Cardano (ADA) is under pressure, dropping 4.5% in the past 24 hours as trading volume also decreased by nearly 19% to 640 million USD. Although it outperformed Bitcoin at the beginning of the year, ADA has lost momentum and is currently down 26% from the start of the year.

Whale activity has decreased, technical indicators have shifted to a downward trend, and price action remains stuck between important support and resistance levels. Without a broader altcoin price surge or a clear accumulation trend, ADA may continue to struggle in finding its direction in the short term.

ADA Drops 26% from the Beginning of the Year Despite BTC Increase—Need an Altcoin Season to Recover?

At the beginning of this year, Cardano outperformed Bitcoin, showing strong signs in the early stage of the market cycle.

However, this momentum quickly faded, and the correlation between the two assets began to weaken. While BTC is currently up about 14% from the beginning of the year, ADA has dropped nearly 26% since 01/01.

This difference indicates a shift in investor focus, as capital has prioritized larger, established assets like Bitcoin, while many altcoins, including ADA, have struggled to maintain their upward momentum.

YTD performance of ADA and BTC. Source: Messari.

YTD performance of ADA and BTC. Source: Messari.Even as Bitcoin has regained momentum in recent weeks, ADA has not significantly benefited. This suggests that BTC's increase alone may not be enough to trigger a recovery for Cardano.

For ADA to make a strong comeback, a broader altcoin price surge may be needed – possibly during a comprehensive altcoin season in the second half of 2025.

However, with market uncertainty and capital rotation still favoring Bitcoin, there is no clear guarantee that this trend will occur.

Cardano Prospects Weakening Amid Whale Caution

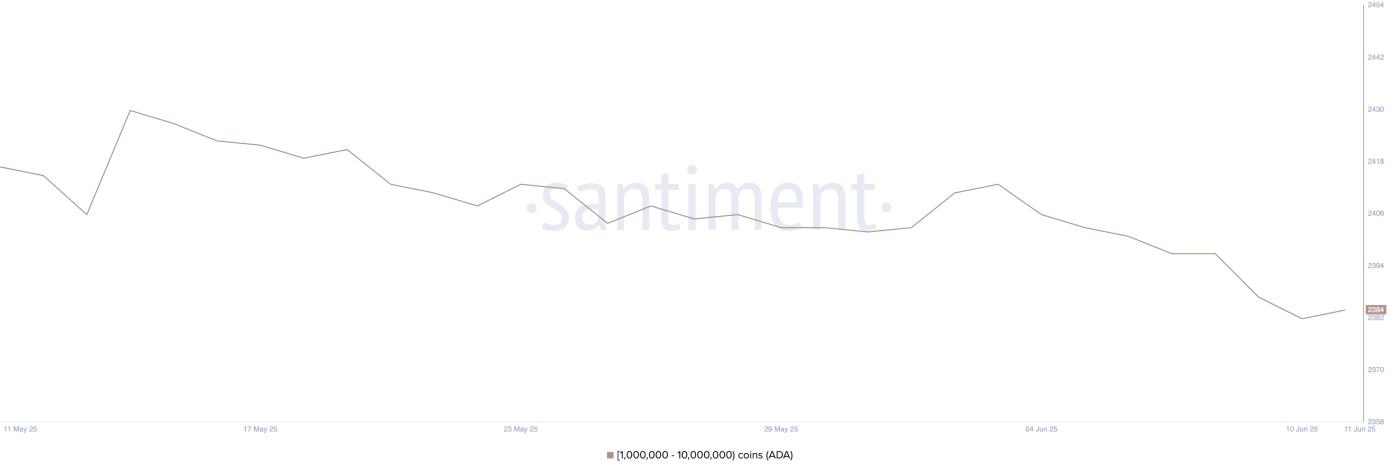

The number of Cardano whales – addresses holding between 1 million and 10 million ADA – is currently 2,384. This number has decreased from 2,413 nine days ago but slightly increased from 2,382 just two days ago.

This recent movement suggests that although the overall trend has shown a slight decrease in large holders, some accumulation may have returned in the past 48 hours.

Addresses holding between 1 million and 10 million ADA. Source: Santiment.

Addresses holding between 1 million and 10 million ADA. Source: Santiment.Tracking whale wallets is important because these addresses often influence price through large buy or sell activities, and changes in their behavior can signal shifts in market confidence or strategic positioning.

Despite a slight increase, the overall decrease in whale numbers over the past week may reflect caution or profit-taking among large holders.

Without strong accumulation from these entities, ADA may struggle to build sustainable upward momentum, especially as broader market attention leans towards Bitcoin.

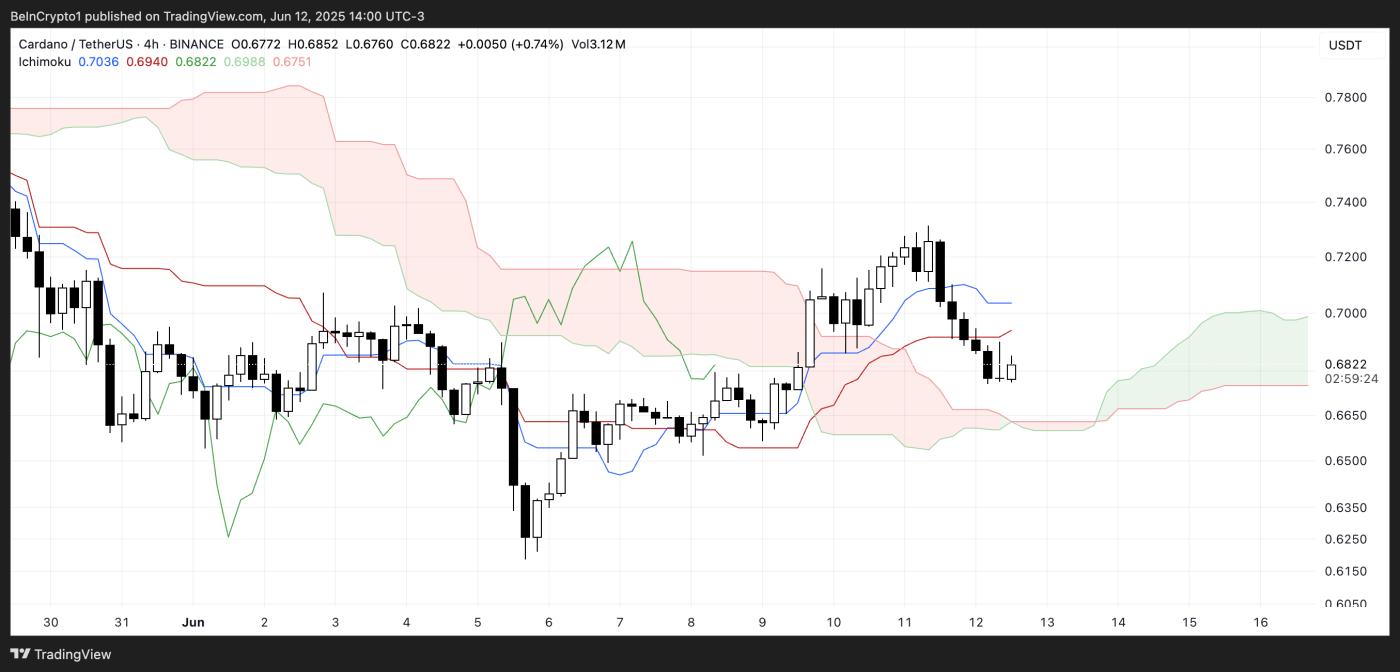

ADA Ichimoku Cloud. Source: TradingView.

ADA Ichimoku Cloud. Source: TradingView.A clear change in whale accumulation or broader altcoin capital flow may be necessary for Cardano to regain momentum.

The Ichimoku Cloud chart shows that ADA recently broke below the green conversion line (Tenkan-sen) and is currently trading below the red base line (Kijun-sen).

The cloud ahead has turned green but remains thin, indicating weak support for continued price increase unless price returns and holds above it.

The current price position below both trend lines and the cloud suggests a diminished short-term outlook. To change momentum, ADA needs to reclaim the base line and break through the cloud with strong volume and conviction.

ADA Oscillating in Range: Will It Drop 8% or Rise 13%?

Cardano's price is currently trading in a narrow range, trapped between resistance at $0.707 and support at $0.654. This consolidation zone sets the stage for a breakout – or breakdown – in upcoming trading sessions.

If the $0.654 support is tested and lost, ADA could slide to $0.618, marking a potential correction of up to 8.6% from current levels.

Such a move could confirm the downward momentum and reflect broader market weakness or fading buyer interest.

ADA Price Analysis. Source: TradingView.

ADA Price Analysis. Source: TradingView.Conversely, if ADA can break above the $0.707 resistance, it could test the next level at $0.731.

Once breaking through this zone, the short-term trend would shift to bullish and open opportunities towards $0.777—equivalent to a near 13% increase.

For this scenario to occur, Cardano needs sustained buying volume and a reversal of current technical pressure. Until then, the price remains range-bound, and traders are waiting for confirmation from both sides.