Traditional cross-border remittance fees are high and time-consuming, with a single transaction sometimes taking several days to complete, which is a pain point for many users. To solve this problem, the US cryptocurrency exchange Kraken has recently launched a new financial payment application Krak, claiming to combine innovative cryptocurrency technology with daily financial services, offering a more convenient and faster option compared to traditional banks.

Regarding this, Kraken's Co-CEO Arjun Sethi stated:

"Krak is the foundation of future money management. Our goal is to make financial services globally accessible, allowing everyone to easily manage their assets regardless of their location."

Krak's Core Functions and Features

The Krak application incorporates multiple functions, with the following key highlights:

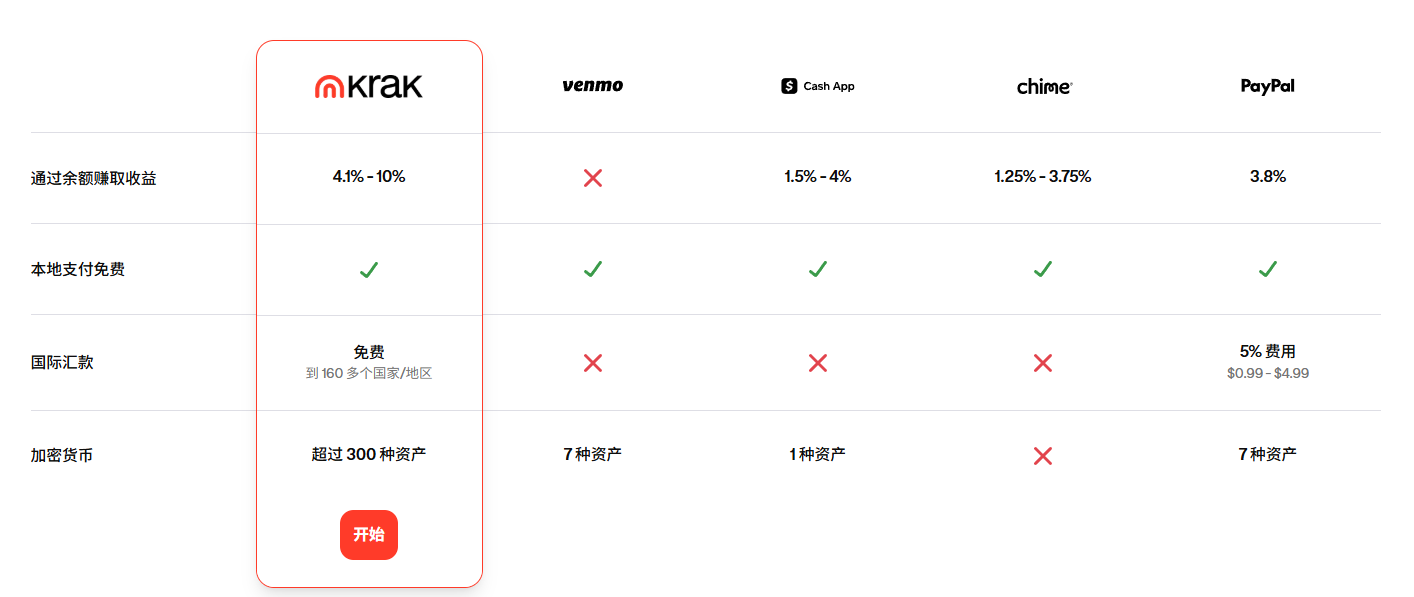

- Peer-to-Peer Instant Payments: Krak supports users making instant transfers in 110 countries through personalized Kraktags payment IDs. Users can complete transactions without providing complex bank account information or cryptocurrency wallet addresses. The application supports over 300 assets, including cryptocurrencies, stablecoins, and fiat currencies, using blockchain technology to process cryptocurrency transfers and Kraken's internal system for cash transactions, achieving near-zero-cost transfer experiences.

- Spending and Earnings Accounts: Krak allows users to earn returns while making payments, with no lock-up periods, minimum deposit requirements, or subscription fees. At launch, eligible users can earn up to 4.1% annual yield through USDG stablecoin (a US dollar stablecoin issued by Paxos), with up to 10% returns on over 20 digital assets.

- Intuitive User Experience: Krak uses a chat-like interface design, making payment operations as simple as sending a message. The application supports animated payment links with emojis and provides transparent exchange rate information, ensuring no hidden fees and enhancing user trust and convenience.

- Future Expansion Plans: Kraken plans to further introduce physical and virtual Krak cards, allowing users to make purchases online and in physical stores. Additionally, Krak will gradually launch prepaid financial services, including personal loans and credit plans, to further expand its financial ecosystem.

To learn more about Kraken's new Krak application, you can visit the official introduction page