You are reading the free trial series of Web3 Caff Research. To unlock all Web3 research reports and column contents on this platform and find the latest trends with more Web3 elites, you can click here to subscribe to PRO membership . If you need to switch to daytime/dark reading mode, please log in first.

RWA stands for Real World Assets in English, which means “real world assets” in Chinese. Through blockchain, physical assets in the real world (such as real estate, infrastructure, bonds, new energy facilities, etc.) are converted into digital tokens that can be traded on the chain. Its technical development can be traced back to 2017. From the derivative concept of asset securitization [1] to the implementation of technology and application layers, it has been 8 years since then. Different from the mapping of real asset accounts in traditional securitization, RWA with blockchain technology uses chain-based token technology to provide new possibilities for reshaping the liquidity of traditional global assets. And with its cutting-edge technological advantages, it aims to break through the boundaries between traditional assets and regulation. Based on the latest data and cases, this article will systematically analyze the current global practice of RWA in core application tracks such as government bonds, real estate, and carbon credits, explore the breakthroughs and conflicts between technology and regulatory coordination, and deduce the possible "minimum pain point" development path in the future. From a global perspective, whether it is a project jointly led by institutions and regulators, or an experimental, sandbox project within Web3, its development needs to face the dynamic balance between technical efficiency, regulatory security, and policies and regulations. At present, there are varying degrees of policy innovation in the United States, the European Union, and the Asia-Pacific region. Among them, the differentiated exploration of China and Hong Kong provides us with a high-value reference. Coincidentally, during the writing of this research report, Hong Kong and the United States successively launched and passed the regulatory framework of the Stablecoin Act. This article will also combine the most cutting-edge regulatory framework at present to conduct a comprehensive and in-depth analysis. At the same time, it will also pay attention to the progress of future key directions such as standardized assets, physical asset RWA, and infrastructure service providers in the field of technical regulatory collaboration.

Author: Eddie Xin , Web3 Caff Research Researcher, Head of Logos Fund Technology Group

Cover: Photo by Andrei Castanha on Unsplash

Word count: 25,000+ words in total

Disclaimer: Web3 Caff Research free trial series content is allowed to be reprinted. Please fully comply with the reprint rules . Violators will be held accountable.

Table of contents

Introduction: Asset Revolution under the Reconstruction of Value Internet

Global RWA core tracks and representative projects

Treasury Tokenization: An Institution-Led Compliance Experiment

Real estate tokenization: liquidity reconstruction and legal adaptation problems

Carbon Credit Tokenization: Compliance Game in Environmental Finance

Breakthroughs and conflicts in technology-regulatory collaboration

Compliance Architecture Innovation: Offshore SPV and On-Chain Sandbox

Technical bottlenecks and solutions

Liquidity dilemma and market differentiation

RWA Legal Compliance Framework and Case Analysis

Domestic legal challenges and compliance paths

Hong Kong Sandbox Mechanism and Cross-border Compliance

Comparison of international compliance frameworks and the interoperability dilemma

Securitization-led: U.S. regulatory expansion and judicial penetration

Sandbox Experiment: Hong Kong Institutional Innovation and Cross-border Collaboration

Unified legislation: the compliance cost paradox of the EU MiCA framework

Emerging Experimental Types: Regulatory Arbitrage and the Limits of Sandbox Effectiveness

The interoperability dilemma: the technical and institutional causes of compliance silos

Future Path Deduction——Technology-driven vs. Regulation-first

Technology-driven (Singapore-Hong Kong synergy paradigm)

Regulatory priority (U.S., EU – Mainland China, Hong Kong benchmarking paradigm)

Hybrid Path (Institution-Led Global Network)

RWA Market Chaos and Risk Warning

The proliferation of “air coins” and “capital disks”

Compliance arbitrage and regulatory loopholes

Technical risks and operational pitfalls

Conclusion: Implications for global practice of RWA

The core contradiction

Regional ecological characteristics

Future strategic direction

Risk prevention and control process

Key points structure diagram

References

Introduction: Asset Revolution under the Reconstruction of Value Internet

Since 1970, when the National Mortgage Association of the United States issued the first mortgage-backed securities based on mortgage portfolios, the Mortgage Pass Through Certificate (MPT), and completed the first asset securitization (asset securitization refers to the creditor selling various contractual debts such as residential mortgages, commercial mortgages, auto loans or credit card debts held by himself to third-party investors in the form of securities. Investors can collect principal and interest from the debts held as creditors) transactions, asset securitization has gradually become a widely used financial innovation tool and has developed rapidly. On this basis, risk securitization products have been derived. Under the liquidity expansion framework based on Keynesian theory, the modernization of the financial industry is no longer satisfied with the low liquidity of assets, so the modern financial industry has shifted its goals and put most of its work on "how to package illiquid assets into highly liquid targets." Inject a steady stream of liquidity into the financial market. And with the continuous change of technology, we have ushered in a technical rule that is naturally in line with financial innovation in the Internet era-token chain.

From the technical characteristics of blockchain, the low-liquidity assets on the chain, combined with highly transparent and traceable transaction links, almost perfectly solve this problem. And RWA seems to be born to prepare to become an important member of digital financial innovation tools. With the improvement of the liquidity of global financial assets, the asset securitization promoted in the early stage still seems to be unable to meet the liquidity injection of real-world assets. In recent years, asset securitization innovations such as REITs (real estate investment trusts), ABS (asset-backed bonds), and CLO (securitization of corporate loan-based assets) have also begun to reflect more real-world asset targets. For example, China began to promote the normalization of infrastructure REITs issuance in 2020, and vigorously developed diversified liquidity injections of low-liquidity underlying assets such as logistics parks and highways. The traceability and transparency of blockchain technology have long been included in the management process of REITs. Against the background of such technical support and financial innovation, RWA has also emerged as the times require, becoming a stream of liquidity in multiple asset categories in the real world that comes from blockchain technology.

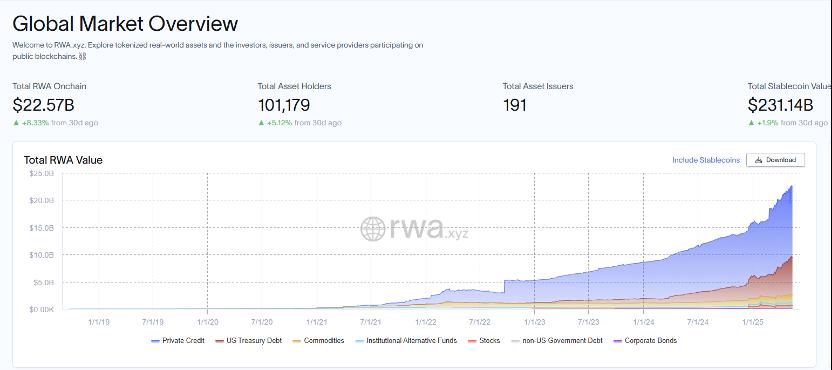

According to data from the RWA monitoring platform RWA.xyz , as of May 2025, the total market value of RWA on the chain has reached US$22.38 billion, an increase of 7.59% from 30 days ago, and the number of asset holders has reached 100,941, a month-on-month increase of 5.33%. According to an internal report by Boston Consulting Group [1], by 2030, the global RWA market size will reach US$16 trillion, accounting for 10% of global GDP.

Figure 1, source: RWA.xyz

The growth curvature of RWA is increasing day by day. With the anchoring of multiple assets, whether it is innovative projects in the Web3 circle or sandbox experiments of traditional financial institutions, increasingly prominent problems are also coming along. There are some chaos in the current market, such as "air coins", "capital disks", "compliance arbitrage" and legal violations. All of them need to find a way out in the dynamic balance between technological innovation and regulatory adaptation. Therefore, in-depth research on RWA's global practices, technical challenges and regulatory coordination mechanisms is of great significance to promoting the healthy development of the industry. Next, let us start from the core tracks and representative projects around the world, and deeply analyze the most cutting-edge new RWA paradigm.

Global RWA core tracks and representative projects

Treasury Tokenization: An Institution-Led Compliance Experiment

Under the macro background, under the structural dilemma of the global economy's "three lows and one high" (high debt, low interest rates, low inflation, and low growth), the traditional debt management framework faces multiple challenges such as insufficient liquidity, lack of transparency, and cross-market segmentation. Sovereign debt tokenization uses blockchain distributed ledger technology (DLT) to achieve digital mapping of debt instruments, converting sovereign debts such as treasury bonds and government bonds into divisible and programmable digital tokens, and demonstrating the value of technology empowerment in improving secondary market liquidity (such as the pilot of US Treasury tokenization to achieve real-time settlement), optimizing price discovery mechanisms (such as the smart contract application of European digital green bonds), and reducing cross-border transaction friction costs (such as the issuance of multi-currency digital bonds in Hong Kong). This innovation is not only a passive upgrade of the form of financial assets, but also involves a deep transformation of the fiscal policy transmission mechanism and the monetary and financial system. Its development will reshape the infrastructure competition landscape of the global debt market and become a strategic focus for countries to compete for the right to formulate digital financial rules and asset pricing. (Zhao Yao, 2025)[2].

The tokenization of government bonds is currently the most popular direction for RWA. The bond market has long been widely regarded as one of the safest investment targets in the global financial market. With sovereign credit endorsement, it has become one of the most popular real assets on the chain. In the context of the continued high interest rate environment in the global market in recent years, the yield of government bonds, led by US bonds, has maintained a high yield, and government bonds anchored by blockchain technology can increase the flexibility of investors to participate in government bond transactions, reduce costs through technology, increase transaction speed, and increase market transparency. Compared with the traditional financial market, RWA has great room for development in the low-risk soil of government bond transactions.

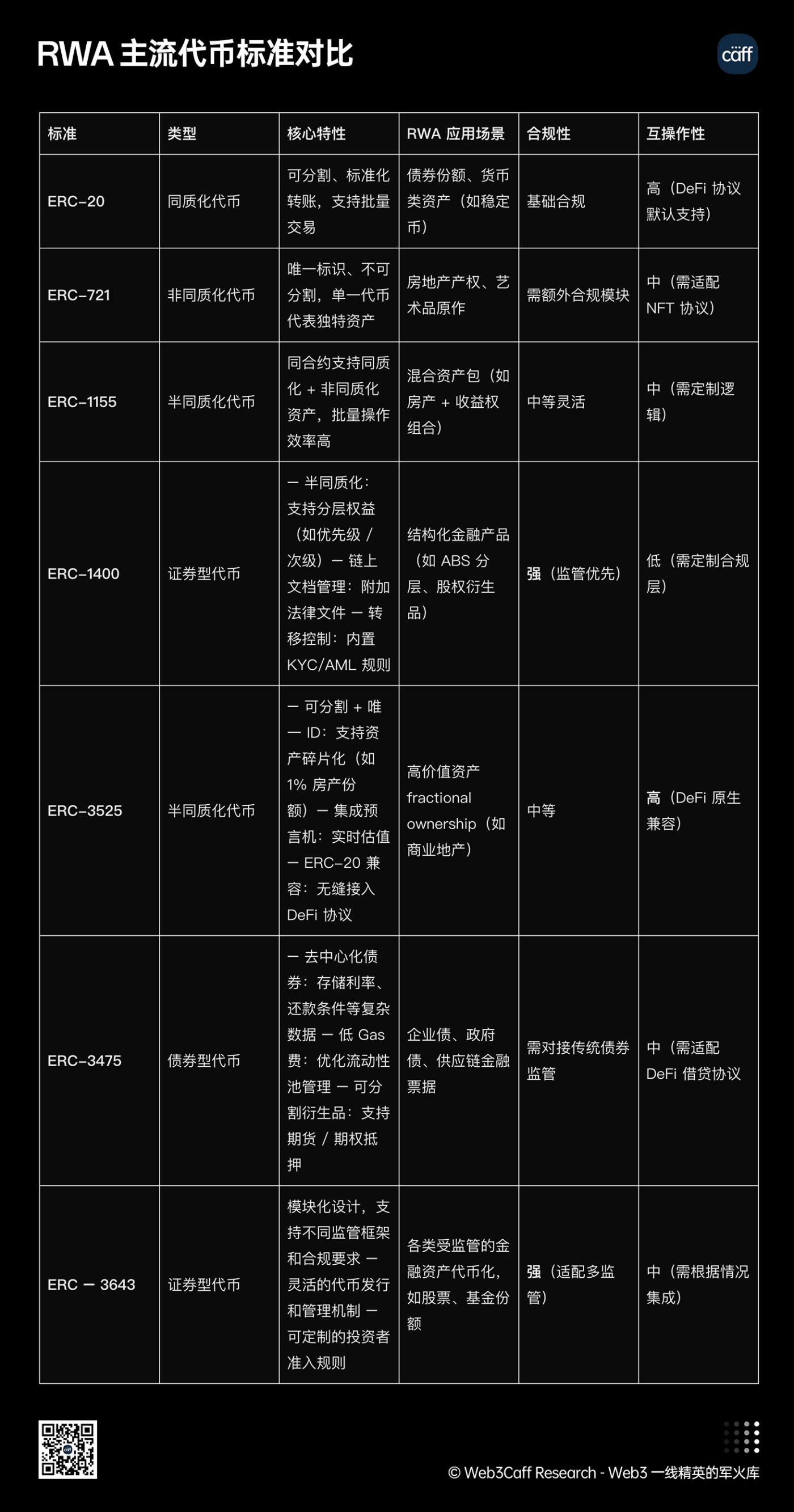

Since RWA maps different underlying assets, before starting, readers will first have a basic understanding of the basic type characteristics of RWA tokens. The following figure shows a comparison of the mainstream RWA token standards:

Figure 2, source: DigiFT

Figure 3, source: Web3 Caff Research researcher Eddie Xin (RWA mainstream token standard comparison)

International leading projects

The European and American markets use smart contracts to achieve automatic distribution of treasury bond returns and optimize compliance costs. For example, in 2024, asset management giant BlackRock's BUIDL fund adopted the ERC-1400 standard (this standard is characterized by semi-homogeneity, support for tiered equity, and adaptability to structured financial products such as ABS tiering and equity derivatives), reducing SEC compliance costs by 30%. Three months after issuance, the management scale exceeded US$500 million [3]. BlackRock issues money market funds with stable returns and secure assets on the chain, allowing other institutions to introduce stable returns from the real world into the DeFi world by using BUIDL as the underlying raw material. Goldman Sachs GS DAP [4] (Goldman Sachs Digital Asset Platform) is a platform built on solutions developed by Digital Asset Company to meet the complex liquidity needs of market participants in the digital capital market. In 2024, Goldman Sachs issued $12 billion in digital bonds through the platform. Compared with the traditional bond issuance model, the average issuance cycle of digital bonds has been greatly shortened from the original 2 weeks to 48 hours, the settlement efficiency has been improved by 60%, and the settlement time has been shortened from the traditional T+2 model to nearly real-time settlement. In 2025, Goldman Sachs plans to focus on tokenized products in the US fund industry and the European bond market, targeting large institutional investors. In addition, Goldman Sachs has also cooperated with the World Gold Council to test the tokenization of gold. Users can view the audit report of gold reserves in real time through the blockchain and conduct transactions.

Figure 4, source: Goldman Sachs GA DAP platform

Practice in Hong Kong, China

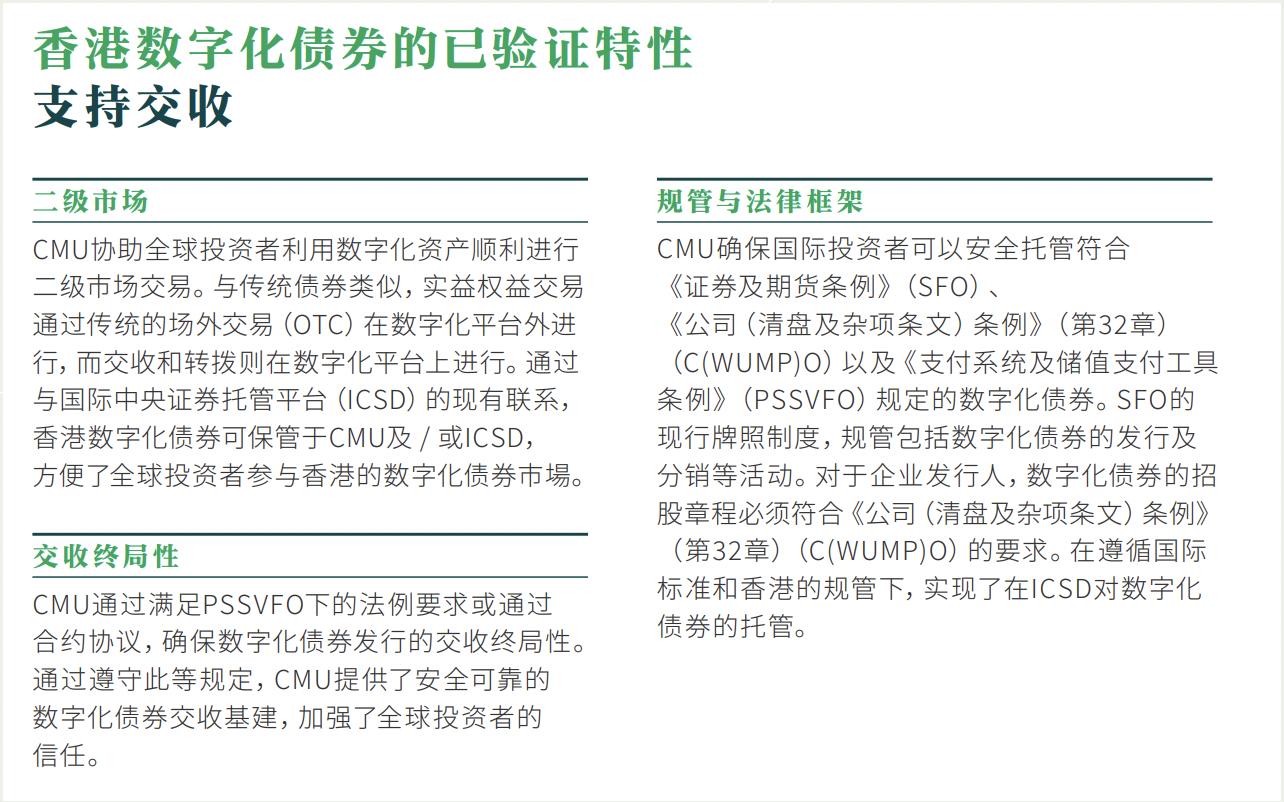

In Hong Kong, the Hong Kong Monetary Authority (HKMA) began its tokenization journey in 2021, testing tokenized bonds with the Bank for International Settlements. In 2023 and 2024, a total of approximately HK$7.8 billion worth of digital bonds have been issued through the CMU (Central Clearing and Settlement System), including Hong Kong dollars, RMB, US dollars and euros. The HKMA's reporting manual states: Tokenized bonds use distributed ledger technology (DLT) to successfully digitize government bond assets, without the need for physical verification, common platforms, real-time transfer of bonds and cash, and extremely high operational efficiency for bond flows. [5]

Figure 5, Source: Hong Kong Monetary Authority and CMU Digital Bond Report

At the same time, Hong Kong is also promoting the Ensemble Sandbox Project (this project is committed to using experimental tokenized currencies to promote interbank settlement and focus on tokenized asset trading. The first phase of the sandbox experiment will cover the tokenization of traditional financial assets and real-world assets, and focus on four major themes: fixed income and investment funds, liquidity management, green and sustainable finance, and trade and supply chain financing.) [5], which aims to experiment with the tokenization of traditional finance and real-world assets. The first recommended use case in the first application theme of "Fixed Income and Investment Funds" is bonds. The industry participants in the recommended use cases of bonds and funds are five platforms: Bank of China (Hong Kong) Limited, Hang Seng Bank, HashKeyGroup, HSBC, and Standard Chartered Bank (Hong Kong).

Subsequently, in terms of bond use cases, Hong Kong successfully issued HK$800 million in tokenized green bonds through the Goldman Sachs GA DAP platform pilot, with HSBC as the custodian. The project takes advantage of the fast settlement characteristics of the chain, reducing costs by 40% compared to traditional settlement methods. In 2025, the scale of the settlement pilot on the chain will be expanded to HK$1.5 billion. At the same time, the project allows European and American institutions to participate through offshore SPVs (the SPV structure is to isolate risks and optimize financing structures by establishing special purpose entities [SPVs], which are often used in asset securitization, project financing and other scenarios. The core is to build an independent legal entity of "bankruptcy isolation" to achieve credit enhancement and risk isolation of specific assets). This means that the project will achieve compliance docking between mainland assets and Hong Kong funds through the "asset chain + transaction chain" architecture.

Exploration of the Mainland

There are currently no successful token-based national debt projects in mainland China. At present, it is still at the exploration level of asset securitization, and the main innovative tool is still REITs, but it has begun to digitally confirm and promote diversified underlying assets. In 2024, mainland China passed the policy of data asset inclusion , allowing digital assets such as corporate data assets to present value in financial statements. This bill was implemented in the same year to promote corporate data rights confirmation, so that assets can be transformed from real tangible to intangible on the transaction side. The confirmation of data assets is the first step. The promotion and construction of data assets in mainland China can be seen as a weather vane on the digital asset side. After the implementation of the bill, the Shenzhen Stock Exchange completed the first data asset ABS, with an issuance scale of 320 million yuan, laying the foundation for data assets to be put on the chain. In addition, mainland China simultaneously promoted the docking of the data asset inclusion policy with the International Accounting Standards (IAS 38), and planned to open a pilot for cross-border transactions of corporate data assets in 2026. At the same time, the Shanghai Environment and Energy Exchange launched the blockchain carbon trading platform, and has successfully realized the on-chain registration and trading of national carbon market quotas, taking a big step towards putting real assets on the chain.

Legal comparison and compliance path

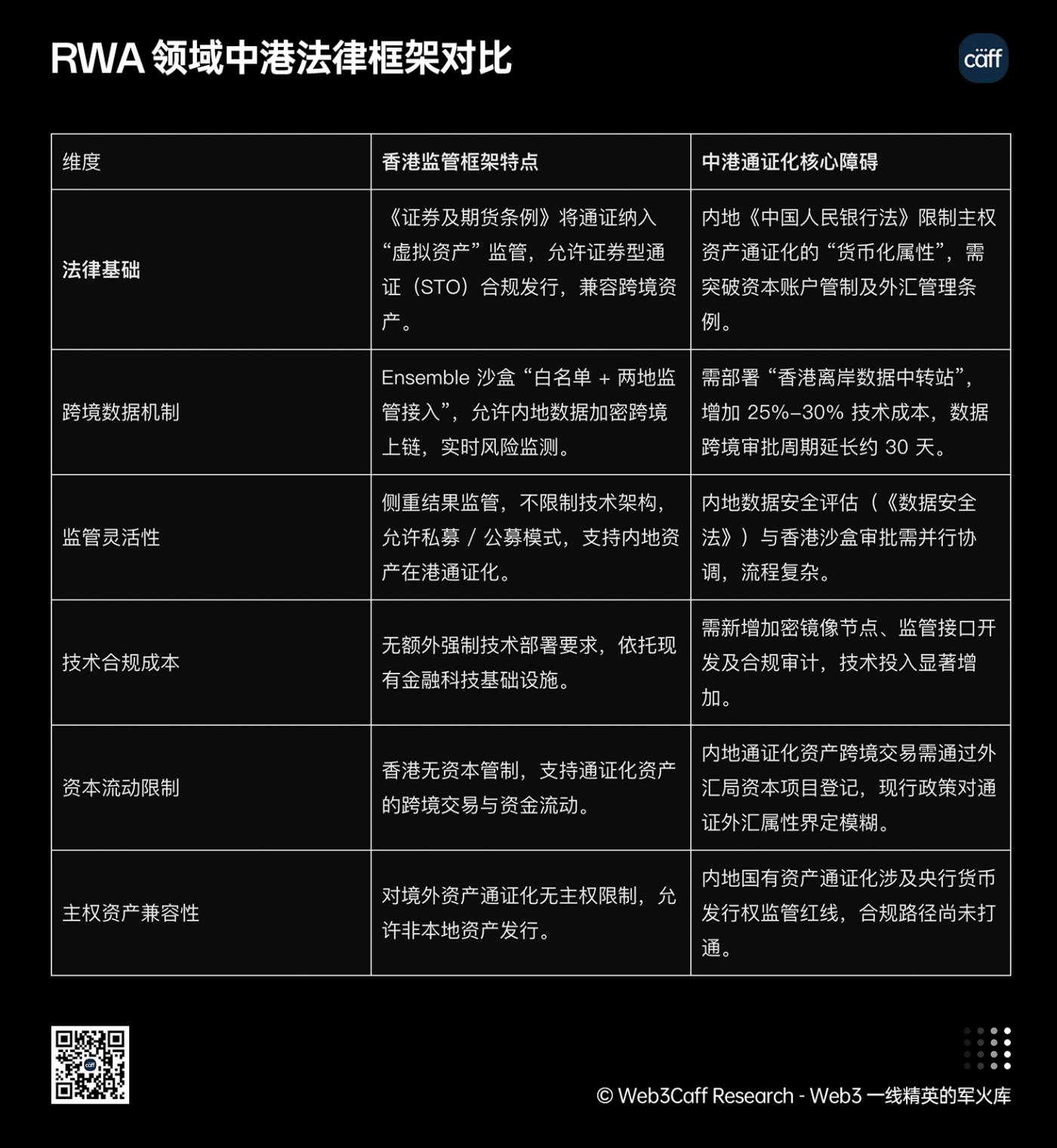

Hong Kong's Securities and Futures Ordinance has inclusive regulation on asset share tokenization, and the legal framework is relatively flexible. Its Ensemble sandbox allows mainland asset data to be cross-border on the chain through the "cross-border data flow whitelist" mechanism, and is connected to the regulatory systems of both places, which can achieve real-time risk monitoring. However, due to cross-border control, mainland data needs to deploy encrypted mirror nodes through the "Hong Kong Offshore Data Transfer Station" for cross-border data. According to the comparison and calculation of the "Memorandum of Cooperation on Promoting Cross-border Data Flow in the Guangdong-Hong Kong-Macao Greater Bay Area" , this process leads to an increase of 25%-30% in compliance technology costs and an extension of the approval cycle by about 30 days. In addition, the tokenization of mainland sovereign assets is subject to the institutional constraints of the "People's Bank of China Law" and the Foreign Exchange Administration Regulations, and it is necessary to break through capital account controls. In terms of compliance, the China-Hong Kong Channel has not yet achieved full process access.

The institutional practice of tokenizing government bonds provides RWA with a legal format for highly liquid assets. However, the tokenization of non-standard assets such as real estate faces more complex challenges in legal ownership adaptation and liquidity reconstruction, and it is urgent to explore innovative solutions that take into account both inclusiveness and security.

Figure 6, source: Web3 Caff Research researcher Eddie Xin (Comparison of legal frameworks in China and Hong Kong)

Real estate tokenization: liquidity reconstruction and legal adaptation problems

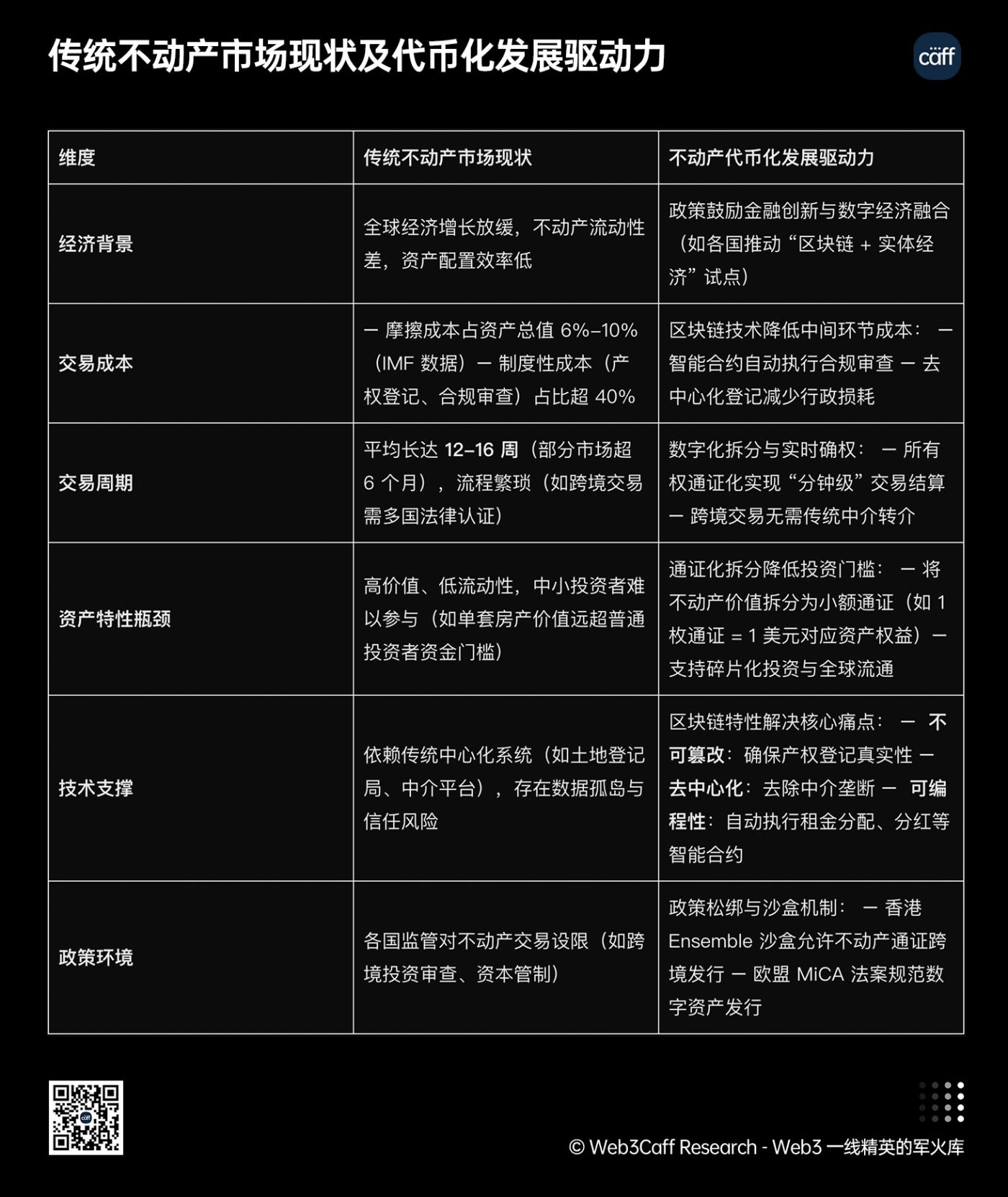

Against the backdrop of slowing global economic growth and accelerating digital transformation, the traditional real estate market faces many challenges. According to the IMF's Global Financial Stability Report (Wind Financial Terminal Authority Report), real estate is characterized by high value and poor liquidity. Moreover, the transaction cycle often exceeds several months. The friction costs of global real estate transactions (referring to the fees and other related costs in financial transactions. They may be direct or indirect) account for 6%-10% of the total asset value, [6] of which institutional costs (such as property registration and compliance review) account for more than 40%, and the transaction cycle is an average of 12-16 weeks, which seriously hinders the effective allocation and price discovery of assets. According to data from the International Monetary Fund in the Wind Financial Terminal, the average transaction cost of global real estate accounts for 6%-10% of the total price. In order to stimulate the economy and optimize resource allocation, countries are actively promoting financial innovation. Encouraging the integration of the digital economy and the real economy provides positive policy space for the development of real estate tokenization. On the technical level, blockchain technology is relatively mature. Its high efficiency, low cost and tradability can accelerate the digital division and confirmation of real estate ownership and transactions.

International leading projects

RealT in the United States has lowered the threshold for real estate investment to $50, but some transactions have been suspended due to mismatches in on-chain and off-chain ownership. In the EU, Propy has driven real estate transactions through AI, saving 40% of labor costs, but because the real estate registration systems of EU countries have not yet been connected to the blockchain (such as the French Land Registry still uses paper archives), EU buyers still need to verify off-chain legal contracts. At present, the more successful case is still the GS DAP platform mentioned above, which was split off by Goldman Sachs. It has reached a cooperation with Tradeweb to explore the tokenization of real estate investment trusts (REITs) and plans to split the rental income rights of New York commercial properties into ERC-3643 standard tokens. The Synthetix platform has also successfully tokenized commodity indices (such as oil, gold, and copper) with a total value of approximately US$100 million, and achieved price tracking through Ethereum, providing investors with indirect participation opportunities.

Practice in Hong Kong, China

The Hong Kong Securities and Futures Commission allows REITs shares to be tokenized. For example, in the Munch catering startup project invested by NFT China.hk, Munch cooperated with RWA.ltd to pilot the NFT splitting of catering store revenue, shortening the financing cycle by 50%. Ensemble Sandbox will launch REITs tokenization testing in 2025, aiming to reduce the entry threshold for qualified investors from HK$1 million to HK$500,000 to activate the participation of small and medium-sized investors. In addition, the Hong Kong pilot Munch project uses the "USDT compliance exchange + mainland wholly foreign-owned enterprises (WOFE) income rights registration" mechanism. According to the data disclosed on its official website Munch Project , this move will increase the liquidity of catering revenue tokens by 35%.

With the diversification of underlying real estate assets, more business formats are also being included. In 2024, Langxin Technology also cooperated with Ant Digital Technology to complete China's first RWA based on new energy physical real estate in Hong Kong. The project tokenized the income rights of 9,000 charging piles, used some charging piles operated on the platform as RWA anchor assets, and issued "charging pile" digital assets on the blockchain based on trusted data. Each digital asset represents part of the income rights of the corresponding charging pile. It obtained 100 million yuan in cross-border financing, and its data was uploaded to the chain through Ant Chain and connected to the regulatory technology systems of both places. Langxin Group's exploration of real-world assets has provided a new financing idea for Chinese and Hong Kong companies going overseas. In the past, only a small number of companies going overseas could complete overseas financing through local bank loans, VC (venture capital) support, etc. Langxin Group used "charging piles" as RWA anchor assets, proving that traditional cross-border and cross-regional companies can still achieve cross-regional credit and financing by corresponding physical assets to digital assets. (Securities Daily) [7]

Exploration of the Mainland

Shenzhen's real estate registration system piloted blockchain technology, taking 30% of property information on the chain to improve the efficiency and transparency of ownership verification. As a "Chinese-origin" Shanghai Tree Graph Blockchain Research Institute (Conflux), it also worked with Ant Digital to complete the " Patrol Eagle Battery Exchange Cabinet RWA " project, transforming 4,000 offline devices into digital financial products. Hong Kong Victory Securities served as the compliance custodian to achieve cross-border subscription by private equity institutions, and successfully explored a new path for "quasi-REITs" asset securitization. The project attempts to collect battery exchange cabinet operation data through the Internet of Things technology, and form RWA after chaining, attracting subscriptions from multiple private equity institutions.

Legal comparison and compliance path

From the current situation, the direction of real estate tokenization has structural priority, as most of the underlying assets are anchored to valuable, low-liquidity assets, combined with the existing successful historical experience of asset securitization, and then transitioning to RWA and chaining. Hong Kong, a financial innovation region, has a flexible regulatory framework for the digital exploration of such assets, but in the mainland, due to the incomplete judicial mutual recognition mechanism between the property registration system and the on-chain data, there are still obstacles to cross-regional legal adaptation. At the same time, the restrictions on asset splitting and capital control policies in the mainland's "Property Law" have also led to the temporary limitation of real estate tokenization to securitization models such as equipment financing leasing. For example, the pilot blockchain technology in the Shenzhen real estate registration system can improve the efficiency of ownership verification, but it has not yet solved the legal status of on-chain data.

Figure 7 Source: Web3 Caff Research Researcher Eddie Xin

Carbon Credit Tokenization: Compliance Game in Environmental Finance

In the process of human civilization's transformation to ecology, the global economic system is also undergoing structural changes. As a key economic tool for ecological governance, the reform of the operation mode of the carbon credit market is related to sustainable development. The global climate governance framework established by the Paris Agreement urgently needs to use market-based means to build a unified and efficient carbon resource allocation mechanism. However, the current global carbon market has a significant geographical fragmentation problem: different regional carbon price formation mechanisms, lack of coordination in trading rules, and obstructed cross-border circulation, resulting in disordered carbon asset pricing and even increased resource mismatch risks. According to the data mentioned in the 2022 China Energy System Carbon Neutrality Roadmap report provided by the International Energy Agency, the average transaction cost of the global carbon market accounts for 10%-15%, and some emerging markets exceed 20%, which seriously weakens the effectiveness of climate policies. From the perspective of global governance, countries are reshaping the green economic order with policy tools. The European Union Carbon Emissions Trading System (EU ETS) continues to tighten quotas and strengthen carbon price discovery; China's "dual carbon" strategy promotes the national carbon market to cover eight key industries and form the world's largest carbon factor market. At the same time, jurisdictions such as Singapore and Switzerland have provided practical samples for innovation in global carbon market rules through carbon asset tokenization legislation and digital asset regulatory sandboxes.

International leading projects

Toucan Protocol is a blockchain-based carbon credit tokenization protocol. It aims to improve the liquidity and market transparency of carbon assets by converting traditional carbon credits (such as Verra-certified VCU) into on-chain tokens (TCO 2, BCT). The cumulative transaction volume has reached 4 billion US dollars, but it is forced to adopt a "fixed" token model due to Verra's physical cancellation requirements. Because Verra (an international organization that manages environmental rights such as carbon credits) has a rule that the corresponding carbon credits and other rights must be completely deleted from the system (just like "physically destroying" a piece of paper), and cannot be split, transferred or changed at any time with ordinary digital tokens. Therefore, only a "fixed" token model can be adopted: these rights are made into digital tokens with a fixed number that cannot be split or modified at will, just like a bunch of coins are bundled into a whole bundle, which can only be traded as a whole bundle and cannot be disassembled and used individually, so as to meet Verra's "must be completely cancelled" requirement. . Klima DAO promotes emission reduction through the carbon credit pledge mechanism, but there is a risk of double counting of carbon offsets, which requires audit verification by third-party institutions. In June 2024, Gold Standard announced that it was developing reference standards for carbon credit tokenization, which will cover technical security, operational compliance and other aspects. The above projects have successfully reflected and activated the liquidity needs of the on-chain carbon market. [8]

Practice in Hong Kong, China

The tokenization platform built by Hong Kong Ant Digits realizes delivery-versus-payment (DvP) transactions of carbon credits and green bonds. In 2025, it will complete the cross-border transaction of blockchain green certificates for Brazilian household photovoltaic projects (with a first phase of 220 million reais), successfully opening up the connection channel between the international carbon market and emerging economies [9]. The platform also supports the implementation of the first household photovoltaic RWA project in China - GCL Energy and Ant Digits tokenized 82 MW distributed power station assets in Jiangsu, Anhui and other places. Through real-time tracking of power generation data through IoT devices, it can provide overseas investors with a stable annualized return of 6.8%.

The Hong Kong Monetary Authority has included carbon credits in the core pilot areas of the Ensemble Sandbox to promote the compatibility of international carbon market rules. Based on the sandbox policy, JD Technology has also made a big move into the Web3 ecosystem, launching the Hong Kong dollar stablecoin JDHKD to provide a low-friction channel for cross-border settlement of RWA; Sui public chain and Ant Digits jointly built the ESG asset protocol layer to achieve on-chain anchoring of carbon emission reductions and green bonds, shortening the transaction settlement time from the traditional T+3 to 15 minutes.

Exploration of the Mainland

As the main region promoting the carbon neutrality policy, China has also stepped into the forefront of the world in the digital exploration of carbon rights. For example, the Shanghai Environment and Energy Exchange launched a blockchain carbon trading platform (2025) to realize the on-chain registration and trading of national carbon market quotas. Landmark institutional projects such as the Left Bank Xinhui Agriculture RWA project integrates agricultural product data and carbon credits, completes 10 million yuan of financing through "blockchain + Internet of Things" technology, and explores the integration path of agricultural carbon assets and real industries. The "Management Measures for Voluntary Greenhouse Gas Emission Reduction Trading" clearly allows project-level carbon assets to be put on the chain, providing policy support for the tokenization of carbon credits. It can be seen that the management exploration of the carbon rights market in mainland China does not avoid the use of blockchain settlement solutions. In these specific scenarios, as the passive demand for application scenarios increases, it is believed that mainland China will continue to maintain an open attitude and actively explore the field of blockchain technology.

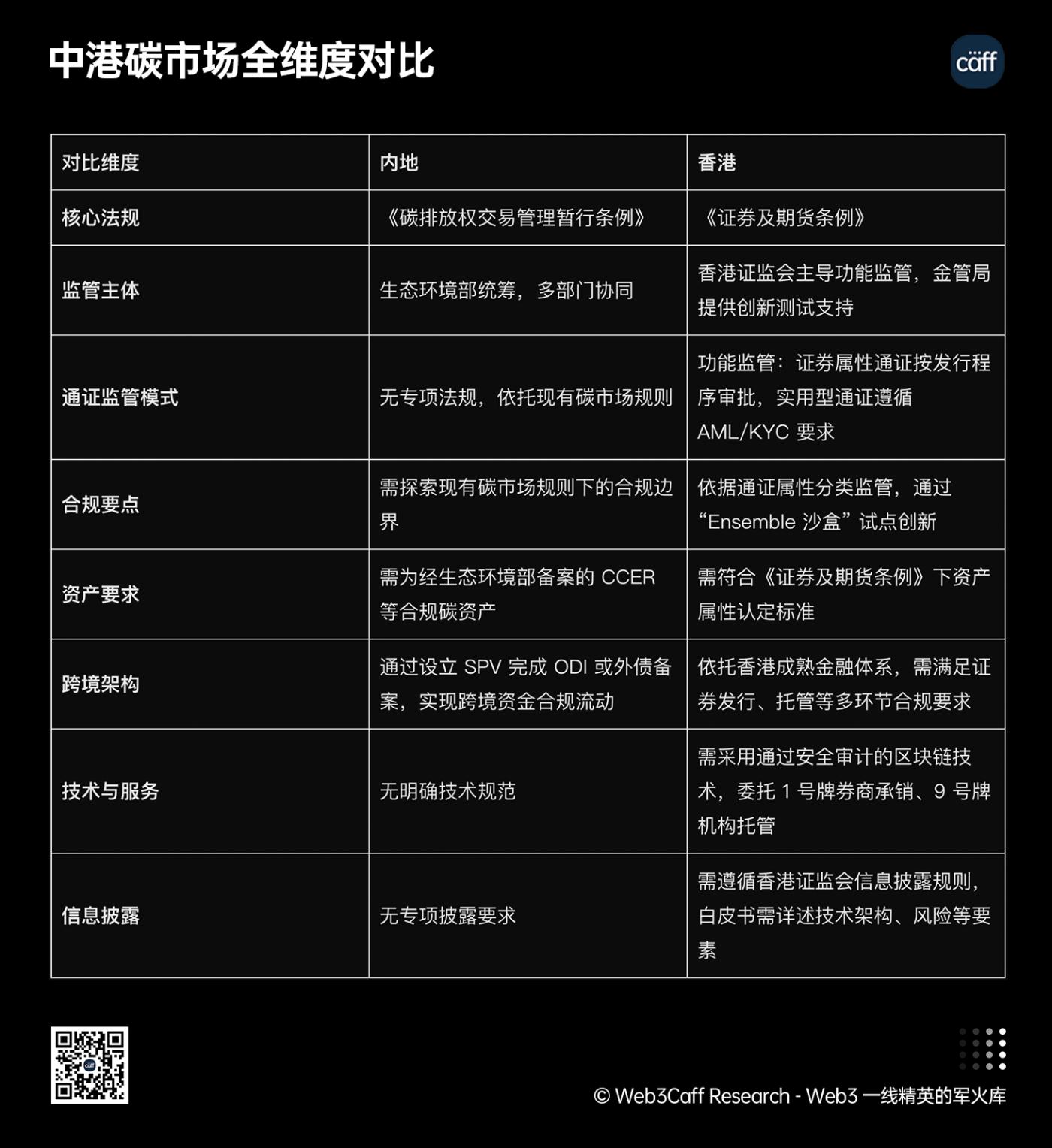

Legal comparison and compliance path

As a center of global financial innovation, Hong Kong is more convenient to connect with global mainstream issuance platforms such as Verra and Gold Standard in cutting-edge financial technology exploration. However, some international platforms still have process restrictions for cross-border tokenization (such as physical cancellation requirements), which increases the complexity of compliance operations. The scale of carbon assets in the mainland leads the world, but there is a lack of international mutual recognition standards. Carbon credit tokenization is temporarily limited to domestic closed-loop transactions, and it is necessary to promote docking and coordination with international rules. For example, although the blockchain carbon trading platform of the Shanghai Environment and Energy Exchange can realize on-chain registration, cross-border transactions still need to rely on traditional mechanisms.

The mainland carbon credit market is centered on the "Interim Regulations on Carbon Emission Trading Management" and is supervised by the Ministry of Ecology and Environment. Through registration, quota allocation and emission reduction certification system, it regulates the trading behavior of key emission units. However, in the field of carbon credit tokenization, no special regulations have been issued, and it is still necessary to explore the compliance boundaries based on the existing carbon market rules.

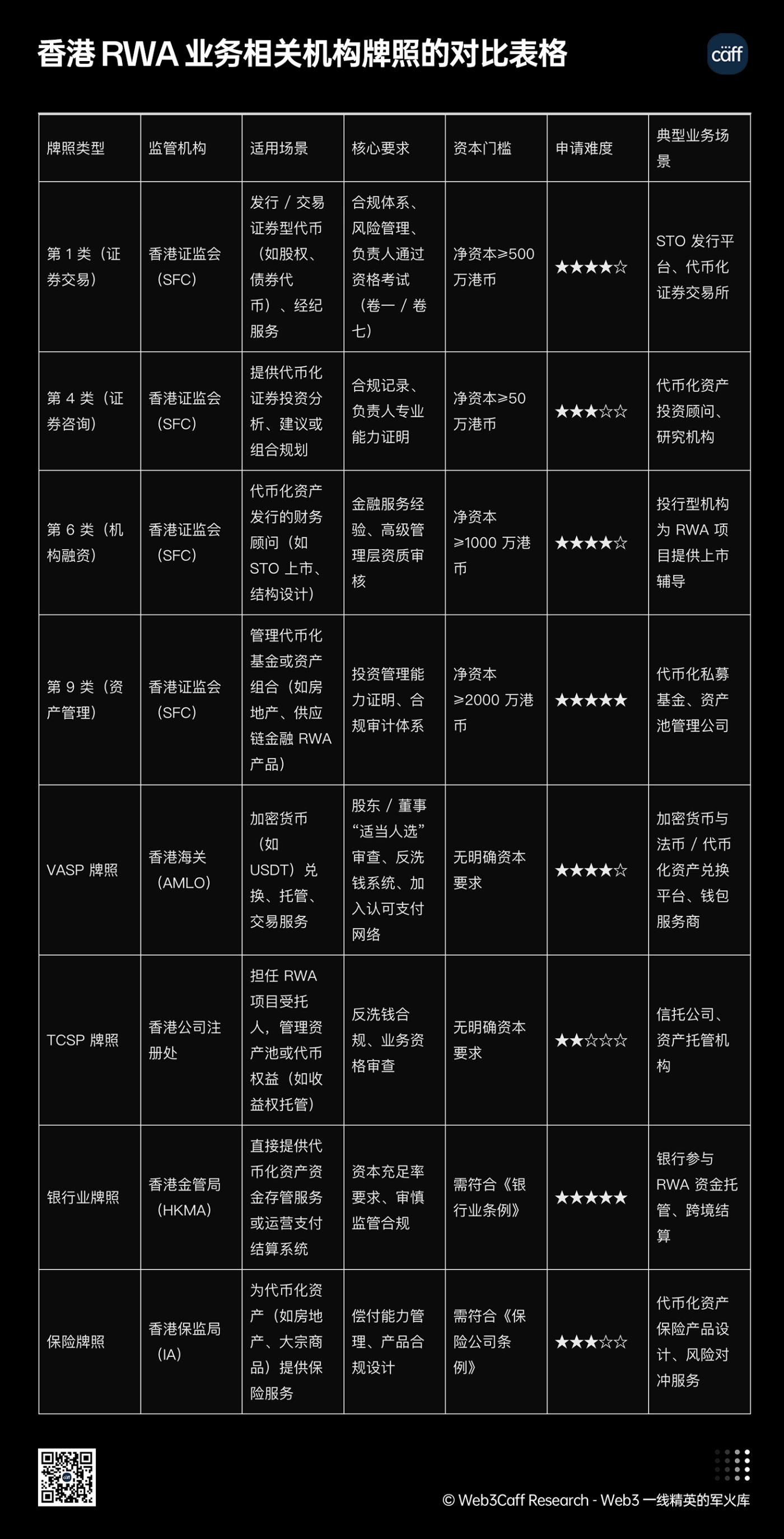

Hong Kong has built a flexible regulatory framework based on the Securities and Futures Ordinance, adopting a functional regulatory model: if the carbon credit token has securities attributes (such as income rights certificates), a prospectus must be submitted in accordance with the securities issuance procedures; if it is a utility token, it must meet anti-money laundering (AML) and customer identification (KYC) requirements. The Hong Kong Monetary Authority provides a testing space for blockchain financial innovation through the "Ensemble Sandbox" and promotes the pilot of carbon credit tokenization under the premise of controllable risks.

Mainland enterprises going to Hong Kong to carry out carbon credit tokenization business need to focus on three compliance points: first, asset compliance, choose high-quality carbon assets such as CCER registered with the Ministry of Ecology and Environment; second, structural compliance, through the establishment of a special purpose vehicle (SPV) to complete ODI (ODI, or Outward Direct Investment, refers to the economic activities of Chinese enterprises and groups in foreign countries and Hong Kong, Macao and Taiwan, investing in cash, physical objects, intangible assets, etc., with the core of controlling the management rights of foreign enterprises. It is a key part of the "going out" strategy of Chinese enterprises) or foreign debt registration to achieve cross-border capital flow compliance; third, business compliance, according to the attributes of the certificate to perform the corresponding approval procedures, use blockchain technology that has passed the security audit, entrust No. 1 licensed securities firms to underwrite and No. 9 licensed institutions to custody, and follow the information disclosure requirements of the Hong Kong Securities and Futures Commission.

Figure 8, source: Web3 Caff Research researcher Eddie made his own (Comparison table of Hong Kong RWA business-related institution licenses)

The ownership dispute of real estate tokenization reveals the essence of the sovereign game of mapping physical assets to on-chain value. Carbon credit tokenization further extends this contradiction to the field of environmental finance, forcing the market to seek a breakthrough between cross-border compliance and mutual recognition of international standards.

Figure 9, source: Web3 Caff Research researcher Eddie made his own (full-dimensional comparison of China and Hong Kong carbon markets)

Breakthroughs and conflicts in technology-regulatory collaboration

In the context of the digital economy reshaping the global financial ecology, the dynamic game between technological innovation and regulatory framework has become the core engine driving the transformation of the financial system. Distributed technologies represented by blockchain and smart contracts, by building a decentralized value circulation network, have launched a systematic challenge to the penetrating management, territorial constraints and compliance review mechanisms of traditional financial supervision. However, in frontier fields such as sovereign debt tokenization, real estate asset tokenization and carbon credit digitization, the improvement of transaction efficiency (such as T+0 real-time settlement), risk diversification optimization (such as asset fragmentation trading) brought about by technological innovation and the core demands of regulators to maintain market stability and prevent systemic risks have both the possibility of collaborative innovation and the dilemma of rule conflicts. This contradiction essentially reflects the paradigm difference between the underlying logic of technology and the top-level design of the system - the former emphasizes the automated execution of code as law, while the latter relies on the authoritative constraints of bureaucratic rules. Analyzing the breakthrough path and conflict focus in the process of technology and regulation collaboration is not only related to the compliance development of emerging financial businesses, but also a key proposition for building a new financial governance order that adapts to the digital economy era and achieving a dynamic balance between innovation incentives and risk control.

Compliance Architecture Innovation: Offshore SPV and On-Chain Sandbox

Global cutting-edge practices

Project Guardian , led by the Monetary Authority of Singapore (MAS), is a benchmark project for global fintech regulatory sandboxes, focusing deeply on the application innovation of blockchain technology in cross-border financial transactions. The pilot project was led by JPMorgan Chase, DBS Bank and Marketnode. It was originally a digital asset joint venture established by Temasek and Singapore Exchange (SGX) in June 2022. Deutsche Bank joined the project in May 2024 to explore asset tokenization applications. Moody's announced its participation in the Guardian project and plans to explore asset tokenization in 2024. In project practice, by introducing the key technical component of Chainlink oracle, a bridge connecting off-chain real-world data and on-chain smart contracts was successfully built. Traditional cross-border settlements are lengthy and costly due to the involvement of multiple parties and information asymmetry. Chainlink Oracles, with their decentralized node network and data aggregation mechanism, can verify key information such as the status of goods and exchange rate changes in trade financing in real time, which is expected to significantly reduce the cost of cross-border settlements. The transaction time is greatly shortened from the industry standard "T+2" mode (settlement on the second working day after the transaction) to minutes, significantly improving the efficiency and transparency of cross-border financial transactions. At the same time, high-frequency and large-scale on-chain transactions may cause liquidity risks and even threaten the stability of financial markets. To this end, the Monetary Authority of Singapore has adopted a dynamic regulatory strategy and innovatively set transaction speed limit rules: when the on-chain transaction volume exceeds the daily average threshold, the system will automatically trigger a smart contract to limit the size of a single transaction, and require relevant financial institutions to submit additional liquidity risk assessment reports. The main goal of the Project Guardian pilot project is to build a framework for the cross-border issuance of tokenized securities. Due to differences in banking systems and regulatory restrictions, this framework is usually more complex. Executing tokenized assets through a blockchain network can make transactions easier, faster and safer.

Exploring the characteristics of China and Hong Kong

Under the wave of global financial technology innovation, mainland China and Hong Kong have carried out differentiated explorations in the field of technology and regulatory coordination based on their own policy systems and market foundations, which has not only demonstrated the vitality of innovative breakthroughs, but also exposed deep-seated contradictions in the connection of rules.

Relying on the "regulatory sandbox" mechanism and top-level design advantages, the mainland has achieved deep coupling of technology and regulation in the digital RMB (e-CNY) pilot. Through the "two-tier operation" architecture, the central bank leads the technical standards and underlying protocols, and commercial banks and technology companies are responsible for the implementation of scenarios, which not only ensures the centralization of currency issuance rights, but also uses blockchain distributed ledgers to achieve real-time traceability of transaction data. According to the latest report from the Economic Daily , by the end of 2024, the number of digital RMB pilot scenarios will exceed 150 million, with a transaction amount of more than 8.7 trillion yuan, building a positive cycle of "technology empowerment-regulatory compliance" in the retail payment field. However, differences in cross-regional data governance standards and ambiguity in the legal recognition of smart contracts have led to regulatory arbitrage space in some scenarios. For example, the differences in the recognition of the effectiveness of smart contract performance in different jurisdictions in cross-border trade have caused compliance risks in the automated settlement of supply chain finance.

Hong Kong, relying on its common law system and status as an international financial center, has taken its own path in virtual asset regulation. The Anti-Money Laundering and Terrorist Financing (Amendment) Ordinance, which will come into effect in 2023, clarifies the licensing system for virtual asset service providers (VASPs), requiring trading platforms to use on-chain data analysis tools (such as Chainalysis) for KYC/AML monitoring, and transforming the anti-money laundering capabilities of blockchain technology into regulatory effectiveness. In the field of security tokens (STO), the Hong Kong Securities and Futures Commission allows innovative projects to test the profit distribution mechanism driven by smart contracts within a limited scope through the "regulatory sandbox + investor tiered protection" model. However, the Hong Kong Monetary Authority (HKMA) launched the Stablecoin Act in May this year, in which the strong regulatory requirements for stablecoins (such as 100% high-liquidity asset reserves) conflict with the low threshold and high leverage characteristics pursued by the DeFi protocol, forcing some projects to adjust their technical architecture or even choose overseas markets.

In the collaborative exploration between China and Hong Kong, cross-border data flow has become the focus of technical regulatory conflicts. The differences between the Mainland's Data Security Law and Hong Kong's Personal Data (Privacy) Ordinance in terms of data export standards and cross-border audit authority make it difficult for blockchain-based cross-border carbon credit tokenization projects to achieve seamless data transfer on the chain. However, the Qianhai Shenzhen-Hong Kong Modern Service Industry Cooperation Zone has launched a pilot project for "data cross-border flow security assessment" to explore the use of "trusted computing + encrypted transmission" technology to achieve technical docking of cross-border carbon markets under the premise of ensuring data sovereignty, providing innovative ideas for breaking through regulatory barriers. This dialectical relationship of "institutional differences forcing technological innovation, and technological upgrades feeding back regulatory optimization" is reshaping the new pattern of collaborative development of financial technology between China and Hong Kong.

Core Challenges

Regulatory jurisdiction disputes have led to a general surge in the compliance costs of global RWA projects. For example, the US SEC has included decentralized platforms such as Uniswap in the scope of securities supervision. In terms of regional institutional differences, Hong Kong follows the APEC cross-border data flow principles, and the mainland implements the "data outbound security assessment" system. Cross-border projects are subject to independent audits in both places, which increases the complexity of compliance. At present, the Hong Kong Monetary Authority's stablecoin regulatory rules are equivalent to the EU MiCA framework. Licensed issuers can apply for the EU EMT license with Hong Kong qualifications, which can reduce compliance costs. This mechanism has attracted institutions such as Circle and Tether to set up Asia-Pacific operations centers, successfully promoting the cross-border flow of RWA.

Although the offshore SPV and sandbox mechanism provide an institutional interface for cross-border compliance, the reliability of technical infrastructure is still a rigid constraint for large-scale implementation. Next, we will continue to penetrate the underlying bottlenecks such as oracle delay and cross-chain interoperability, and analyze the implementation priority of technology-regulatory collaboration.

Technical bottlenecks and solutions

As the "data bridge" of the blockchain ecosystem, the oracle machine undertakes the key function of securely transmitting off-chain real-world data (such as asset prices and IoT sensor data) to on-chain smart contracts. Its core technical principle is based on a decentralized node network, which verifies the authenticity of data through a consensus mechanism: after the node operator obtains information from an external data source, it uses a hash algorithm to encrypt the data, and then uses consensus algorithms such as Byzantine Fault Tolerance (BFT) or Proof of Stake (PoS) to ensure that the data is written to the blockchain after verification by the majority of nodes. However, the traditional single oracle architecture has significant risks - if the data source fails, the data is delayed or maliciously tampered with, it will directly lead to the on-chain smart contract executing erroneous instructions.

Oracle data reliability

International cases show that in 2022, the DeFi lending protocol Inverse Finance had a design flaw in the oracle TWAP (time-weighted average price) mechanism, resulting in the illegal misappropriation of on-chain assets worth $14.75 million. This incident exposed the core vulnerability of traditional oracles in dynamic markets: According to an analysis article by the Web3 security audit team Certik : The TWAP oracle time window used by the protocol only covers two adjacent blocks. The attacker manipulated the price of SushiSwap's INV-WETH trading pair through flash loan, and raised the price of INV from 0.106 ETH (about US$366) to 5.966 ETH (about US$20,583) in 7 minutes. Then, he used the inflated price to pledge 1,746 INV (fair value of approximately US$644,000) in Inverse Finance, lent out assets such as 1,588 ETH, 94 WBTC and 4 million DOLA, and finally achieved fund transfer through cross-protocol arbitrage. This process exposed two core problems: first, the oracle time window was set unreasonably and could not resist short-term price manipulation; second, the protocol lacked real-time monitoring of collateral liquidity, resulting in inflated assets passing verification. Chainlink officials later admitted that its TWAP mechanism had design flaws in high-volatility markets and needed to be optimized by combining multiple data sources and machine learning algorithms.

This case reveals the core contradiction in the design of oracle systems: it is necessary to ensure the real-time nature of data while preventing manipulation risks. According to the Chainlink 2.0 white paper , its decentralized oracle network has increased the cost of node misconduct to more than $980 million through economic incentives and cryptographic proofs, significantly enhancing the robustness of the system. In the future, with the application of hardware trusted execution environments (TEEs) and AI verification layers, the reliability of oracle data is expected to reach financial-grade standards.

Ant Digital Technology of Hong Kong explored localized solutions in the "Langxin Project" and innovatively deployed the "Internet of Things Terminal + Multi-party Secure Computing" system for the asset tokenization scenario of new energy charging piles. The solution is based on edge computing technology. The smart sensors built into the charging piles collect 12 core operating data such as current, voltage, and charging time in real time, and perform local encryption processing through TEE (Trusted Execution Environment) to ensure that the data has not been tampered with before transmission. Subsequently, the data is synchronized to three independent verification nodes (including testing agencies, power grid companies, and audit firms). Based on homomorphic encryption and zero-knowledge proof technology, each node cross-verifies without leaking the original data, and finally compares the hash value and stores it on the chain. According to the results of the Langxin Technology test report , the solution controls the data delay within 2 minutes, which is 4 times more reliable than the traditional single oracle solution. It provides a systematic solution of "hardware collection + multi-party verification + privacy computing" for the chain-up of off-chain data in asset digitization scenarios, effectively avoiding the risk of contract default caused by data distortion.

Cross-chain interoperability optimization

In the context of the fragmented development of the global blockchain ecosystem, cross-chain interoperability has become the core bottleneck restricting the efficient circulation of assets and the transfer of value. According to the Shark team incident analysis report, the Wormhole cross-chain protocol once caused a security incident caused by a smart contract vulnerability, resulting in hundreds of millions of dollars in direct losses, exposing the technical shortcomings of the cross-chain protocol in terms of verification mechanism, asset custody and risk hedging. In this incident, the attacker exploited the loophole in the protocol's guardian signature verification, minted 120,000 Wrapped ETH without actually depositing assets, and transferred them to other chains through a cross-chain bridge to cash out funds, highlighting the deep defects in the security design of the cross-chain protocol.

In addition, the differences in the underlying architecture between heterogeneous blockchain networks have exacerbated the market fragmentation. The pricing efficiency of assets using traditional cross-chain protocols is significantly affected by liquidity fragmentation, and the volatility of inter-chain spreads is higher than that of the optimized model. Although the specific token spread data is not clearly disclosed in the public report, industry practice shows that pricing deviations of similar assets between heterogeneous chains due to uneven liquidity distribution are common. As we all know, even if the underlying real assets are benchmarked, such as real estate tokenization and data asset tokenization, in order to improve the real and effective liquidity of transactions, basic liquidity supply such as traditional financial market makers is still required. Cross-chain assets face pricing efficiency challenges in the scenario of dispersed liquidity. This fragmentation not only increases the arbitrage costs of investors, but also hinders the large-scale application of cross-chain assets.

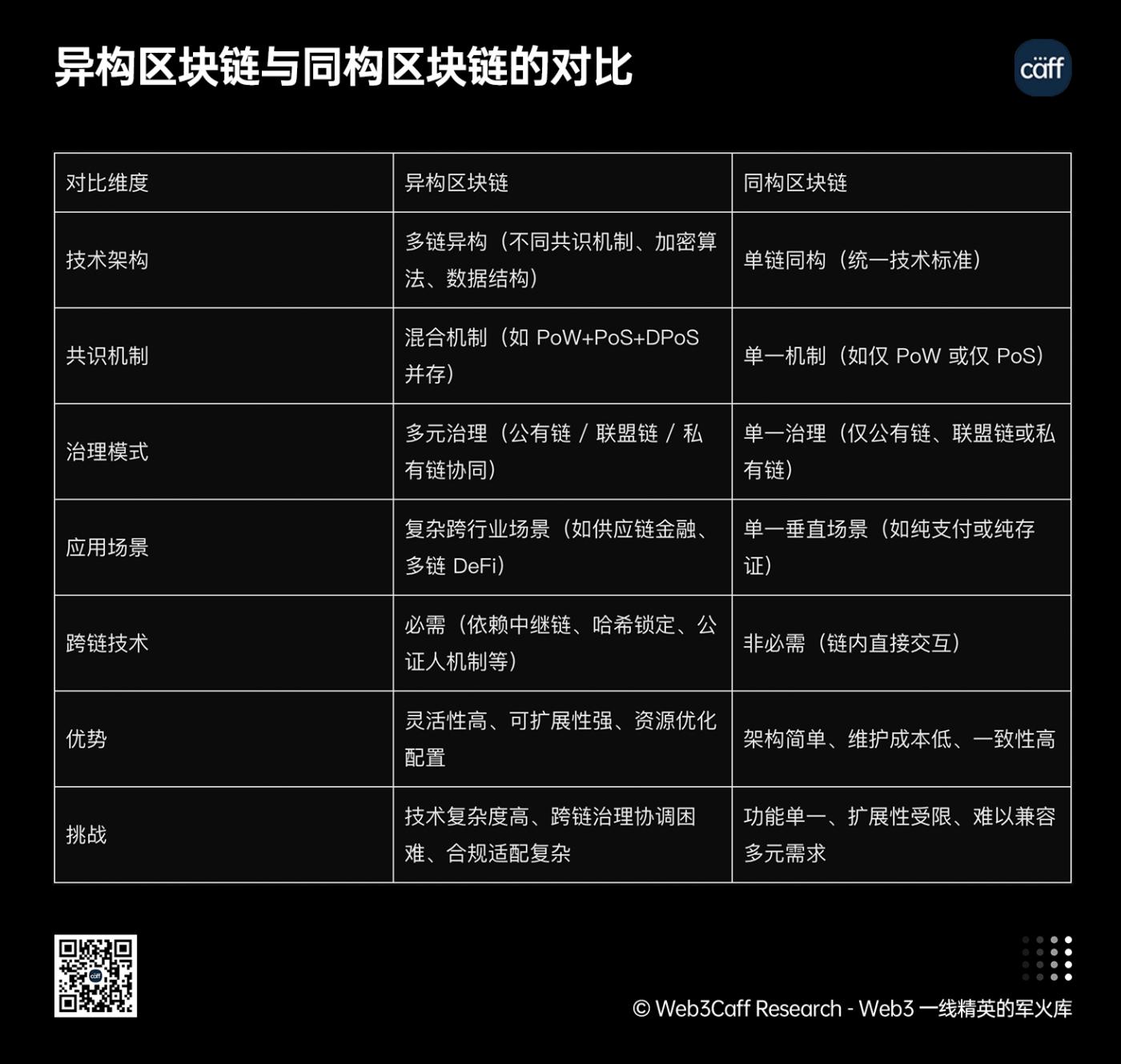

Figure 10, source: Web3 Caff Research researcher Eddie Xin (comparison between heterogeneous blockchain and homogeneous blockchain)

The Ensemble sandbox project led by the Hong Kong Monetary Authority (HKMA) builds innovative solutions by introducing the LayerZero full-chain protocol. The protocol is based on the "light node verification + oracle collaboration" mechanism to achieve instant transmission and verification of cross-chain messages; at the same time, it relies on the licensed custodian institutions designated by the HKMA (such as HSBC and DBS Bank) to over-collateralize cross-chain assets and strictly control the fluctuation of inter-chain price differences within 3% . For example, in the pilot cross-border carbon credit tokenization scenario, LayerZero supports the seamless transfer of carbon quotas between Ethereum and Binance Smart Chain, and cooperates with the real-time valuation and margin collection of custodians to effectively avoid the risk of cross-chain asset decoupling [11].

The mainland takes the pilot project of "cross-chain infrastructure in the Guangdong-Hong Kong-Macao Greater Bay Area" as a breakthrough point, focusing on regional collaborative innovation. The project is based on alliance chain technology, and through a unified cross-chain communication standard (such as the cross-chain hash locking protocol), it realizes the underlying technology compatibility of the blockchain platforms in Guangzhou, Shenzhen and Hong Kong. At the consensus mechanism level, the hybrid mode of "Practical Byzantine Fault Tolerance (PBFT) + Delegated Proof of Stake (DPoS)" is adopted to ensure the efficiency of transaction confirmation and improve the system security through multi-center node governance. According to Xie Baojian's article "Bay Area Economy: Leading a New Pattern of Comprehensive Opening Up" in the April 2025 issueof "People's Forum" , and the "Digital "Chain" Greater Bay Area-Blockchain Assists the Integrated Development Report of the Guangdong-Hong Kong-Macao Greater Bay Area (2022)" released in Shenzhen by the China (Shenzhen) Comprehensive Development Research Institute, comprehensive data: At present, the pilot has successfully opened up cross-border trade financing, supply chain finance and other scenarios, and realized the cross-chain exchange of RMB digital assets and Hong Kong dollar stablecoins, processing more than 20,000 cross-chain transactions per day, and is committed to providing a replicable technical paradigm for the construction of a national cross-chain ecosystem.

Smart contract security enhancement update reminder

As the core execution unit of the blockchain ecosystem, the security of smart contracts is directly related to the reliability of asset transactions and business operations. The German Federal Financial Supervisory Authority (BaFin) once took emergency measures to suspend the business of the Centrifuge platform due to a reentrancy attack vulnerability in the smart contract, which led to the illegal misappropriation of user funds [12]. This incident exposed the limitations of relying on manual audits in traditional contract development - problems such as code logic loopholes and missing boundary conditions are difficult to fully identify, prompting the industry to accelerate the introduction of formal verification tools. Such tools are based on mathematical logic proofs. By converting contract code into a verifiable formal model, they systematically verify whether the contract meets the predetermined properties, such as the controllability of fund flows and the compliance of state transitions, thereby eliminating security risks caused by code defects from the root.

Hong Kong has established a dual protection system of "technical testing + third-party audit" in regulatory practice. For the real-world asset (RWA) tokenization project, the Hong Kong Securities and Futures Commission explicitly requires that smart contracts must pass the annual security audit of licensed auditing institutions such as KPMG and EY. The audit content covers code logic review, vulnerability scanning, stress testing and other links. At the same time, the Hong Kong Securities and Futures Commission requires the introduction of automated audit tools (such as Slither and MythX) for dynamic monitoring and real-time tracking of abnormal behaviors in contract operation. According to the KPMG audit report data, the incidence rate