- The Altcoin Season Index dropped to 26, reflecting Bitcoin Dominance but also opening up the possibility of a reversal for altcoins in the future.

- A sustainable upward trend to a market capital of 270 billion USD is a crucial factor in confirming the breakout structure of altseason.

The overall cryptocurrency market recorded a slight recovery, with altcoins — rather than Bitcoin (BTC) — being the main driver of the upward trend. This has caused many investors to worry about the possibility of a sell-off. However, on-chain data shows a completely different development.

Stable Exchange Deposits: A Calm Signal Amid Volatility

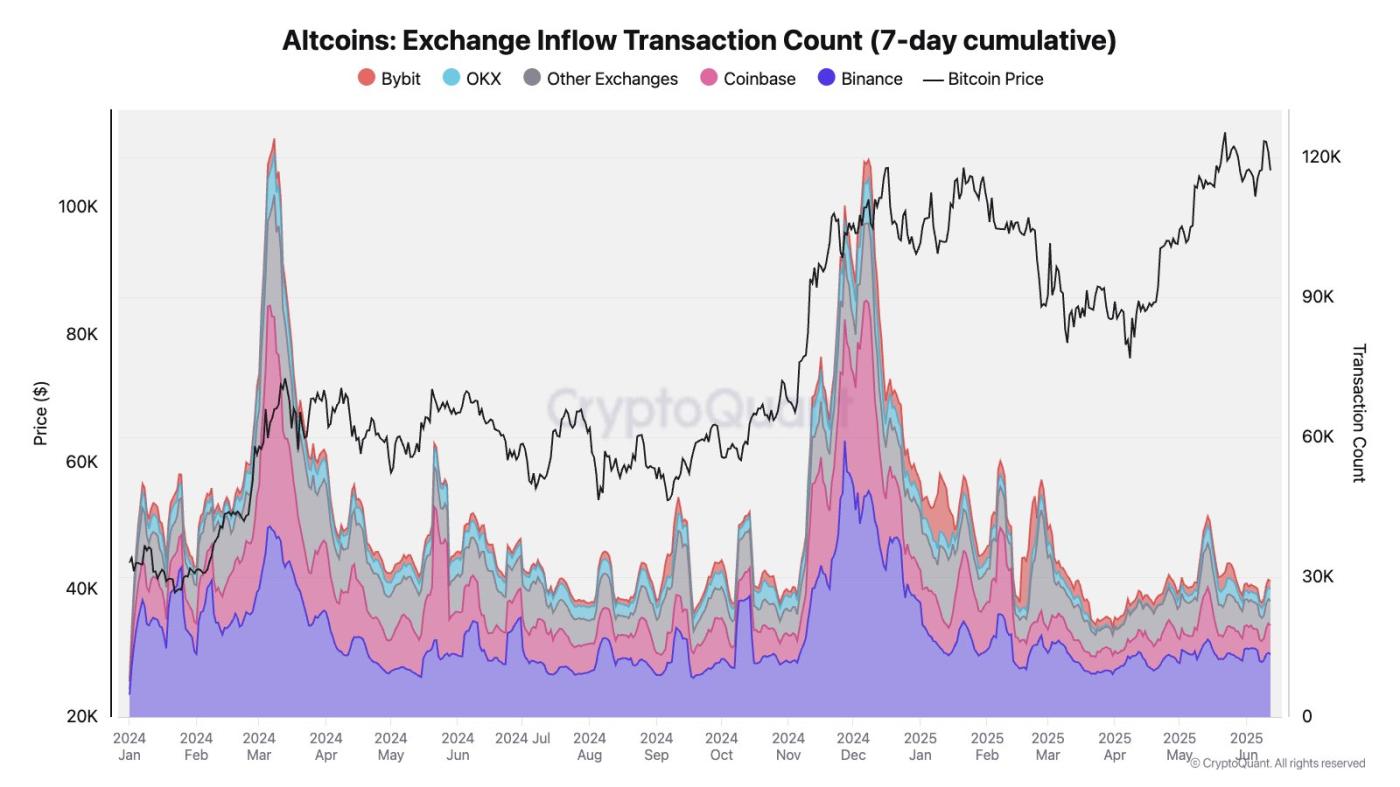

Despite increased price volatility, the number of altcoin deposits to exchanges remains low.

On major exchanges like Binance, Coinbase, OKX, and Bybit, altcoin deposits only fluctuate around 30K transactions, much lower than the peak of over 100K recorded during major corrections in March and December 2024.

This is clearly different from previous stages, when altcoins were heavily dumped before each major correction.

This stable deposit trend shows a change in investor trading behavior, possibly shifting to Decentralized Exchanges (DEX) or converting altcoins to USDC and USDT.

Source: Julio Moreno/X

Absolute Silence: Is It Really "Too Quiet"?

However, relying solely on Centralized Exchange (CEX) data can make the view of the entire market activity incomplete.

The 'quiet' deposit flow reflects holders' psychology of not rushing to sell. This is a sign that panic selling has been limited and could be a longer-term buying motivation for altcoins.

Under the influence of geopolitical uncertainties, the Fear and Greed index reached 52, showing that market sentiment has returned to a neutral state after a series of cryptocurrencies plummeted.

This implies that fear has diminished, and the market is in a self-"cleaning" phase after the recent strong sell-off and liquidation.

Source: CoinMarketCap

This neutral level does not show excessive optimism or extreme fear, but reflects a hesitant and cautious market. Recent volatility events and large-scale liquidations have helped the market reset to its initial state.

Can Altcoin Season Index Reverse?

Analysis of the Altcoin Season Index shows the index has dropped to 26, after recently reaching 30.

This confirms that Bitcoin is controlling market volatility. However, altcoins are not completely out of opportunities — some recovery signs are still appearing locally.

If this index crosses the 50 threshold, it will be a signal confirming a strong upward momentum for altcoins. At the current moment, Bitcoin still has the advantage, but the market state can quickly turn around.

Source: CoinMarketCap

2025: Repeating the 2021 Pattern?

Comparison between the 2021 and 2025 altcoin seasons according to analysis shows that both periods have in common a "double fakeout" just below the 1-month MA line, followed by an impressive recovery phase.

In 2021, this structure triggered a prolonged altcoin surge lasting several months.

In 2025, the market has experienced two breaches of the 180 billion USD mark, with quick retracements and rapid recoveries. A growth structure has appeared, but the result will depend on subsequent developments.

Source: Merlijn The Trader/X

However, volume and macro momentum have not yet exploded in 2025. If the total altcoin market cap can steadily accumulate towards 270 billion USD, the breakout possibility will become more apparent.

Conversely, if altcoin prices cannot maintain above the MA line, the chance of rejection is quite high. Overall, the technical configuration is there, but the market needs real momentum and capital flow from projects with practical applications to establish a breakout.