Author: 1912212.eth, Foresight News

CoinList will launch the Enso (ENSO) token sale on June 13. The ENSO FDV is $125 million, with a total sale of 4 million tokens at a price of $1.25 per token. 100% will be unlocked at TGE, with a purchase limit of $100 minimum and $2.5 million maximum. The CoinList platform sale accounts for 4% of the total token supply, and users who are not selected will receive a refund in their CoinList wallet within 48 hours.

What is Enso

Enso integrates all blockchains into a unified network. Blockchain developers only need to integrate once to read, write, and interact with smart contracts on any chain. Its founder, Connor Howe, previously worked at Sygnum (a digital asset banking group) and graduated from the University of Stirling.

By 2025, the true obstacle to mass adoption is no longer TPS, decentralization, storage, or block size, but the complexity of building real products on-chain. If developers cannot quickly, easily, and reliably deliver products, underlying performance metrics are meaningless.

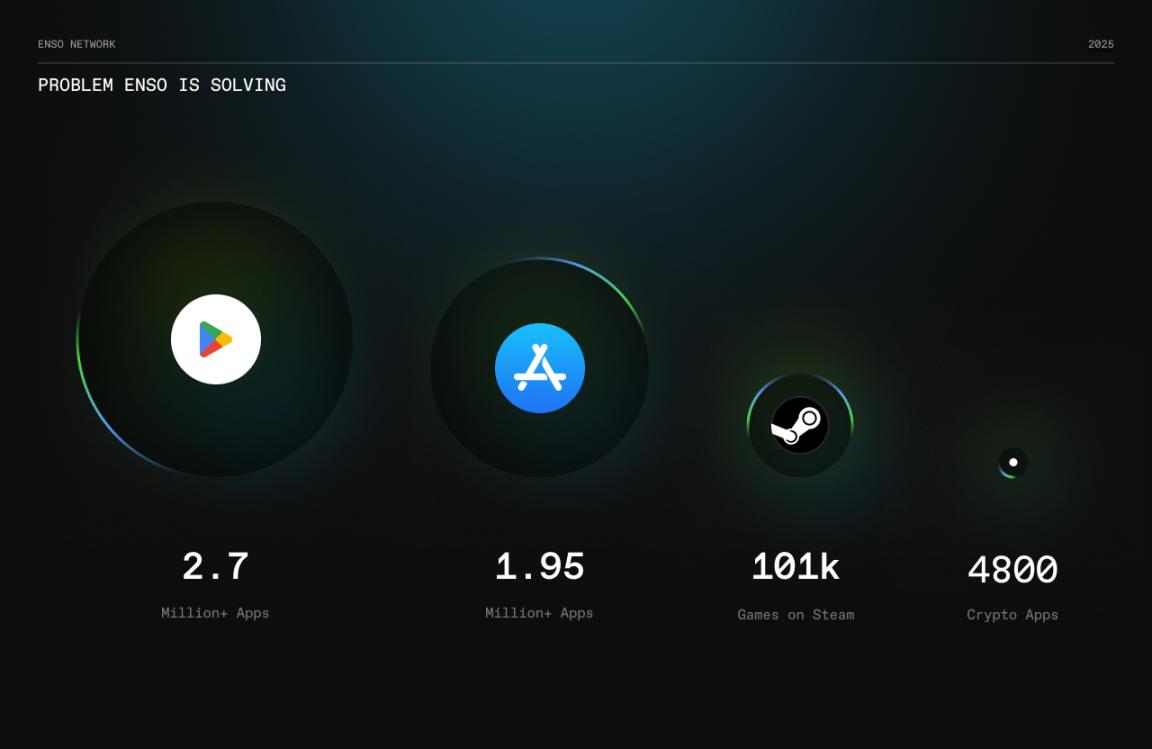

Despite the "gatekeeping" mechanisms of traditional app stores, Google Play has 2.7 million apps, the Apple App Store offers 1.95 million, and Steam has over 101,000 games. In the permissionless crypto environment, there are currently only about 4,800 applications.

The crypto ecosystem has over 1,000 blockchain frameworks, with Ethereum alone deploying more than 41 million smart contracts. The complexity of integration forces innovative teams to become "integration experts" - often investing over $500,000 and spending more than 6 months on integration, unable to focus on what truly matters: product development, community building, and user distribution.

Web3 has historically struggled to achieve product-centric rapid experimentation. In the Web2 ecosystem, platforms like GitHub, Figma, and Unreal Engine enable users to easily share their creations, achieving high reusability, low redundancy, and rapid product iteration.

Enso is building this infrastructure for developers in Web3 - unifying all blockchain data, chains, and smart contracts into a powerful network. With Enso, developers can dramatically reduce their build cycle from over 6 months to less than a week.

Operating Logic

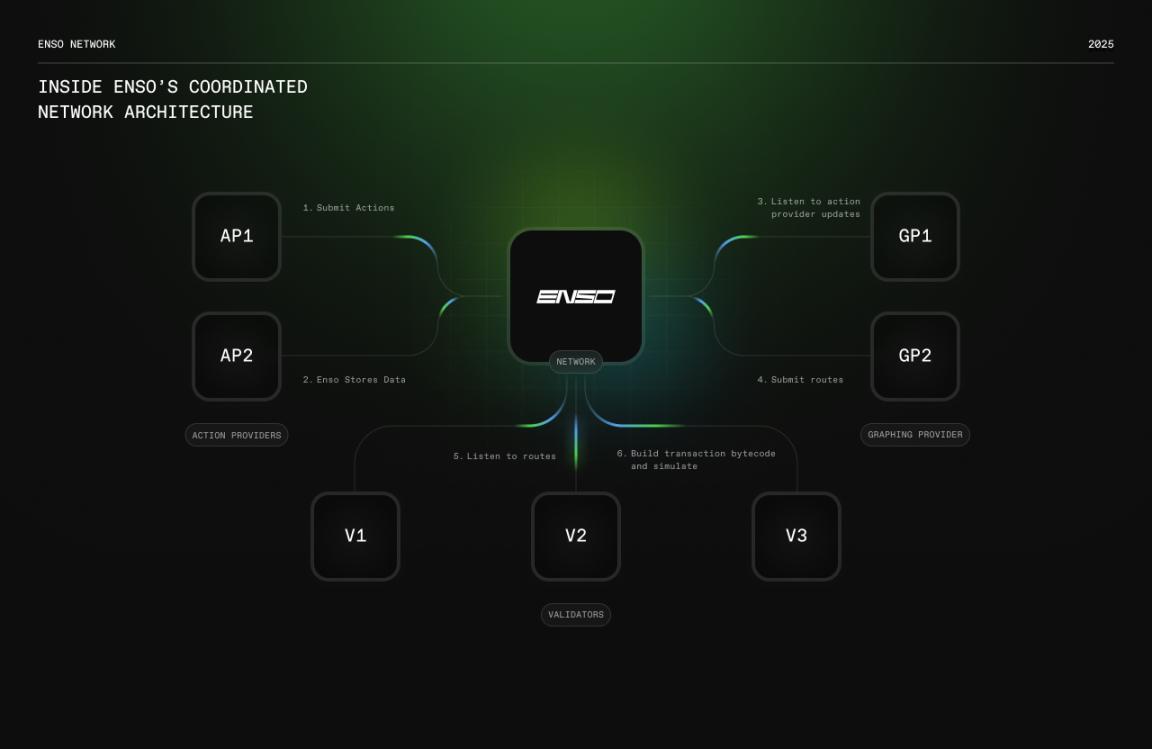

The Enso network covers the entire ecosystem of data reading and on-chain operations. Enso builds a decentralized, open network where developers and AI agents can contribute data sources and smart contract information required for execution. Enso can access the latest ecosystem developments through tools, enhancing developer stickiness and converting new Web3 developers into Enso users.

Similar data contribution models have succeeded in Web3, such as The Graph (GRT, market cap $924 million, FDV $1.04 billion), which focuses on data retrieval services. Currently ranked 78th in market cap, Enso not only provides data scraping capabilities but also has transaction execution abilities, making its performance after launch promising.

The Enso network is driven by three core participant types:

- Action Providers: Contribute modular contract abstractions.

- Graphers: Develop complex algorithms, integrating multiple operation modules to meet specific requests.

- Validators: Responsible for verifying the security and efficiency of solutions, ensuring reliable network operation.

Tokenomics

Total ENSO supply is 100 million, with 25% allocated to the team, 31.3% to investors, 23.2% to the foundation, 1.5% to advisors, and 15% to the ecosystem fund.

Typically, VC token allocation around 20% is considered normal, but ENSO's VC allocation is as high as 31.3%, potentially perceived as a VC coin. According to Rootdat, the project first raised $5 million in financing in April 2021, led by Polychain Capital with participation from Multicoin Capital, Cyber Fund, Spartan, and others. In June 2024, Enso raised an additional $4.2 million, with Hypersphere Ventures among the investors.

In terms of token utility, ENSO has four main purposes:

- Query Fees: Each request to the Enso network will incur a fee. Initially generated bytecode will embed a fee mechanism, with these fees settled in ENSO tokens through auctions and distributed to various network participants.

- Network Governance: ENSO token holders can participate in the network's future governance, such as system upgrades, reward distribution, and key infrastructure decisions.

- Validation Mechanism: Validators play a crucial role in ensuring network security, reviewing contributions, and network changes. ENSO holders can delegate tokens to professional node operators worldwide, further enhancing network decentralization and resilience.

- Staking Mechanism: ENSO holders can provide stronger economic security for the network through staking.

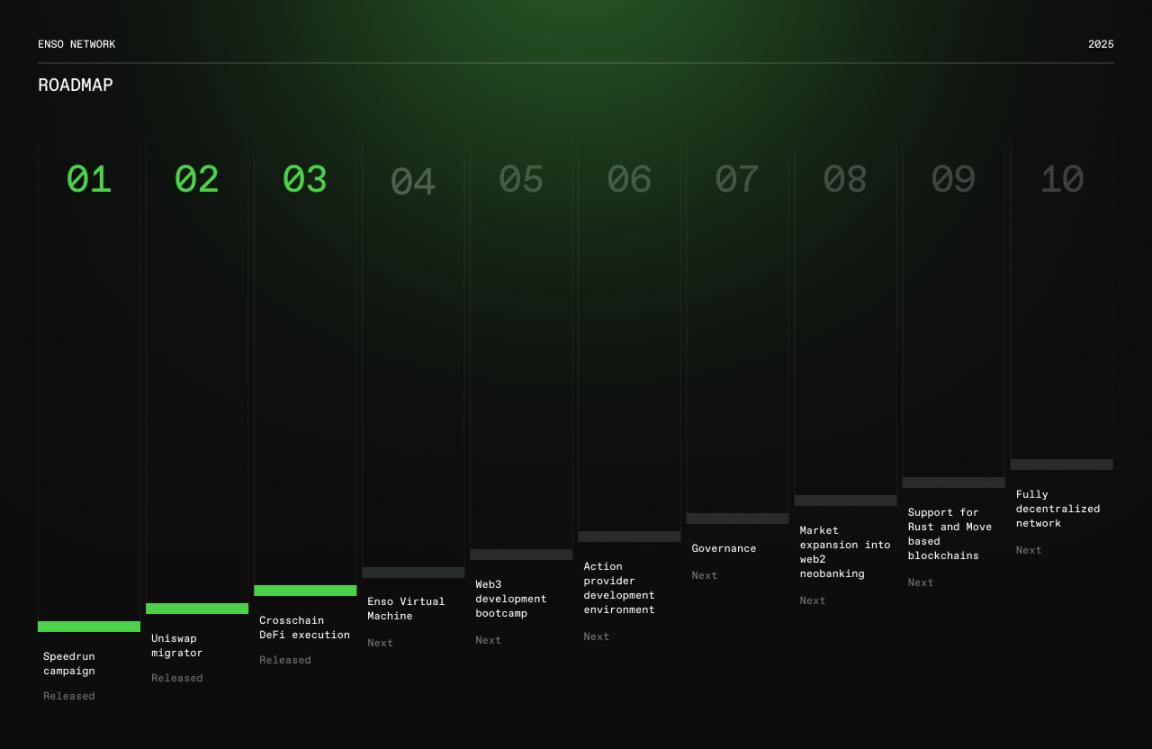

The official roadmap shows that Enso will have its TGE in Q3 of this year.