Introduction: How Did DeFi Transform from a Geek's Toy to Wall Street's Darling?

In the past few years, a hot term has been constantly mentioned in financial circles - DeFi (Decentralized Finance). A few years ago, when geeks first started building some peculiar financial tools on Ethereum, no one expected these "small toys" would eventually attract the attention of traditional Wall Street financial giants.

Looking back at the period between 2020 and 2021, DeFi rose rapidly at a stunning speed. At that time, the total value locked (TVL) in the entire market soared from billions of dollars to a peak of $178 billion. Protocols with strange-sounding names like Uniswap and Aave became overnight celebrities in the global crypto world.

However, for most ordinary investors, DeFi has always been like a maze filled with traps. Wallet operations are headache-inducing, smart contracts are as difficult to understand as Martian language, not to mention having to be on guard against assets being wiped out by hackers every day. Data shows that even though DeFi is so popular, the proportion of investment institutions entering the traditional financial market is less than 5%. On one hand, investors are eager to try; on the other hand, they are hesitant to act due to various barriers.

But capital's sense of smell is always the most acute. Starting from 2021, a new tool specifically designed to solve "how to easily invest in DeFi" emerged - the Decentralized ETF (DeETF). It combines the concept of traditional financial ETF products with blockchain transparency, retaining the convenience and standardization of traditional funds while also accommodating the high growth potential of DeFi assets.

You can understand DeETF as a bridge, with one end connecting the "difficult to enter" new continent of DeFi, and the other end connecting the vast number of investors familiar with traditional financial products. Traditional institutions can continue to invest using their familiar financial accounts, while blockchain enthusiasts can easily combine their investment strategies as if playing a game.

So, how did DeETF gradually emerge alongside the growth of DeFi? What evolution did it go through, and how did it step by step become a new force in on-chain asset management? Next, we will start from the birth of DeFi and talk about the story behind this new financial species.

(The translation continues in the same manner for the rest of the text, maintaining the specified translation rules and preserving any HTML tags.)Uncertain Regulatory Environment: The U.S. SEC has very strict regulations on crypto ETFs, with compliance costs remaining high.

Smart Contract Security Concerns: Between 2022-2023, hacker attacks caused approximately $1.4 billion in losses to DeFi protocols, leaving investors still worried.

However, despite these challenges, DeETF is still viewed as an important innovation in future financial markets. It gradually blurs the boundaries between traditional investors and the crypto market, making asset management more democratic and intelligent.

Part Two: Emerging Projects Rise, DeETF Track Blooms

(I) From Single Mode to Diverse Exploration: A New Landscape for DeETF

As the DeETF concept gradually gains market acceptance, this emerging field has entered a "blooming" phase after 2023. Unlike the early single ETP (exchange product) mode, DeETF is now rapidly evolving along two paths:

One path continues to follow traditional financial logic, issuing ETPs through formal exchanges like DeFi Technologies, continuously enriching DeFi asset categories, allowing traditional investors to easily invest in on-chain assets as if buying stocks;

The other path is more radical and closer to the crypto spirit - a purely on-chain, decentralized DeETF platform. Users don't need broker accounts or KYC, just a crypto wallet to independently create, trade, and manage asset portfolios on-chain.

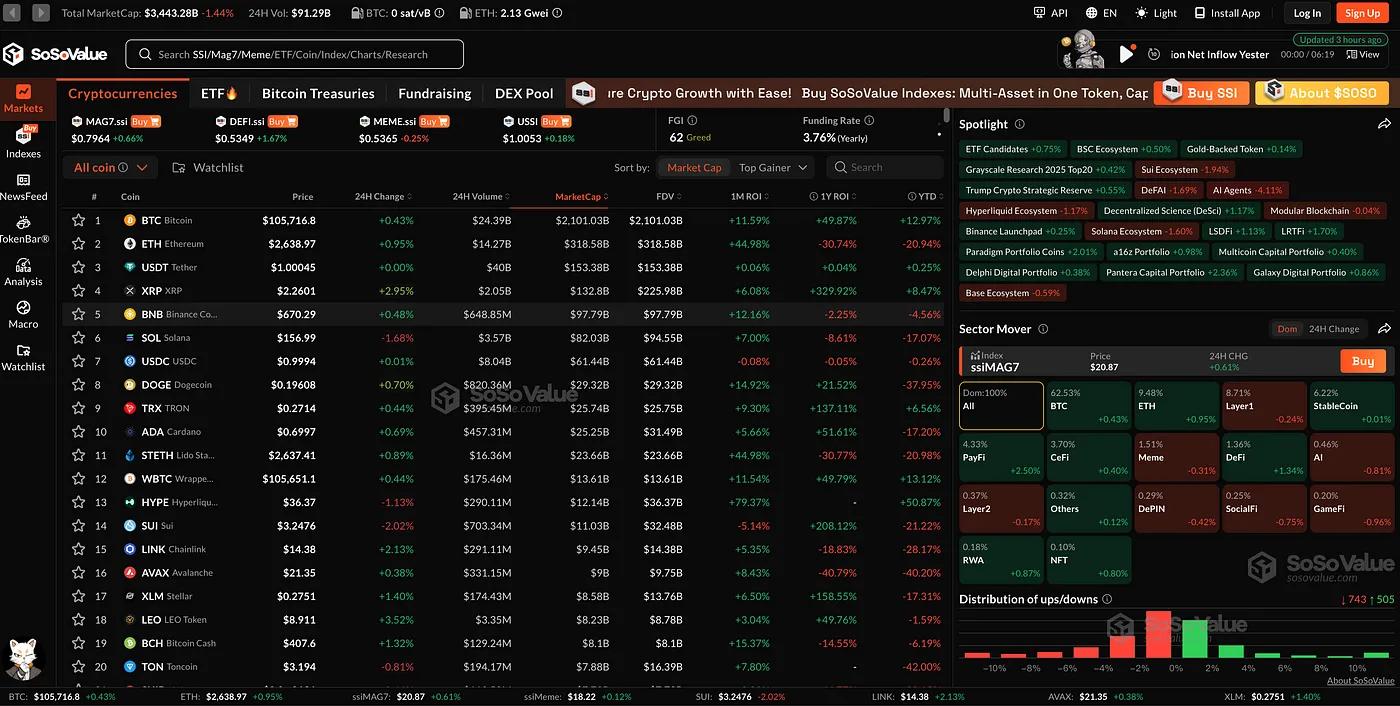

Especially in the past two years, platforms like DeETF.org and Sosovalue have become pioneers in on-chain native asset portfolio direction. Sosovalue supports multi-theme portfolio strategies (such as GameFi, blue-chip portfolios), providing users with an "one-click purchase + trackable" ETF product experience, attempting to solve portfolio management threshold issues in a lighter way.

In the institutional path, besides DeFi Technologies, the influence of RWA leader Securitize cannot be ignored. It is tokenizing traditional financial assets like U.S. private equity, corporate bonds, and real estate in a compliant manner, introducing primary market investors into the on-chain market. Although not directly called DeETF, its portfolio asset custody structure and KYC mechanism already possess core DeETF characteristics.

They proposed the concept of "24/7 round-the-clock trading, no intermediaries, user-initiated portfolio composition", breaking the traditional ETF limitations of trading hours and custodian institutions. Data shows that by the end of 2024, the number of active on-chain ETF portfolios on DeETF.org has exceeded 1,200, with total locked value reaching tens of millions of dollars, becoming an important tool for DeFi native users.

In professional asset management, organizations like Index Coop have begun standardizing DeFi assets, such as launching the DeFi Pulse Index (DPI), providing users with an "out-of-the-box" DeFi blue-chip asset portfolio, reducing individual token selection risks.

It can be said that since 2023, DeETF has transformed from a single attempt into a diverse competitive ecosystem, with projects of different routes and positions blooming.

(II) New Trend in Smart Asset Portfolios: Who is Making DeETF More "Usable"?

In the past few years, the DeETF track has evolved from "DIY free composition" to "preset portfolio one-click purchase". Platforms like DeETF.org advocate a "user-selected" portfolio mechanism, while Sosovalue leans more towards a "thematic strategy" product path, such as GameFi blue-chip packages and L2 narrative combinations, mostly targeting users with existing research foundations.

However, few platforms truly hand over "portfolio strategies" to algorithmic automation.

This is precisely the entry point for YAMA (Yamaswap), which won the first Juchain Hackathon: instead of stacking portfolios on traditional DeFi, it tries to make DeETF more "intelligent".

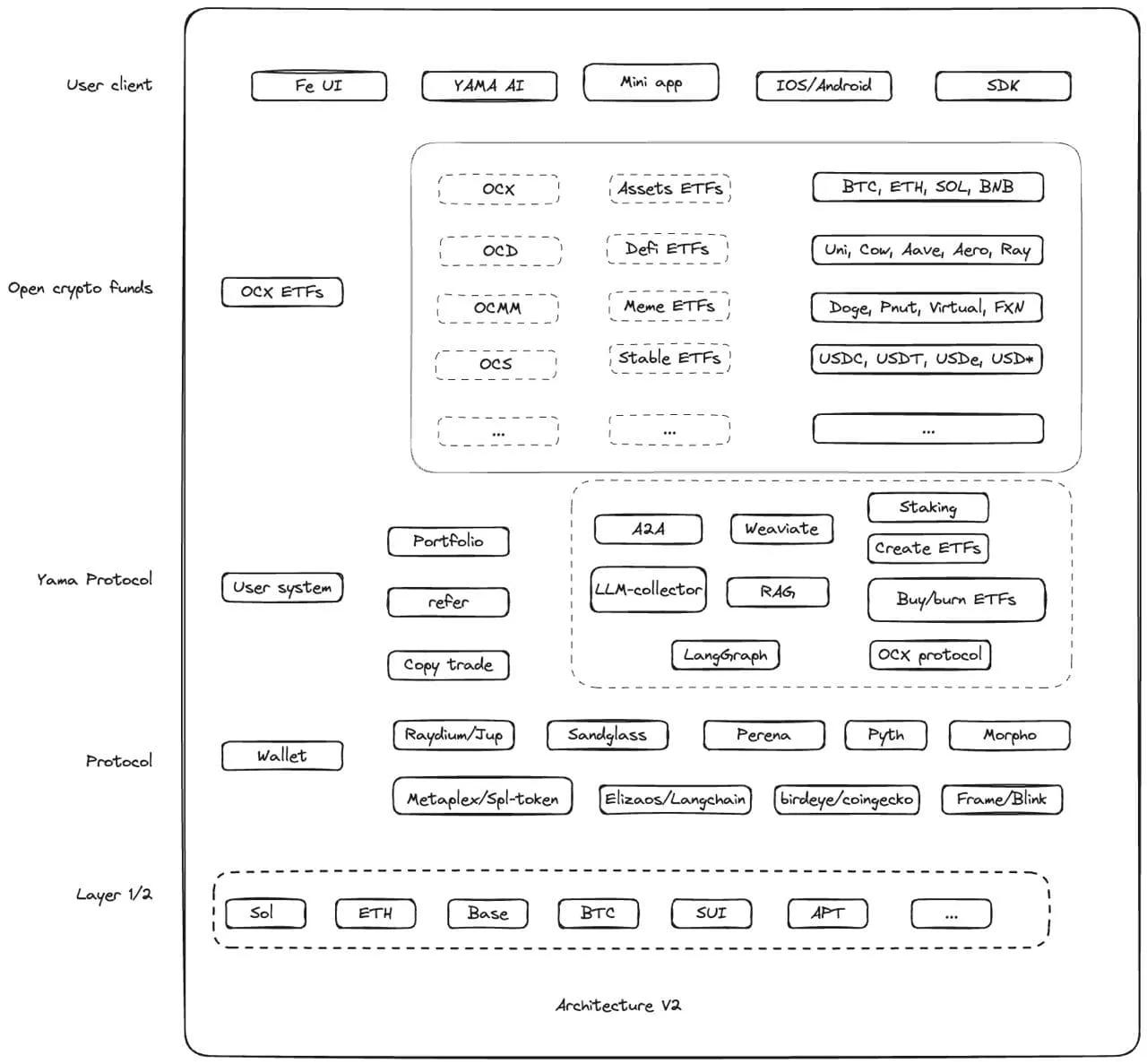

Specifically, YAMA doesn't want users to bear all research pressure, but has built an AI-driven asset allocation recommendation system. Users only need to input requirements, such as "stable returns", "focus on Ethereum ecosystem", "preference for LST assets", and the system will automatically generate recommended portfolios based on on-chain historical data, asset correlation, and backtesting models.

Similar concepts have appeared in the TradFi world's Robo-advisor services like Betterment and Wealthfront, but YAMA has moved this to the chain and completed asset management logic at the contract level.

For deployment, YAMA chose to run on Solana and Base, thereby significantly reducing usage costs. Compared to the mainnet's gas costs of tens of dollars, this architecture is naturally suitable for more daily asset portfolio interactions, especially more user-friendly for retail users.

In terms of portfolio security, YAMA's smart contract supports on-chain transparency of portfolio components, weights, and dynamic changes, allowing users to track strategy execution at any time, avoiding the "black box configuration" of traditional DeFi aggregation tools.

Unlike other platforms, YAMA emphasizes a composite experience of "self-deployment" + "AI portfolio recommendation" - solving the pain point of "not knowing how to invest" while maintaining transparency and self-management of asset control.

This product path may represent the direction of the next stage of DeETF platforms moving from "structural tools" to "intelligent research assistants".

Yamaswap Technical Architecture

(III) DeETF Track is Forming Divergent Evolution Paths

As crypto user structure shifts from primarily trading to "portfolio management" needs, the DeETF track is gradually diverging into several development routes.

For instance, DeETF.org still emphasizes user-initiated configuration and free combination, suitable for users with a certain cognitive foundation; Sosovalue further productizes asset portfolios, launching on-chain themed ETFs like "Solana Infrastructure Portfolio" and "Meme Ecosystem Basket", similar to traditional fund styles. Index Coop focuses on standard index products, targeting long-term stable market coverage.

In traditional DeFi projects, DeFi Technologies and Securitize target retail and institutional users respectively, representing two different compliant exploration paths - the latter has become one of the first platforms to receive SEC exemption, providing an example for the compliance process of on-chain asset portfolios.

However, from the user interaction perspective, a new trend is emerging in the entire track: more intelligent and automated asset allocation experiences.

For example, some platforms are beginning to introduce AI models or rule engines to dynamically generate configuration recommendations based on user goals and on-chain data, attempting to lower barriers and improve efficiency. This model shows obvious advantages against the backdrop of expanding DeFi users and increasing research needs.

YAMA is one of the representatives of this path: it has made a structural integration between AI portfolio recommendation and on-chain self-deployment, while using low-cost, high-performance public chains for deployment, enabling ordinary users to complete asset allocation without complex operations.

Although each path is still in the early stages, more and more DeETF platforms are transforming from "pure tools" to "strategy providers", which also reveals the underlying evolution logic of the entire crypto asset management track: not just decentralization, but also simplification and removal of professional barriers in financial experiences.

Conclusion: From Trend to Practice: DeETF Reshaping the Future of On-Chain Asset Management

In the past few years, the crypto industry has experienced numerous cycles of excitement and collapse. Every new concept's birth has been accompanied by market noise and doubt, and DeFi is no exception. DeETF, originally a niche and marginal intersection, is quietly accumulating energy and becoming a branch of on-chain finance worth serious attention.

Looking back at DeFi's development, a clear main line can be seen:

From initial smart contract experiments to building open trading and lending protocols, and then triggering large-scale capital flows, DeFi completed in six to seven years what traditional finance took decades to achieve. Now, DeETF, as the "user experience upgrade" of DeFi, is taking on the task of further popularization and lowering barriers.

Data shows that although the overall scale of the DeETF track is currently small, its growth potential is enormous. According to Precedence Research's report, the DeFi market is expected to grow from $32.36 billion in 2025 to approximately $1.558 trillion in 2034, with a compound annual growth rate (CAGR) of 53.8%. This means that in the next 5 years, under the rapid development of DeFi, DeETF will not only be part of the DeFi ecosystem but is likely to become one of the most important application scenarios for on-chain asset management.

Standing at this point today, we can already see different types of explorers:

Companies like DeFi Technologies are trying to enter from traditional finance, issuing more compliant and familiar crypto ETP products;

Platforms like DeETF.org insist on on-chain autonomy, emphasizing free combination and complete transparency;

Emerging forces like YAMA not only continue the decentralized spirit but also introduce AI-assisted portfolio construction on this basis, attempting to make on-chain asset management truly "intelligent and personalized".

If early DeFi solved the problem of "can financial services be decentralized", today's DeETF and projects like YAMA are solving the problem of "can decentralized finance be affordable and usable for more people".

Future on-chain asset management should not be just an arbitrage tool for a few, but a capability that any ordinary investor can master. And DeETF is precisely that key.

From MakerDAO to Uniswap, from DeFi Technologies to YAMA, every progress in decentralized finance is another refresh of the concepts of financial freedom, transparency, and inclusiveness.

Today, DeETF is redefining the way of on-chain asset management, and innovative projects like YAMA are injecting new imagination into this path.

The story is far from over.

But the future is slowly taking shape.