1/ The launch of @KaminoFinance v2 has shown strong demand out of the gate, with over $150M supplied and $60M borrowed across a variety of new markets.

Exponent PTs: $17M deposited

SyrupUSDC: $25M deposited

Marinade mSOL: $44M deposited

And more🧵

Blockworks Research

@blockworksres

10-23

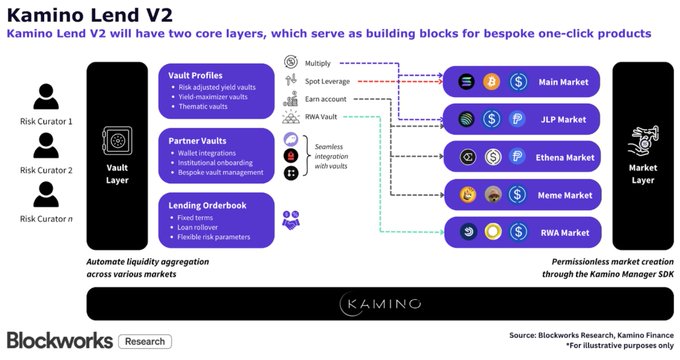

7/ The litepaper for Kamino Lend V2 was recently introduced.

Kamino Lend V2 will adopt a modular architecture with two core layers to enhance security, capital efficiency, and flexibility.

With this upgrade, Kamino can tap into new markets, including institutions and RWAs.

6/ Coupled with $500k in incentives, the SyrupUSDC market has attracted $18M in stablecoins supplied.

With a 6.6% APY on SyrupUSDC and a 2% - 3.75% cost to borrow, this market has provided a profitable venue for looping strategies.

7/ @KaminoFinance's v2 markets support new isolated lending and borrowing use-cases within Solana DeFi.

With dominant liquidity moats, issuers utilize the platform as a premier go-to-market venue.

Subscribe to @blockworksres for more insights on the evolving DeFi landscape.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share