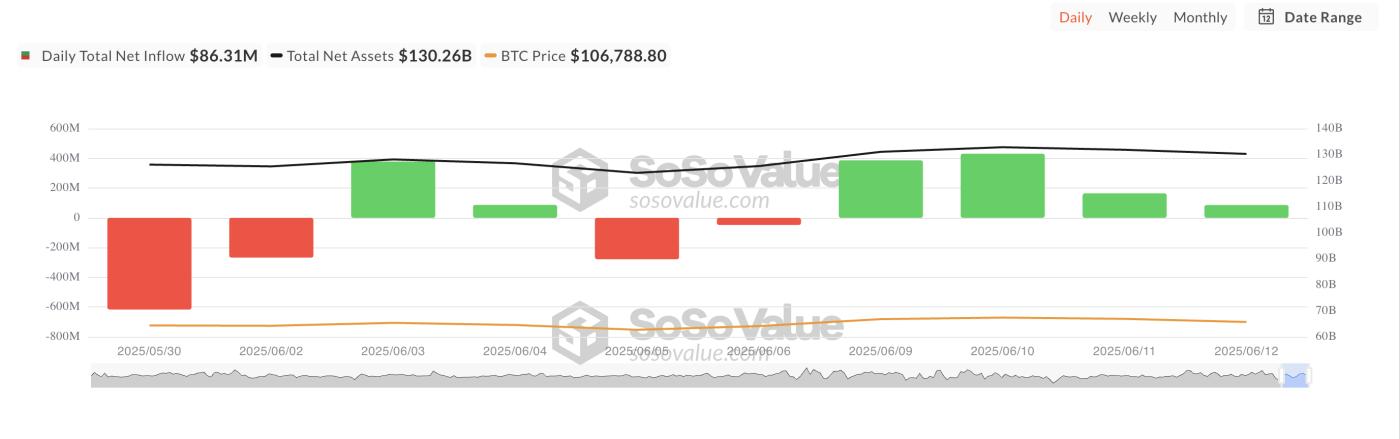

Yesterday, Bitcoin ETFs recorded over $85 million in inflows. This was the fourth consecutive day of positive movement for this asset type.

However, despite continuous inflows showing investor confidence, daily inflow volume continues to decrease as BTC struggles to regain price momentum.

BTC ETFs Lose Momentum as Profit-Taking Accelerates

BTC closed at a low of $105,671 on Thursday as sellers continued to sell to lock in profits from the recent price increase. This profit-taking wave has reduced institutional interest, contributing to a significant decline in daily ETF inflow volume.

Net inflows into BTC-supported funds totaled $86.31 million yesterday. While this reflects continued investor interest, it also shows a gradual slowdown in daily inflow momentum as BTC price remains under pressure.

Total net inflows into Bitcoin Spot ETF. Source: SosoValue

Total net inflows into Bitcoin Spot ETF. Source: SosoValueFidelity's Bitcoin spot ETF, FBTC, recorded the highest net outflow among all BTC ETFs yesterday, with $197.19 million leaving the fund. FBTC's total historical net inflow is currently $11.49 billion.

Bitcoin Drops, but Derivative Traders Remain Optimistic

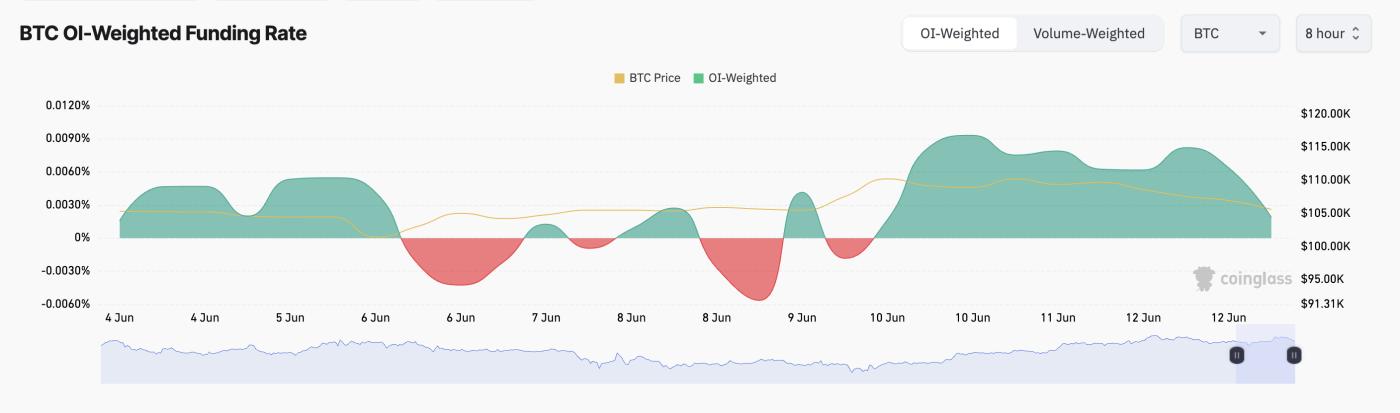

The king coin dropped 3% yesterday, extending the multi-day price decline that has slowed short-term optimistic sentiment. Interestingly, the spot market decline has not discouraged derivative market traders.

According to Coinglass, BTC's funding rate on cryptocurrency exchanges remains positive despite recent price difficulties. At the time of writing, this rate was 0.0019%.

BTC funding rate. Source: Coinglass

BTC funding rate. Source: CoinglassThe funding rate is a periodic payment exchanged between long-term and short-term traders in perpetual futures contracts to keep prices aligned with the spot market. When positive, long-term traders are paying short-term traders, indicating optimistic sentiment and higher demand for leveraged long positions.

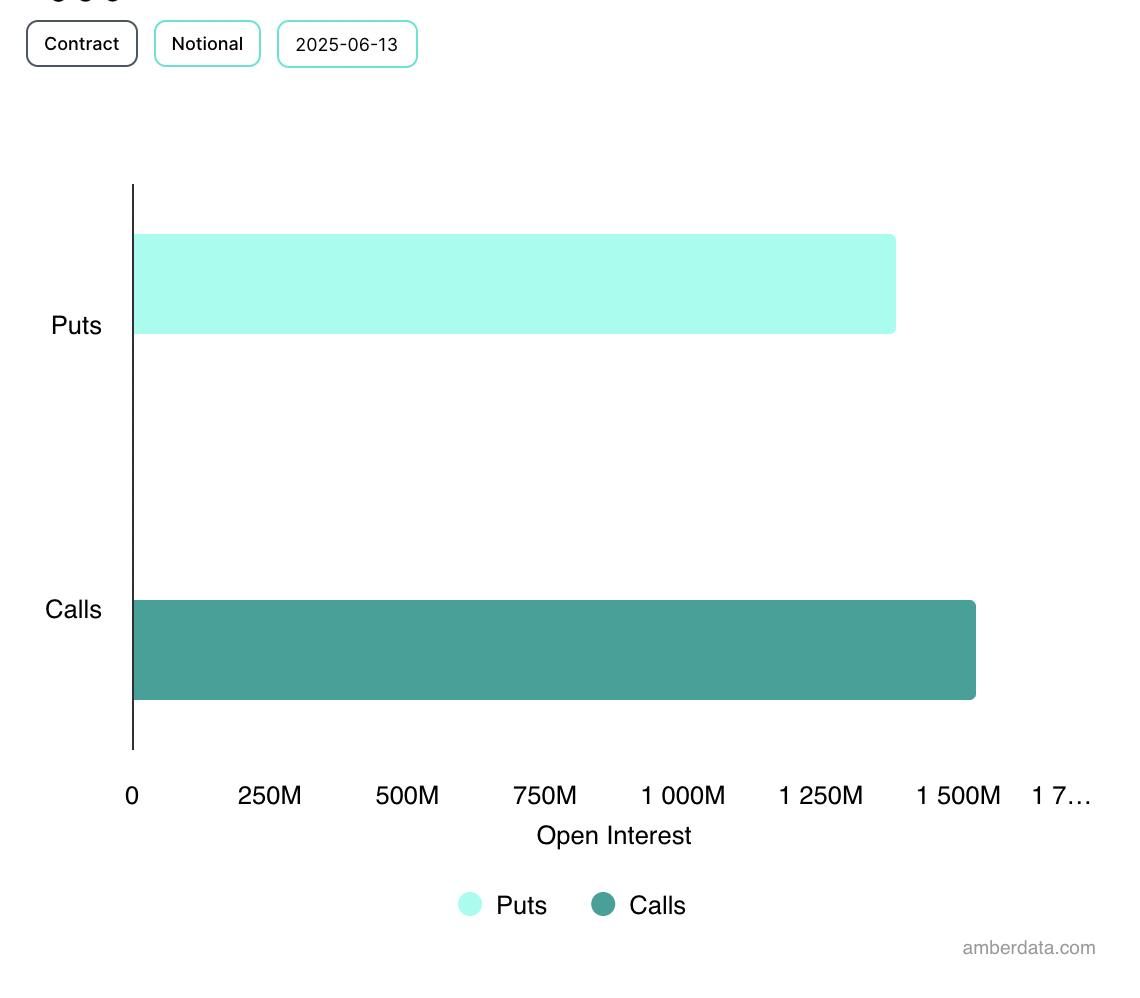

Moreover, on the options front, demand for Call Options exceeds Put Options, suggesting many market participants expect recovery or are positioning for short-term upward volatility.

BTC option open interest. Source: Deribit

BTC option open interest. Source: DeribitWith inflows gradually decreasing and BTC under pressure, the key question entering next week is whether this persistent ETF trend will continue or if the market will see net outflows as investor sentiment continues to cool.