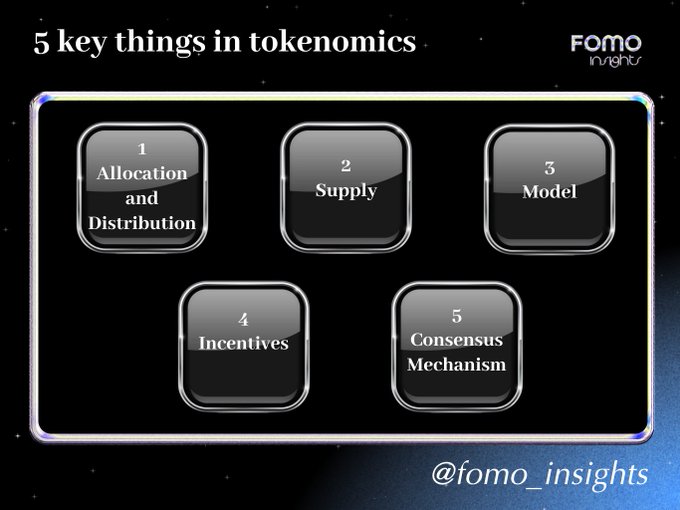

Which coin is rising, while my coin keeps going down This is certainly a concern that is not unfamiliar to newbies when stepping into crypto One of the important things when starting out is to understand the tokenomics of the project Tokenomics is the economic model of a crypto project, defining how tokens are created, distributed, and maintained in value It's like the "rules of the game" that we analyze to see if the project is sustainable 5 Core Elements of Tokenomics 1/ Allocation & Distribution Who receives tokens, and how are they brought to the market? Fair Launch: Tokens are mined by the community, without favoring anyone Example: Bitcoin Pre-mine: Tokens allocated in advance to the team, investors to raise capital Example: Uniswap ($UNI) distributed 60% to the community over 4 years If the team holds too many tokens, they can dump, causing price to drop Projects that are transparent and distribute gradually (3-5 years) are usually more trustworthy 2/ Supply Supply determines the number of tokens that exist and how it changes Circulating Supply: Tokens currently in circulation Total Supply: All tokens, including locked ones Maximum Supply: Maximum total tokens Example: Bitcoin limits 21 million BTC Low circulating supply but high valuation -> leads to selling pressure when tokens are unlocked 3/ Token Model Inflationary: Unlimited supply, encourages participation but can decrease value Example: Dogecoin Deflationary: Limited supply, can burn tokens, increases long-term value Example: BNB periodically burns tokens Inflationary is suitable for short-term speculation Deflationary is good for long-term investment 4/ Incentives Projects need to create motivation for users to participate and hold tokens Profit sharing: Receive rewards through airdrop, transaction fees Example: Curve Finance shares fees with CRV holders Staking: Lock tokens to receive rewards, support the network Example: ADA However, too many rewards cause inflation, too few fail to motivate users to stay with the project 5/ Consensus Mechanism How blockchain networks operate and secure themselves Proof-of-Work (PoW): Miners solve mathematical problems, energy-intensive Example: Bitcoin Proof-of-Stake (PoS): Token holders validate, energy-efficient, encourages long-term holding Example: ETH PoS advantage is being environmentally friendly, suitable for long-term projects

This article is machine translated

Show original

FOMOinsights

@FOMO_insights

06-26

. @NEARProtocol đề xuất giảm lạm phát từ 5% xuống 2.5%

Liệu đây là bước đi giúp NEAR dẫn đầu về AI phi tập trung và DeFi, hay rủi ro đẩy giá token vào vòng xoáy sụp đổ? x.com/FOMO_insights/…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content