Original | Odaily (@OdailyChina)

Author | Wenser (@wenser 2010)

Overnight, many Binance Alpha players discovered that "the sky was falling" - the two major tokens KOGE and ZKJ, which have been used for Alpha points interaction, experienced a flash crash. As of the time of writing, the ZKJ price is temporarily reported at $0.32, with a **24-hour drop of up to 83.7%**, previously reaching a 24-hour high of $1.98 and a low of $0.25; the KOGE price is temporarily reported at $27.75, with a **24-hour drop of 55.78%**, previously reaching a 24-hour high of $62.81 and a low of $8.48.

The latest news is that Binance officially announced that they have "noticed significant price fluctuations in ZKJ and KOGE recently. Preliminary investigations show that this is mainly due to large holders withdrawing on-chain liquidity and market chain liquidation. They will adjust the Alpha points calculation rules starting from June 17, 2025, 00:00 (UTC), at which point the trading volume between Alpha tokens will no longer be counted towards points calculation."

The increasingly competitive and intense "Binance Alpha Exam" has finally reached a turning point due to the flash crash of the ZKJ/KOGE trading pair. Odaily will sort out this event in this article and explore the pros and cons of the Binance Alpha mechanism and its possible future direction.

A Three-Week "Alpha Hunt": Using KOGE and ZKJ as a Net, with Alpha Points as Bait

On May 24, as the BTC market gradually rose, the market's enthusiasm for Binance Alpha interaction also surged, with its trading volume once rising to $1.69 billion, including ZKJ trading volume of $1.05 billion, KOGE trading volume of $251 million, and B2 trading volume of $205.9 million, ranking among the top three.

Due to the low wear and tear cost and sufficient liquidity of ZKJ and KOGE tokens, which can accommodate large transactions over tens of thousands of dollars to participate in Binance Alpha interaction, these two tokens became the best choice for "Alpha candidates" after being effectively tested by market traders. Among them, KOGE's single transaction of nearly $10,000 can control wear and tear to around $0.5. Many community users reported that KOGE might be an example of BSC ecosystem whales "killing two birds with one stone".

Originally, this was a "win-win" game: Binance Alpha gains users and transaction fees; BSC node whales gain transaction fees; Binance Alpha users gain Alpha points; and projects like KOGE and ZKJ earn LP fees and other returns.

But once the balance of interests begins to tilt, the seemingly balanced situation will instantly collapse, and the hard-won "harvest stage" will turn into a "net-closing operation".

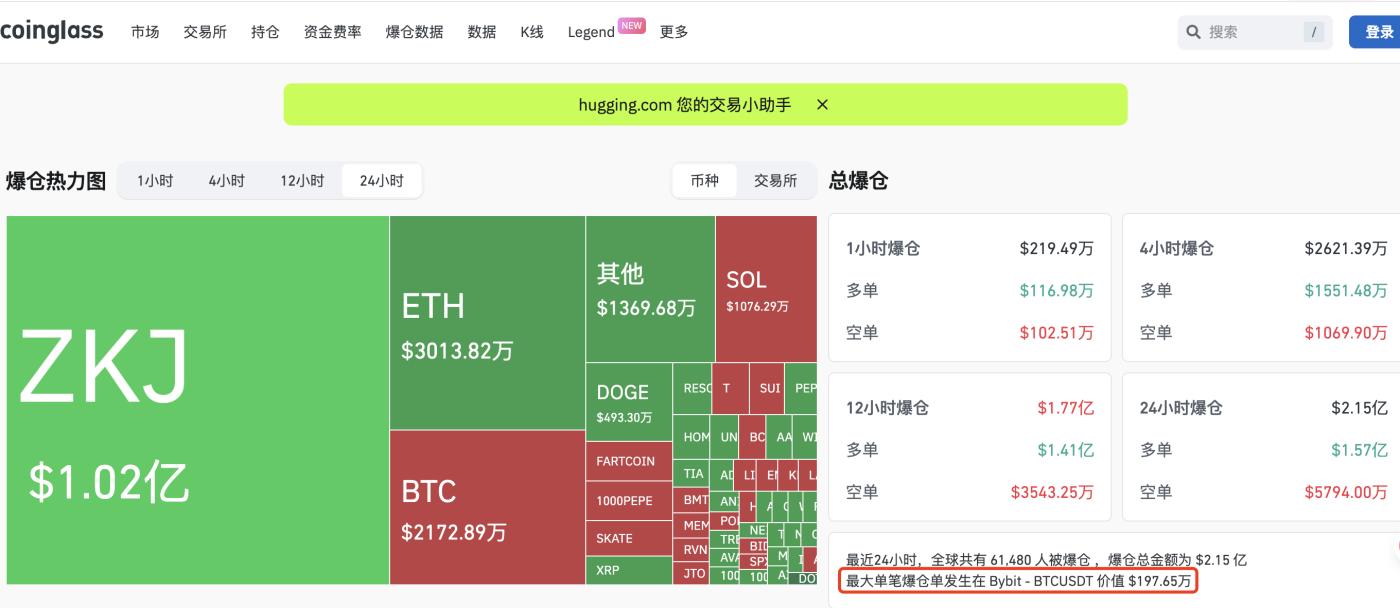

[The translation continues in the same manner for the rest of the text, maintaining the original formatting and translating all non-tagged text to English.]According to Coinglass data, the total network liquidation volume in the past 24 hours was $215 million, with long liquidations reaching $157 million. ZKJ's liquidation alone was as high as $102 million, which can be described as a bloody liquidity feast for KOGE whales who used KOGE/ZKJ to exit liquidity. The largest single currency liquidation occurred on Bybit

Overall, ZKJ and KOGE's flash crash was a premeditated hunting operation, with Binance Alpha points serving as seemingly delicious but actually dangerous bait.

Traders Trapped in Binance Alpha's Siege: Points Like Exam Scores, Airdrops are Both Gifts and Costs

After experiencing the ZKJ and KOGE flash crash, discussions about Binance Alpha's point system have been heated. Many people only gained the bitter fruit of "asset losses over 80%", thus generating numerous complaints about the Binance Alpha mechanism. Binance's official immediate announcement also highlighted the severity of this event.

Binance Alpha Airdrop Fails to Offset ZKJ Flash Crash Losses

As blockchain analyst AI Aunt said, the total airdrop value of all Binance Alpha projects so far does not match the market value lost by ZKJ. Its market value once plummeted from $2 billion to $377 million, with about 81% of market value evaporating in less than a day. This demonstrates the high volatility and brutality of the cryptocurrency industry. Many people invested thousands or even tens of thousands of dollars, with assets shrinking by over 80%.

Previously, according to X platform user Mingo, Binance Alpha's May monthly earnings were around $1,500. For many, after working hard for a month, this wave directly resulted in losses of thousands or even tens of thousands of dollars, which can be described as not worth the effort.

The largest single currency liquidation occurred on Bybit

Overall, ZKJ and KOGE's flash crash was a premeditated hunting operation, with Binance Alpha points serving as seemingly delicious but actually dangerous bait.

Traders Trapped in Binance Alpha's Siege: Points Like Exam Scores, Airdrops are Both Gifts and Costs

After experiencing the ZKJ and KOGE flash crash, discussions about Binance Alpha's point system have been heated. Many people only gained the bitter fruit of "asset losses over 80%", thus generating numerous complaints about the Binance Alpha mechanism. Binance's official immediate announcement also highlighted the severity of this event.

Binance Alpha Airdrop Fails to Offset ZKJ Flash Crash Losses

As blockchain analyst AI Aunt said, the total airdrop value of all Binance Alpha projects so far does not match the market value lost by ZKJ. Its market value once plummeted from $2 billion to $377 million, with about 81% of market value evaporating in less than a day. This demonstrates the high volatility and brutality of the cryptocurrency industry. Many people invested thousands or even tens of thousands of dollars, with assets shrinking by over 80%.

Previously, according to X platform user Mingo, Binance Alpha's May monthly earnings were around $1,500. For many, after working hard for a month, this wave directly resulted in losses of thousands or even tens of thousands of dollars, which can be described as not worth the effort.

Binance Alpha May Earnings Overview

Binance Alpha Points Become a Digital Game, Needs Change in Approach

After the incident, Binance officially issued an announcement stating: "We have noticed significant price fluctuations in ZKJ and KOGE. Preliminary investigations show this is mainly due to large holders withdrawing on-chain liquidity and market chain liquidations. To maintain market fairness and stability and reduce systemic risks from centralization, Binance will adjust the Alpha points calculation rules from June 17, 2025, 00:00 (UTC), at which point trading volume between Alpha tokens will no longer be counted in points calculation."

Subsequently, Binance Alpha might need to change its purely numerical game style. Specific reference approaches could include:

1. Avoid mechanisms concentrating trading volume on a few tokens like KOGE and ZKJ, ensuring relatively controlled and balanced interaction wear;

2. Increase Alpha points sources, not just limited to token trading. For example, community communication, posting on Binance Square, or "mouth rubbing" leaning towards InfoFi could be considered Alpha points interaction channels;

3. Establish supervision mechanisms to prevent KOGE whales from manipulating the chain of "token issuance-liquidity pool creation-Alpha listing-Alpha points acquisition" again, though this is highly idealistic and extremely difficult.

Summary: Liquidity Feast Ultimately Paid for by Retail Investors

In the end, market retail investors are still the most deeply hurt. After all, Binance as a platform still earned transaction fees, ZKJ and KOGE whales completed liquidity harvesting, while market retail investors became successive "leeks" to be cut.

But for these sickle holders, once the harvesting speed is too fast and frequency too high, who would continue to take over?

Binance Alpha May Earnings Overview

Binance Alpha Points Become a Digital Game, Needs Change in Approach

After the incident, Binance officially issued an announcement stating: "We have noticed significant price fluctuations in ZKJ and KOGE. Preliminary investigations show this is mainly due to large holders withdrawing on-chain liquidity and market chain liquidations. To maintain market fairness and stability and reduce systemic risks from centralization, Binance will adjust the Alpha points calculation rules from June 17, 2025, 00:00 (UTC), at which point trading volume between Alpha tokens will no longer be counted in points calculation."

Subsequently, Binance Alpha might need to change its purely numerical game style. Specific reference approaches could include:

1. Avoid mechanisms concentrating trading volume on a few tokens like KOGE and ZKJ, ensuring relatively controlled and balanced interaction wear;

2. Increase Alpha points sources, not just limited to token trading. For example, community communication, posting on Binance Square, or "mouth rubbing" leaning towards InfoFi could be considered Alpha points interaction channels;

3. Establish supervision mechanisms to prevent KOGE whales from manipulating the chain of "token issuance-liquidity pool creation-Alpha listing-Alpha points acquisition" again, though this is highly idealistic and extremely difficult.

Summary: Liquidity Feast Ultimately Paid for by Retail Investors

In the end, market retail investors are still the most deeply hurt. After all, Binance as a platform still earned transaction fees, ZKJ and KOGE whales completed liquidity harvesting, while market retail investors became successive "leeks" to be cut.

But for these sickle holders, once the harvesting speed is too fast and frequency too high, who would continue to take over?