BULLA has increased by nearly 50% since Thursday, but many prominent community members believe Hasbulla is conducting another Rug Pull. Despite concerning trends, BULLA has become one of the strongest-performing tokens in the BNB ecosystem this week.

Most blockchain analysts have viewed this meme token as a scam due to the influencer's shady history. However, being listed on Binance Alpha has helped the token gain some credibility.

Explanation about Hasbulla and BULLA

Hasbulla, a Russian crypto influencer, has a long history of launching meme coins, most of which ended with fraud allegations.

Therefore, when he started the presale for the new BULLA token, the community was very suspicious of a Rug Pull. Hasbulla's BULLA token had been trading for most of the previous month, but everything remained unclear.

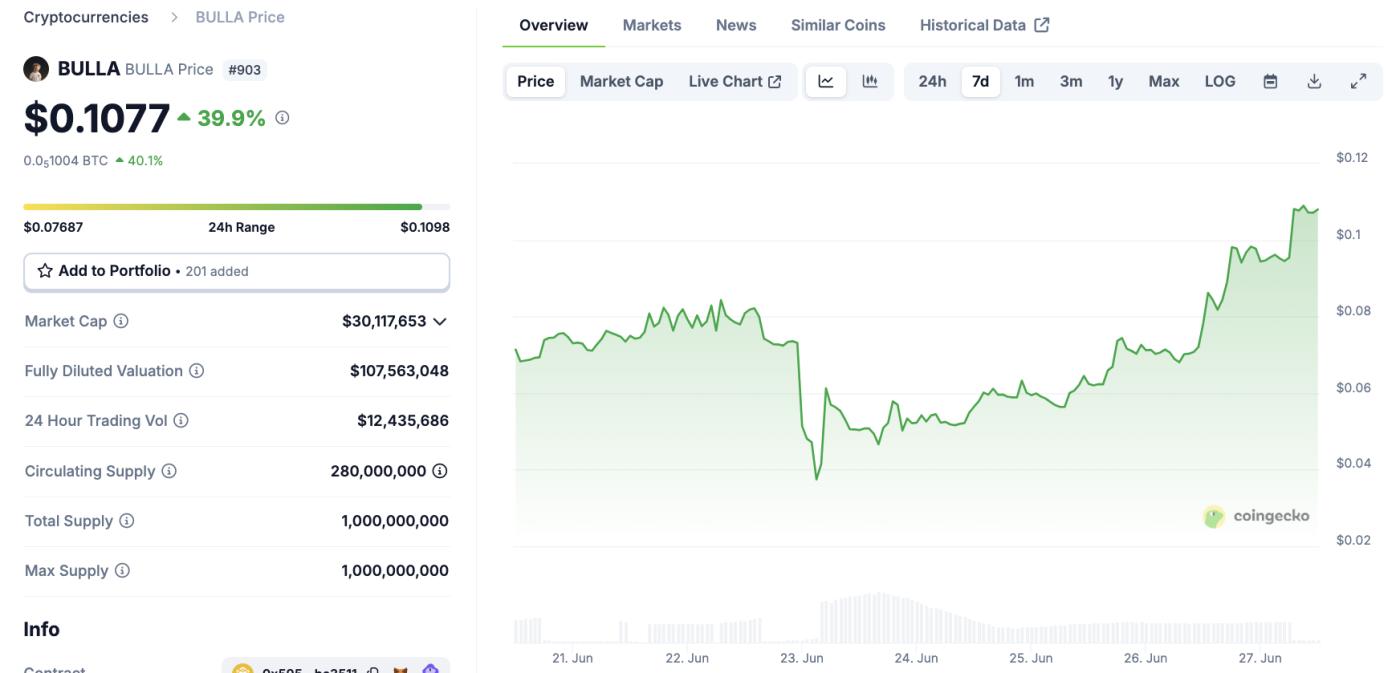

Clearly, the entire history of this asset was interrupted by sharp declines. When Hasbulla launched BULLA on 08/06, it had a market capitalization of 100 million USD. Five days later, 70 million USD had evaporated.

Mostly, BULLA showed a continuous downward trend, but a few events helped it bounce back.

On 22/06, Binance Alpha announced that they were introducing Hasbulla's newest asset, enhancing BULLA's prominence. This included a large airdrop, something this exchange is particularly famous for.

This immediately attracted heavy criticism, with analysts fearing a Rug Pull. Immediately after, the token's price dropped 50%:

However, this price drop did not seem entirely consistent with the Rug Pull theory. Instead, if there was a scam, it had not yet ended. Five days later, BULLA began to return to trend, causing Hasbulla to boast about the token's success.

Compared to the price drop when listed on Binance, BULLA has recovered all those losses and recorded a new increase, jumping 40% today.

BULLA Price Performance. Source: CoinGecko

BULLA Price Performance. Source: CoinGeckoSo, what happened? The community still firmly believes that BULLA is a scam, especially when considering Hasbulla's history. However, blockchain analysts have not yet clearly proven this.

For example, some skeptics hypothesized that DWF Labs might have driven BULLA's growth, as the company had previously worked with Hasbulla.

Additionally, DWF Labs has been involved in many controversies, making it an easy target for blame. However, it must be clear that no specific evidence exists.

Of course, Hasbulla's team could have pushed BULLA's price themselves without external help. The more direct issue seems obvious: no serious analyst wants to bother providing clear evidence of a pump and dump.

Experts had condemned BULLA before its launch, but Hasbulla's supporters continued to buy it. Some analysts supported letting them be scammed.

This indifferent and contemptuous attitude will not create any early warnings but may provide interesting analyses after the fact.