Author: Chi Anh, Ryan Yoon, Tiger Research

This report, written by Tiger Research, analyzes Ethereum's dominance in the current real-world asset tokenization market, examines its structural challenges, and explores which blockchain platforms are poised to lead the next phase of RWA growth.

Key Points

- Ethereum currently leads the RWA market through its first-mover advantage, past institutional experiments, deep on-chain liquidity, and decentralized architecture.

- However, more generalized blockchains with faster and cheaper transactions, as well as RWA-specific chains designed for regulatory compliance, are addressing Ethereum's limitations in cost and performance. These emerging platforms are positioning themselves as next-generation infrastructure by offering superior technical scalability or built-in compliance features.

- The next phase of RWA growth will be led by chains that successfully integrate three elements: on-chain regulatory compatibility, a service ecosystem built around real-world assets, and meaningful on-chain liquidity.

1. Where is the RWA Market Growing Currently?

Tokenization of real-world assets (RWA) has become one of the most prominent themes in the blockchain industry. Global consulting firms like BCG have released extensive market forecasts, and Tiger Research has conducted in-depth analysis of emerging markets like Indonesia, highlighting the growing importance of this field.

So, what exactly is RWA? It refers to converting tangible assets like real estate, bonds, and commodities into digital tokens. This tokenization process requires blockchain infrastructure. Currently, Ethereum is the primary infrastructure supporting these transactions.

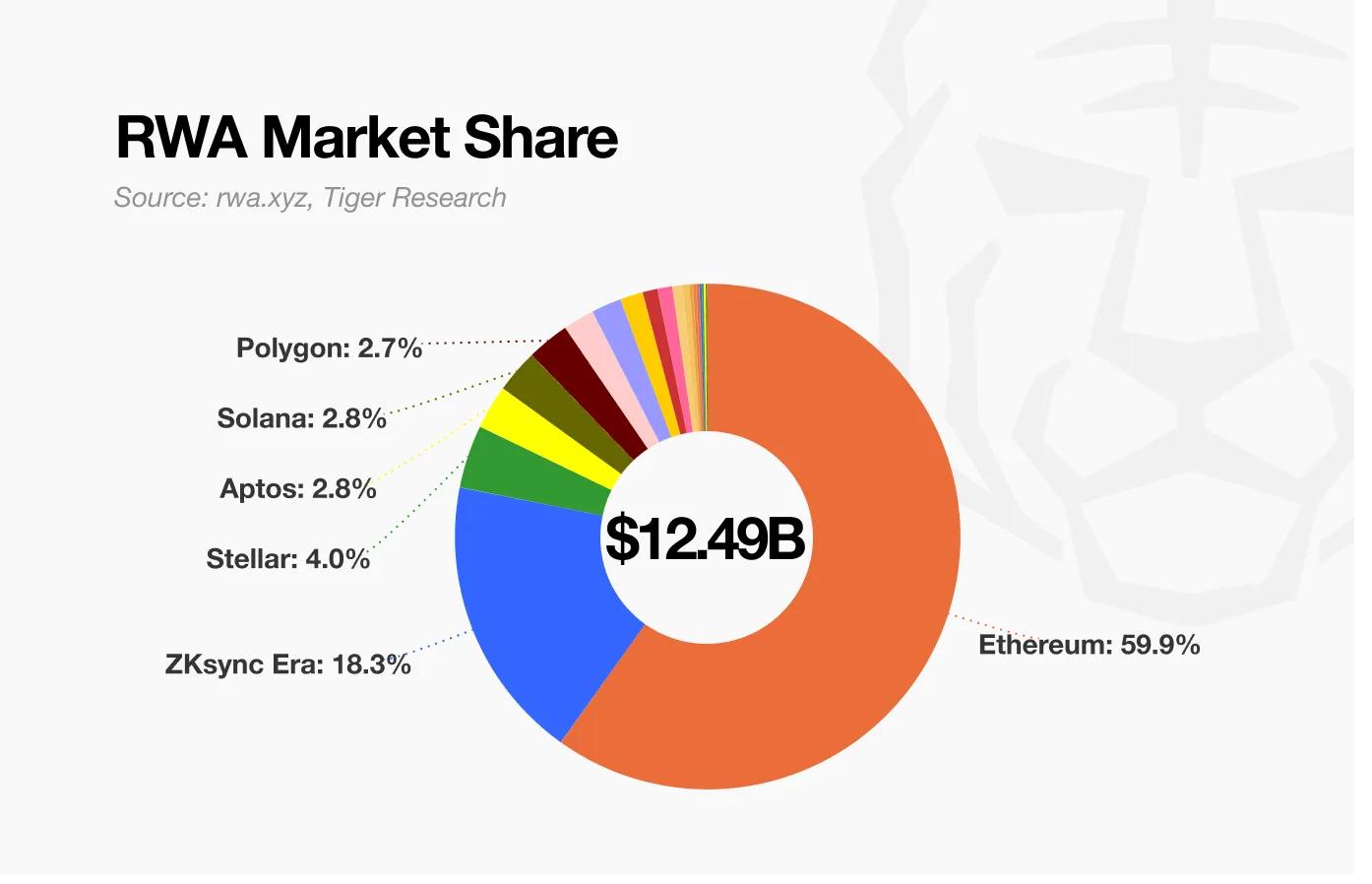

Source: rwa.xyz, Tiger Research

Despite increasing competition, Ethereum maintains its dominance in the RWA market. Specialized RWA blockchains have emerged, and mature DeFi platforms like Solana are expanding into the RWA domain. Nevertheless, Ethereum still accounts for over 50% of total market activity, highlighting the robustness of its existing position.

This report examines the key factors behind Ethereum's current market leadership and explores the evolving conditions that may shape the next phase of growth and competition.

2. Why Does Ethereum Maintain Its Leading Position?

2.1. First-Mover Advantage and Institutional Trust

There are clear reasons why Ethereum has become the default platform for institutional tokenization. It was the first to introduce smart contracts and actively prepared for the RWA market.

Supported by a highly active developer community, Ethereum established critical tokenization standards like ERC-1400 and ERC-3643 long before competing platforms emerged. This early foundation provided the necessary technical and regulatory basis for pilot projects.

As a result, many institutions began evaluating Ethereum before considering alternatives. Several notable initiatives from the late 2010s helped validate Ethereum's role in institutional finance:

JPMorgan's Quorum and JPM Coin (2016-2017): To support enterprise use cases, JPMorgan developed Quorum, a permissioned fork of Ethereum. The launch of JPM Coin for interbank transfers demonstrated that Ethereum's architecture—even in a private form—could meet regulatory requirements for data protection and compliance.

Societe Generale Bond Issuance (2019): SocGen FORGE issued a €100 million secured bond on the Ethereum public mainnet. This showed that regulated securities could be issued and settled on a public blockchain while minimizing intermediary involvement.

European Investment Bank Digital Bond (2021): The European Investment Bank (EIB) collaborated with Goldman Sachs, Santander, and Societe Generale to issue a €100 million digital bond on Ethereum. The bond was settled using a central bank digital currency (CBDC) issued by the Banque de France, highlighting Ethereum's potential in fully integrated capital markets.

These successful pilot cases enhanced Ethereum's credibility. For institutions, trust is based on verified use cases and references from other regulated participants. Ethereum's track record continues to attract attention, creating a reinforcing adoption cycle.

Source: Securitize

For example, in 2018, Securitize officially announced building tools on Ethereum to manage the full lifecycle of digital securities. This laid the groundwork for the eventual launch of BlackRock's BUIDL fund, currently the largest tokenized fund issued on Ethereum.

(Translation continues in the same manner for the rest of the text)These characteristics—transparency, security, and accessibility—make Ethereum a compelling choice for institutions exploring asset tokenization. Its decentralized system meets key requirements for operating in high-risk financial environments.

3. Emerging Challengers Reshaping the Landscape

The Ethereum mainnet has proven the feasibility of tokenized finance. However, with success, it has also exposed structural limitations hindering broader institutional adoption. Key obstacles include limited transaction throughput, latency issues, and unpredictable fee structures.

To address these challenges, Layer 2 Rollup solutions like Arbitrum, Optimism, and Polygon zkEVM have emerged. Major upgrades including the Merge (2022), Dencun (2024), and the upcoming Pectra (2025) have brought improvements in scalability. Nevertheless, the network still falls short of traditional financial infrastructure. For instance, Visa processes over 65,000 transactions per second, a level Ethereum has not yet reached. For institutions requiring high-frequency trading or real-time settlement, these performance gaps remain a critical constraint.

Latency also poses challenges. Block generation averages 12 seconds, and with additional confirmations needed for secure settlement, finality typically takes up to three minutes. During network congestion, this delay can further increase—creating difficulties for time-sensitive financial operations.

Moreover, Gas fee volatility remains a concern. During peak periods, transaction fees have exceeded $50, and even under normal conditions, costs frequently rise above $20. Such fee uncertainty complicates business planning and can undermine the competitiveness of Ethereum-based services.

Securitize illustrates this dynamic well. After encountering Ethereum's limitations, the company expanded to other platforms like Solana and Polygon, while also developing its own chain Converage. While Ethereum played a crucial role in facilitating early institutional experiments, it now faces increasing pressure to meet the demands of a more mature, performance-sensitive market.

3.1. The Rise of Fast, Efficient, and Cost-Effective General Blockchains

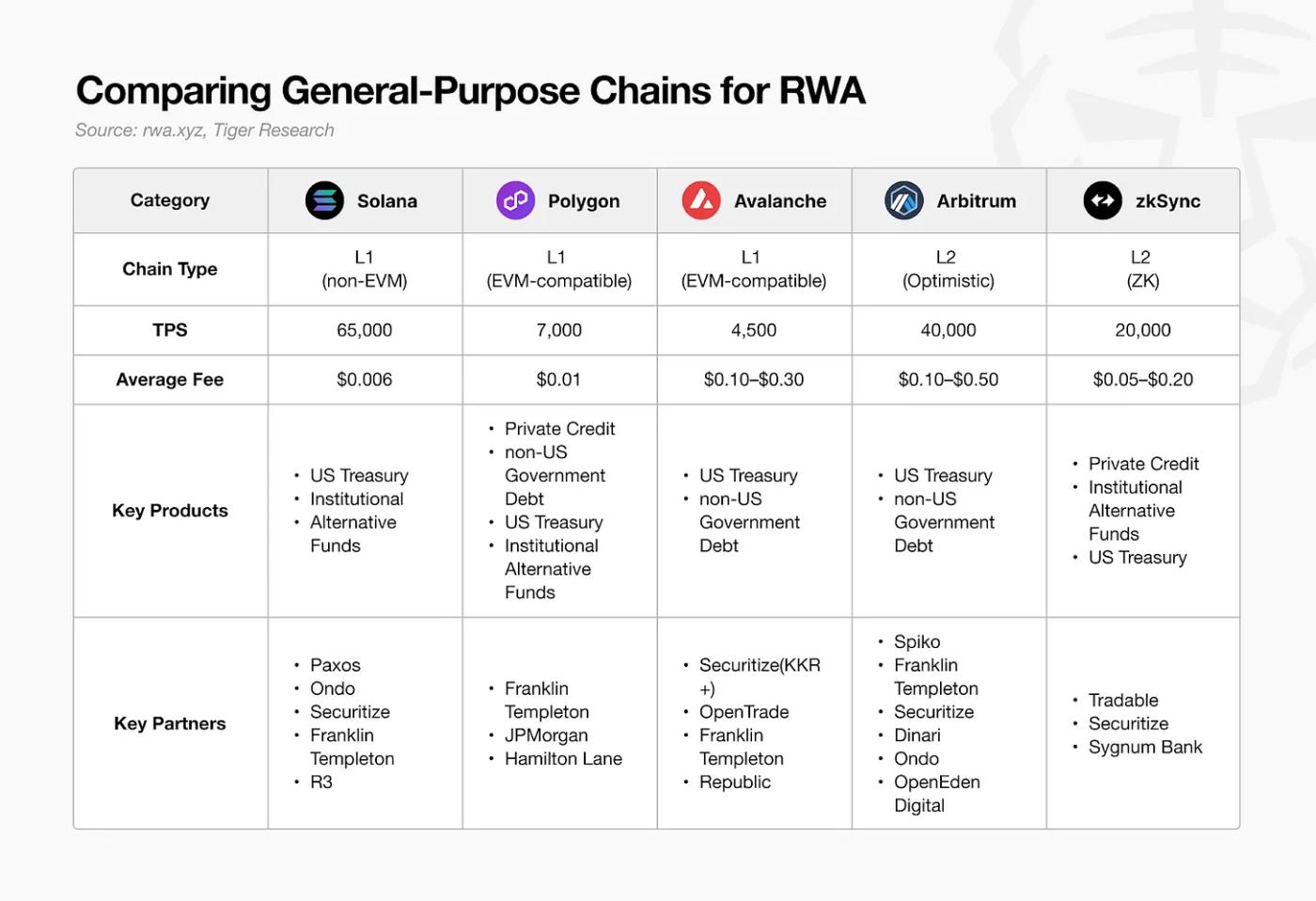

As Ethereum's limitations become increasingly apparent, institutions are increasingly exploring general blockchains that offer alternative advantages in key performance bottlenecks such as transaction speed, fee stability, and finality time to complement Ethereum.

Source: rwa.xyz, Tiger Research

However, despite ongoing collaboration with institutional participants, the actual number of tokenized assets on these platforms (excluding stablecoins) remains significantly lower compared to Ethereum. In many cases, tokenized assets launched on general chains are still part of an Ethereum-dominated multi-chain deployment strategy.

Nevertheless, there are signs of substantial progress. In the private credit sector, new tokenization initiatives are emerging. For example, on zkSync, the Tradable platform has gained attention, accounting for over 18% of activity in the field—second only to Ethereum.

At this stage, general blockchains are just beginning to establish a foothold. Platforms like Solana, which have experienced rapid DeFi ecosystem growth, now face a strategic challenge: how to convert this momentum into a sustainable position in the RWA space. Excellent technical performance alone is insufficient. To compete with Ethereum, they must provide infrastructure and services that meet institutional investors' trust and compliance expectations.

Ultimately, the success of these blockchains in the RWA market will depend less on raw throughput and more on their ability to deliver tangible value. Differentiated ecosystems built around each chain's unique advantages will determine their long-term positioning in this emerging field.

3.2. The Emergence of RWA-Specific Blockchains

An increasing number of blockchain platforms are abandoning generic designs in favor of domain-specific specialization. This trend is evident in the RWA space, with a wave of new purpose-built chains emerging, optimized specifically for real-world asset tokenization.

Source: Tiger Research

The rationale for RWA-specific blockchains is clear. Tokenizing real-world assets requires direct integration with existing financial regulations, making the use of generic blockchain infrastructure insufficient in many cases. Specific technical requirements—especially around regulatory compliance—must be addressed from the ground up.

A key area is compliance processing. KYC and AML procedures are crucial for tokenization workflows but have traditionally been handled off-chain. This approach limits innovation by merely wrapping traditional financial assets in a blockchain format without redesigning the underlying compliance logic.

The current shift is towards moving these compliance functions entirely on-chain. There is growing demand for blockchain networks that can not only record ownership but also natively enforce regulatory requirements at the protocol level.

In response, some RWA-focused chains have begun offering on-chain compliance modules. For instance, MANTRA includes decentralized identity (DID) functionality, supporting compliance enforcement at the infrastructure layer. Other specialized chains are expected to follow similar paths.

Beyond compliance, many such platforms leverage deep domain expertise to target specific asset categories. Maple Finance focuses on institutional lending and asset management, Centrifuge on trade finance, and Polymesh on regulated securities. Rather than broadly tokenizing sovereign bonds or stablecoins, they are using vertical specialization as a competitive strategy.

That said, many of these platforms are still in early stages. Some have not yet launched their mainnet, and most remain limited in scale and adoption. If general chains are just beginning to gain attention in the RWA space, specialized chains are still at the starting line.

4. Who Will Lead the Next Phase?

Ethereum's dominance in the RWA market is unlikely to persist in its current form. Today, the tokenized assets market represents less than 2% of its estimated potential, indicating the industry is still in its early stages. To date, Ethereum's advantage has primarily stemmed from its early product-market fit (PMF). However, as the market matures and scales, the competitive landscape is expected to undergo significant changes.

Signs of this transformation are already evident. Institutions are no longer focusing solely on Ethereum. Both general and RWA-specific blockchains are being evaluated, with increasingly more services exploring custom chain deployments. Tokenized assets initially issued on Ethereum are now expanding into multi-chain ecosystems, breaking the previous monopolistic structure.

A critical turning point will be the application of on-chain compliance. To make blockchain-based finance truly innovative, regulatory processes like KYC and AML must be conducted directly on-chain. If specialized chains successfully provide scalable, protocol-level compliance and drive industry-wide adoption, the current market landscape could be significantly disrupted.

Equally important is the presence of actual purchasing power. Tokenized assets only become investable when active capital is willing to acquire them. Regardless of technology, tokenization's utility is limited without meaningful liquidity. Therefore, the next generation of RWA platforms must cultivate a robust service ecosystem built on tokenized assets and ensure users have strong liquidity participation.

In short, the conditions for success are becoming increasingly clear. The next leading RWA platform is likely to be one that achieves the following three points:

A fully integrated on-chain compliance framework

A service ecosystem built on tokenized assets

Deep and sustainable liquidity to facilitate actual investment

The RWA market is still in its infancy. Ethereum has validated the concept. The opportunity now lies with platforms that can provide superior solutions—those that meet institutional requirements while unlocking new value in the tokenized economy.