This article is machine translated

Show original

Here's the translation:

Interpreting Buffett's Bearish View on US Stocks through Thunder God's Perspective, Brother Bee Has Similar Risk Views with Slight Differences:

Brother Bee's Logic Mainly Consists of Two Points:

💠 First, the US Stock Market Bubble

In recent years, the rise of US stocks is related to QE and inflation, which may not necessarily indicate a bubble.

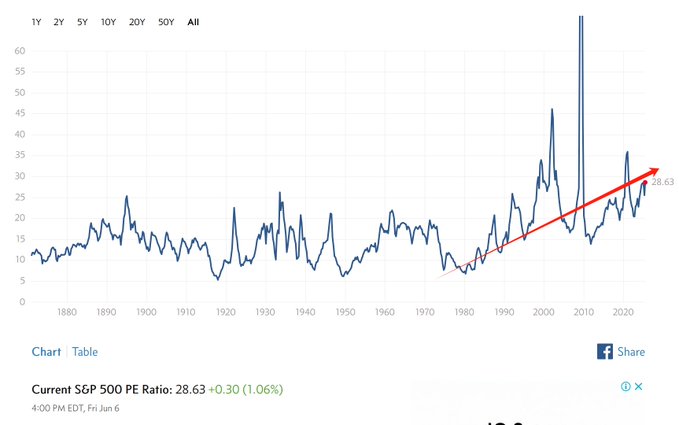

However, the price-to-earnings (P/E) ratio of US stocks, as a profitability/market value indicator, reflects the time it takes to realize the stock's value in the future.

The current P/E ratio is 28.63, which means it would take 28.63 years to realize its value.

Historically, the US stock P/E ratio fluctuated between 5-25, but after 1980, it began trending upward, possibly reflecting market expectations of a bubble.

💠 Second, the US Dollar Bubble

From the 1970s to 1990s, the US gradually abandoned the gold standard, ending international gold-dollar exchange. Simply put, the Federal Reserve could relatively freely issue dollars. This opened the Pandora's box of the US dollar.

In 2008, during the US subprime mortgage crisis, the Federal Reserve launched quantitative easing (QE), significantly diluting the value of the dollar as the world's currency. This was also a key background for 's development of BTC.

In 2020, with the US "pandemic" outbreak, the Federal Reserve launched unlimited QE, arguably pushing the dollar bubble to its peak.

If the US experiences a recession, would the Federal Reserve use this trick again? Theoretically, unlimited means without limits, but can this method truly be used indefinitely?

💠 These Two Things Might Be One Thing

On August 15, 1971, Nixon announced "closing the gold window", preventing international central banks from exchanging dollars for gold. This event is known as the "Nixon Shock".

In 1973, the US and other major economies completely transitioned to floating exchange rates, fully abandoning the gold standard.

The US stock P/E ratio entered an upward channel starting from 1980.

Therefore, these two events might be interconnected.

However, it's unclear how this bubble might burst, as currently, there's no extremely exaggerated bubble like the internet bubble or subprime mortgage crisis.

💠 "Trade Protectionism" Might Be a Shallow Perspective

Brother Bee doesn't believe this is about trade protectionism or Trump's tariff policies. Trade protectionism might be a shallow perspective.

[The rest of the translation continues in the same manner, maintaining the original structure and meaning.]

雷神Value

@leishenvalue

06-06

昨天提到不应该忽视大危机的可能性,结果晚上就传出川普和马斯克撕破脸,特斯拉创下了历史最大跌幅。美股也跟着下跌,不过加密跌得更惨,以太坊直接跌7个点,没有了过去一阵的硬气。感觉加密就是上冲无力,遇到个理由就跌了,清了一波杠杆。 x.com/leishenvalue/s…

No one can always be the boss. Remember this sentence @MirraTerminal

There is nothing wrong with this!

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content