The cost of mining a Bitcoin is expected to exceed 70,000 USD in the second quarter of this year, creating significant pressure on mining companies as network hashrate increases and energy prices rise simultaneously.

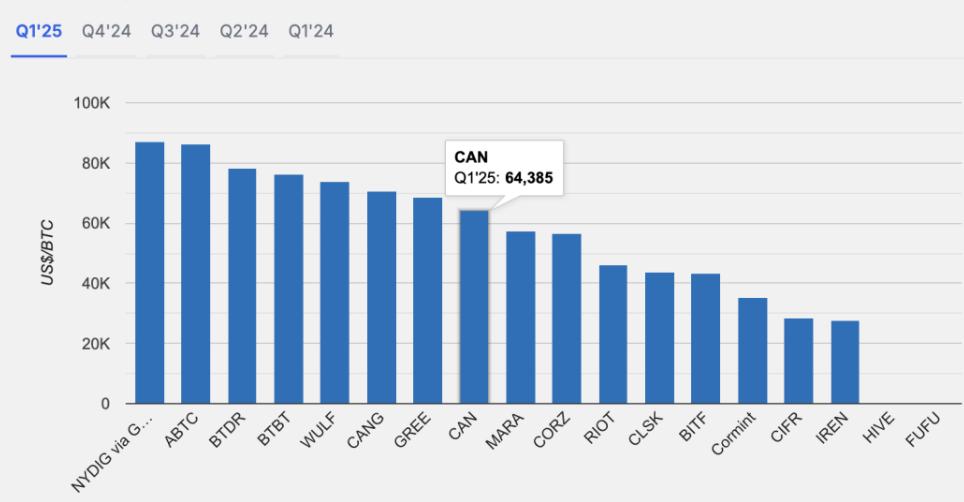

According to a report from research firm TheMinerMag, the median cost of mining a Bitcoin has increased sharply, from 52,000 USD in the fourth quarter of 2024 to 64,000 USD in the first quarter of 2025, and is expected to continue rising by more than 9% in the current quarter.

The main reason for this increase is the increasingly fierce competition, which continuously sets new hashrate records, while energy prices have also soared.

Although Bitcoin is still trading steadily around 107,635 USD, creating a certain profit buffer, the trend of increasing production costs forces mining companies to quickly adjust their operational strategies to maintain financial efficiency.

In the context of shrinking profit margins, listed mining companies are focusing strongly on optimizing performance and reducing costs per unit of computing power (fleet hashcost). In the first quarter of 2025, this cost reached a median of around 34 USD per petahash/second (PH/s).

However, some companies like Terawulf have been strongly impacted by energy prices nearly doubling compared to the same period last year, causing their mining costs to increase by more than 25%. This emphasizes the critical importance of securing stable and cheap energy sources for mining companies.

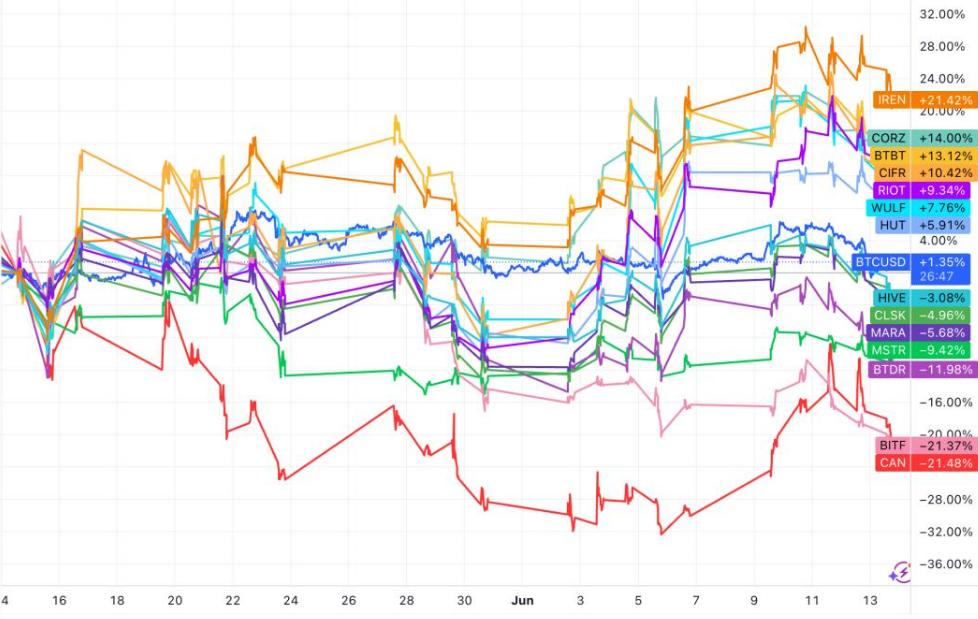

The differentiation in the Bitcoin mining industry is also becoming evident in the stock market. Investors are prioritizing companies with the ability to diversify revenue sources beyond traditional Bitcoin mining. While Bitcoin's price has only increased slightly, IREN's stock has surged 21.4%, along with many other companies achieving double-digit gains.

In contrast, pure mining companies like Canaan and Bitfarms have seen their stock prices drop by more than 21%. This situation reflects a market trend that prioritizes new business models, leveraging mining infrastructure to provide high-value services such as AI storage and high-performance computing. This is seen as a sustainable approach that reduces dependence on the price fluctuations of a single asset.