1. Legislative Catalyst

Against the backdrop of rapid evolution in traditional finance and regulatory environments, the recent passage of the Genius Act has reignited market interest in Real-World Assets (RWAs). Beyond the progress of stablecoin-related legislation, the RWA space has quietly achieved several significant milestones: it continues to demonstrate robust growth, marked by a series of notable breakthroughs — such as Kraken’s launch of tokenized stocks and ETFs; Robinhood’s proposal to the U.S. Securities and Exchange Commission (SEC); and Centrifuge’s issuance of the “JTRSY” fund on Solana.

At a time when market attention is at an all-time high and broader adoption by traditional financial institutions appears imminent, it is crucial to take an in-depth look at the current RWA landscape — particularly the leaders like Ethereum. RWAs based on Ethereum have exhibited remarkable month-over-month growth, consistently maintaining double-digit percentages; the pace in 2025 has accelerated beyond the single-digit monthly growth seen in 2024. A key driver of this momentum is Etherealize, coupled with the Ethereum Foundation’s designation of RWA as a strategic priority. At this critical juncture, this article will explore the dynamics of RWA development on Ethereum and its Layer-2 networks.

2. Data Analysis: A Panorama of Ethereum’s RWA Growth

The data clearly indicate that Ethereum’s RWA values have entered a pronounced growth cycle. Examining the total value of non-stablecoin RWAs on Ethereum reveals a striking long-term trajectory: for years, it remained between $1 billion and $2 billion until April 2024, when a phase of rapid acceleration began. This growth continued to intensify throughout 2025. The core drive comes from BlackRock’s BUIDL fund, which has already reached $2.7 billion in scale. As illustrated by the orange trend line, BUIDL itself has followed a parabolic growth trajectory since March 2025, powerfully driving the broader expansion of Ethereum’s RWA ecosystem.

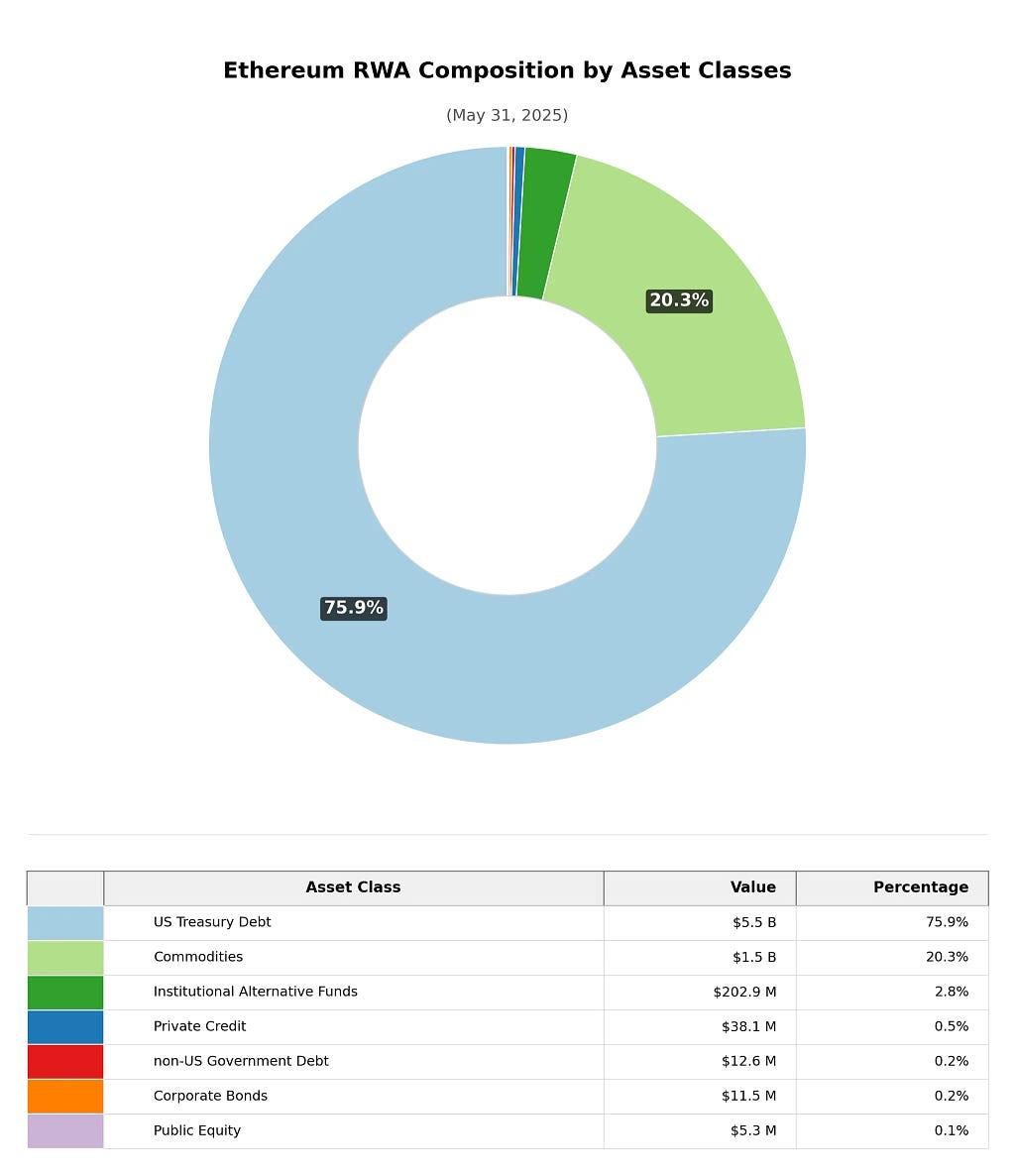

When categorized by asset type (excluding stablecoins), the market capitalization of RWAs on Ethereum is heavily concentrated in two major categories: government debt (75.9%) and commodities (primarily gold, 20.3%), with all other categories representing only a minor share. In contrast, within the total RWA market across all blockchains, private credit holds the largest share (57.4%), followed by government debt (30.9%).

Focusing further on Ethereum’s top RWA assets, the pie chart clearly illustrates the dominance of BUIDL. A year-ago comparison shows that BUIDL’s scale was roughly on par with products like PAXG and XAUT; today, it surpasses them by a decisive margin. Although the composition of the top ten assets remains largely stable, government debt products have grown significantly faster than gold-backed assets, steadily expanding their market share.

When considering the entire crypto market, the top three assets remain BUIDL, XAUT, and PAXG. Notably, BENJI ranks fourth overall, even though it doesn’t appear among Ethereum’s top 10 assets, as it primarily operates on Stellar.

From a protocol perspective, the current leaders are primarily stablecoin issuers — the top four protocols are Tether, Circle, MakerDAO (Dai), and Ethena. Notably, the securitization protocol Securitize has seen its total value significantly surpass some stablecoin projects like FDUSD and USDC, rising into the top tier. Other securities-focused protocols in the top ten include Ondo and Superstate.

Reviewing monthly data from early 2024 to the present, the growth wave began in April 2024, with an astonishing 26.6 percent month-over-month increase — accounting for one quarter of that month’s total RWA increment on Ethereum. This momentum carried through the next three months, albeit with some moderation from August to December 2024; even then, the network sustained an average monthly addition of about $200 million (about 5 percent month-over-month, annualized over 60 percent).

Entering 2025, January saw another explosive surge of 33.2 percent month-over-month. After a brief pullback in February, Ethereum maintained double-digit growth for four consecutive months, with April and May each surpassing 20 percent.

2.1 BUIDL

As BUIDL has swiftly risen to become the largest RWA project by market capitalization on Ethereum, a close examination of its growth trajectory is essential. The month-over-month growth chart indicates that, through March 2025, growth rates had been relatively stable. Thereafter, in March 2025, BUIDL’s growth exploded. The most recent data for May show that although hyper-fast growth has slightly decelerated, BUIDL still added $210 million in that month alone, reflecting an 8.38 percent increase month-over-month. The coming months will be a crucial observation window — whether the growth rate continues to moderate or remains in an explosive phase will be telling.

Several factors underlie BUIDL’s explosive growth. Institutional demand serves as the primary driver, while the product’s competitiveness is the key catalyst: around-the-clock operation, faster settlement speeds compared with traditional finance, and high yields within a compliant framework. Notably, DeFi integrations are generating synergistic effects and unlocking further utility. For example, Ethena Labs’ USDtb product draws 90 percent of its reserves from BUIDL. As market recognition of BUIDL as high-quality collateral continues to grow, Securitize’s launch of sBUIDL has further opened up DeFi use cases.

BUIDL’s asset distribution is highly concentrated: approximately 93% resides on Ethereum mainnet, with other ecosystems remaining far smaller. Concurrently, as the assets under management keep expanding, BUIDL’s monthly dividends continually set new highs — $4.17 million in dividends in March 2025, soaring to $7.90 million by May.

2.2 Stablecoins

Given that the Genius Act will structurally impact the stablecoin regulatory framework, a systematic overview of the Ethereum stablecoin market’s development trajectory is of great forward-looking significance. Since 2024, this sector has exhibited a steady upward trend in total market capitalization. Although its growth has been somewhat slower than other RWA categories, it has nevertheless maintained a resilient monthly growth rhythm.

Among smaller projects (market cap under $500 million), most experienced continual contraction in early 2024. However, by late 2024, many began to rebound: projects like GHO, M, and USDO saw sustained growth in their market caps. A wave of new stablecoin initiatives surpassed the $50 million mark, introducing greater diversity into the Ethereum stablecoin ecosystem — and through 2025, smaller projects have thrived.

Mid-sized projects (market cap $500 million to $5 billion) in 2024 included FDUSD and FRAX; BUSD, after ceasing issuance, dropped sharply from over $1 billion in January 2024 to below $500 million by March. In 2025, both USD0 and PYUSD have crossed the $500 million threshold, contributing to a more diversified mid-cap stablecoin space.

The leading stablecoins (market cap over $5 billion) remain USDT and USDC. USDT held around $40 billion market cap for most of 2024, leaped to $70 billion in early December, and then stabilized until a recent slight decline. USDC grew steadily from $22 billion in January 2024 to $38 billion by May 2025. Early 2025 saw both USDS and USDe break through $5 billion market capitalization, though USDT and USDC continue to dominate in share.

USDT and USDC hold absolute dominance, directly influencing the entire stablecoin ecosystem.

The growth in November 2024 was particularly noteworthy: USDT spiked 30.16 percent month-over-month, and USDC increased 16.31 percent. Following this surge, both continued to grow for several subsequent months. USDC’s month-over-month growth remained consistently above 5 percent. Issuers attributed this to different factors: Tether pointed to an influx of collateral assets from exchanges and institutional trading desks anticipating higher trading volumes; Circle cited a 78 percent year-over-year increase in USDC circulation — driven by renewed market confidence and a more robust standards framework under emerging stablecoin regulations.

However, recent market dynamics have shifted: in the past four months, on-chain USDT growth on Ethereum has stalled, and May 2025 marked the first month of decline for USDC after months of consecutive increases. This phenomenon may signal that the market is transitioning into a new cycle.

2.3 Layer-2 Ecosystem

Within the broader RWA landscape, Ethereum holds an absolute dominance with 59.23% market share of non-stablecoin RWA — but it still faces critical challenges.

Notably, zkSync, driven almost entirely by the Tradable project, has surged into second place, while Stellar relies exclusively on Franklin Templeton’s BENJI fund (with $455.9 million). Despite the impressive on-paper RWA figures of these chains, structural shortcomings must be recognized: a lack of asset diversity and dependence on single marquee projects.

As exemplified by zkSync and Stellar, most Layer-2 networks face similar issues of insufficient ecosystem diversity — they rely heavily on one or two core projects to bolster their RWA market cap. For instance, on Arbitrum, of the $256.2 million total RWA value, BENJI accounts for $111.9 million (43.7 percent) and Spiko for $93.5 million (36.5 percent), with the two combining to represent over 80 percent of Arbitrum’s RWA market. Polygon shows a comparable distribution, with Spiko and Mercado Bitcoin being the primary sources of market cap.

Extending the view across the entire Layer-2 ecosystem, the RWA values and market shares of each network display significant differentiation (see table below). Apart from zkSync, only Polygon and Arbitrum have achieved substantial scale; the remaining Layer-2 networks remain in early development stages. Polygon’s and Arbitrum’s successes are highly dependent on the single driving force of Spiko — a project that contributes roughly one-third of total RWA value on both networks.

When aggregated across Layer 2 networks and ranked by sector, private credit is the largest segment — driven primarily by zkSync’s Tradable. U.S. Treasury debt projects rank second, comprising about half of the remaining total RWA value.

When examining the top 10 Layer 2 assets, we consolidate Tradable’s multiple assets into a single entry — placing it first — and thereby reveal other projects that would otherwise be obscured. It’s followed by the Spiko EU T-Bills Money Market Fund, BENJI, and the Blockchain Capital III Digital Liquid Venture Fund, with BUIDL’s market cap trailing these leaders.

Observing the evolution of Layer-2 RWA market caps, their growth cycle has not been fully synchronized with Layer-1. The mid-2024 period did not see a simultaneous growth kickoff. zkSync’s integration of the Tradable project contributed an approximate $2 billion increase in RWA, and even excluding that effect, Layer-2 networks have shown consistent double-digit month-over-month growth since September 2024. Prior to that, RWA expansion on Layer-2 had been sporadic and modest. Taken together, late 2024 marks a turning point for RWA development in the Layer-2 ecosystem, which has now entered a robust growth phase.

3. Etherealize: Ethereum’s New RWA Engine

As a pivotal force driving Ethereum RWA adoption, Etherealize was born from a deep understanding of industry bottlenecks: when breakthroughs at the protocol layer fail to translate into real-world applications, institutional participation often stagnates. To address this gap, Etherealize systematically bridges the divide between technical innovation and real-world deployment by developing tailored tools, building strategic partnerships, and actively engaging in policymaking.

Currently, Etherealize advances Ethereum RWA adoption through market education, content dissemination, and data-dashboard tools.

On one hand, the team has authored and published multiple in-depth articles about both Etherealize and the wider Ethereum ecosystem; they have also participated in several high-profile podcasts and conducted interviews with traditional finance and crypto media. Engaging in dialogues with industry thought leaders has amplified their influence.

On the other hand, Etherealize is proactively communicating with regulators — hosting several seminars and roundtables focused on digital asset compliance and oversight, continually proposing constructive solutions for formalizing the RWA process.

Recently, Etherealize’s founder, Vivek Raman, was invited to testify before the U.S. House Financial Services Committee for a hearing on “American Innovation and the Future of Digital Assets,” further highlighting Etherealize’s critical role in regulatory engagement.

At present, Etherealize has released only a data dashboard for market education and promotional purposes. However, the roadmap outlines upcoming developments aimed at institutional clients, including an SDK. Etherealize is actively recruiting founding engineers, making this initiative one to watch as it works to accelerate RWA product adoption.

In the expected roadmap, Q2 2025 prioritizes the release of an institutionally focused SDK. This toolkit will integrate custodial interfaces, compliance workflows, and gas-optimization modules, enabling banks and asset managers to build secure, auditable issuance processes. By doing so, it will significantly lower the barriers for traditional financial institutions to participate in Ethereum RWAs.

Building upon this foundation, Q3 2025 will see the pilot launch of an enterprise-grade wallet based on Noir, ensuring enterprise-level privacy protections. Through a “privacy by default” mechanism, the wallet will safeguard confidentiality requirements for RWA transactions.

In Q4 2025, Etherealize aims to expand internationally: plans include partnering with Singapore’s Digital Port and the Swiss Crypto Valley Association to align product features and compliance with regulatory landscapes in the Asia-Pacific and Europe.

Simultaneously, to reduce friction between different Layer-2 networks, Etherealize will spearhead rollup standardization and construct a unified cross-chain interface. This will facilitate asset mobility and advance integration of RWA across the Ethereum ecosystem, enhancing interoperability.

Finally, to narrow the gap between traditional finance and blockchain, Etherealize will maintain its commitment to 24 × 7 support — from legal document preparation to smart contract deployment — providing end-to-end professional services.

4. Ethereum’s RWA Strategic Moats

First-Mover Advantage

Traditional financial institution decision processes differ markedly from those in DeFi — regulatory reviews, pilot validations, and proofs of concept (PoCs) can substantially prolong deployment timelines. In early stages, institutions often adopt a conservative stance, scaling only after pilot outcomes prove successful. Although Ethereum’s leading RWA project BUIDL now dominates, it too required nearly a year of groundwork before its explosive growth. Ethereum’s core advantage lies in its early positioning: even before the RWA wave emerged, it had already completed experimental collaborations with several top financial institutions.

Ecosystem

Beyond institutional collaboration, a mature RWA ecosystem demands long-term accumulation. Ethereum maintains its leadership by virtue of:

- Breadth: Supporting a diverse array of asset issuers and protocol architectures.

- Depth: Housing multiple projects whose market caps exceed $1 billion, creating substantial scale effects.

The integration of traditional finance and DeFi continues to intensify. Most RWA projects prioritize deployment on Ethereum mainnet, leveraging its mature decentralized lending, market-making, and derivatives protocols to enhance capital efficiency. A recent example is Ethena adopting BUIDL as 90 percent of USDtb’s reserve backing. The Genius Act’s mandate that stablecoin reserves be allocated to U.S. government debt is driving the convergence of on-chain government debt products and stablecoin protocols. At the same time, mainstream DeFi protocols have added BUIDL as core collateral.

Ethereum also maintains an advantage in RWA liquidity: it leads in the number of active addresses, token varieties, and depth of on-chain trading. Although the Layer-2 ecosystem faces uncertainties around collaboration mechanisms, it remains the primary path for scaling.

Security

Security is the bedrock of the RWA ecosystem, and the maturity of smart contract technology is critical. As RWA project logic grows more complex, the demands on smart contracts increase correspondingly. In May 2025, Sui’s Cetus protocol suffered a hacker attack, losing $223 million — highlighting deadly risks from oracle manipulation and contract vulnerabilities. Although an on-chain freeze recovered $162 million, such reactive measures underscore inherent risk-management limitations. In contrast, Ethereum’s fundamental advantage lies in its more decentralized architecture, proven operational reliability, and thriving developer community.

Roadmaps

Ethereum’s technology roadmap promises to accelerate RWA development. First, enhancements to Layer-1 performance will help narrow the gap with high-throughput blockchains. Second, promoting Layer-2 interoperability and focusing on application-layer improvements will bridge traditional finance and on-chain RWA more effectively.

Moreover, Ethereum’s privacy roadmap — strengthening security standards and privacy mechanisms (such as integrating privacy tools into mainstream wallets and simplifying censorship-resistant transaction flows) — will provide robust protection for RWA transactions, building an asset confidentiality framework that meets institutional requirements.

5. The “Genius Act”: A Regulatory Double-Edged Sword

The new stablecoin regulatory regime both strengthens centralized control and provides regulatory clarity to the market. Currently, Section 4(6) of the Act does not explicitly permit stablecoin issuers to pay interest to token holders. Although the market may develop alternative solutions, this issue remains uncertain. Meanwhile, the Genius Act mandates that stablecoin reserves must be backed 1:1 by U.S. dollars or U.S. government debt and other highly liquid, safe assets.

USDC’s reserves are now almost entirely allocated to U.S. government debt, complying with the new rule. However, other major issuers must completely overhaul their reserve structures or risk being forced out of the U.S. market. This requirement will directly impact algorithmic stablecoins, delta-neutral stablecoins, and other specialized designs.

By anchoring collateral to U.S. sovereign credit, regulators gain stronger intervention capabilities (while simultaneously driving increased government bond demand). Yet, gaps in the legislation could introduce new systemic risks — echoing lessons learned from the 2000 Commodity Futures Modernization Act (CFMA).

On the positive side, the Act’s clear compliance boundaries may accelerate institutional entry: banks and asset managers, long seeking regulatory certainty, will find these needs met. More large corporations and institutions may be licensed to issue stablecoins. For example, major U.S. banks are reportedly in discussions about a joint crypto stablecoin, and Meta is reconsidering launching a new stablecoin project.

Ethereum’s Resilience: A Diverse Ecosystem

Ethereum’s stablecoin ecosystem derives resilience from its diversity. Since early 2025, multiple stablecoin issuers have significantly grown their market caps, and a host of new stablecoin projects have emerged — incorporating varied designs in collateral structures, yield strategies, and governance models. The Genius Act’s requirement for 1:1 backing with U.S. government bonds exerts compliance pressure on many projects, forcing them to choose between restructuring reserves or temporarily exiting the U.S. market.

However, Ethereum’s ecosystem diversity distinguishes it from blockchains dominated by just a few stablecoin/RWA projects — this mitigates the risk of homogeneity when regulations are universally applied. A multiplicity of structures forms a natural risk-isolation mechanism: even if some stablecoins adjust strategies under compliance mandates, others will continue innovating and uphold decentralized principles without being entirely bound to U.S. Treasury frameworks. Subsequent developments will hinge on the strategic positioning of the Ethereum Foundation and Etherealize.

Conclusion

Ethereum’s RWA ecosystem has witnessed explosive growth in recent months. BUIDL has been the most powerful driver behind this surge, while numerous government debt products have also demonstrated strong momentum. Behind this scaling, government debt projects are increasingly integrating with Ethereum’s existing DeFi and RWA infrastructure — for example, BUIDL’s role as collateral in lending and stablecoin protocols.

Ethereum still holds prominent advantages in the RWA sector. Whether it is the first-mover edge, security, deep ecosystem accumulation, expansive technology roadmap, BUIDL’s leading position, Layer-2 diversity, or Etherealize’s deep enablement — these factors collectively form Ethereum’s core moat in the wave of on-chain traditional finance.

With the Genius Act accelerating the infusion of U.S. dollar credit into on-chain markets, a larger influx of capital will create greater revenue and growth opportunities — but it also introduces a challenge: it ties Ethereum’s financial foundation more closely to fiat (the U.S. dollar), thereby importing sovereign credit risk and potentially transforming the on-chain settlement system into an extension of U.S. dollar hegemony. The blockchain world will no longer be an entirely separate, parallel financial system. Amid this period of explosive growth, there are hidden concerns, centered on Ethereum’s exploration of its own positioning — namely, whether it will support a deeper bond to the U.S. dollar system.

Ethereum’s RWA Boom: Navigating Regulatory Upheaval and a New Growth Engines was originally published in IOSG Ventures on Medium, where people are continuing the conversation by highlighting and responding to this story.