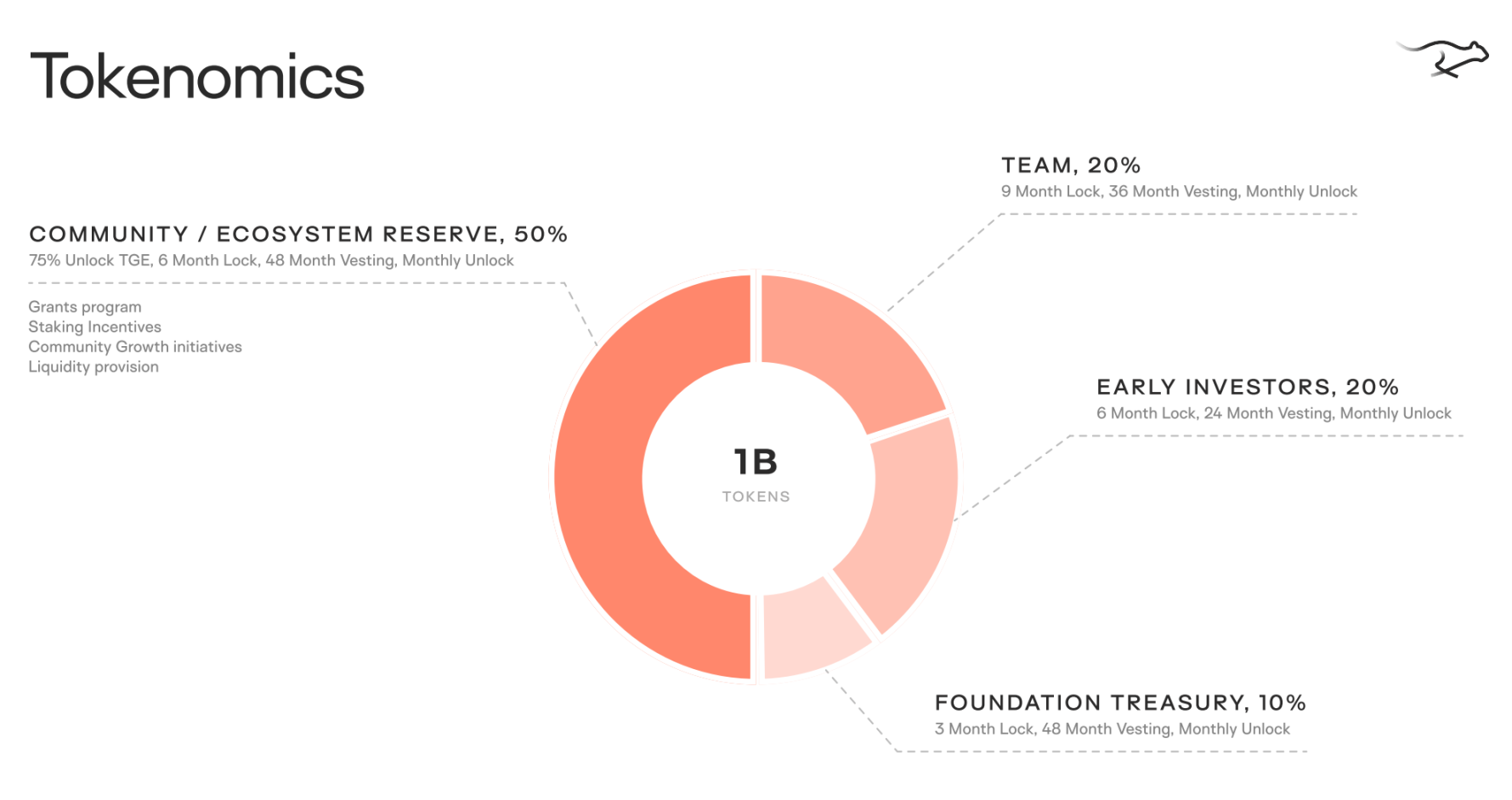

The total supply of KTA is 1 billion. As of early June 2025, the circulating supply is approximately 400 million.

According to more consistent and detailed sources, the initial distribution and lock/release plan of KTA is as follows:

It is worth noting that the KTA governance token was launched in a "secret" way on the Ethereum Layer-2 network Base in March 2025 without any market preheating in advance, which caused panic, uncertainty and suspicion (FUD) in the community in the early stage, and even speculation that the project party was hacked or intended to defraud. Founder Ty Schenk explained that the team did not consider marketing at the time, hoping to avoid confusion with Meme coins on the Ethereum mainnet and take advantage of the lower gas fees and user base of the Base chain. The KTA token will migrate to become the native token of its L1 after the Keeta mainnet is launched. This atypical token issuance strategy undoubtedly added drama to its early market performance.

Market Performance and Investor Sentiment

Since its launch, the KTA token has experienced significant price appreciation and market cap growth, especially after gaining attention from celebrities. For example, since its launch in March 2025, the price of KTA has risen more than 74 times, and rose 600% in two weeks in May. This strong market performance is mainly driven by multiple factors such as Eric Schmidt's endorsement, performance expectations of tens of millions of TPS, the popularity of the RWA track, and the "early" perception relative to other L1 projects when a large number of tokens are still locked.

Currently, KTA is mainly traded on decentralized exchanges (DEXs) and a few centralized exchanges (CEXs) such as BitMart, LBank, BingX, etc. The market generally expects that if it can be listed on more mainstream exchanges in the future, it may become a catalyst for further increases in KTA prices.

KTA's price surge before the mainnet was fully launched and its technical strength had not been verified on a large scale reflects the "pre-mainnet premium" phenomenon in the market, that is, investors speculate based on expectations of future success. This situation is often accompanied by information asymmetry: project teams and early investors usually know more about the true capabilities and development progress of the technology than the general public, while the general public relies more on white papers, marketing propaganda and limited test network data. Keeta's "secret launch" strategy, whether intentional or not, has exacerbated this information asymmetry to a certain extent, and after Schmidt and other factors were "discovered" later, it has contributed to the market's FOMO sentiment. This phenomenon is common in the cryptocurrency market and also highlights the risks faced by retail investors when trading with incomplete information or over-reliance on market heat. In addition, although the community allocation tokens account for as much as 50%, its incentive plan and standards are not clear before the TGE, which makes it difficult for the outside world to determine the actual control of these "community" tokens and who is the main beneficiary of the early price increase.

The road ahead: promises, challenges, and the road to mainnet launch

Keeta Network has a grand vision, but the road from concept to reality is full of challenges. The successful launch of the mainnet and its subsequent performance will be the key to testing its true value.

Mainnet launch and future landscape

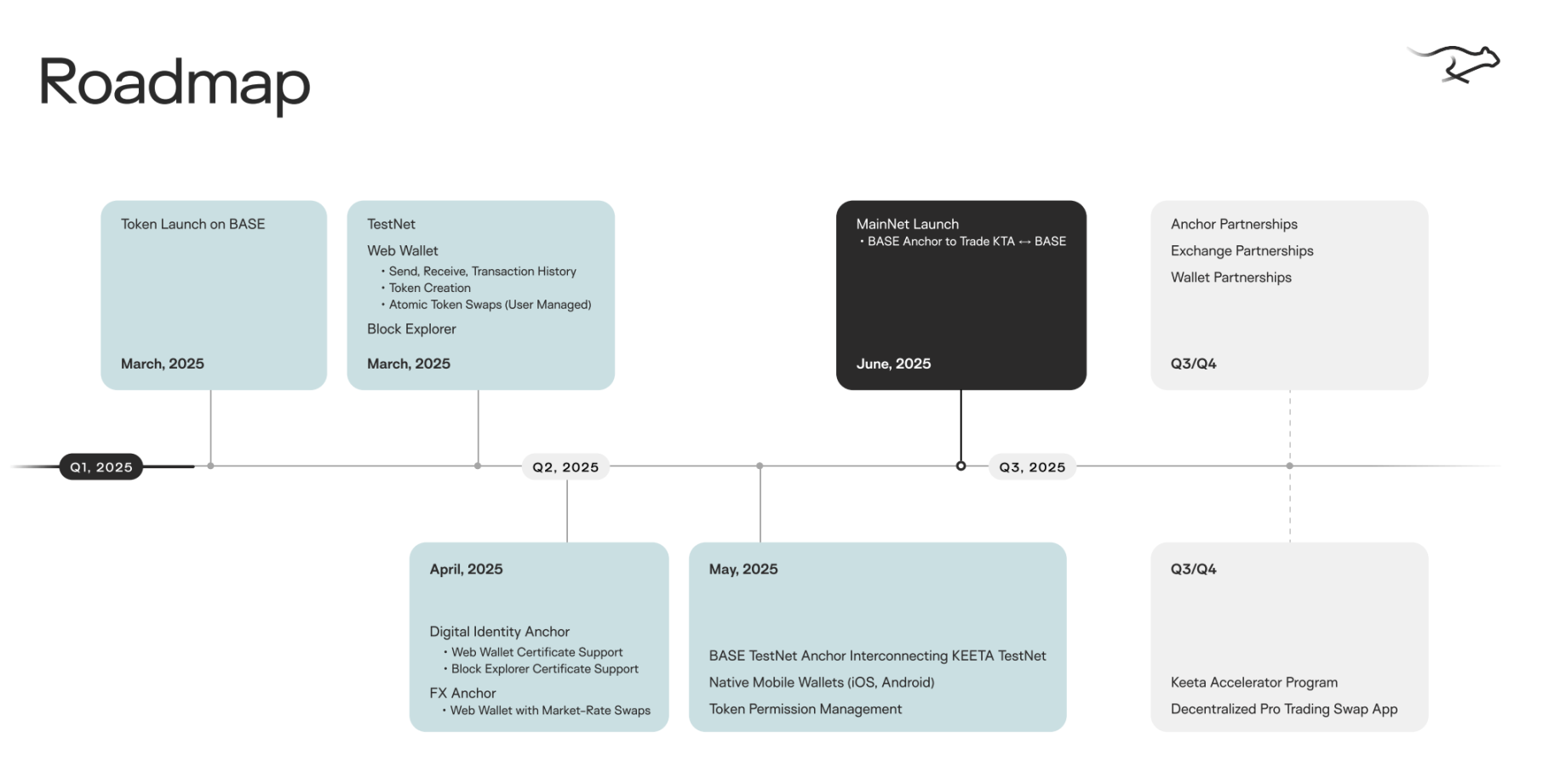

According to public information, the Keeta testnet was launched at the end of March 2025, and a web wallet and block browser were launched. The much-anticipated mainnet is scheduled to be officially launched in June or summer 2025. This is Keeta's most important milestone in the near future.

In the roadmap before the mainnet launch, Keeta plans to gradually improve its testnet functions:

- April 2025 : Integrated digital identity verification and certificate support in web wallets and block explorers.

- May 2025 : Integrate foreign exchange (FX) anchors to support token swaps at market rates within the web wallet; deploy Base testnet anchors to achieve cross-chain interoperability with external networks; launch native mobile wallets (iOS and Android); and launch advanced token permission management capabilities.

- After June 2025 : Keeta Wallet is expected to be launched shortly after the mainnet launch. The wallet is designed to uniformly manage fiat currencies, cryptocurrencies, stocks, digital identities and other tokenized assets.

In addition, Keeta has released the official software development kit (SDK) documentation on May 16, 2025, and its developer portal (developers.mykeeta.com) and GitHub code base are also online and active. Future plans also mention Layer-2 expansion solutions, enhanced interoperability, and expanded DeFi capabilities.

Facing doubts: TPS's "ideals and bones", transparency and community ecology

Although Keeta has painted a bright future, doubts about its core technical indicators have never stopped. As mentioned above, there is a huge gap between its claimed 10 million TPS and the data observed on the current test network (less than 5000 TPS or about 1210-1779 TPS shown by Chainspect). The Keeta team explained that the performance of the test network was limited due to the lack of transaction fees during the test, and there will be a dedicated benchmark test network in the future. However, the market is still waiting for the mainnet to give a final answer.

Information transparency is another major challenge facing Keeta. There is still insufficient public information on the specific implementation details of how vDAG overcomes inherent technical difficulties to achieve ultra-high TPS. In addition, the unclear community incentive plan before TGE and the ambiguity of the actual control of a large number of tokens (especially community shares) have also caused market concerns.

In terms of community ecosystem construction, although Keeta has established official social media channels and actively interacts with the community through X Spaces and Discord, some analysts believe that its community activity and developer participation do not seem to fully match its market popularity. As of May 20, 2025, its official Twitter followers are about 12,000, although other sources say that its followers have reached 75,000.

For any Layer-1 public chain, especially one with grand promises like Keeta, the mainnet launch is a decisive “moment of truth”. Theoretical architecture design and performance testing in a lab environment must be verified and reflected in the real, decentralized mainnet environment. The current testnet performance, even with the team’s explanation of “intentional limitations”, is far from the ultimate goal. The mainnet needs to demonstrate a sustainable TPS far higher than the testnet, strong security, and effective operation of its compliance framework and RWA functions to win lasting trust from the market beyond the speculative craze. The cryptocurrency industry is full of projects with strong narratives and financing backgrounds, but ultimately failed to deliver a technically strong mainnet. Keeta’s mainnet performance will be a key indicator of its long-term viability and whether it can truly impact the RWA and cross-border payment space. If it fails to deliver a satisfactory answer at this critical node, its current high valuation may face a rapid revaluation.

Keeta's competitive landscape in the RWA sector

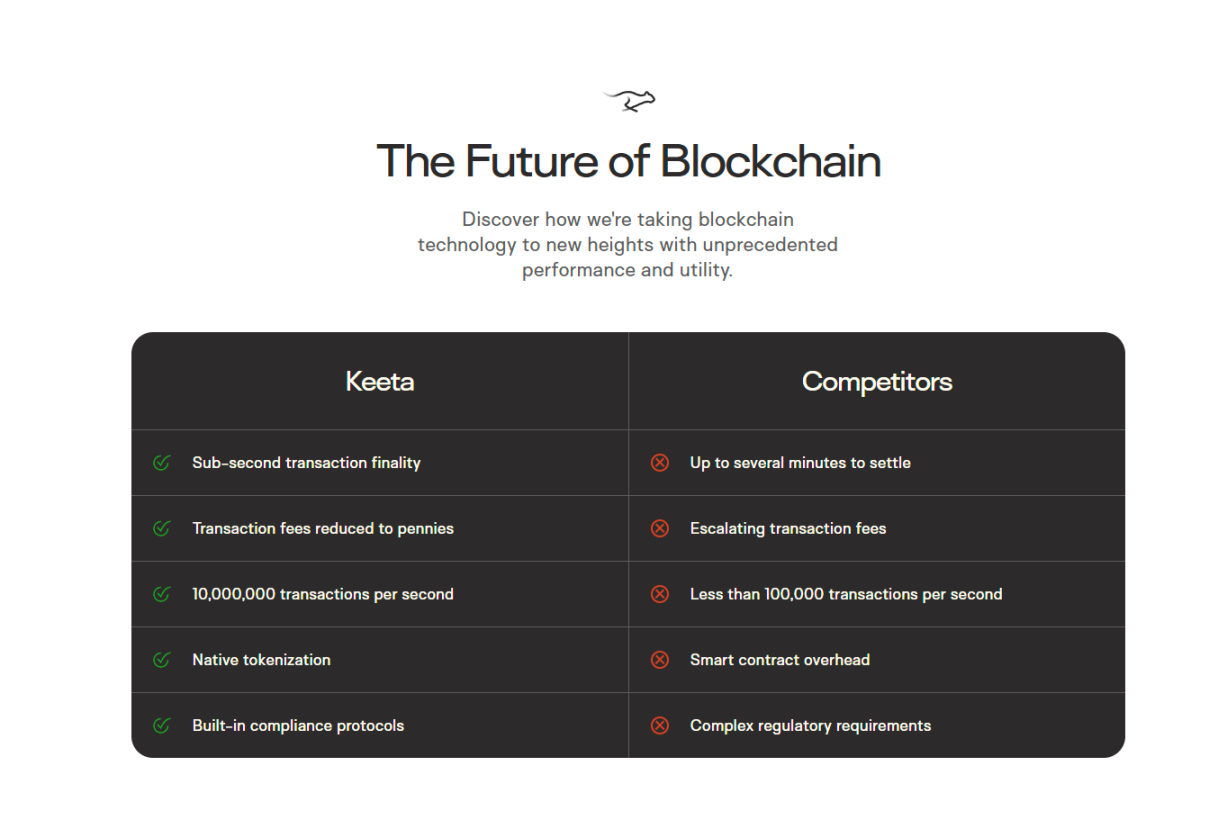

Keeta Network attempts to gain a foothold in the increasingly competitive RWA field by emphasizing compliance and scalability. Its core differentiation lies in the deep integration of compliance (through KYC/AML, rule engine, X.509 digital identity authentication, etc.) into the protocol level, supplemented by the promise of extremely high transaction throughput, in order to attract traditional financial institutions with strict compliance requirements to participate in the tokenization and circulation of RWA.

Looking at the entire RWA track, Keeta is not without competitors. Ethereum currently dominates the RWA field (about 57% market share) with its first-mover advantage and huge ecosystem, and has multiple RWA token standards such as ERC-3643 and ERC-1400, but its mainnet scalability and high gas fee issues are still pain points. As Ethereum's Layer-2 expansion solution, Polygon provides low fees and high speed, and is compatible with EVM, which is more suitable for RWA projects for retail users. Avalanche, through its subnet architecture, allows developers to create dedicated blockchains with customized compliance rules. Coupled with its high throughput and fast finality, it is an ideal choice for regulatory-sensitive projects. Franklin Templeton's tokenized money market fund runs on the Avalanche subnet. Algorand also simplifies the issuance and management of RWA with its Algorand Standard Assets (ASA), and has built-in compliance tools and high performance. In addition, public chains such as Stellar, Tezos, XDC Network and Solana are also actively deploying in the RWA field, each with its own focus.

Among the many competitors, Keeta is trying to break out by creating a niche market of "compliant scalability". While many L1 public chains claim to have high scalability (such as Solana), and others focus on RWA (such as Algorand's ASA or Avalanche's subnets), Keeta's core selling point is to combine extreme scalability with a compliance framework that is deeply integrated into the protocol layer and designed for traditional finance . If Keeta can deliver on both fronts, it may indeed carve out a lucrative niche market. Its rules engine and KeetaScript are key to achieving this goal, which allows RWA to be programmed with compliance logic from the beginning. This reflects the trend of the blockchain field evolving from purely permissionless systems to solutions that can interface with the regulated traditional financial world. Keeta's bet is that institutions will prioritize this "compliant scalability" when choosing an RWA platform, and are even willing to make some compromises in absolute decentralization for it.

Conclusion: Keeta’s potential and the future of RWA – opportunities and risks coexist

Keeta Network has quickly become a market focus with its grand vision of building a high-speed, compliant RWA and payment infrastructure, endorsed by heavyweights and a very attractive (although not yet fully proven in a large-scale environment) technical narrative. If Keeta can successfully deliver on its technical promises, especially breakthroughs in scalable and compliant processing of RWA, it undoubtedly has the potential to profoundly change the management, trading and accessibility of traditional assets.

However, the challenges facing Keeta are equally severe. First, there is the urgency of technical verification : the market urgently needs to witness its claimed TPS and vDAG efficiency in a real, decentralized mainnet environment. Secondly, there is the establishment of market acceptance and trust : Keeta needs to get out of the current speculative craze and win the real adoption of financial institutions and RWA issuers, which requires time and practice to prove its reliability and security. Third, transparency and community building : the project party needs to address concerns about information opacity and focus on cultivating a more active and engaged developer and user ecosystem. Finally, execution risks cannot be ignored: Keeta must not only deliver its ambitious roadmap on time, but also successfully navigate the complex and changing RWA regulatory environment.

Overall, Keeta has many elements to become a "potential stock", but it also has many "hidden worries". Its future depends entirely on whether it can steadily transform its grand goals into tangible reality. It may become a dark horse that subverts the industry, or it may become mediocre due to failure to fulfill its promises or inability to effectively break through in the fierce public chain competition.

Keeta's current high market valuation is largely based on expectations of its potential, the so-called "pre-mainnet premium". However, the real sustainable value comes from the "execution premium" - successfully launching a robust mainnet, attracting important RWA projects and partners (currently lacking strong public evidence), demonstrating the effectiveness of its compliance framework in real financial institution cooperation, and cultivating a vibrant developer ecosystem. The current market performance reflects hope, while the "execution premium" needs to be obtained through proven practicality and widespread adoption.

Regardless of Keeta's ultimate success or failure, its exploration in the RWA track will provide valuable lessons for the entire industry, especially in terms of how to balance technological innovation, market expectations, compliance requirements, and the hard work required to build truly transformative technology. As a key trend in promoting the integration of blockchain technology and the real economy, RWA is in its infancy, and Keeta is a sample of this trend that deserves close attention.