Author: Fairy, ChainCatcher

Strategy has come up with a new trick again.

To continuously increase its Bitcoin position, MicroStrategy has been frequently "generating blood" in recent years, advancing on three fronts from common stocks to convertible bonds to preferred stocks, with continuous financing.

The bull market is not over, and chips are doubled. Yesterday, Strategy announced the launch of a new preferred stock product STRD, which is another chip on its Bitcoin-heavy path. What's different about this "new card"? What signals are released by its structural design, potential risks, and market game?

STRD: High Interest, But Not Guaranteed

STRD is the third type of preferred stock product launched by Strategy, planning to publicly issue 2.5 million shares, with raised funds primarily used for BTC acquisition and supplementing operating capital. STRD is essentially another structured expression of a BTC long strategy, continuing the framework of STRK and STRF, with new designs in revenue distribution and exit mechanisms.

Similar to previous versions, the underlying asset behind STRD is still Bitcoin, but this time Strategy has adopted a more "defensive yet offensive" structure: the annual coupon rate is 10%, but without mandatory payment obligations, and interest does not accumulate.

Crypto KOL Phyrex interpreted it precisely: "The essence of STRD is borrowing money from Strategy at a 10% annual interest rate, but Strategy may not necessarily distribute the 10% annual interest as promised, and if not paid, it will not be made up in the future. In the statement, Strategy promises to pay on time, premise being favorable corporate profitability."

As for where this interest will come from, Strategy theoretically has three possible payment paths:

Selling BTC holdings: If Strategy converts some of its Bitcoin holdings into cash, it can obtain cash flow, but this will face capital gains tax and contradict its long-term holding strategy.

Continuous rolling financing: Possibly raising money through reissuing debt or other tools to pay interest, which might be Strategy's current preference.

Corporate operating cash flow: If the company's other businesses are profitable, it could also be used to pay interest.

Although Strategy has the right not to pay interest, the cost of doing so would be extremely heavy. Once interest payments stop, STRD's market price would inevitably be under pressure, investor confidence would be shaken, and future refinancing would face greater obstacles. Therefore, the market generally believes that as long as the Bitcoin market performs steadily, Strategy will most likely choose to fulfill its promise on time to maintain its market reputation and capital chain sustainability.

"Three Swords Together": Strategy's Multi-Layered Preferred Stocks

After discussing STRD's characteristics, let's look at Strategy's current three preferred stock products. STRK, STRF, and STRD each have positioning in liquidation order, revenue design, and risk structure, forming key puzzle pieces of Strategy's multi-layered capital structure. Below is a comparison table of the three products compiled by Bitwise Senior Investment Strategist Juan Leon (table content translated by ChainCatcher):

From an investor adaptation perspective, STRK is more suitable for conservative allocation needs pursuing stable returns with lower risk appetite; STRF targets neutral investors expecting to lock in higher fixed returns but can accept certain credit risks; STRD focuses on high-risk-tolerance offensive funds.

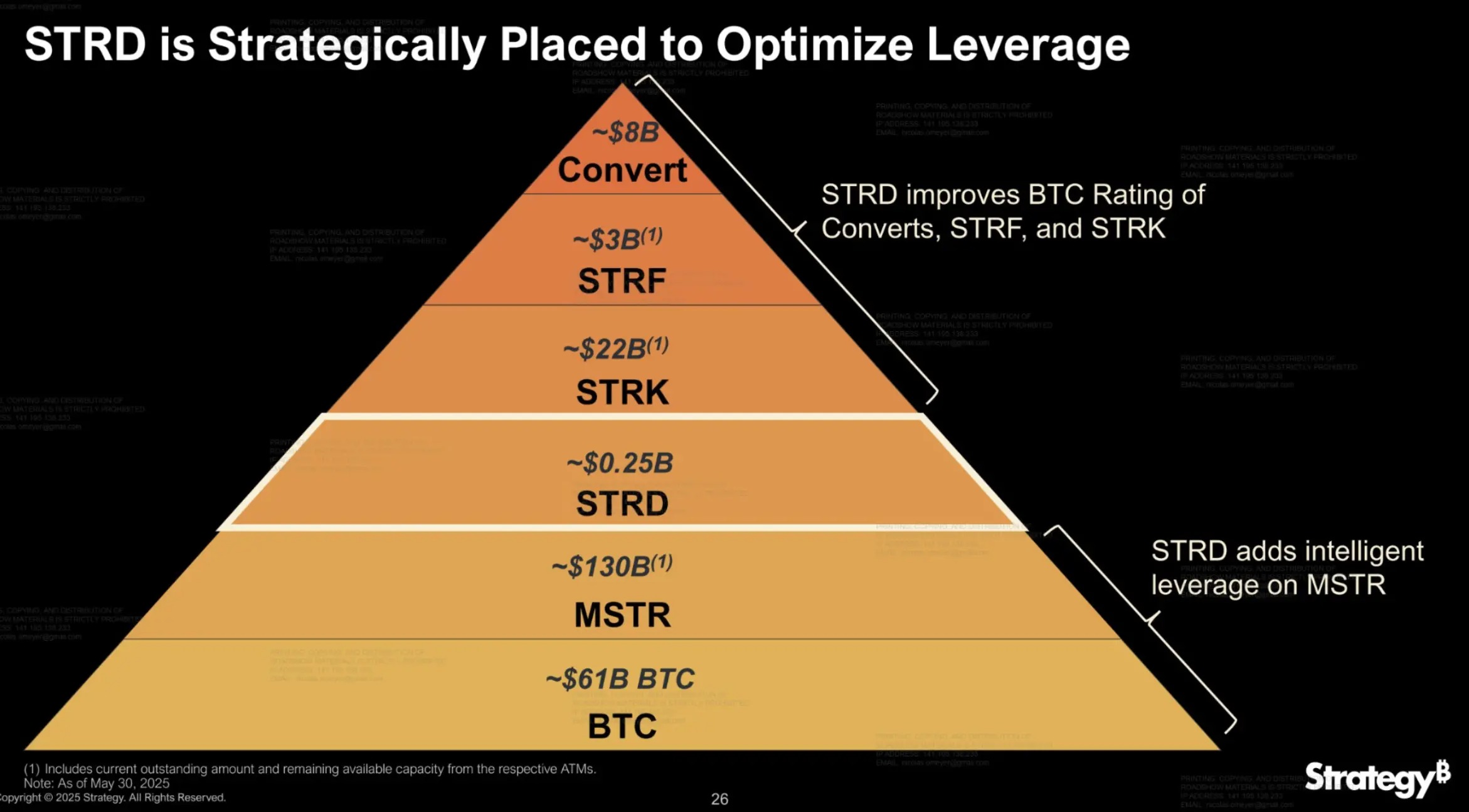

Besides product-level expansion, the launch of STRD might also be a reinforcement of Strategy's capital structure foundation. According to a chart shared by community member @DogCandles, STRD has a "low status" but "great effect", improving credit support for upper-level products and optimizing the overall capital structure.

Community Skeptical, STRD Sparks Controversy

The release of STRD is a carefully designed move by Strategy, but the community is not entirely enthusiastic. Many voices directly point to its "capital magic":

@chaojidigua: Jiang Taigong fishing, willing to take the bait.

@MemeSiguoyi: Don't look at the crypto world printing air coins, we also have our own hollow money-printing magic in stocks.

@Softelectrock: Ponzi nested dolls.

Adam Livingston, author of "Bitcoin Era", directly reveals: STRD is essentially a BTC accumulation option disguised as a revenue tool. When BTC surges, Strategy redeems at par value; when BTC plummets, it simply doesn't pay interest. Investors are actually paying for his "ultimate Bitcoin adoption" belief.

Metaplanet's Bitcoin Strategy Director Dylan LeClair called it a "genius design" from a structural perspective: "The issuance of STRD actually improves the credit quality of STRF."

Regarding Strategy's future development path, crypto KOL Phyrex offered a bolder prediction: "Strategy might have plans for Bitcoin inventory, such as lending out BTC or participating in quantitative trading to maintain cash flow. Strategy might become a BTC-based bank in the future."

Strategy's chips have been pushed to the center of the table. Wrapping belief in structured products, masking one-sided bets with risk-return models, attracting market sentiment with "high interest".

This financial experiment based on belief is becoming increasingly complex and increasingly worth watching.