Title: Potential Impact of Stablecoins on the Financial System

Stablecoins are a type of cryptocurrency pegged to a specific asset (usually fiat currency), serving as a bridge between the decentralized financial system (DeFi) and traditional financial systems, and a crucial infrastructure for DeFi. Recently, the United States and Hong Kong, following the European Union, have passed stablecoin regulatory bills, marking the establishment of regulatory frameworks for stablecoins in major global regions. As DeFi encounters development opportunities, it may deepen integration with traditional financial systems while also bringing new challenges and risks to the global financial system, which we attempt to analyze.

Summary

A Milestone in Cryptocurrency Regulation. Recently, the United States passed a stablecoin bill, becoming the first to establish a regulatory framework for stablecoins and filling a regulatory gap in this field. Just two days later, Hong Kong also passed a similar stablecoin bill, helping Hong Kong participate in the global digital financial center competition and consolidate its international financial center status. Stablecoins are a "bridge" between traditional financial systems and DeFi. After the EU, the United States and Hong Kong have introduced regulatory frameworks for stablecoins, marking an important step for cryptocurrencies to integrate into mainstream financial systems.

[The translation continues in the same manner for the entire text, maintaining the specified translations for technical terms and preserving the XML tags.]Potential Restructuring Force of the International Monetary Order. For the US dollar, the impact of stablecoins is somewhat "contradictory": on one hand, since 99% of fiat stablecoins are pegged to the US dollar, the development of stablecoins seems to consolidate the dollar's dominant position in the global financial system; on the other hand, the international context of stablecoins and crypto assets is actually based on the rising risks of geopolitical financial restrictions and weakened fiscal discipline under the trend of de-globalization, and the de-dollarization needs of some economies. Therefore, stablecoins' high correlation with the US dollar is not only a chain mapping of the dollar's global financial dominance but also a "bridge" towards a more diversified new order in the global financial system, which may explain why the rise and popularization of crypto asset prices have accompanied the intensification of the de-globalization trend. Additionally, the EU and Hong Kong, China have also opened up space for the issuance of non-USD stablecoins, challenging the dollar's dominance in the stablecoin realm. In the long term, whether the dollar's status will continue to be strengthened under the guidance of new regulatory frameworks or challenged by other currencies and crypto assets remains to be observed in the industry's development. For emerging economies, since stablecoins compete with local currencies, if local residents and enterprises use stablecoins for settlement, it will effectively convert local currencies to US dollars, leading to currency depreciation and inflation; therefore, multiple economies have introduced restrictions on stablecoin usage for financial security considerations.

Implications for Monetary Internationalization. For the Hong Kong dollar, regulating stablecoin issuance, especially Hong Kong dollar stablecoins, can help enhance the influence of the Hong Kong dollar in cross-border payments and crypto assets, strengthen the international competitiveness of Hong Kong's financial industry and its currency, and consolidate Hong Kong's status as an international financial center. Meanwhile, Hong Kong can leverage its financial market advantages and the institutional innovation brought by the stablecoin bill to provide a "testing ground" for other monetary internationalization efforts. The bill's allowance for issuing non-USD stablecoins can expand the usage of non-USD currencies in international payments, settlements, and investment scenarios, accelerating the internationalization process. In summary, the Hong Kong stablecoin bill has a profound impact on monetary internationalization, but this process still requires continuous attention to financial stability risks and timely optimization of relevant policies.

Risks

Risks in crypto industry development, unexpected impact of stablecoins on the traditional financial system, and slower-than-expected regulatory policy advancement.

Main Text

Stablecoin Bill: A Milestone in Crypto Regulation

EU, US, and Hong Kong Establish Stablecoin Regulatory Frameworks

Stablecoins are a type of cryptocurrency with value anchored to a specific asset (typically fiat currency), serving as a bridge connecting the decentralized financial system (DeFi) and traditional financial systems, and a crucial infrastructure for DeFi. Recently, the US passed a stablecoin bill, becoming the first to establish a regulatory framework for stablecoins, filling a regulatory gap in this field. Just two days later, Hong Kong also passed a similar stablecoin bill, helping Hong Kong participate in the global digital financial center competition and consolidate its international financial center status. Stablecoins are a "bridge" between traditional and decentralized financial systems (DeFi). After the EU, both the US and Hong Kong have introduced stablecoin regulatory frameworks, marking an important step in integrating crypto into mainstream financial systems.

[The rest of the document follows the same translation approach, maintaining technical terms and preserving the structure of the original text.]Source: US Senate, Hong Kong Monetary Authority, European Parliament, CICC Research DepartmentHow to Understand the Impact of Stablecoins on the Financial System?

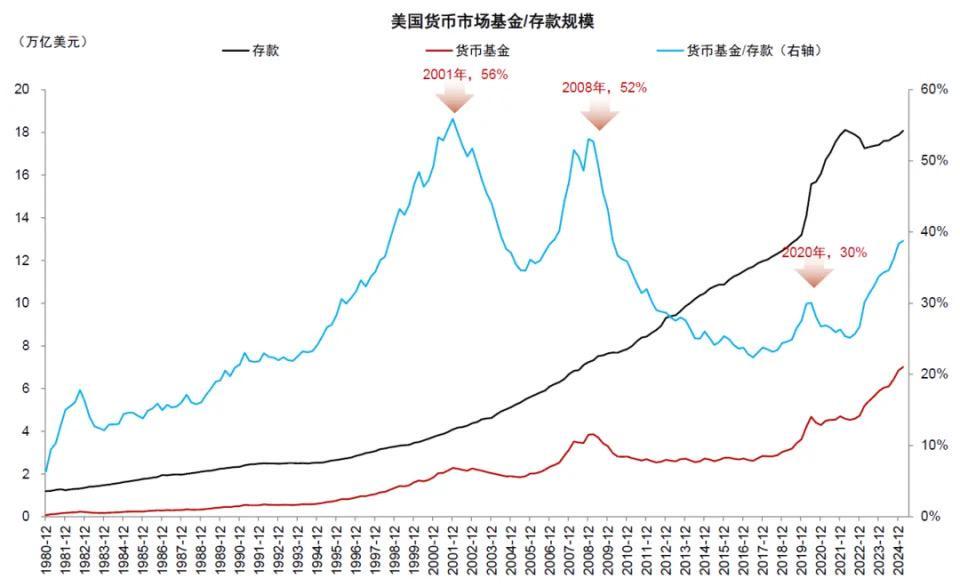

In terms of scale, as of the end of May 2025, the total market value of mainstream stablecoins was approximately $230 billion, growing over 40 times compared to the scale at the beginning of 2020, with a rapid growth rate. However, it remains relatively small compared to the mainstream financial system, such as US dollar deposits (onshore deposits of about $19 trillion) and US Treasury bonds (about $37 trillion), and is also smaller than mainstream cryptocurrencies (Bitcoin market value of about $2 trillion). In terms of transaction volume, stablecoins play a significant role as an important payment method and infrastructure in the cryptocurrency system. According to institutional estimates, the annual transaction volume of mainstream stablecoins (USDT and USDC) reaches $28 trillion, exceeding the annual transaction volume of credit card organizations Visa and Mastercard (about $26 trillion, although stablecoins may have a large number of high-frequency transactions that make this data not entirely comparable); this figure is also higher than Bitcoin's transaction volume in 2024 ($19 trillion). With stablecoins being incorporated into the financial regulatory framework, decentralized finance is expected to usher in development opportunities and deepen integration with the traditional financial system, while also bringing new challenges and risks to the global financial system.

1. Lower Cost and Higher Efficiency International Payment Method

According to World Bank data, the global remittance average fee rate was 6.62% as of the third quarter of 2024. The United Nations Sustainable Development Goal for 2030 requires reducing this cost to no more than 3%, with a transfer time of 1-5 working days. The efficiency of the traditional financial system is mainly affected by the need to pass through multiple intermediary banks via the SWIFT network. In comparison, stablecoin remittance transaction costs are generally lower than 1%, with transfer times typically within a few minutes. However, it is worth noting that before the bill's enactment, stablecoin payments were not yet subject to KYC and anti-money laundering regulations, which also challenge capital account controls in emerging markets. Therefore, although technically more efficient for cross-border payments, this difference is to some extent due to regulatory differences, and compliance costs for stablecoins may increase with regulatory standardization. Due to potential impacts on emerging market capital accounts and monetary sovereignty, stablecoins face regulatory restrictions in some countries and regions. In the long term, we anticipate that stablecoins' market share in international payments may increase as the regulatory framework is improved, although this process will still be accompanied by industry development and regulatory refinement.

Data Source: Federal Reserve, FDIC, China International Research Department4. Absorbing Government Debt and Influencing Monetary Policy Transmission

Stablecoin Issuers Become US Treasury Buyers. USDT and USDC reserve assets primarily consist of short-term US Treasury bonds and repurchase agreements, with short-term US Treasury bonds accounting for 66%/41% of USDT/USDC reserve assets. By the first quarter of 2025, USDT and USDC issuers hold approximately $120 billion in US Treasury reserves. If merged as a single "economic entity", they would rank 19th among overseas US Treasury holders, between South Korea and Germany.

How to Understand Stablecoins' Role in Debt Absorption? As stablecoin market capitalization rises, we anticipate increased demand for US Treasury bonds as reserve assets. If following market predictions cited by Treasury Secretary Becent, stablecoin scale may increase from the current $200-300 billion to $20 trillion by 2028, surpassing Japan's current holdings. However, it's worth noting that stablecoins can primarily absorb Treasury bonds within 3 months, with limited capacity for long-term bonds. Short-term Treasury bond rates are controlled by central bank monetary policies, depending on inflation and employment factors.

Impact on Monetary Policy Transmission. As previously mentioned, stablecoin issuers purchasing US Treasuries may lower short-end interest rates, requiring central banks to withdraw currency. Long-term, stablecoins' attraction of deposits might lead to financial disintermediation, potentially migrating financing from traditional to decentralized financial systems and potentially weakening central bank monetary policy control.

[The translation continues in the same manner for the entire text, maintaining the specified translations for specific terms and preserving the structure of the original document.]3. Regulatory Policy Advancement Not as Expected: The current stablecoin regulatory framework is still incomplete, and the implementation of regulatory policies requires time from introduction to execution, with potential risks of policy advancement not meeting expectations.

[1]The stablecoins discussed in this report are primarily based on overseas cases, with underlying assets mainly discussed in terms of USD

[2]Data source: https://blog.cex.io/ecosystem/stablecoin-landscape-34864?utm_source=chatgpt.com, the high-frequency trading of stablecoins may lead to data that is not entirely comparable and may involve duplicate calculations

[3]https://eur-lex.europa.eu/eli/reg/2023/1114/oj/eng

[4]https://www.chinaifs.org.cn/upload/1/editor/1734920703798.pdf

[5]https://assets.ctfassets.net/h62aj7eo1csj/4vkA9567QmK4pyYoPBtrQa/fb039fd97d657d8151dcf4d3e969e481/The_State_of_Crypto_Lending_-_Galaxy_Research.pdf

[6]As of the first quarter of 2025, FDIC USD deposits are approximately 19 trillion USD, with a massive amount of offshore USD not included in the statistics

[7]As of May 2025

[8]As of May 2025

[9]CEX.IO Stablecoin Landscape report https://blog.cex.io/ecosystem/stablecoin-landscape-34864?utm_source=chatgpt.com

[10]Although the two are not entirely comparable and may involve duplicate calculations

[11]The calculations here are limited to static results under given hypothetical conditions and do not include subjective judgments from the research department of China International Financial Company