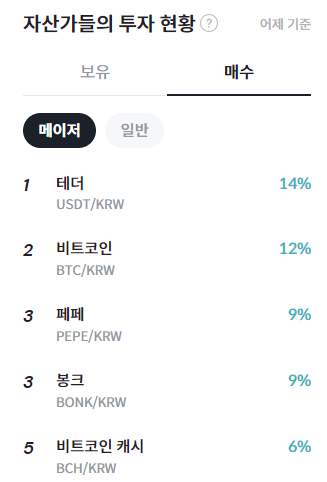

On the previous day, Tether (USDT) was the most purchased cryptocurrency by asset holders, accounting for 14% of the total trading volume. Following that, Bitcoin (BTC) was at 12%, Pepe (PEPE) and Bonk were each at 9%, and Bitcoin Cash (BCH) at 6%.

This indicator was calculated based on purchase data from the top 800 asset holders on Bithumb, showing the actual investment concentration on specific cryptocurrencies. It is worth noting that a higher net purchase ratio indicates stronger confidence and buying sentiment for the asset.

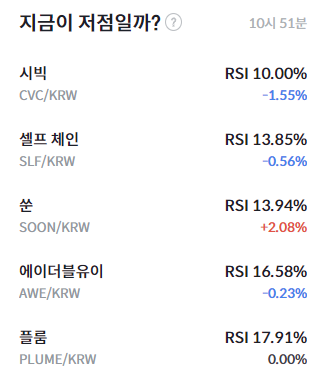

[Now, Is This the Bottom?]

As of 10:51 AM on June 16, 2025, according to the Relative Strength Index (RSI) data, Civic (CVC) entered a strong oversold phase, recording an RSI of 10.00%. Self Chain (SLF) was at 13.85%, Soon (SOON) at 13.94%, Awe (AWE) at 16.58%, and Plume (PLUME) at 17.91%.

These figures are all below the technical analysis standard of RSI 30, indicating an overall oversold state and potentially interpreted as a low-price buying opportunity by some investors. The RSI is a technical indicator calculated based on price fluctuations over the past 14 days, and on Bithumb, it is calculated based on the Simple Moving Average (SMA).

Real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>