A cryptocurrency data center in Pyote, Texas, located on land leased from the University of Texas System

Dozens of wind turbines stand against the desert sky,, each as tall as 50 stories. A total of 800,000 solar panels cover a scrubland area almost the size of London Heathrow Airport. a refrigerated data, after row of computer servers emit aisy buzzing, occupying an area equivalent to two city blocks in New York. The University Center of the land all these new projects, creating income for tens of thousands of students.

For a long time, time, Texas on money leenting the mineral rights beneath its land in the Permian Basin: extracting oil and natural gas from North America's America's most fertile mineral deposits. Beneath the wind and solar farms, pip,elinesing miles of delivering "liquid gold" remain" key to its wealth. Thanks to record-years of record fossil fuelels production and investment returns, the>

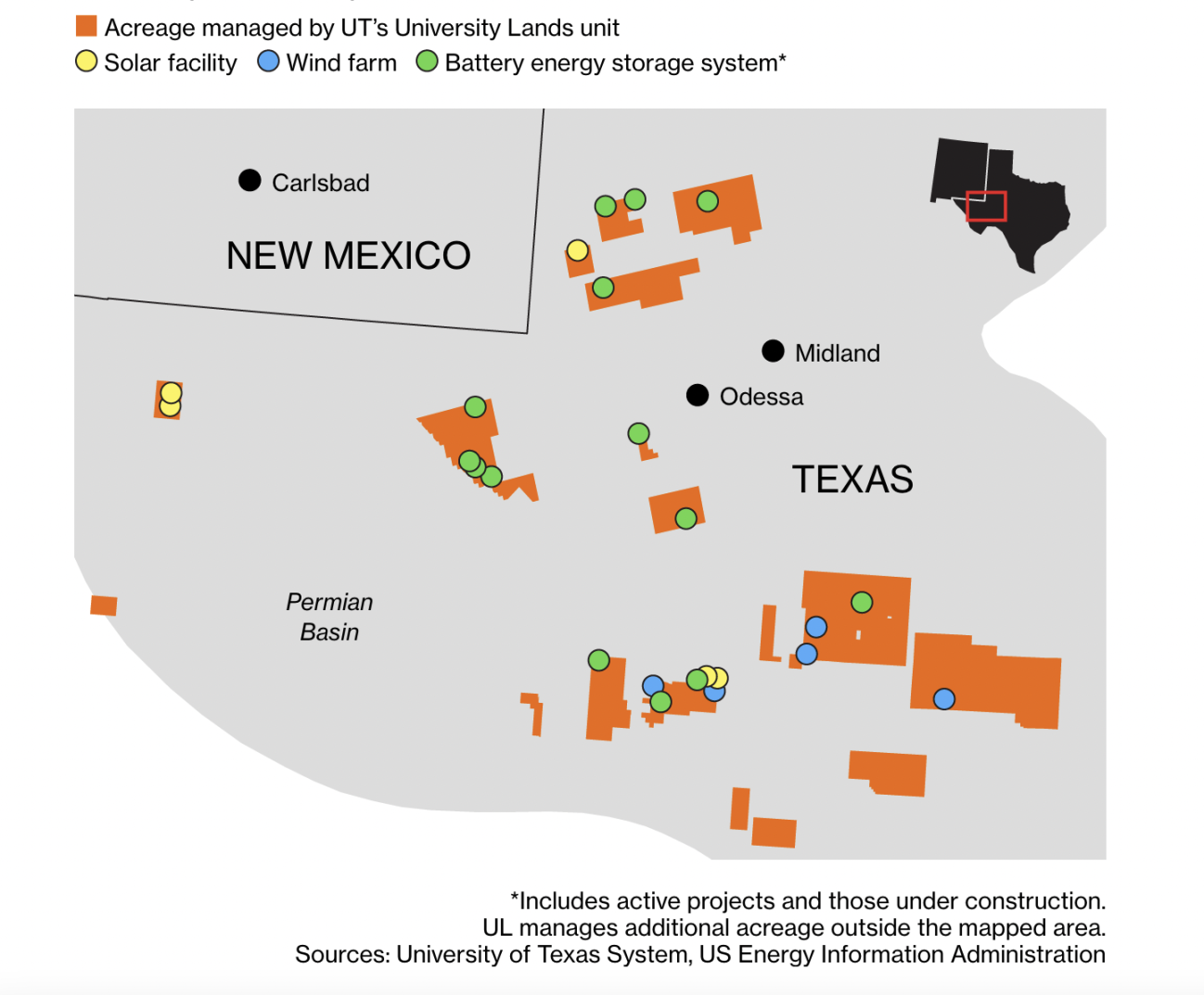

But the University of Texas System (which also manages land for Texas A&M University) is increasingly seeking to create more income ground. Beyond surface development projects started decades ago - leasing rights for roads, power lines, and pipelines, and graland use for grazing - the university now has new attempts: renting land land for renewable energy, battery storage, and cryptocurrency data centers, creating income income sources that barely existed five years ago.

A wind farm in Rankin, Texas

<>

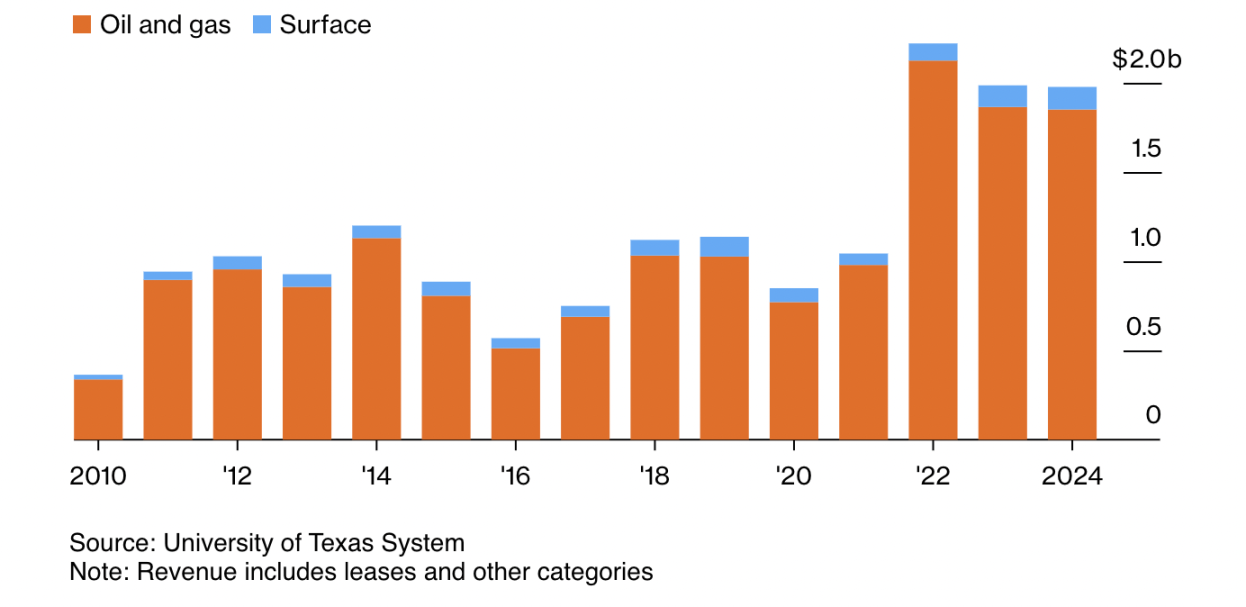

University of Texas System Land (for each fiscal year ending August 31)

In May this year, the University of Texas reached a preliminary agreement to lease 200,000 acres (10% of its land holdings) to Apex Clean Energy, headquartered in Virginia, for wind and solar power generation. The company's customers include Meta (Facebook's parent company) and the US Army. financial details have not been disclosed, this will be be the largest ground project deal for the University to date.

If these projects succeed, the University of Texas expects to add tens of millions of dollars in income annually over the next decades. The university is is seeking to provide sites for AI large data centers, companies helping utility companies and other institutions prevent carbon emissions from entering the atmosphere, and natural gas power plants.

Murphy., of Lands (the department managing state property for the University of Texas) is trying to diversthe system's income. Some oil company CEOs recently stated that US production in the Permian Basin has reached is near its peak. "Our mission is to create permanent income for the institution. We have a long-term view, 30 to 50 years," Murphy said, "We we believe this is a long-race run, and we are at the starting point."

William Murphy Jr of Texas In his Houston office

The University of Texas's strategy comes at a time when renewable energy is under attack in Washington, reverse the Biden administration's support for renewable energy, fuel President Donald Trump fiercely criticized wind turbines, calling them unsightly and unreliable. "Huge, ugly windmills - they're destroying your community," he said in January.

Texas's own love-hate relationship with renewable energy could pose challenges for the University of Texas's plans. The state is the largest wind power producer in the US and ranks second in solar energy, just behind California. "We believe in an 'all-of-the-above' energy development approach," said Texas Republican Governor Greg Abbott in December.

To support this strategy in the Permian Basin, the Texas Public Utility a.1 billion plan in April to build three transmission lines to help meet the needs of oil drilling platforms, new data centers, cryptocurrency mining farms, and hydrogen production plants. "Without these new transmission lines, no one want to expand wind and solar supply in West Texas," said," said Hirs, energy at Houston said.

However, in 2021, a devastating winter storm caused Texas massive power outages, Texas Republicans blamed the blame the's reliance on wind and solar energy. solar. Research found that natural gas power plant failures were the of primary reason for the outage. Nevertheless, the Republican-controlled Texas legislature is considering some bills that building solar and wind energy projects more and><>said if Texas officials move away from renewable energy, the of Texas change its strategy. example of gas-driven projects. "If theseives,, it could the situation in he said, "We are not a political entity, and we will not push anything."

Murphy his's Houston office walls are filled with black and white photos of early oil drilling platforms, near the by ConocoPhillips headquarters and London Shell's main US outpost.. An old oil wooden wheel, twice Murphy's height, occupies the main position in the We the indicating that the University of Texas still very much values making money from fossil fuels. "We plan to let oil and natural gas exist for a very long time," said the ,47-Murphy a fifth-generation Native who was once an oil and gas lawyer and managed one of the state's largest cattle ranches.

In Pyote, Texas, an operator burns excess natural gas on land managed by the University of Texas

The University of Texas oversees 33,300 square miles of land in the Permian Basin, almost the size of Delaware and Rhode Island combined, spanning 19 counties, centered on the famous oil town of Of Midland. In the 19th century, the state constitution granted the University of Texas the mineral and surface rights to these lands. At the time, except for grazing, this arid land was considered almost worthless. But explorers discovered oil in 1923, bringing wealth to Texas higher education.

The University of Texas itself does not explore oil or gas, nor develop any projects on state-owned land. It leleases these lands and collects royalties based on oil and gas production. Over the past years, land leto oil and gas companies has created $15.8 billion in income. With rising prices and productionalties have recently surgededs, income exceeding >

Renewable energy and energy storage projects on land managedased by the University of Texas System

All these funds have flowed into a fund supporting two large public universities in Texas. Two-thirds are allocated to the University of Texas, and one-third to Texas A&M University, which has a $20 billion endowment. These two systems collectively educate approximately 350,000 students. They also operate hospitals, including the MD Anderson Cancer Center at the University of Texas in Houston.

The state constitution stipulates that oil and gas revenues must be used for capital expenditures, such as constructing classrooms, hospitals, and laboratories, rather than daily operations. This wealth has sparked a construction boom, with recent allocations of $50 million for a new cancer and surgical center at the University of Texas Rio Grande Valley, $60 million to fund a "smart hospital" with a virtual reality laboratory at the University of Texas Arlington, and $54 million to support the Mays Business School in constructing a new site at the Texas A&M flagship campus.

New ground project revenues can be used for categories like "academic excellence" and supporting special programs. Although still small compared to fossil fuel revenues, non-oil and gas revenues have totaled $1.2 billion over the past 15 years and have been rising sharply. In November last year, the University of Texas system announced that it would waive tuition for undergraduate students from families with incomes of $100,000 or less across its nine campuses, using its endowment, non-fossil fuel funds, and other sources.

Today, such funds are particularly valuable for universities because of their flexibility in an adverse higher education environment. The Trump administration has been confronting elite universities, cutting federal funding in fields it dislikes, including any areas perceived as related to diversity, equity, and inclusion. A Republican bill seeks to impose a tax of up to 21% on investment income from the largest private university endowments. As a public school system, the University of Texas is not a target, and in any case, its per capita endowment (a government measure of wealth) is too low, around $230,000, compared to Harvard's over $2 million.

Given continuous growth in population and higher education enrollment, Texas still craves more resources. By partnering with companies like NextEra Energy (a renewable energy provider in Juno Beach, Florida), the University of Texas has already signed 5 wind energy and 5 solar energy lease agreements. It also has 4 protocols for cryptocurrency mining and 14 for battery storage systems, either operational or under construction. In the previous fiscal year's record $127 million in non-oil sources of income, only $7 million came from renewable energy.

A cryptocurrency data center in Peot, Texas, located on land leased from the University of Texas system

The biggest benefit might be leasing land for large data centers, which have sparked controversy due to their massive energy consumption. Tech companies have promised to spend hundreds of billions of dollars constructing them to meet artificial intelligence computing needs. "Texas is getting everyone's attention," said Brant Bernet, senior vice president at CBRE Group responsible for finding data center land for companies.

Murphy is cautiously striking these deals, not wanting to occupy too much land and forgo more profitable opportunities. "We need to maximize returns, but not rush," he said, "We understand the future, and we also understand its potential."