Author: Peggy, BlockBeats

On June 12, the decentralized asset management platform Trident announced the launch of an XRP treasury financing plan with a maximum of $500 million and hired Chaince Securities LLC as a strategic advisor.

Against the backdrop of waning retail enthusiasm and cooling community discussions, this news has drawn market attention: Why do institutions still choose to allocate large amounts of XRP as on-chain reserve assets? Does this mean that the retail camp once known as the "XRP Army" is gradually being replaced by institutional funds?

XRP is one of the earliest blockchain projects to enter the public eye, yet it has long been labeled as "centralized," "entangled in lawsuits," and "lacking innovation." The five-year tug-of-war with the SEC, slowed technological iterations, and weak community engagement once made it a representative of an "old-era project." However, since 2024, XRP's ecosystem has quietly shifted: its price is approaching historical highs again, XRPL is building infrastructure around sidechains, stablecoins, and DeFi modules, and corporate buying and development investment are gradually warming up. These changes, though not loud, are accumulating substantial progress on multiple indicators.

This is not a narrative comeback, but a structural reconstruction completed in low-attention circumstances. This article will observe how XRP walks a second path of "neither exploding nor perishing" from the perspectives of capital flows, ecosystem evolution, and on-chain data.

Is XRP Making a Comeback?

Strategic Buying: Who is Buying XRP?

Although the mainstream narrative has not been updated, the capital choices in the real world are providing another answer. Despite XRP's "old coin" image in the crypto community not yet fading, the actual capital flow has quietly turned.

In the past year, this project long viewed as a "centralized legacy" has not fallen into oblivion. Instead, its price has been stable around $2, maintaining resilience through multiple market pullbacks. By the end of 2024, XRP's market cap briefly exceeded USDT, returning to the top three global crypto assets; its on-chain TVL simultaneously grew from less than $10 million to over $40 million.

Meanwhile, a group of institutions has begun to re-evaluate XRP's asset attributes and include it in medium to long-term allocation ranges. On May 30, Hong Kong tech enterprise Webus International launched a $300 million financing plan to use XRP for global payment systems. The next day, NASDAQ-listed energy enterprise VivoPower announced completing a $121 million private placement to build an asset reserve mechanism centered on XRP, led by a Saudi royal family member and a Ripple ecosystem senior advisor. On June 12, Trident DAO launched an XRP treasury plan with a cap of $500 million, incorporating it into on-chain governance and asset-linked tools.

These practical cases from energy, transportation, and Web3 financial sectors collectively indicate that corporate perception of XRP has moved beyond controversy labels or market narratives, gradually viewing it as a realistic option of a "low-volatility digital asset". Especially as the SEC regulatory case approaches its end and Ripple perfects its compliance path, XRP's legal uncertainty has been somewhat alleviated, and its low transaction fees and high settlement efficiency better match cross-border payment and financial allocation needs.

Although technical updates are still in progress, these capital behaviors have already constituted a non-emotional, medium-term planning asset selection logic. In other words, even if the community still has doubts, the other side of the market is redefining its value through actions.

Ecosystem Reconstruction: No Longer Just a Payment Chain?

After being long defined as a "cross-border payment channel," XRP's ecosystem structure is undergoing a systematic transformation. In the past year, Ripple has successively launched an EVM-compatible sidechain, USD stablecoin RLUSD, and initiated developer activities and payment infrastructure collaborations in multiple countries.

From an initial remittance network, Ripple is evolving into a multi-layered platform covering payment, custody, stablecoins, and project incubation, aiming to provide comprehensive on-chain financial services for institutional clients. As the product structure continuously expands, a batch of new protocols built around XRPL has emerged, introducing this traditional public chain into broader scenarios such as on-chain finance, yield management, and asset governance.

By the end of 2024, Ripple launched an Ethereum-compatible EVM sidechain, accompanied by the RLUSD stablecoin launch and mainnet function updates, gradually expanding XRPL's infrastructure capabilities. These moves make XRP no longer limited to payment purposes but capable of carrying on-chain financial applications.

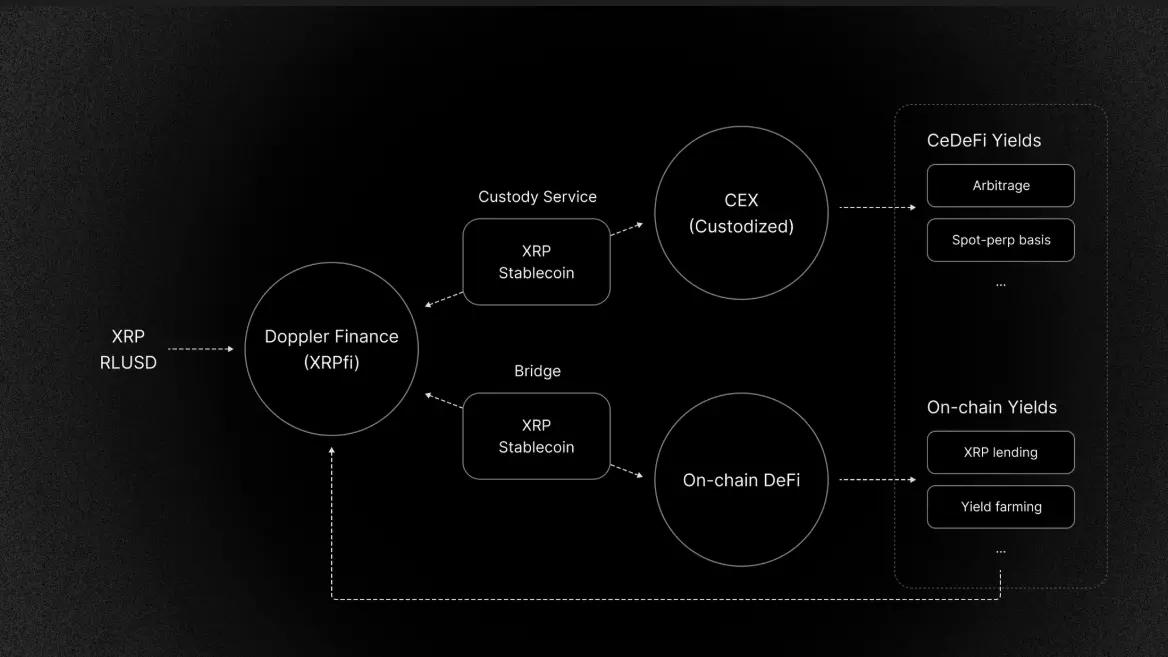

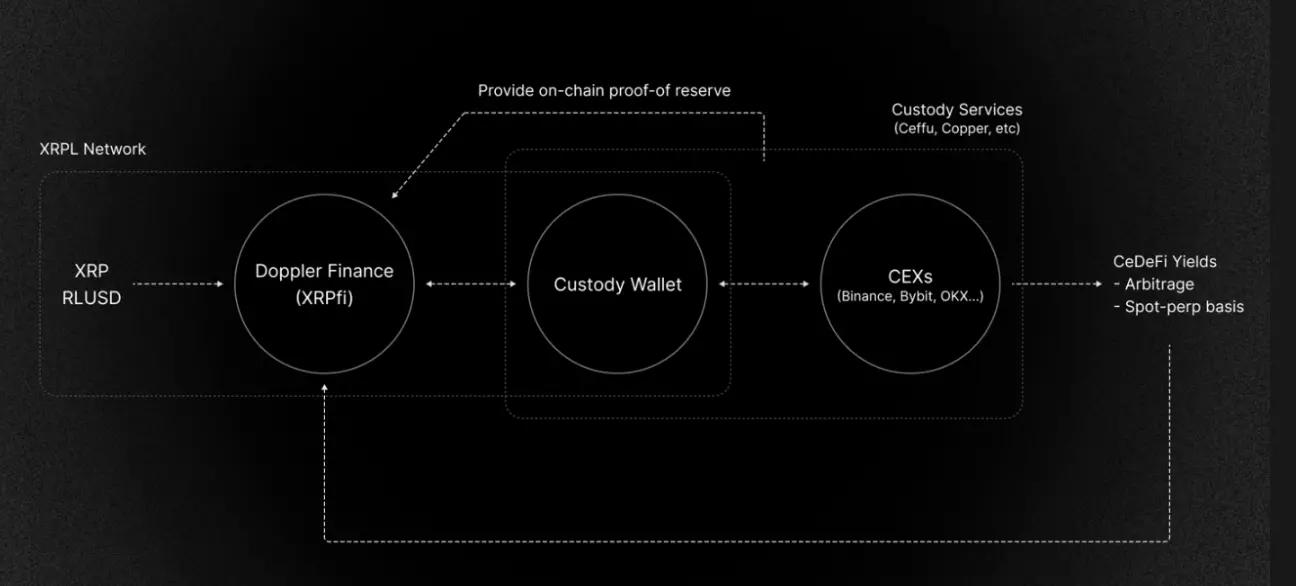

Based on these underlying updates, a new on-chain financial structure called "XRPFi" is taking shape, with its core goal being to inject new on-chain utility into XRP against the backdrop of XRPL's native chain lacking staking and yield mechanisms. Among these, Doppler Finance is currently one of the most representative projects, adopting a dual-path architecture of custody and on-chain parallel, providing yield products and asset management interfaces to token holders. According to official data, the platform's current TVL exceeds $30 million, with funds running through compliant custody channels, supporting users to view asset flows and yield sources.

Doppler Finance's dual-path yield structure, source: official website

From a product structure perspective, Doppler's yield strategies mainly come from two models:

First, structured arbitrage strategies (such as spot-perpetual arbitrage, cross-platform price-neutral arbitrage), focusing on "increasing XRP quantity" rather than pure USD yield;

Doppler Finance's CeDeFi yield structure

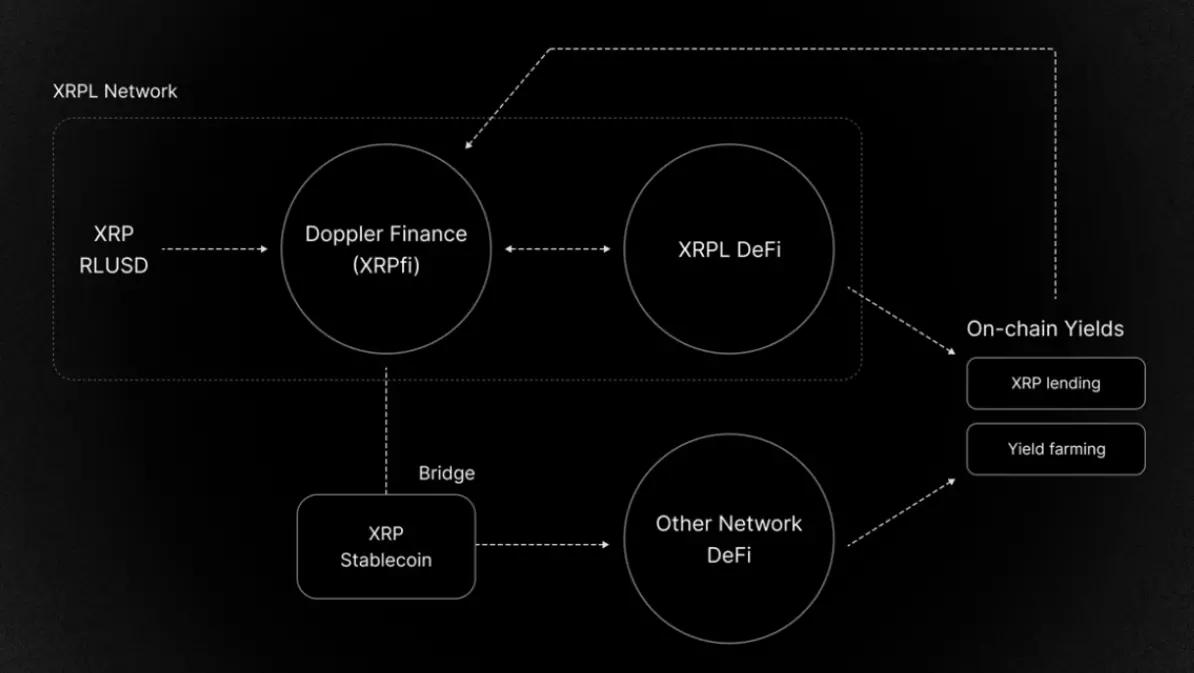

Second, using XRP as collateral to obtain stablecoins, then deploying them to high-liquidity DeFi protocols to achieve low-leverage, risk-controllable yields. Meanwhile, its platform also supports staking yields on Root Network, upcoming XRPL lending protocols, and one-click staking and leverage tools to lower user participation barriers.

XRPfi's yield path structure in the on-chain ecosystem

Besides Doppler, projects like OnXRP, Magnetic, and Anodos have emerged on XRPL, built around AMM and lending. Some of these protocols are deployed on XRPL's EVM sidechain, while others use sidechains like Root Network for asset mapping. The entire XRPFi ecosystem has not pursued a "high TVL sprint" path, but is gradually building a DeFi system adapted to the XRP user structure through sidechain expansion, compliant interfaces, and incentive mechanisms.

According to defillama data, as of June 2025, XRPL's on-chain TVL has first broken through $40 million, with funds primarily from markets in South Korea, the Philippines, Singapore, and parts of Europe.

In terms of path, XRP is currently attempting a "transformation narrative" similar to Tron or Solana - transitioning from a payment tool to an institutional financial protocol foundation. However, unlike the latter two, XRPL has not abandoned its "low-fee, high-certainty" compliance orientation, but instead achieves expansion through composable sidechains while maintaining the main chain's lean structure.

This "technical layering + application division of labor" approach, though progressing slowly, is constructing new application boundaries for XRP and forming an important foundation for building the XRPFi ecosystem.

Not the Protagonist, But Alive

Despite the gradual ecosystem expansion, XRP's perception in mainstream communities remains stuck in old impressions. For many crypto-native users, XRP is still a project "lacking consensus".

This emotional gap is particularly evident on social platforms. Facing continuous good news, some users helplessly comment, "Please stop with the good news, the coin price is falling again." This sarcastic remark, to some extent, captures the current real situation of the XRP community: continuous construction, but no emotional uplift; structural evolution, yet unnoticed by the market.

In conclusion, XRP may no longer be the center of narrative, nor may it be suitable for short-term investors seeking explosive growth. However, it continues to build, is still being incorporated into institutional financial systems, and developers are still constructing financial infrastructure. In an industry where the lifecycle of a project typically does not exceed five years, simply "still being alive" might already be rare enough to warrant another look.