Original | Odaily Planet News (@OdailyChina)

Author | Wenser (@wenser 2010)

During market volatility, on-chain contract trading has become increasingly hot, with Hyperliquid platform's trading volume and HYPE token market cap reaching historic highs: cumulative trading volume has exceeded 1.5 trillion dollars, with HYPE token price briefly breaking through 45 dollars.

Behind these impressive achievements are not only the long and short contract operations of whales and retail investors, but also the continued investment and trading by investment institutions.

In late June, well-known investment institutions Galaxy and ManifoldTrading deposited a total of 30 million dollars in USDC into HyperLiquid and began purchasing HYPE tokens; previously, the US-listed company Lion Group Holding Ltd. (stock code: LGHL) had also allocated 2 million dollars to purchase HYPE tokens.

Discussions about "institutional entry into HYPE" are becoming increasingly intense, with some even shouting the old slogan - "HYPE is the next SOL" - with SUI being the previous token of high expectations, marking the first time HYPE has been elevated to such a discussion level.

Odaily Planet News will provide a brief analysis of this speculation in this article, exploring the driving forces and future potential behind HYPE.

HYPE's Upward Momentum: Platform, Institutions, and Off-Market Buying

Unlike the relatively stable price of SUI, the HYPE token price has experienced a series of significant ups and downs.

In March this year, due to platform mechanism issues, the Hyperliquid platform's HLP was once heavily targeted and liquidated, losing millions of dollars, and the platform fell into a trust crisis due to data rollback. (Odaily Planet News note: For details, please refer to articles such as 《Why Did Hyperliquid Whales Self-Liquidate? Who Bears the Millions of Dollars in Losses?》 and 《To Compensate for Over 200 Million Dollars in Losses, Hyperliquid's "Unplugging" Forced Settlement Sparks Controversy》.) The HYPE price was also affected, dropping from around 13 dollars to near 10 dollars, with many believing at the time that Hyperliquid would lose its contract market under the siege of Binance, OKX, Bybit, and other CEXs.

However, as time entered April, after Trump initiated a tariff trade war and released favorable policies, the overall market and contract market provided Hyperliquid with a new development opportunity, and HYPE began its journey of bottom recovery and creating new highs - on May 23rd, HYPE price broke through 33 dollars, exceeding the December 22nd, 2024 price of 32.3 dollars, creating a historical high; until June 16th, HYPE price reached a historical high of 45.59 dollars.

HYPE Price Performance

Looking closely at its underlying driving forces, I believe it is mainly driven by the following factors:

Driving Force One: Platform Development and Buyback

Apart from Hyperliquid benefiting from the favorable development in a volatile market, the platform's buyback mechanism and staking mechanism have provided strong momentum for the stable and rising HYPE token price.

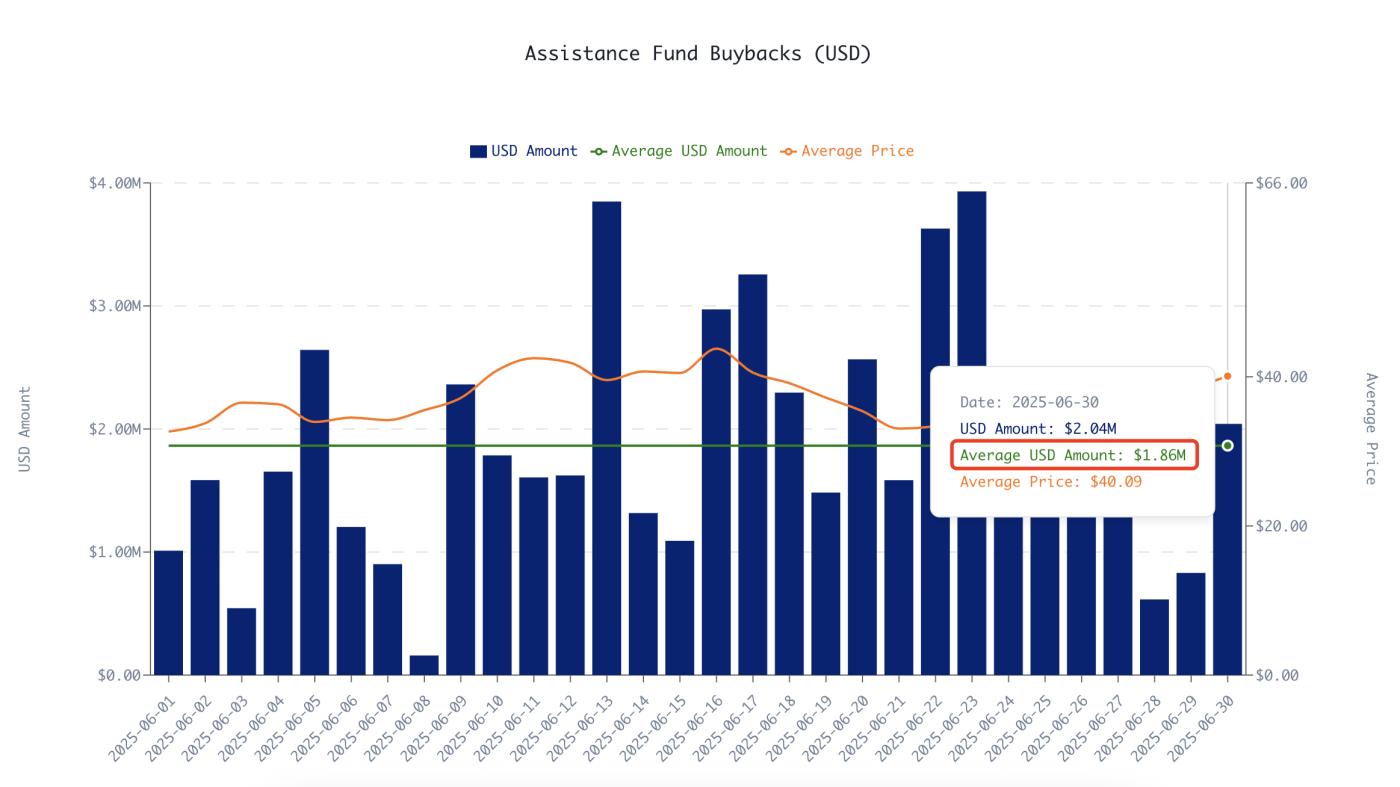

According to ASXN Data website, based on on-chain data from the past 30 days as of June 30, 2025, the average daily buyback amount for HYPE tokens by the Hyperliquid protocol is 1.86 million dollars. It can be said that this buyback fund is the biggest driving force for the HYPE token with a total supply of 1 billion and a circulating supply of about 330 million.

HYPE Token Buyback Fund Scale

According to Hyperliquid community builders Charlie.hl and supermeow.hl in a previous article 《How Does the 25.9 Billion Dollar Hyperliquid Simultaneously Occupy Infrastructure and Application Layers?》, by applying the "market cap / quarterly buyback multiple" indicator from the traditional stock market payment industry, they conservatively estimate that the HYPE token price could rise to 76 dollars.

Additionally, the Builder Code program launched by Hyperliquid provides functional support and user-level convenience for developers to collect fees through the platform, potentially attracting more on-chain developers and institutions to access the Hyperliquid interface, further promoting platform ecosystem development.

Driving Force Two: Institutional-Level Layout

Similar to how institutions like Multicoin Capital previously invested early in Solana and continuously bought SOL tokens, now investment institutions are focusing on Hyperliquid, known as the "on-chain contract market hegemon".

Previously, according to Onchain Lens monitoring, 2 investment institutions @galaxyhq and @ManifoldTrading deposited a total of 30 million dollars in USDC into HyperLiquid and began purchasing HYPE tokens.

[The rest of the translation continues in the same manner, maintaining the original structure and translating all text while preserving HTML tags and links.]

From a Data Perspective, How Far is HYPE from SOL?

On May 26th, according to Coingecko data, HYPE price was temporarily reported at $38.03, with a market cap of approximately $12.64 billion, surpassing SUI and ranking 13th in total cryptocurrency market cap (including USDT, stETH, WBTC, etc.).

On June 16th, as the price reached its historical peak, HYPE's market cap briefly exceeded $15 billion, reaching $15,017,966,172, creating a new all-time high. At the time of writing, HYPE's price was around $39, with a circulating market cap of approximately $13 billion and a fully diluted valuation (FDV) of around $39 billion.

In contrast, at the time of writing, SOL's price was reported at $149, with a circulating supply of 534 million tokens and a total supply of 600 million tokens; its circulating market cap was around $80 billion, with an FDV of approximately $90 billion.

Although their ecosystem positioning is not entirely consistent, in the current context where the meme coin fever has subsided and on-chain contracts have become the mainstream sector of the crypto market, signs of "SOL declining while HYPE rises" are emerging.

Based on the conservative estimated price of $76 mentioned earlier, HYPE's circulating market cap is expected to rise to around $25 billion; its FDV would increase to approximately $76 billion, which is about 84% of SOL's current FDV.

Conclusion: HYPE's Next Breakthrough Point is Ecosystem-Level Applications

In summary, considering the on-chain contract platform, HyperEVM ecosystem, Hyperliquid NFT assets, and ecosystem development, Hyperliquid has enormous future potential. If a "killer application" similar to Pump.fun in the Solana ecosystem emerges, HYPE could potentially compete with SOL.