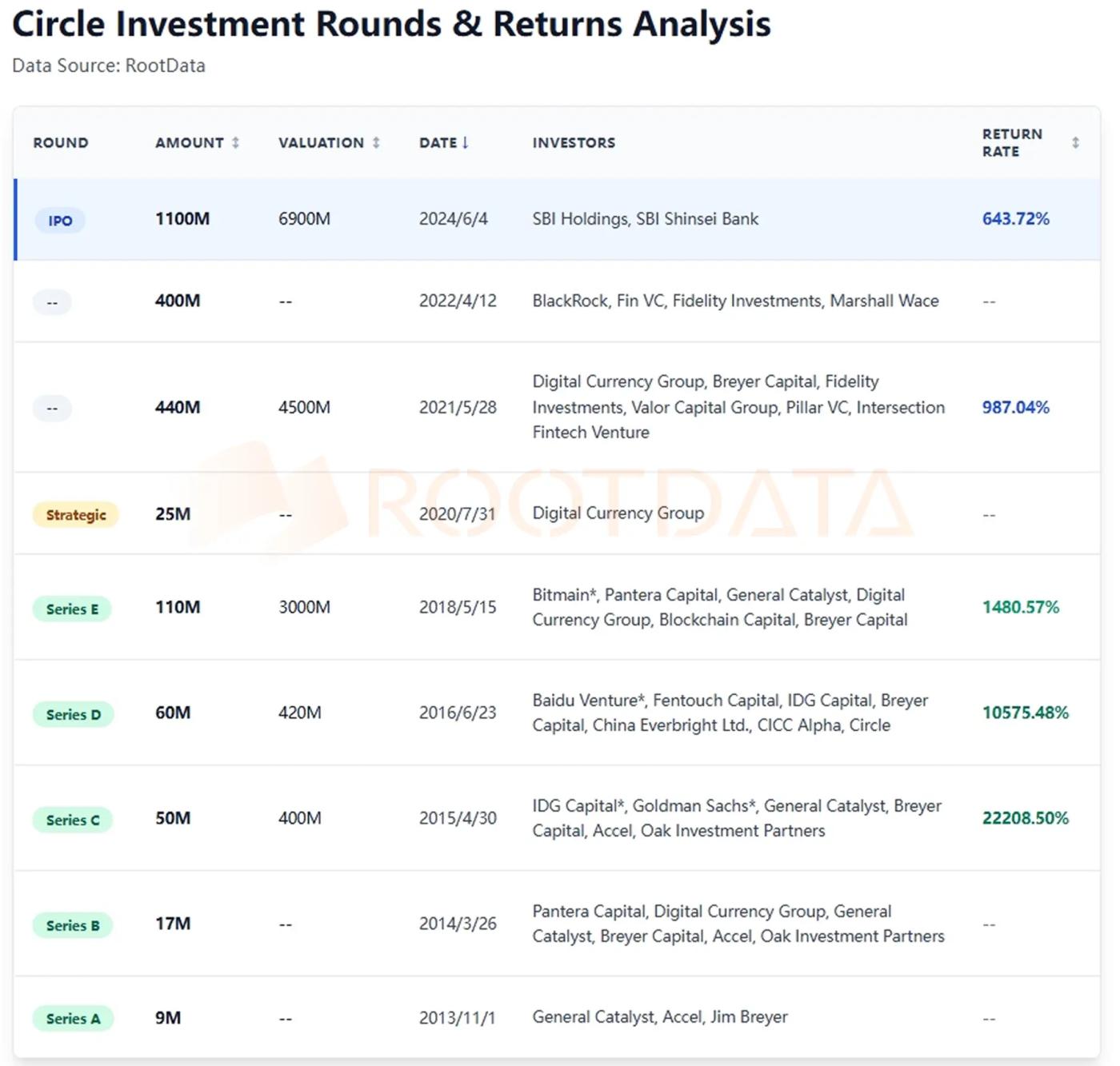

Circle (NYSE:CRCL) stock reached $199.59, with a total market value of $44.417 billion. Early investors have gained significantly. According to RootData financing data and Circle's prospectus:

Accel and General Catalyst have key advantages from early entry. Series A investment of 9M had the lowest cost, with an initial low valuation (possibly in the millions), exceeding 4000 times the current market value, but the prospectus shows significant share dilution.

IDG Capital is an important player in Circle's early investment in China. Although its participation in Series C, D, and E rounds may be affected by dilution, after the IPO, IDG Capital holds 10.4% of Class A shares, ranking first, followed by General Catalyst (10%), Breyer (6.7%), and Accel (5.4%). Circle co-founders Jeremy Allaire and P. Sean Neville hold 78.9% and 21.1% of Class B shares, respectively.

DCG strategically invested $25 million in Circle and supported Circle's USDC through Genesis Trading, but the valuation was not disclosed. Based on previous funding rounds, the valuation is estimated at around $3-4.5 billion. Calculating with a $3.5 billion valuation, DCG's $25M investment to the current market value of $44 billion represents a potential multiple of about 12.6 times. Combining financing rounds and the prospectus, DCG's low-cost entry and holding shares until the IPO peak have brought higher returns.