Original | Odaily (Odaily@OdailyChina)

Author | Nan Zhi (@Assassin_Malvo)

On June 10, Huma Finance released a Huma Staking Rewards Proposal, which provides a detailed explanation of the Feather points coefficient calculation rules for Season 1 (the second staking activity). In the first staking and TGE activity, the annual yield for Huma USDC staking reached over 100%, which is considered a rare "big reward" in the current landscape of diminishing returns. Is the second activity worth participating in?

In this article, Odaily will collect and calculate data to try to clarify the expected returns for Season 1.

Proposal Details

The proposal's original link is: https://www.notion.so/huma-fi/Huma-Staking-Rewards-Proposal-20eefc699c5a80f5bcc1e6f010ccd135, with the opinion consultation period ending on June 17. This article will calculate based on the current version, with key calculation rules including:

LP Lock-up Period and Mode Multiplier: Providing different base multipliers based on LP lock-up duration (such as 3 or 6 months) and mode (Classic or Maxi). The minimum is 1x for non-locked, Classic mode, and the maximum is 15x for 6-month Maxi mode. (Note: LP here refers to USDC deposit, not the traditional AMM LP)

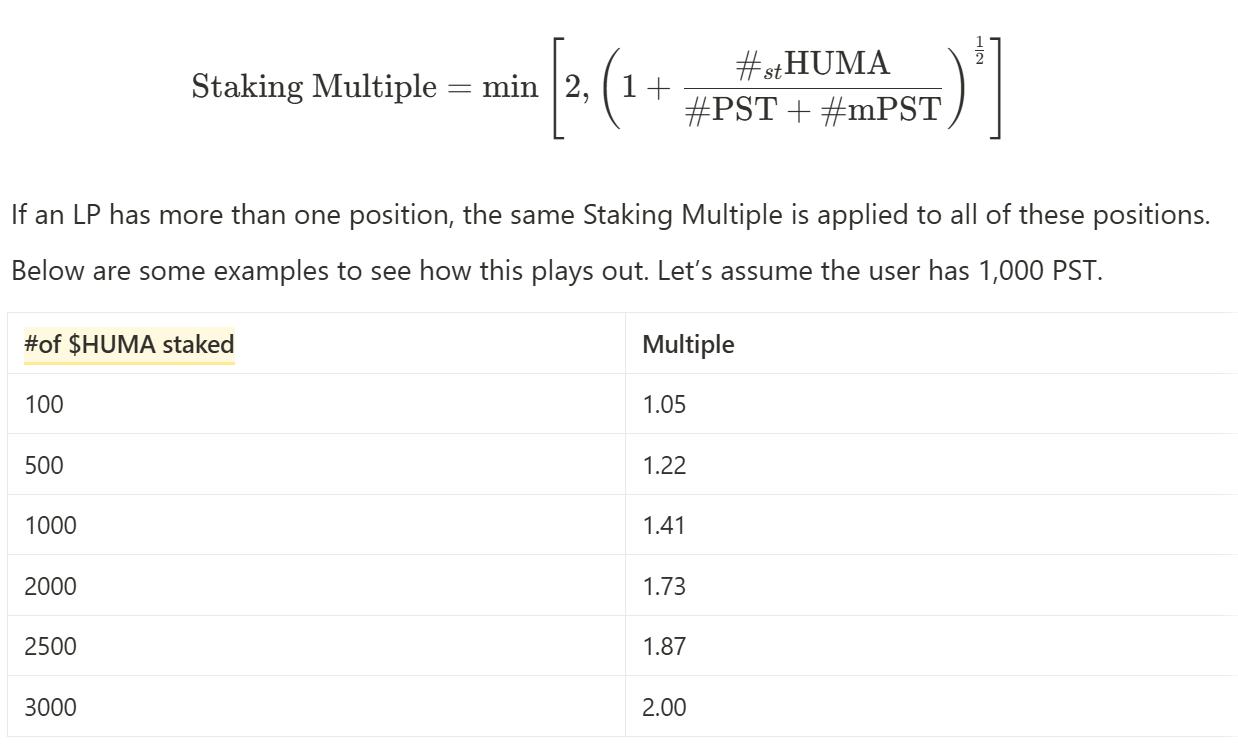

Staking Multiplier: Determined by the ratio of staked HUMA tokens to total LP tokens, providing additional LP reward bonuses. When staked HUMA reaches three times the LP token amount, the multiplier reaches a maximum of 2. The official calculation formula is as follows:

OG LP Identity: Users who participated in Huma Season 0 and currently have a deposit of over $100 will receive a fixed 1.2x bonus. For users who have transferred assets, OG status can be restored by transferring assets back before July 1.

Vanguard Identity: Users who stake all their airdrop tokens before June 15, or those without airdrops but staking over 100,000 HUMA tokens for 6 months or more, can receive a 1.2x Vanguard identity bonus.

Earnings Calculation

According to previous announcements, Season 1 will distribute 2.1% of tokens, but the proportion allocated to LP is not yet clear. Assuming all users adopt the same staking method and 2.1% is fully allocated to LP, we have the following data:

The current TVL is $56.65 million, FDV is $462 million, and the value of 2.1% tokens is $9.7 million. With Season 1 lasting 3 months, the absolute return rate is 970/5665 = 17.1%, equivalent to an annualized yield of 68.4%.

Further distinguishing, there are two staking modes (Maxi and Classic) and three staking durations, resulting in six scenarios, with the current user choices as shown in the image.

Based on different point acquisition coefficients, APR varies. The most popular option of 6-month Maxi mode mode has an APR of 127.06%, while the second most popular non-locked Classic mode is 8.47%.

Additionally, there are ways to increase point acquisition efficiency such as OG, Vanguard, and HUMA staking, which can amplify up to 1.2 × 1.2 × 2 = 2.88 times, but the specific outcome depends on each user's strategic approach.

In summary, under the current TVL and token price, choosing the 6-month Maxi mode in Huma Finance's second airdrop activity is expected to achieve an APR of over 100%, which is particularly beneficial for first-period staking participants who continue without any asset adjustments.