Written by: TechFlow

This Thursday, following CoinBase, the most important IPO in the crypto market is arriving.

Circle, the issuer of USDC stablecoin, will be listed on the New York Stock Exchange, expected to raise up to $896 million, with the stock code CRCL.

However, on the eve of the listing, the stock price of a Hong Kong-listed company, China Everbright Holdings, has been continuously rising, increasing by 44% in 5 days, revealing a hidden past of Circle in China.

China Everbright Holdings jointly invested in Circle with IDG Capital as early as 2016, becoming its shareholder.

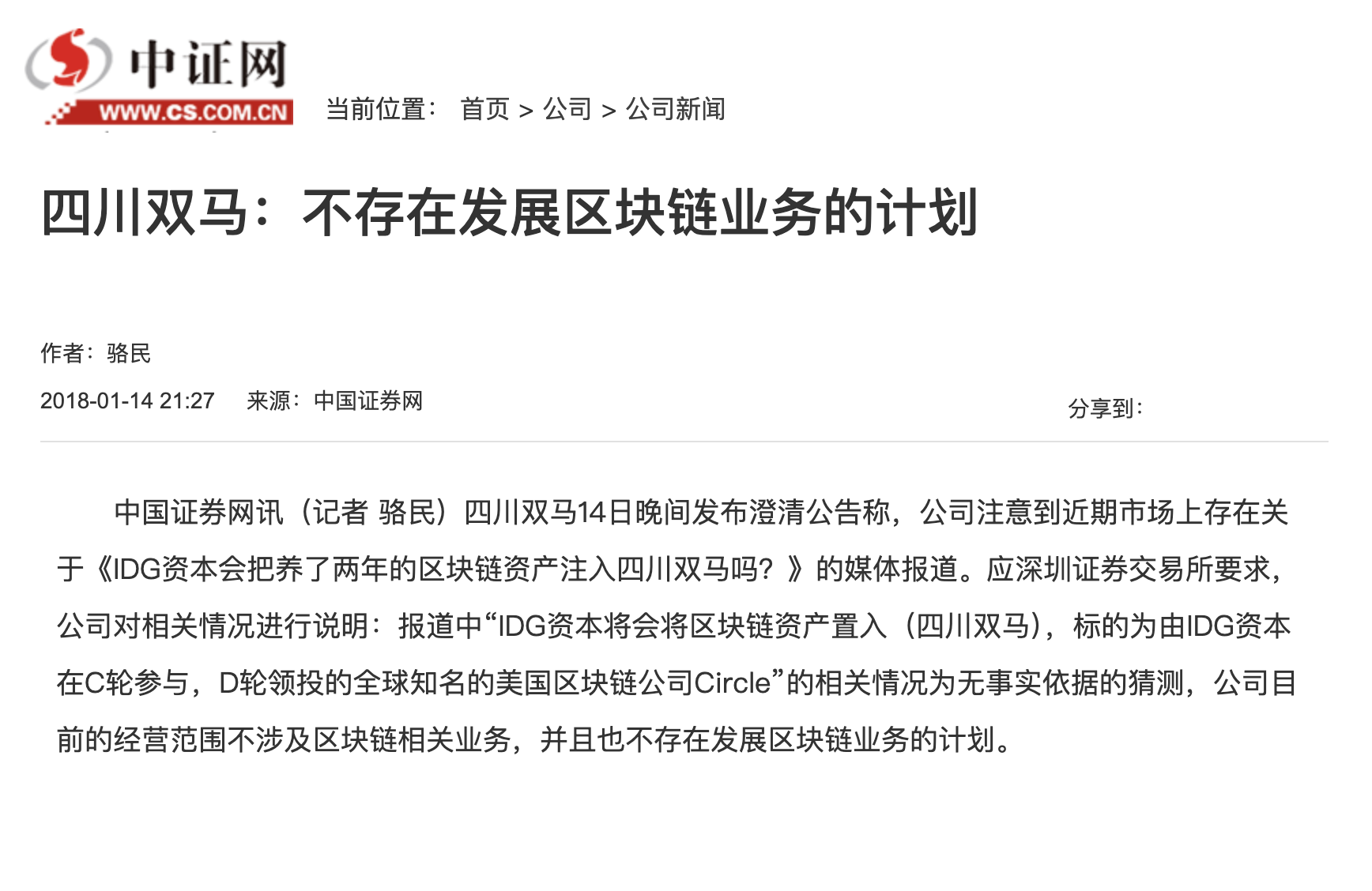

Even in 2018, domestic media reported that Circle might be injected into a domestic A-share listed company, prompting the Shenzhen Stock Exchange to inquire, and the listed company had to come forward to deny the rumor.

Circle's frequent connections with Chinese companies are a witness and microcosm of its historical development, from crypto wallet to exchange to stablecoin, Circle's youthful years were full of hardship and twists.

This article will take you through Circle's historical process and Chinese connection.

The Initial Dream: American Alipay

In 2013, Jeremy Allaire and Adobe's chief scientist Sean Neville co-founded Circle, headquartered in Boston, which was his third formal entrepreneurial venture.

Before this, he had created two listed companies in 1995 and 2012, the software company Allaire and online video platform Brightcove, accumulating deep network resources.

Circle initially raised $9 million in Series A funding, setting a record for the highest funding for a cryptocurrency company at that time.

Investors included Jim Breyer, Accel Partners, and General Catalyst, who were investors in Allaire's previous company Brightcove. It was more like investing in Jeremy Allaire himself rather than the company Circle.

Circle initially did not involve stablecoins but was committed to building an "American version of Alipay".

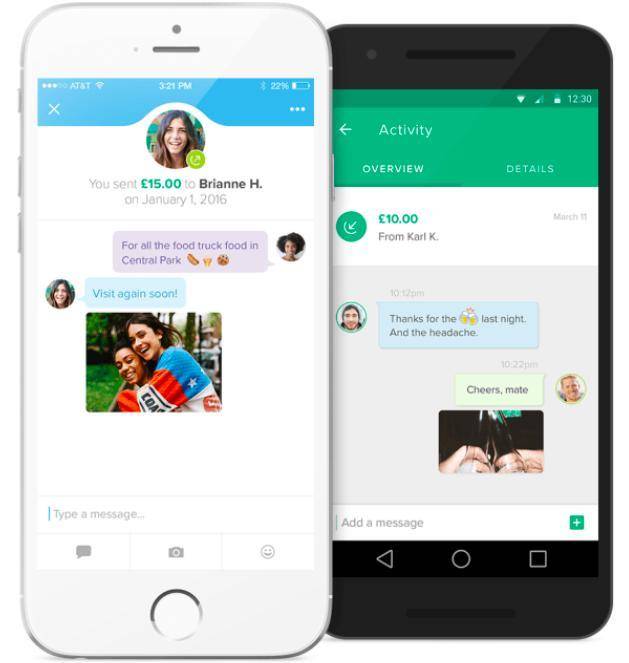

Circle's initial product was a digital currency wallet, mainly providing storage and fiat currency exchange services for cryptocurrencies (Bitcoin), using Bitcoin to achieve rapid fund transfers.

For example, international transfers using SWIFT require 3-5 working days of confirmation, but using Circle, transfers could be made quickly through the "cash-Bitcoin-cash" path, with Bitcoin serving as an intermediate channel.

At that time, Allaire was a firm Bitcoin believer, believing that achieving a cross-border payment system was only a matter of time. He wanted users to be able to transfer and pay without too many obstacles, just like using email or text messages.

Subsequently, Circle continued to rise.

In August 2015, Circle received $50 million in funding led by Goldman Sachs Group and IDG Capital.

Why did IDG Capital participate in leading the investment in Circle?

This might be inseparable from Circle's early investor Jim Breyer, known for early investment in Facebook, who also had another identity - IDG's investment partner in the United States.

IDG's investment also laid the groundwork for Circle's future connection with China.

In September, Circle obtained the first digital currency license BitLicense from the New York State Department of Financial Services, meaning Circle could provide digital currency services in New York State with a license.

In the same year, the mobile payment market in China was fierce, with WeChat quickly occupying Alipay's market share through red packets. Circle on the other side of the ocean was not just observing but also launched social payment by the end of the year.

At the time, this was a bold innovative attempt, but in hindsight, it might have stemmed from an unclear self-positioning, foreshadowing multiple transformations to come.

Chinese Connection

In 2016, Circle formed connections with numerous Chinese VCs.

In June, under the blazing sun, Circle successfully partnered with Chinese capital, announcing the completion of a $60 million Series D funding round, led again by Series C lead investor IDG Capital, with Baidu, China Everbright, Yixin, Wanxiang, and CICC also following the investment.

Among them, IDG Capital consecutively led Circle's Series C and D rounds and entered its board of directors. IDG Capital founding partner Xiaogu Xiong once commented on this investment:

Currently, domestic investment in internet companies is basically investing in applications rather than technology. A very important reason is that domestically, business model innovations are seen more, while technological innovations are relatively fewer. The American technologies invested by IDG Capital, such as Circle's Bitcoin blockchain technology, basically belong to the type that "Americans can do, but China currently cannot, or cannot do as well as the United States". However, although the technology is invested overseas, IDG Capital's original intention is to bring cutting-edge technology to China one day and achieve long-term development upon landing, which is the "Chinese perspective" of investing in an American company.

Not only introducing numerous Chinese capitals, Circle also had "entering China dreams".

In early 2016, Circle established an independently operated Circle China company - Shike China, with the main body being Tianjin Shike Technology Co., Ltd., meaning "payment that can pass through the world". The company's CEO was Li Tong, then IDG Capital's EIR, with Wanxiang Group's Xiao Feng serving as a director.

Founder Allaire stated that Circle would operate within China's regulatory framework and would not rashly launch products without government permission.

Additionally, Circle had been communicating and sharing information with China's regulatory layer and banks. However, China highly values financial security, and conducting payment business domestically requires a third-party payment license. Therefore, Circle's business in China remained stagnant for a long time, existing in name only.

According to Qichacha information, on August 15, 2020, Tianjin Shike Technology Co., Ltd. applied for simple deregistration and was officially deregistered on September 7, exiting China.

Circle's entry into China ultimately became a fleeting dream.

Difficult Transformation

In 2016, with the Bitcoin fork and capacity expansion controversy intensifying, Allaire gradually became dissatisfied with Bitcoin's stagnant development, stating in a previous interview, "Three years have passed, and Bitcoin's development speed has slowed down significantly".

On December 7, Circle announced "abandoning Bitcoin business", retaining Bitcoin and USD fiat currency transfer services, but users could not buy or sell Bitcoin, and stated that "Circle will shift its business focus to social payment".

In fact, Circle's overall development direction shifted from payment to trading. Coindesk once reported that "Allaire downplayed Bitcoin's (payment) role in Circle's business and began doing more money-making work".

In the cryptocurrency field, what business is most profitable? Exchanges.

In 2017, Circle stated that although it canceled the direct Bitcoin buying and selling function in its APP, it still provided market-making for major exchanges and launched Circle Trade, providing large-scale crypto asset OTC services for institutional clients.

In February 2018, Circle announced the acquisition of crypto asset exchange Poloniex for $400 million, officially entering the cryptocurrency exchange field, with the acquisition financing led by its major shareholder IDG Capital.

In May, Circle continued to announce financing, receiving $110 million in funding led by Bitmain, with old shareholders like IDG Capital and Breyer Capital continuing to follow.

It's worth noting that the lead investor Bitmain was also invested by IDG Capital. According to TechFlow's understanding, it was IDG Capital that facilitated the matchmaking for Bitmain's lead investment. At this point, IDG Capital had become Circle's largest institutional shareholder.

This investment was extraordinary for Circle. On one hand, it was financed at a very high post-investment valuation of $3 billion, but less than a year later, its valuation dropped by 75%.

Secondly, in the second half of 2018, the crypto market experienced a brutal bear market, and both Circle and Bit faced a life-or-death test. This capital injection helped Circle overcome the difficulties to some extent.

With capital injection, Circle began to expand aggressively, attempting to diversify comprehensively.

In July 2018, Circle launched USDC, a stablecoin pegged to the US dollar. Looking back, this was undoubtedly a historic moment, and Circle made the most important decision for itself.

Besides its core exchange and stablecoin businesses, Circle's layout began to extend outward.

In October 2018, Circle acquired the equity crowdfunding platform SeedInvest and established Circle Research to output cryptocurrency industry news and reports.

At this point, driven by capital, Circle became a comprehensive cryptocurrency group with exchanges as its core, diversifying into stablecoins and OTC services: Poloniex provided trading services; Circle Pay offered transfers; SeedInvest was used for fundraising; Circle Trade provided OTC trading services; USDC served as a US dollar stablecoin.

Everything seemed beautiful, but little did they know, the winter had arrived, and such diversified layout was extremely dangerous.

2019 was the darkest year in Circle's history.

In February, Cointelegraph Japan first disclosed that Circle's valuation on the SharesPost stock trading platform was $705 million. Nine months earlier, after receiving a $110 million investment from Bit, its valuation had reached $3 billion. In less than a year, the valuation plummeted by 75%.

In May, Coindesk reported that Circle had laid off 30 people, about 10% of its total staff, and subsequently lost three senior executives.

But what might have troubled Allair the most was the Waterloo encountered by the heavily acquired Poloniex.

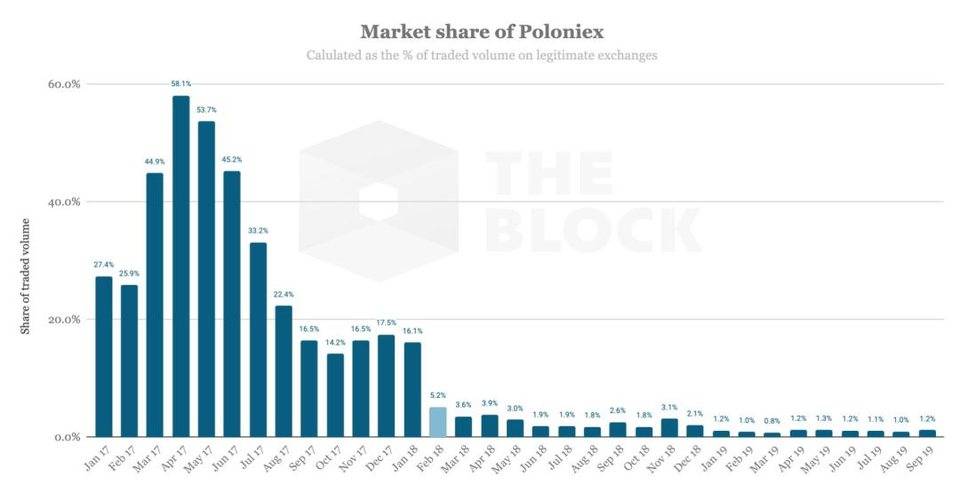

On May 13, 2019, Poloniex announced the delisting of 9 cryptocurrencies from US users' pages. According to US law, these tokens were close to the concept of securities but were not registered with the SEC, posing a compliance risk. In October, another 6 cryptocurrencies were delisted, resulting in significant profit losses.

As a result, Allair repeatedly expressed dissatisfaction with US regulators but was helpless and could only transfer Poloniex's business entity to Bermuda, where the regulatory environment was more relaxed. On July 23, Circle announced that Poloniex would obtain a digital asset business license in Bermuda.

However, this could not stop Poloniex from continuously losing market share. From nearly 60% market share in 2017 (among compliant exchanges), by September 2019, its market share had dropped to only 1%.

With plummeting valuation, core business setbacks, and talent loss, Circle once again stood at a crossroads of fate.

At a critical moment of survival, Circle chose to amputate to survive, gradually divesting its core businesses from the second half of 2019 and focusing on the USDC stablecoin.

In June 2019, Circle announced that starting from July 8, Circle Pay services would gradually cease supporting user payments and charges, and completely discontinue all support for Circle Pay by September 30.

On September 25, Circle announced the suspension of the Circle Research project.

In October, to everyone's surprise, Circle sold its exchange business Poloniex to "Polo Digital Assets", an Asian investment company operated by Justin Sun, the founder of TRON.

According to the later disclosed SPAC documents, Circle lost over $156 million in the process of acquiring and subsequently selling Poloniex.

On December 17, Circle sold its OTC service desk Circle Trade to Kraken.

By 2020, Circle's crypto investment trading app Circle Invest was sold to Voyager Digital through equity.

Thus, after a series of slimming down, Circle transformed from a diversified cryptocurrency group to a stablecoin issuer focused on the US dollar stablecoin USDC.

(Translation continues in the same manner for the rest of the text)