Bitcoin is trading near its all-time high (ATH) and has maintained levels above $100,000 for the past two months. However, spot trading volume has not followed suit. Unlike previous bull markets, this price level has not triggered a surge in trading activity.

This discrepancy has raised concerns among investors. Recent analyses from CryptoQuant, glassnode, and other market data sources provide key insights into this unusual trend.

Bitcoin Price Separated from Spot Trading Volume... What Does It Mean?

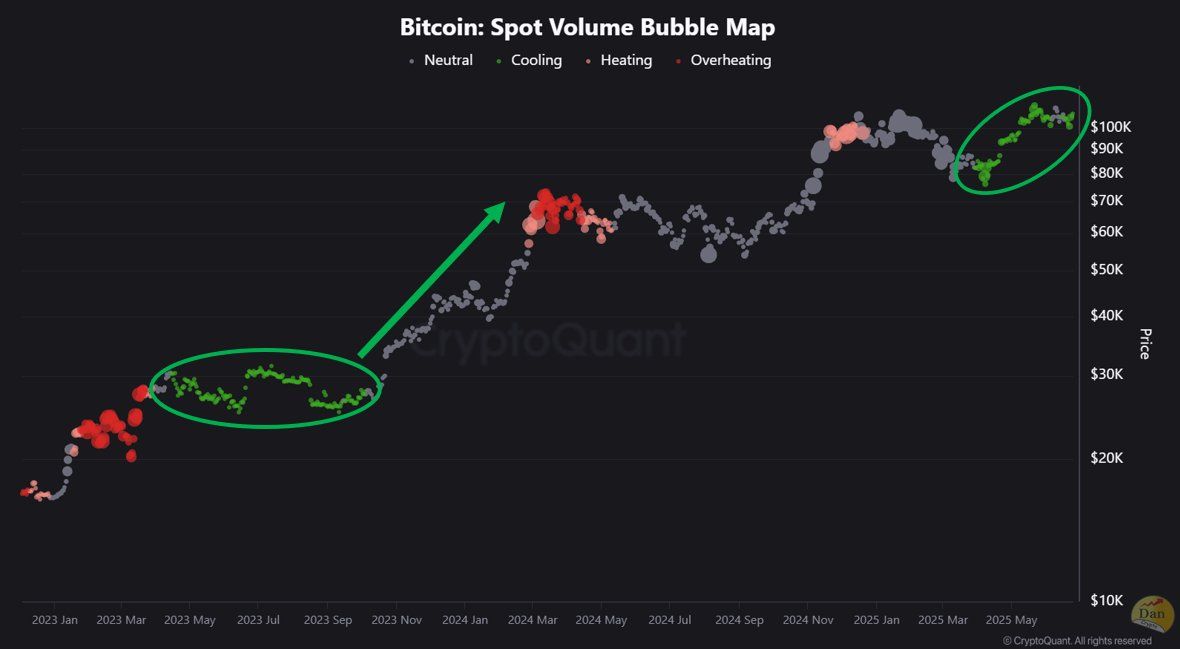

According to Dan from CryptoQuant, the market is currently in a "cooling" phase without signs of overheating.

The chart shows each circle's size representing trading volume, with colors indicating volume growth rate. Volume decrease indicates a cooling market. A neutral market shows no sharp changes, and a volume surge can indicate overheating.

Despite Bitcoin being close to ATH, green circles indicating cooling dominate the chart. This suggests an absence of speculative enthusiasm. Dan emphasized that this stage requires patience.

"Currently, Bitcoin is near its all-time high, but the market shows a cooling trend without overheating signs. Breaking the all-time high might require macroeconomic catalysts like interest rate cuts or regulatory easing. However, the market has already established a stable foundation. Therefore, a strategy of patience, watching major market events and waiting for opportunities, seems promising." – Dan, CryptoQuant statement.

Additionally, glassnode's Week 25 report reflects CryptoQuant's assessment. Unlike ATH rallies in Q2 and Q4 of 2024, the recent rise above $100,000 has not been accompanied by an increase in spot trading volume.

This reflects the absence of speculative intensity often seen in previous bull markets.

Instead, glassnode suggests that an accumulation strategy is driving the current price increase. Long-term investors appear to be holding Bitcoin and not selling for profits.

"Current spot trading volume is $7.7 billion, significantly lower than the cyclical peaks observed in this bull market. This difference further emphasizes the absence of speculative intensity, indicating market hesitation and reinforcing the narrative of establishing a bottom." – Report states.

Decreasing Liquid Supply... Adding to the Puzzle

Another important factor is the decrease in Bitcoin's liquid supply.

According to glassnode and other sources, only about 25% of the total Bitcoin supply is liquid. The remaining 75% is held by long-term holders or institutions with no intention of selling.

"Bitcoin illiquid supply continues to increase and is at an all-time high. Only 25% of Bitcoin supply is 'liquid'. The supply shock will be severe!" – Nic, Coin Bureau co-founder statement.

This creates a potential supply crisis. With fewer coins in the market, even moderate demand could drive prices up. This explains why Bitcoin remains at ATH levels without a surge in spot trading volume.

The decrease in spot trading volume may indicate an absence of FOMO among individual investors, which previously triggered bull markets. Instead, this could represent a shift towards long-term value investment rather than short-term speculation.

However, Bitcoin's price may stagnate unless macroeconomic catalysts like interest rate cuts or technological breakthroughs boost market confidence.