HKMA, Visa, Fidelity International, and ChinaAMC Test e-HKD Transactions with Australian Dollar Stablecoin via CCIP Protocol, Paving the Way for Cross-Border Payments.

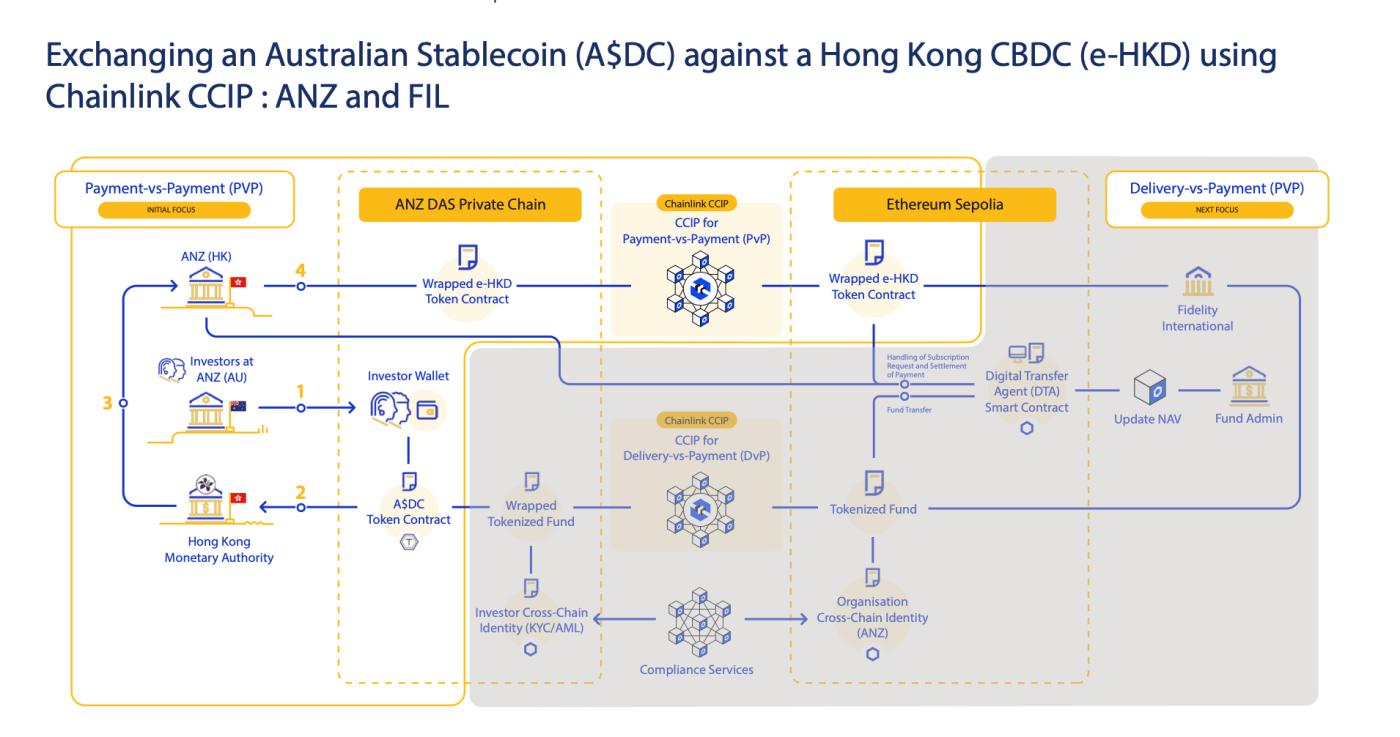

The Hong Kong Monetary Authority (HKMA) has just completed a breakthrough test in Phase 2 of the e-HKD+ pilot program, enabling direct exchange between the experimental central bank digital currency e-HKD and Australian dollar stablecoin through the blockchain protocol of Chainlink. This initiative involves leading financial institutions including Visa, ANZ, Fidelity International, and ChinaAMC Hong Kong.

The test focused on simulating cross-border transactions through encoded assets, allowing Australian investors to purchase Hong Kong money market fund (MMF) units using e-HKD or tokenized bank deposits. This marks a significant step in connecting traditional financial systems with blockchain technology.

Chainlink's Cross-Chain Interoperability Protocol (CCIP) played a crucial role in connecting ANZ's private DASchain with the public Ethereum Sepolia test network. This connection enables atomic payments, where the transfer of e-HKD and Australian dollar stablecoin (A$DC) occurs simultaneously, significantly reducing counterparty risk through an instant transaction completion mechanism on both sides.

Token Standard Compatibility and Technical Challenges

A key aspect of the test was evaluating compatibility between two different Ethereum token standards. E-HKD is built on the ERC-20 standard, widely used in the Ethereum ecosystem, while tokenized deposits use the ERC-3643 standard with integrated legal compliance features like identity verification.

This test highlights the complex challenges of interoperability between public and permissioned blockchains. Financial institutions often prioritize using private chains to maintain operational control and ensure regulatory compliance, but still need access to public chains to expand asset distribution scope.

CCIP's data transmission protocol has demonstrated effective cross-chain information exchange without relying on traditional asset bridges. This opens up possibilities for developing more secure and efficient cross-border payment solutions.

Subsequent test phases will expand the assessment scope to include the complete transaction process, from MMF unit purchase to other operational aspects. Results from these tests are expected to provide crucial input for developing global standards related to CBDCs, tokenized deposits, and digital payment infrastructure.

This initiative reflects the increasing collaboration trend between central banks, traditional financial institutions, and blockchain technology providers in exploring digital asset potential. The participation of major players like Visa and Fidelity demonstrates growing blockchain technology acceptance in the mainstream financial sector.

Detailed results from subsequent pilot program phases are expected to be published by the end of 2025, potentially shaping how CBDCs and stablecoins will interact in the future global financial system.