Author: Snow Goose, DataCafe

Imagine you start a coin-flipping challenge with 1,000 yuan initial funds, and you can choose to continue playing:

Flip a coin each round,

If heads, wealth increases by 80%.

If tails, wealth decreases by 50%.

It sounds like a game you can't lose!

But the reality is...

If 100,000 players participate in this game and each plays 100 rounds, you'll find: their average wealth is indeed growing exponentially, but the vast majority of people end up with less than 72 yuan, or even go bankrupt!

Why is the average wealth growing, but most people become poorer?

This is a typical non-ergodic trap. Always feeling that one more round will turn the situation around, precisely because we mistakenly equate group average with individual destiny.

The Non-Ergodic Trap: Long-Term Average ≠ Your Real Destiny

[The rest of the translation continues in the same professional and accurate manner, maintaining the original meaning and tone of the Chinese text.]In other words, the Kelly formula suggests investing 37.5% of your total funds. Betting too much, even with an advantage, could lead to bankruptcy due to consecutive losses; betting too little means missing out on potential growth.

The significance of the Kelly formula lies in: finding a point that maximizes long-term earnings while ensuring survival.

Additionally, the Kelly formula is highly sensitive to win rates and odds, which are often uncertain or dynamically changing in reality. Therefore, many prudent practitioners choose half of the Kelly recommendation (known as the Half Kelly strategy) to achieve a smoother earnings path.

Simulation Experiment: How Many Out of 100,000 People Can "Survive" a Coin Flip Gambling Game?

To more intuitively understand the impact of different betting strategies on individual fate, I simulated 100,000 players participating in the initial coin toss game, with a total of 200 rounds, each player playing independently.

The game rules remain the same: initial capital of 1000, earning 80% on heads, losing 50% on tails. Players can choose a fixed betting proportion: such as All In (100%), 65%, 37.5%, ...

The result... Almost all players betting 100% were wiped out!

The final wealth followed a "power-law distribution", with a few extremely wealthy individuals, but the vast majority of players went bankrupt.

We compared the wealth distribution of players with 4 different betting strategies, with assets distributed further right indicating higher player assets.

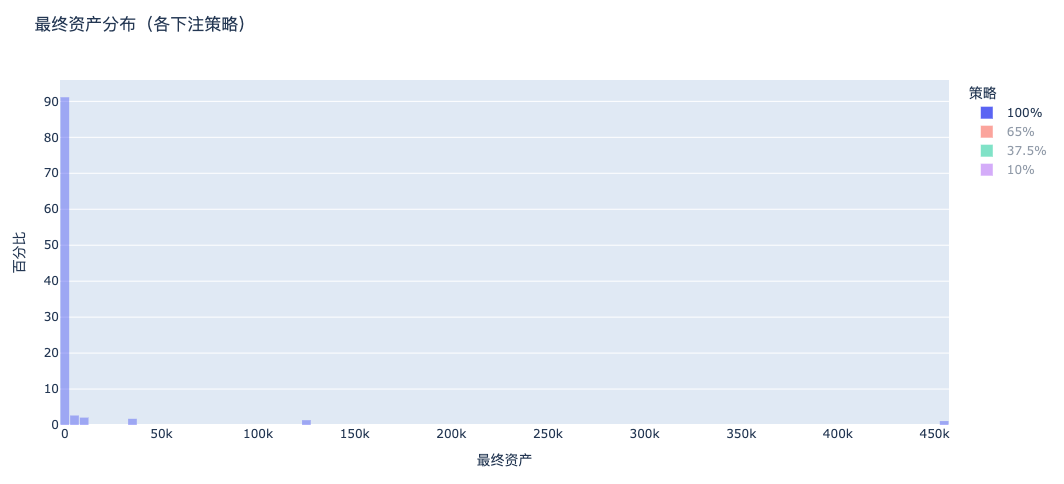

a. 100% Betting: Almost Everyone Goes Bankrupt

The final asset distribution under the All In strategy shows a massive left-side poverty peak + an extremely thin right-side wealth tail structure: most people go bankrupt, with a few people taking all the money, which is a true representation of gaming asymmetry + survivor bias.

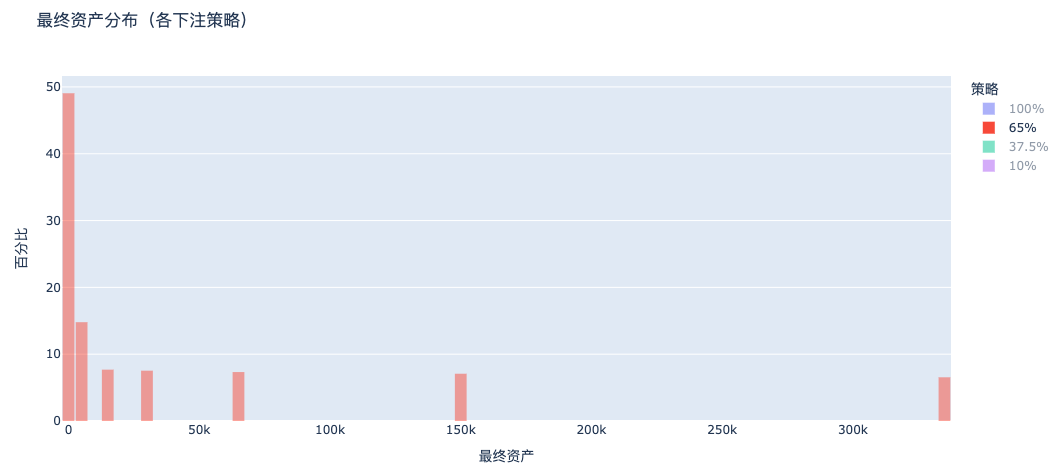

b. 65% Betting: Still Highly Polarized, Many Still Go Bankrupt

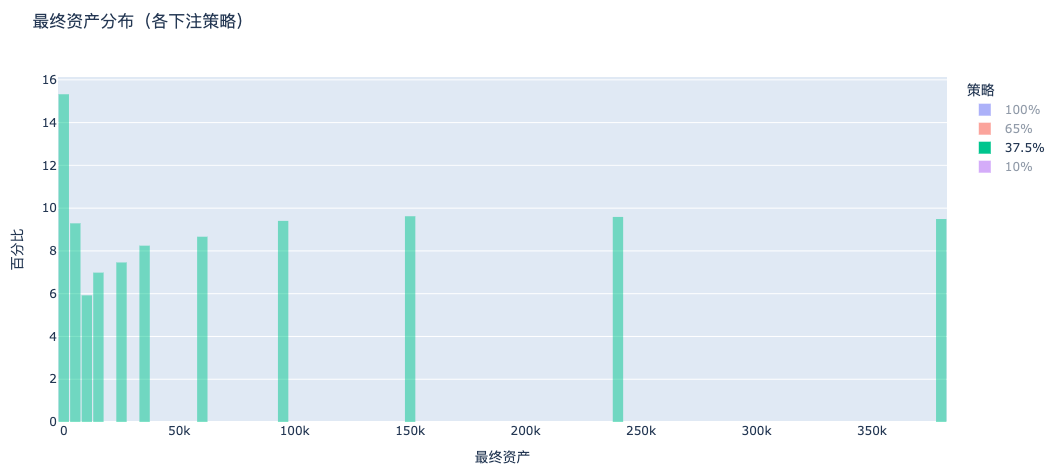

c. 37.5% Betting (Kelly Formula): Stable Wealth Growth

Under the Kelly betting strategy, the asset distribution clearly shifts right, with most people's assets growing and concentrated, making it the optimal wealth accumulation model.

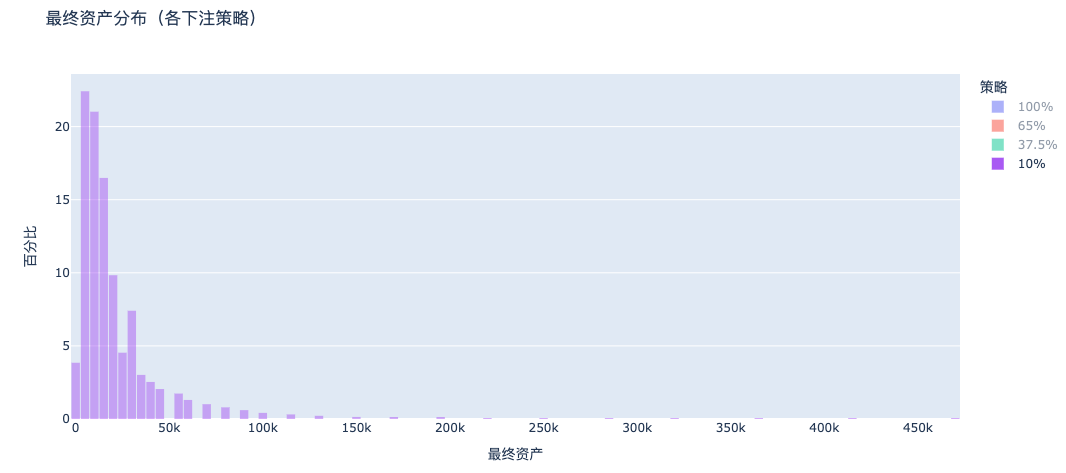

d. 10% Betting: Almost No Bankruptcies but Very Low Returns

Without the bankruptcy distribution peak seen in the All In scenario, the overall wealth is concentrated in the low asset area. In comparison, the 37.5% strategy pulls out a clear long tail on the right, achieving asset multiplication.

Kelly betting is the only strategy that balances "not going bankrupt in most cases" and "significant appreciation", making it mathematically the optimal long-term survival strategy. This is the essence of the Kelly formula: it's not about winning the most, but ensuring you can survive long enough.

Life Philosophy in the Kelly Formula

The Kelly formula tells us that the secret to long-term success is learning to control the "betting" proportion. Life is not about who can land a single critical hit, but about who can keep playing.

In one's career, it's not about quitting impulsively or staying in a comfort zone, but continuously strategizing, improving capabilities, daring to change lanes, and keeping options open;

In investing, it's not about going All In for quick riches, but controlling positions based on odds and preserving chips;

In relationships, it's not about investing all emotions and value in one person, but maintaining self while investing;

In growth and self-discipline, it's not about achieving change through a single burst of effort, but by steadily and compoundedly optimizing life's structure.

Life is like a long game where your goal is not to win once, but to ensure you can keep playing. As long as you don't get eliminated, good things will happen.