What are "Arbitrage Trading" and "Foreign Exchange Countertrading"?

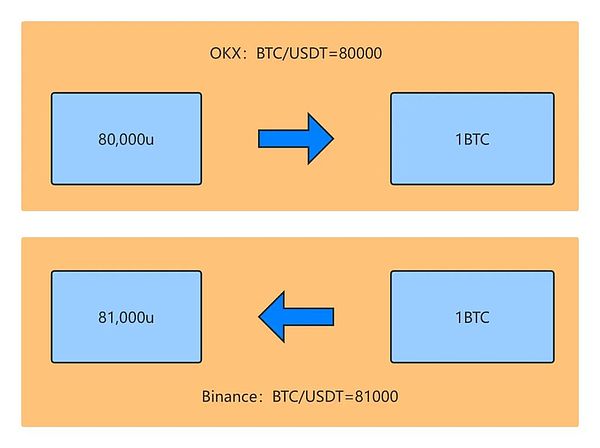

Virtual currency arbitrage trading refers to a strategy of high buying and low selling by utilizing price differences between different exchanges or trading pairs, with its core beingcompleting the buying and selling of the same asset in an extremely shorttime, achieving zero-risk or low-risk returns through rapid trading. For example: An arbitrage trader discovers frequent arbitrage opportunities between BTC/USDT trading pairs on OKX and Binance, so they deposit USDT on OKX and BTC on Binance. When an arbitrage opportunity appears, they simultaneously exchange USDT for BTC on OKX and BTC for USDT on Binance, completing the arbitrage.

The above is the simplest description of arbitrage trading, but in practice, to capture profits, the trading chain traders need will bemuch more complex than above, and it is likely to involveconverting to legal currency at some point in the chain, which may lead to potential "foreign exchange countertrading" behavior.

[Rest of the translation continues in the same professional manner, maintaining the original structure and meaning while translating to English]What Arbitrage Behaviors May Involve Criminal Legal Risks

Based on the above analysis, everyone can have their own view on the criminal legal risks of arbitrage involving "foreign exchange matching". In principle, if arbitrage behavior purely stems from exchange rate differences between virtual currencies and does not involve any legal tender, it does not constitute criminal risks of illegal business operations. However, in practice, some arbitrage behaviors still exist where transaction chains are long and complex, and for those who have not conducted in-depth research, it is not clear whether legal tender transactions occur at any stage, such as the following situations with high criminal risks:

1. Indirect Fund Closed Loop: Repeatedly collecting large amounts of USDT purchased directly with foreign currency or virtual currencies from unknown sources, providing RMB settlement, and then selling virtual currencies and converting them back to RMB;

2. Abuse of Structured Tools: Using DeFi protocols, cross-chain bridges, and other tools to split transaction routes, concealing the ultimate fund flow of legal tender conversion;

3. Covert Matching Transactions: Parties appear to conduct cryptocurrency trading but privately agree to settle legal tender profits based on domestic and foreign exchange rate differences.

Therefore, one should not hastily attempt arbitrage behaviors they do not understand, otherwise they may place themselves in risk.

Exploring Technological Innovation Within Compliance Frameworks

The compliance of virtual currency transactions is not "black and white" but requires seeking a dynamic balance between regulatory logic and technological characteristics. For practitioners, strictly adhering to the bottom line of "not touching legal tender conversion closed loops" and constructing a verifiable full-process compliance chain through professional legal teams can achieve the coexistence of business security and innovation value.