Author | James Butterfill

Translated by | Wu Blockchain Aki

Gold and Bitcoin are often compared as scarce non-sovereign assets. Although there has been extensive discussion about their investment case as value storage tools, few have compared them at the production level. Both assets rely on mining — one physical, the other digital — to introduce new supply. The industrial characteristics of both are defined by cyclical economics, capital intensity, and deep connections to energy markets.

However, the mechanisms and incentive structures of Bitcoin mining differ subtly from gold mining, ultimately having significant implications for the economic structure and strategic layout of industry participants. This report will guide you through their similarities, but more valuably, their substantive differences.

Asset Scarcity Derived from Physical and Computational Mining

Gold mining is a centuries-old process involving extracting and refining metal from underground, requiring finding suitable deposits, obtaining permits and land use rights, and using heavy machinery to extract ore from underground, then separating metals through chemical processing for subsequent distribution.

In contrast, Bitcoin mining requires repeated computational processes to competitively solve Bitcoin transaction batches and earn newly issued Bitcoin and transaction fees. This process, called Proof of Work, requires purchasing rack space, electricity, and specialized hardware (ASIC) to efficiently run computations, then broadcasting results to the Bitcoin network via internet connection.

In both systems, mining is an inevitable high-cost process supporting each asset's scarcity: Bitcoin's scarcity is maintained by code and competition; gold's scarcity is determined by physical and geological location. However, the methods of extracting scarcity, economic models of producers, and their evolution over time have almost no similarities.

Bitcoin Mining Economic Model: Competition, Technological Advancement, and Diverse Income Sources

The economic model of gold mining is relatively predictable. Companies can usually forecast reserves, ore grade, and mining schedules quite accurately, though initial predictions may deviate significantly: approximately one-fifth of gold mining projects achieve profitability during their lifecycle. Major costs — labor, energy, equipment, compliance, and restoration work — can be predicted relatively accurately in advance. Depreciation is primarily normal equipment wear or reserve depletion. Short to medium-term primary uncertainty is typically gold market price stability, which experiences minimal fluctuations. Moreover, almost all these input costs can be effectively hedged.

In comparison, Bitcoin mining is more dynamic and unpredictable. Company revenues depend not only on Bitcoin market price volatility but also on their share in global hash rate (i.e., global competition). If other miners more aggressively expand operations, your relative output might decline even if your mining operation remains unchanged. This is a variable miners must continuously consider during operations.

Thus, our first difference is that unlike gold mining's relatively stable production predictions, Bitcoin miners face production uncertainty challenges arising from industry participants' entry and exit and their strategic changes.

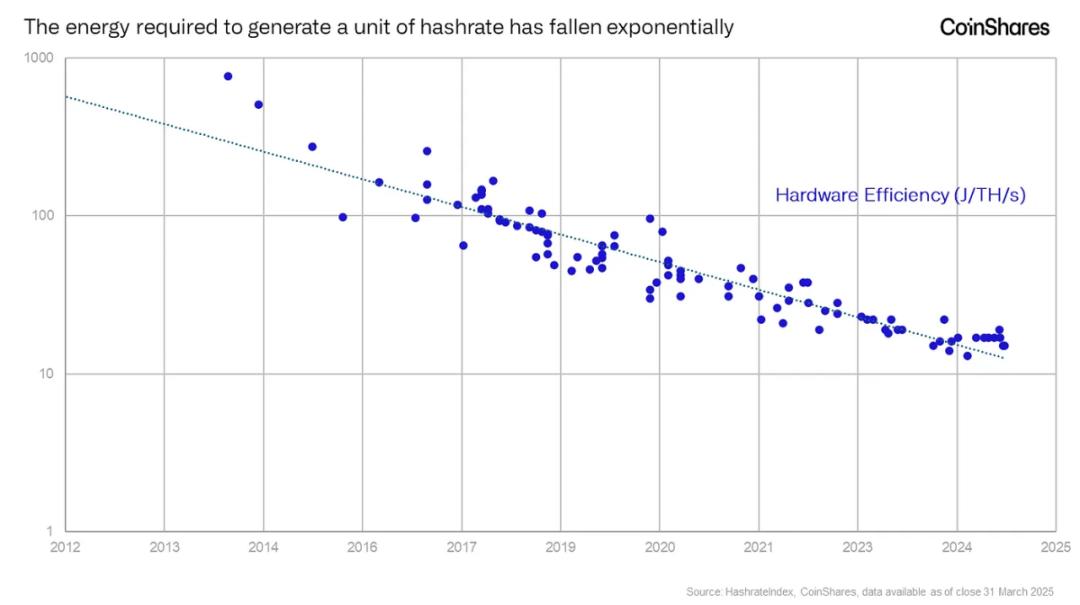

One of the most important costs for Bitcoin mining companies is depreciation, especially ASIC equipment depreciation. The chips in these Bitcoin mining machines are continuously improving in efficiency, forcing companies to upgrade before natural wear, maintaining competitiveness. This means depreciation occurs on a technological advancement timeline rather than physical wear. This is a major expenditure — though non-cash — and stands in stark contrast to gold mining, where mining equipment has a longer lifespan because most efficiency improvements have already occurred.

Bitcoin production, influenced by industry competition and short-term depreciation cycles, subjects miners to constant pressure to reinvest in new hardware to maintain production levels — what professionals often call the "ASIC hamster wheel".

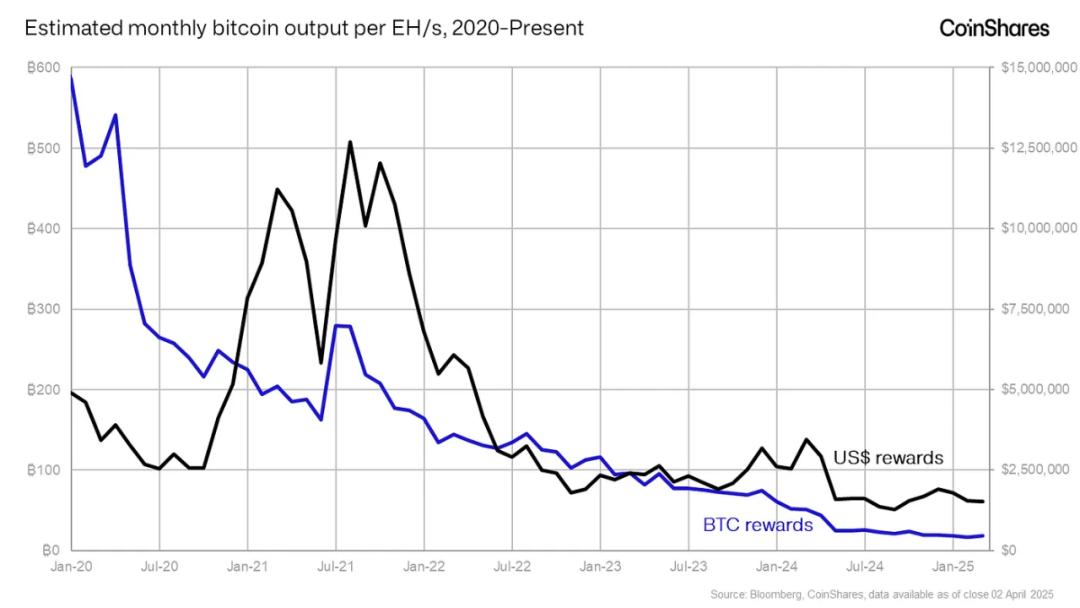

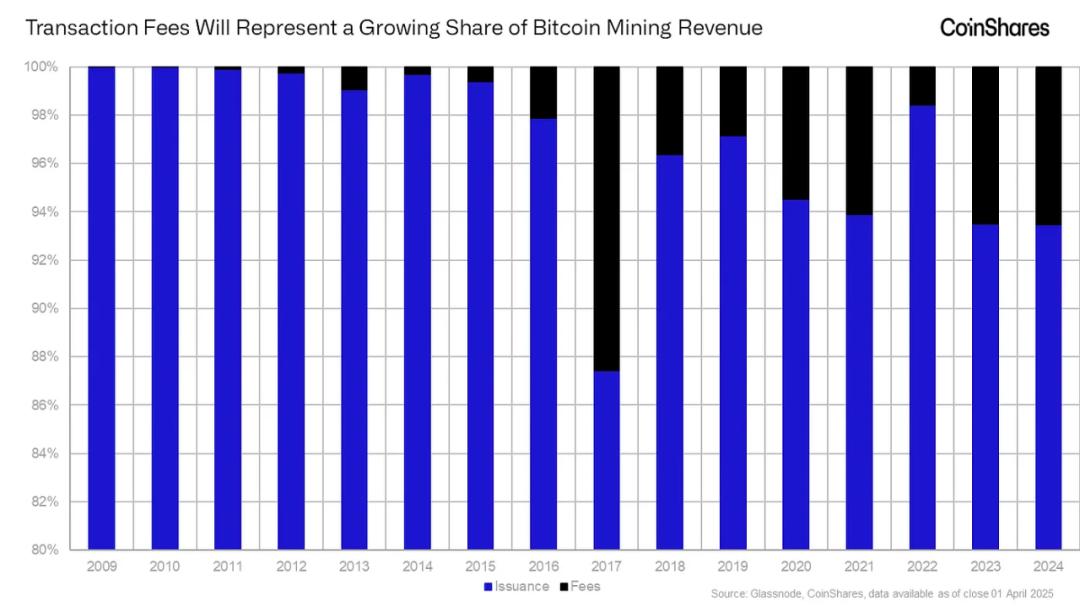

However, Bitcoin also has a fundamental advantageous difference compared to gold in its revenue structure. Gold miners profit solely by extracting and selling unreleased reserves. Bitcoin miners, however, profit both by extracting unreleased supply and through transaction fees. Transaction fees provide miners with an income source from released supply, which fluctuates based on Bitcoin transfer demand. As Bitcoin approaches its 21 million supply limit, transaction fees will become an increasingly important income source — a dynamic gold miners do not have.

Note: Y-axis partially shows bottom range of 80%.

Lastly, a major long-term advantage of Bitcoin mining is the ability to repurpose operational byproducts — heat energy. When electricity passes through mining machines, significant heat is generated, which can be captured and redirected for other purposes like industrial processes, greenhouse agriculture, or residential and district heating. This opens new income streams for miners. As mining machines become commoditized and depreciation cycles extend, heat reuse impact may further grow. Similarly, gold miners can benefit from selling byproducts like silver or zinc, typically identified in project planning and used as elements offsetting gold production costs.

Bitcoin Mining Offers a Brighter Environmental Future Compared to Gold Mining

Gold mining is notoriously resource-extractive, leaving persistent physical footprints: deforestation, water pollution, waste pools, and ecosystem destruction. In many regions, it also raises concerns about land rights and worker safety.

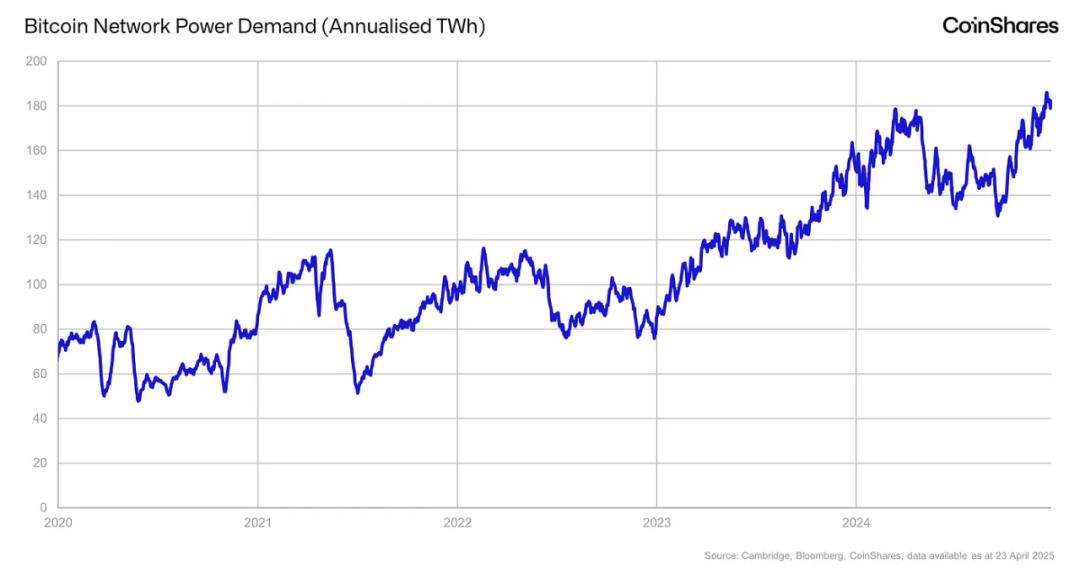

Conversely, Bitcoin mining doesn't involve physical extraction, instead completely relying on electricity. This provides opportunities for integration with local infrastructure — rather than conflict. Due to miners' mobility and interruptibility, they can serve as grid stabilizers and monetize energy resources that would otherwise be wasted or isolated, such as flare gas, excess hydroelectric, or constrained wind and solar energy.

Many are unaware that Bitcoin mining also demonstrates potential as a clean energy subsidy and can serve as a means of proving grid connection. By co-locating with renewable or nuclear power generation facilities, miners can improve project economics before grid connection — without relying on public fund subsidies.

Lastly, though well-documented, it's worth noting that compared to traditional industries, Bitcoin's carbon emissions are lower and more transparent on average. One could argue that Bitcoin is even necessary during the smooth transition to a predominantly renewable energy grid.

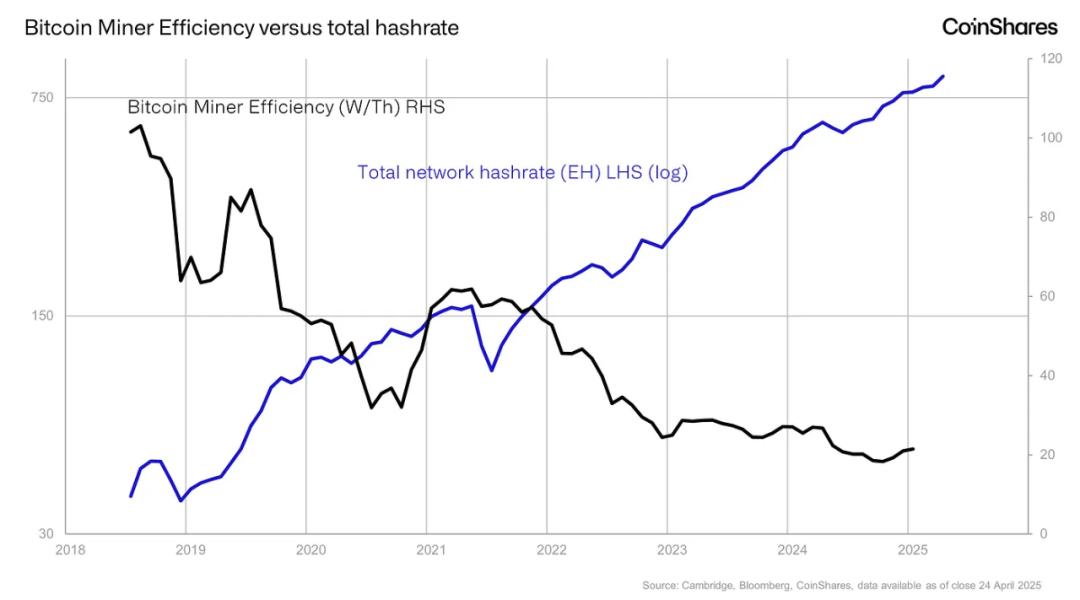

Since the 2024 energy consumption peak, we've seen almost no increase in energy consumption, attributable to continuous improvements in new mining machine hardware efficiency, with the current average power consumption at just 20 watts per terahash (W/Th), a five-fold efficiency improvement compared to 2018.

Investment Characteristics of Bitcoin Mining: Rapid Cycles and Technology-Driven

Both industries are cyclical and sensitive to the prices of their production assets. However, unlike gold miners who typically operate on multi-year timelines, Bitcoin miners can quickly scale their operations up or down based on market conditions. This makes the Bitcoin mining industry more flexible but also more volatile.

Publicly traded Bitcoin mining companies tend to trade like high-beta tech stocks, reflecting their sensitivity to Bitcoin prices and broader risk sentiment. In fact, some market data providers classify listed Bitcoin miners in the technology sector rather than traditional energy or materials industries.

In contrast, gold mining companies have a longer history and typically hedge future production, which can reduce their sensitivity to gold price fluctuations. They are usually classified in the materials sector and evaluated like traditional commodity producers.

Capital formation also differs. Gold miners typically raise capital based on reserve estimates and long-term mine plans. In comparison, Bitcoin miners tend to be more opportunistic, often raising funds in recent years through direct or convertible equity issuances to support rapid hardware upgrades or data center expansion. As a result, Bitcoin miners are more dependent on market sentiment and cyclical timing, and typically operate on shorter reinvestment cycles.

Bitcoin Mining: Energy, Computation, and Investment Opportunities in Future Financial Networks

Gold and Bitcoin may converge towards similar macroeconomic roles in the long term, but their production ecosystems differ structurally. Gold mining develops slowly, involves physical extraction, is environmentally harmful, and resource-intensive. Bitcoin mining, by contrast, is more rapid, modular, and increasingly likely to integrate with modern energy systems.

For investors, this means Bitcoin miners are an imperfect digital analogue to gold miners. Instead, they represent a new class of capital-intensive infrastructure that combines commodity cycles, energy markets, and technological disruption opportunities. Investors with long-term perspectives should view them as a unique, emerging asset class with distinctive fundamentals, especially as transaction fees become increasingly important and energy partnerships continue to develop.

In our view, understanding these nuances is necessary for making informed investment decisions in an environment increasingly moving towards distributed financial systems.

As an investment, Bitcoin miners not only offer opportunities in scarcity but also involve data center infrastructure, energy market growth, and computational power monetization — a convergence unachievable in traditional mining.

Prospects for Bitcoin Mining

Overall, we believe most potential macroeconomic scenarios after the "liberation day" remain favorable for Bitcoin. The introduction of reciprocal tariffs might drive inflation higher in the US and its trading partners. US trading partners may face rising inflation while simultaneously confronting growth headwinds. This dynamic could compel them to adopt more accommodative fiscal and monetary policies — measures typically leading to currency depreciation, thus enhancing Bitcoin's attractiveness as a non-sovereign, inflation-resistant asset.

In the US, the outlook is more ambiguous. Both Trump and Bessen indicate a preference for lower long-term yields, especially regarding 10-year Treasury bonds. Although the motivations can be speculated — such as reducing debt service burdens or stimulating asset markets — this stance typically favors interest-rate-sensitive assets like Bitcoin. However, the current situation is precisely the opposite. US 10-year Treasury yields have dropped below 4% before rebounding to 4.5%, now around 4.3%, due to doubts about basic trade settlement, damaged US reputation, and the increasingly precarious status of the US dollar as a global reserve currency. Meanwhile, Trump's uncompromising tariff policy might further drive inflation. However, this crisis is artificially created and could quickly be reversed through tariff concessions and agreements.

These signals might also reflect declining future earnings expectations in the stock market, triggering concerns about an impending economic slowdown. This presents critical risks for broader markets, including Bitcoin. If investors continue to view Bitcoin as a high-beta, risk-appetite asset, market sentiment could cause Bitcoin to trade in sync with stock markets during global economic downturns, despite its narrative as a long-term value storage tool.

Nevertheless, Bitcoin has performed relatively better compared to stock markets since the "liberation day". This resilience highlights Bitcoin's unique characteristics: a globally tradable, government-neutral asset with fixed supply, accessible 24/7/365. Consequently, market participants are increasingly recognizing Bitcoin as a reliable long-term value storage tool.