Author: Hotcoin Research

1. Introduction

With the continuous development of crypto asset ETF and RWA on-chain, cryptocurrency and traditional finance are gradually breaking the boundaries. Recently, innovative practices in stock tokenization are becoming a hot topic in the market. On June 30, Bybit and Kraken simultaneously launched the "xStocks" product provided by Backed Finance, a Swiss compliant asset tokenization platform, covering about 60 stocks and ETF tokens. Arjun Sethi, co-CEO of Kraken Exchange, said that "the scale of the stock tokenization market will eventually far exceed stablecoins." On the same day, Robinhood, a US stock brokerage giant, announced the launch of a stock token trading service based on the Arbitrum network for EU users, supporting more than 200 US stocks and ETF transactions, including Nvidia, Apple and Microsoft, and achieving 24-hour uninterrupted trading on weekdays. The market responded positively to this, and the stock price of Robinhood's parent company rose 8% in a single day, setting a new high since its listing. In addition, Dinari obtained the first broker license for stock token trading in the United States, claiming to become the first compliant stock token platform in the United States. Coinbase, the largest crypto exchage in the United States, also revealed that it has applied for approval from regulators and is preparing to provide on-chain stock trading services to users.

This series of intensive news clearly conveys a signal: stock tokenization is moving from concept to implementation, and gradually entering the mainstream of finance from the edge. Will stock tokenization become the next outlet to leverage the migration of trillion-dollar traditional markets to the blockchain? Is tokenized stock a disruptive innovation in financial democratization, or another short-lived hype carnival in the crypto market? This article will conduct a detailed analysis of the basic principles, advantages, representative platforms of stock tokenization, and its impact on the crypto market and traditional financial landscape, and explore the possible future development path of stock tokenization, to help readers fully understand the true value and challenges of stock tokenization, and better grasp the opportunities and risks behind this wave of financial innovation.

2. Mechanism and advantages of stock tokenization

1. Definition and implementation of stock tokenization

Stock tokenization is the process of converting traditional securities such as stocks into tokens on the blockchain. Investors do not directly hold stock certificates, but digital tokens corresponding to specific stocks, which give holders the same rights as the original stocks, such as price fluctuations, dividends, etc.

There are currently two main ways to implement stock tokenization in the industry:

1:1 anchoring mode for real stocks: a compliant custodian institution holds a corresponding number of stocks, and mints them at a ratio of 1 token issued on the chain for every 1 real share held. This type of stock token is backed by real assets, similar to stablecoins backed by reserve assets. For example, the US stock tokens such as bAAPL and bTSLA issued by Backed in Switzerland have equivalent stocks held by regulated banks, and reserve certificates are disclosed regularly; another example is the US stock tokens issued by the Swarm platform, whose underlying stocks are held by custodians and verified by trustees, and the reserve status is disclosed monthly to ensure 100% physical support.

Synthetic token/derivative model: that is, not holding the underlying stocks, but simulating stock price performance on the chain through oracle price feeds and financial derivative structures. For example, the iAssets synthetic assets launched by Helix, a decentralized exchange in the Injective ecosystem, move traditional market assets such as stocks, commodities, and foreign exchange to the chain in the form of pure contracts. This type of synthetic stock token is not backed by custodial physical stocks, but is more like an indefinite contract or a contract for difference, and price tracking is achieved entirely through the on-chain contract mechanism.

2. Advantages of stock tokenization

Compared with the traditional securities market, on-chain stock token trading is revolutionary in many ways.

Breakthrough of trading time and geographical restrictions: Stock tokens can be traded 24/7, and can be freely bought and sold even on weekends or when traditional markets are closed; global investors can participate without any obstacles with just a mobile phone or computer, without being restricted by region, time zone or cumbersome cross-border procedures. For example, the US stock tokens issued by Robinhood allow European users to buy and sell US stock tokens anytime, anywhere, just like trading cryptocurrencies, without having to open a US brokerage account or worry about trading time differences.

Greatly optimized settlement efficiency and transaction costs: peer-to-peer transactions on blockchain eliminate the need for central custody and clearing institutions, reduce intermediary links and manual audits, and enable transactions to be settled in real time and funds to be received quickly. This is expected to reduce transaction fees and friction costs. Industry insiders generally believe that stock tokenization can significantly reduce the cost of securities transactions and increase settlement speed.

Improved asset accessibility and liquidity: Through tokenization, expensive blue-chip stocks can be split into smaller token units, making it easier for investors to hold them in fragments and make small investments; at the same time, tokens on the chain can be freely transferred and traded secondary, not limited to a single exchange, so the potential liquidity pool is wider. Especially for emerging market investors who were previously unable to participate in the U.S. stock market, stock tokens lower the entry threshold and remittance costs, allowing more people to share the growth dividends of the global capital market.

Combined with DeFi, it creates new use cases: users can use tokenized stocks like currency, transfer, hold, consume, and even mortgage them for loans, all from their own crypto wallets without intermediaries, borders, or delays. Scenarios that are unimaginable in traditional stock trading, such as using Apple stock tokens as collateral to borrow stablecoins on the chain, and providing liquidity for Tesla stock tokens in DeFi pools to earn fees, are now becoming possible. These innovative uses are expected to release the dormant value of equity assets and improve the operating efficiency of financial markets.

Stock tokenization combines the openness of cryptographic technology with the value foundation of traditional securities: it removes geographical and time barriers while giving assets higher circulation efficiency and financial Lego composability. According to RWA.xyz data, the stock tokenization market has grown significantly since the beginning of 2025. As of July 3, the market size has exceeded US$340 million, and the future stock token market size is expected to reach trillions of dollars.

Source: https://app.rwa.xyz/stocks

3. Inventory of representative stock tokenization platforms

The concept of stock tokenization is rapidly moving from concept to implementation, and various platforms are springing up like mushrooms after rain. The following is an inventory of recent representative stock tokenization trading platforms or projects:

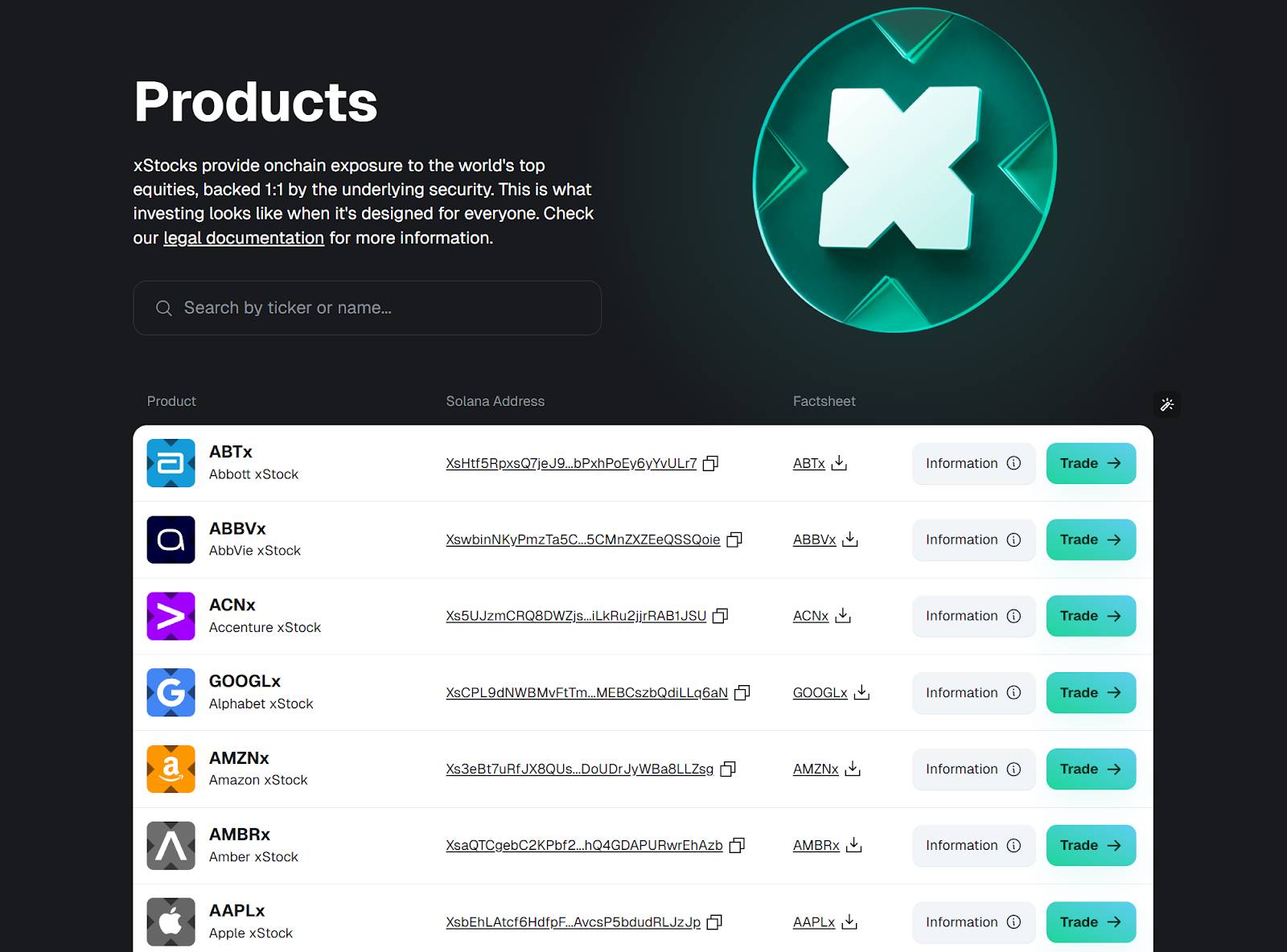

1.xStocks

On June 30, Swiss asset token issuer Backed announced that it would launch xStocks stock token trading service in cooperation with Kraken, Bybit, Raydium, Jupiter and Kamino. The first batch of 61 well-known US company stocks and ETF tokens including Apple, Amazon, Tesla, Nvidia, etc. will be supported, and trading will be open to users in non-US regions. As one of the few token issuers with compliance qualifications, Backed complies with the regulatory framework of the Swiss DLT Act, providing exchanges and DeFi protocols with tokenized stock products that have undergone regulatory review, accelerating the global rollout of stock tokenization. Backed adopts a strict 1:1 physical collateral model: for every stock token minted on the chain, one corresponding share will be purchased in the secondary market. The relevant assets are kept by a licensed Swiss custodian bank, and reserve certificates are regularly issued to ensure transparency.

Source: https://xstocks.com/products

2.Bybit

In 2023, Bybit launched stock and commodity CFD trading services for some users, but its attributes are in the form of off-chain contracts. On June 16, Bybit officially launched the independent TradFi multi-asset trading platform, which is based on the MT5 platform, allowing users to trade precious metals, oil, indices, stock CFDs and foreign exchange directly on the Bybit platform without installing MT5 separately. TradFi supports up to 5x leverage, and all transactions are settled in USDT, without the need to exchange currencies or open a traditional brokerage account. On June 30, Bybit announced a partnership with Backed's xStocks to directly support on-chain stock token transactions anchored 1:1 to real stocks. Currently, Bybit has announced that it will gradually launch multiple stock token trading pairs including Coinbase (COINX), Nvidia (NVDAX), Circle (CRCLX), Apple (AAPLX), Robinhood (HOODx), Meta (METAX), Google (GOOGLX), Amazon (AMZNX), Tesla (TSLAX), McDonald's (MCDX), etc.

3. Robinhood

On June 30, Robinhood, a traditional brokerage giant, announced at a press conference in Cannes, France that it would launch a US stock and ETF token trading service for European users, allowing users to use cryptocurrency accounts to directly buy and sell tokens of more than 200 US-listed stocks and ETFs, and Robinhood promised to "not charge additional commissions, support dividend payments, and provide 24/5 uninterrupted trading." These stock tokens are issued based on Ethereum's Arbitrum Layer 2 network. Robinhood works with custodial brokers to ensure that each token is backed by 1 real share, and synchronizes on-chain and off-chain settlement and equity updates. Token holders receive the same dividend and stock split rights as stock holders. Robinhood also announced that it is developing its own Layer 2 blockchain "Robinhood Chain", and the issuance and trading of stock tokens will be gradually migrated to this dedicated chain in the future. Robinhood Chain is built on Arbitrum technology and will be optimized for tokenized assets, supporting 7×24-hour trading, self-custody, and cross-chain bridging. Robinhood proposed "free tokenization of everything" to build an on-chain trading network covering real assets around the world in the next ten years.

4. Dinari

Dinari became the first stock token platform in the United States to obtain broker-dealer registration in June 2025. Dinari's stock tokens are called dShares and are issued on Ethereum's Arbitrum One second-layer network. Whenever Dinari actually purchases stocks from the stock exchange, it will mint dShares tokens in equal shares and implement strict 1:1 collateral. As a transfer agent registered with the US securities regulator, Dinari itself directly manages and custody these underlying stock assets to ensure that tokens and stocks correspond one to one. In order to meet compliance requirements, Dinari implements strict identity authentication (KYC/AML) for users: Currently, it only supports registration for users in the United States and Canada. Users need to submit government-issued identification (driver's license, passport, etc.) and address proof documents, and can only trade after review. Dinari's platform already provides nearly 100 types of US stock token transactions, including popular stocks such as Apple, Amazon, Microsoft, Nvidia, and Coinbase. In addition to receiving gains from stock price fluctuations, dShares holders can also receive dividends: Dinari will convert the received stock dividends into the on-chain stablecoin USD+ and distribute it to users. In terms of fees, Dinari charges a fixed fee for each transaction: if executed on the Ethereum mainnet, each order is charged $10; if executed on L2 networks such as Arbitrum, each transaction is charged $0.2. Dinari explicitly stated that it will not issue platform coins to avoid confusion with securities issuance. Dinari adopts a B2B2C model and prefers to integrate its compliance trading interface into other platforms rather than directly promote it on a large scale to end users.

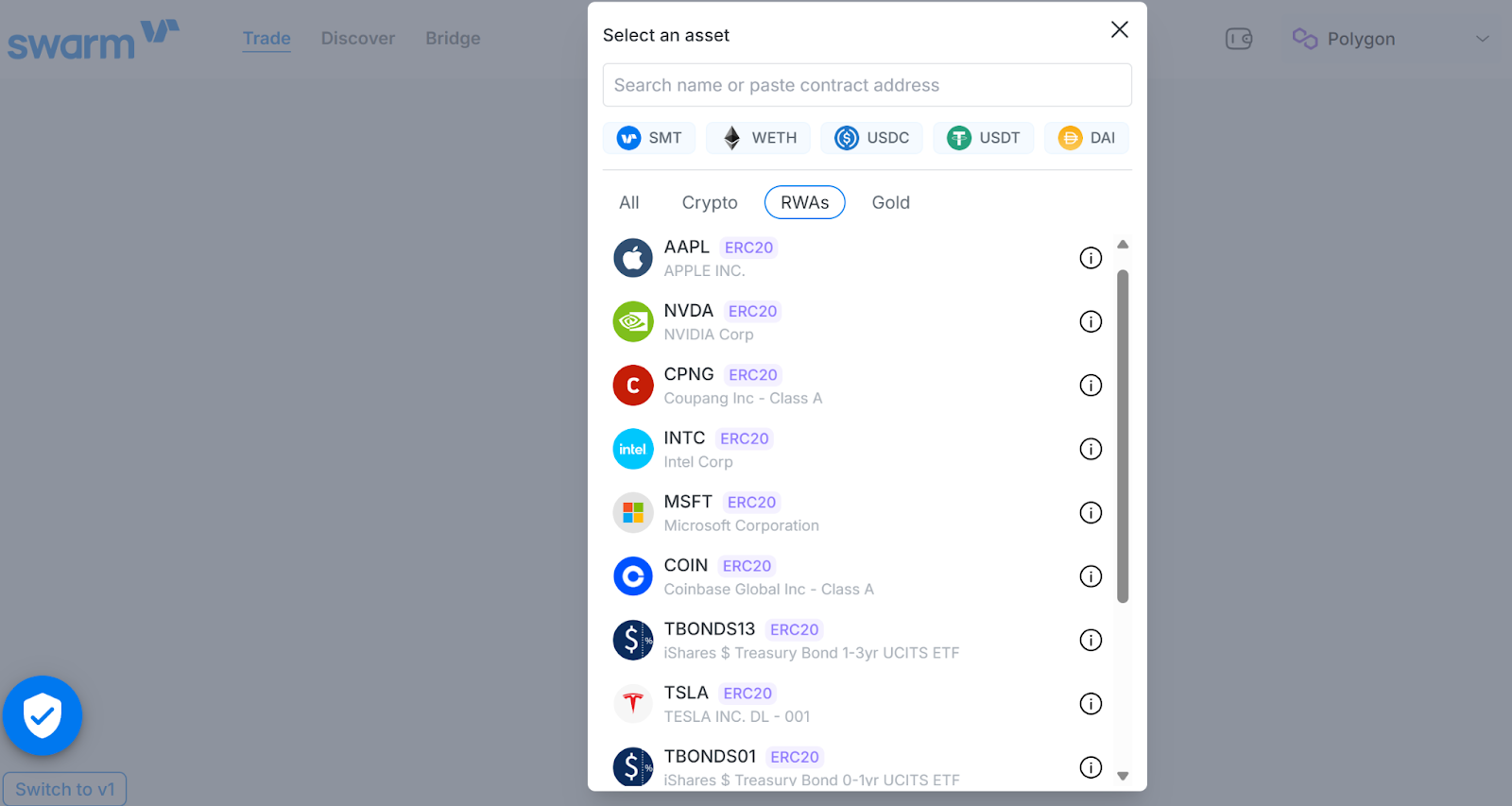

5. Swarm

As a project that provides compliant DeFi infrastructure for token issuance, liquidity and trading, Swarm has launched stock token and gold token trading services since 2023. Users can use stablecoins such as USDC to buy and sell 12 US stock tokens including Apple (AAPL), Nvidia (NVDA), Microsoft (MSFT), Coinbase (COIN), Tesla (TSLA) and physical gold tokens through Swarm's built-in decentralized trading application dOTC. Swarm supports Ethereum mainnet, Polygon, Base and other networks. Users can get the best liquidity price on any chain, and the transaction fee is 0.25%. The stock tokens issued by the Swarm platform are managed by SwarmX GmbH, a subsidiary of Swarm, and strictly adopt a 100% support model for physical stocks: the underlying stocks corresponding to all tokens are held by compliant custodians, and the trustees of the tokens will verify them, and the relevant reserve asset information will be disclosed to the public every month. As a decentralized protocol, Swarm does not have a mandatory KYC link, and users must comply with the laws of their country on their own, which is very attractive to global users.

Source: https://swarm.com/

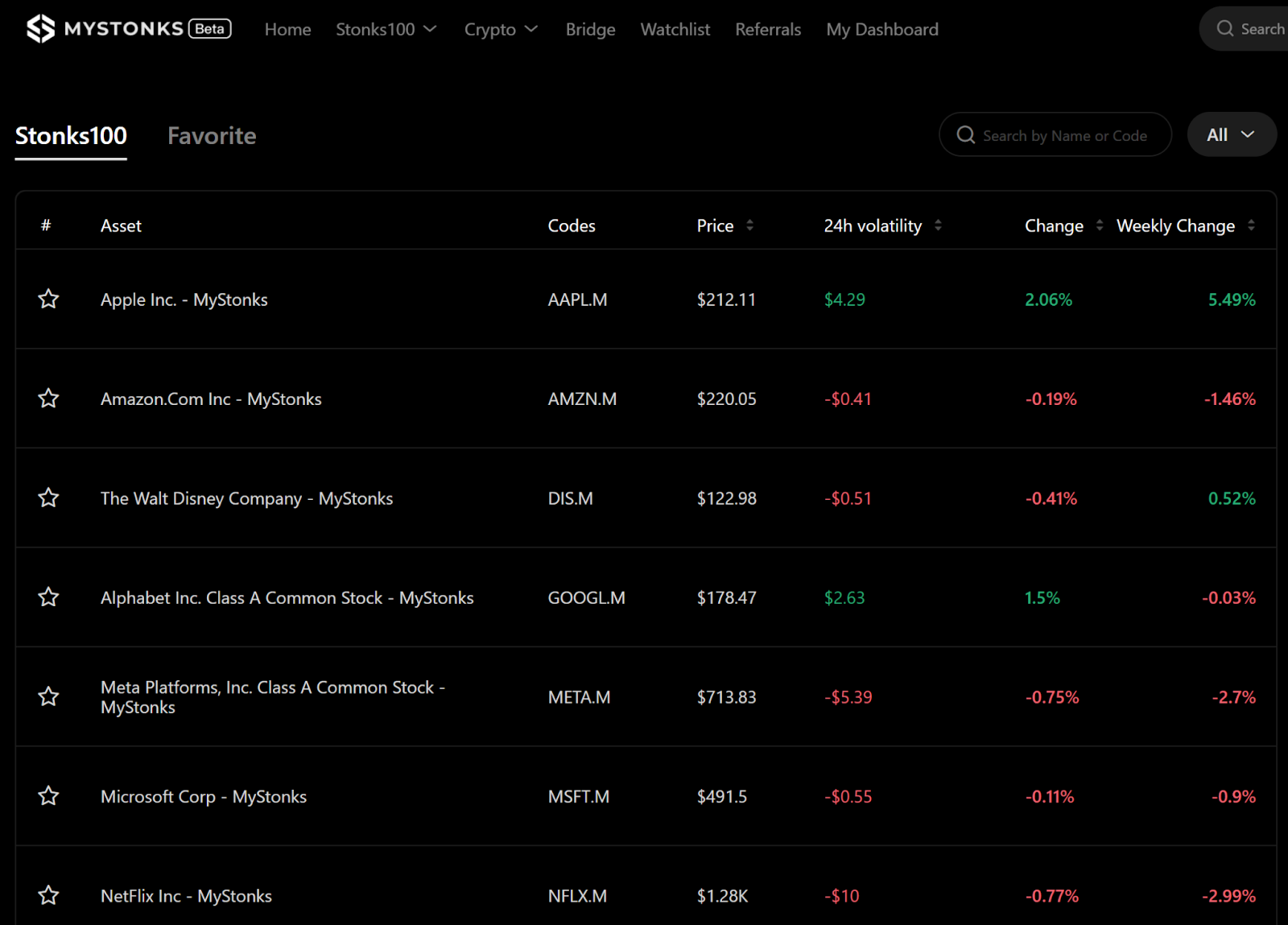

6. MyStonks

The decentralized protocol MyStonks is an emerging platform running on the Base chain. It has launched a "Stonks 100" section, which provides trading of 95 US stocks and 5 US-listed crypto/stock ETF tokens, including popular targets such as Apple, Amazon, Disney, Google, Meta, Microsoft, and Nvidia. MyStonks adopts a mechanism of on-chain and off-chain linkage: whenever a user buys or sells US stock tokens on the chain, MyStonks will simultaneously buy or sell real stocks at a 1:1 ratio over the counter, and Fidelity Investments will serve as custodian. When a user buys a US stock token on MyStonks, the platform will mint the corresponding token on the Base blockchain at a 1:1 ratio and send it to the user's on-chain wallet; when the user sells, the platform performs the opposite operation, destroying the token and returning the resulting stablecoin to the user. The transaction process is provided with on-chain price feeds by the Chainlink oracle, and the platform charges a transaction fee of 0.3%.

Source: https://mystonks.org/

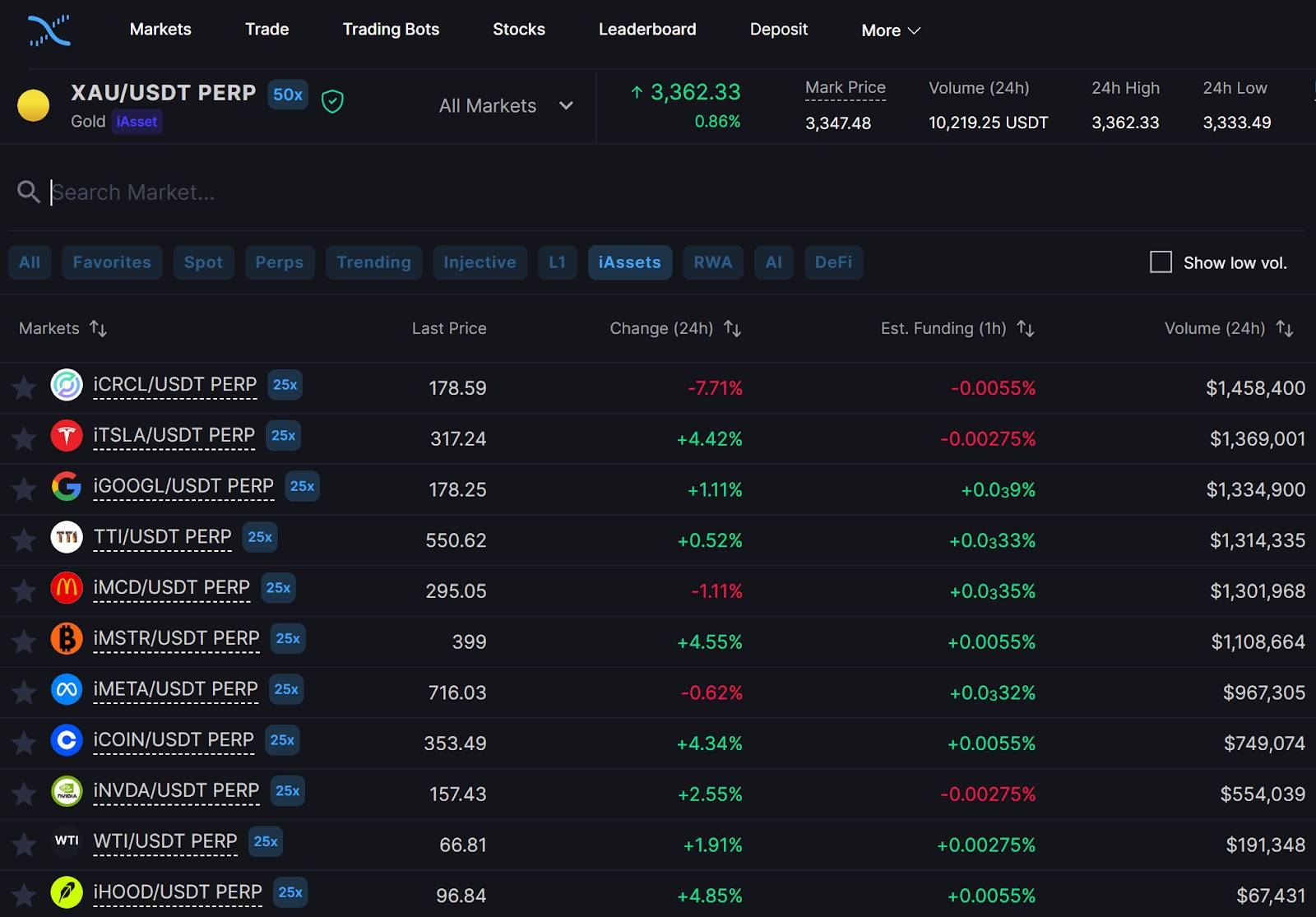

7. Helix

Helix is a decentralized exchange built on the Injective public chain, natively supporting cross-chain spot and perpetual contract trading. Helix recently launched a synthetic asset trading market for 13 US stocks, covering technology and crypto stocks such as Meta (FB), Tesla (TSLA), Nvidia (NVDA), MicroStrategy (MSTR), and Coinbase (COIN). These synthetic stocks are called iAssets on Helix, which are essentially a kind of on-chain derivatives: there is no need to hold or custody the underlying stocks in advance, but to track the price difference of the underlying assets through smart contracts and oracle prices. Since there is no physical asset support, the trading method of iAssets is similar to that of traditional crypto perpetual contracts: users use stablecoins such as USDT as margin, and can trade 7×24 hours of continuous contracts with a maximum leverage of 25×, and all positions are settled in USDT instead of physical delivery. Helix offers competitive rates (0.005% for maker orders and 0.05% for takers), and has launched incentive programs such as trading points rebates to attract high-frequency trading users to participate. Helix’s model represents a “purely on-chain” path to stock tokenization: it satisfies crypto-native users’ preferences for high volatility and leveraged trading, but its iAssets are not backed by real stocks and are therefore more suitable for short-term speculation and hedging tools.

Source: https://helixapp.com/

8. Coinbase and other platforms

Coinbase has publicly stated that it is making "stock tokenization" one of the company's strategic priorities, and in June this year applied to the U.S. SEC for approval to launch on-chain stock trading business. According to Paul Grewal, Coinbase's chief legal officer, if it gets the regulatory "green light", Coinbase plans to provide users with services to trade listed company stocks on the blockchain, allowing it to compete directly with traditional brokerages such as Robinhood and Charles Schwab. In addition to Coinbase, Ondo Finance announced in February this year that it will launch an RWA tokenization market called "Ondo Global Markets", allowing users to buy and sell stocks, bonds and ETF tokens backed by real assets 1:1. All tokens will be issued on its proprietary Ondo chain (not open to U.S. users for the time being); Superstate, a new company founded by Compound founder Robert Leshner, also plans to launch the "Opening Bell" platform to allow compliant registered public companies to issue and trade stocks directly on the Solana blockchain. The first pilot will be Canadian listed company SOL Strategies, which will achieve cross-border stock circulation through the chain. It can be foreseen that more different types of players will join this "Wall Street on the Chain" competition in the future, and the stock tokenization ecosystem will continue to expand.

IV. Impact and Challenges of Stock Tokenization

1. The impact of stock tokenization

The stock tokenization craze will have a profound impact on both the crypto market and the traditional financial industry:

For the crypto space: This indicates that crypto exchage are evolving from simple digital currency trading to a one-stop financial platform covering traditional assets such as stocks. Companies like Robinhood, Coinbase, and Kraken have expanded their business boundaries, and the boundaries between crypto exchage and Internet brokerages are gradually blurring. Investors can simultaneously allocate Bitcoin and Apple stock on the same platform, and both assets exist and are traded in the form of tokens. This not only opens up a potential huge source of income for crypto platforms, but also gives them the opportunity to compete for the user base that originally belonged to traditional brokerages. It can be foreseen that crypto exchage and traditional brokerages will start a new round of competition in terms of users, liquidity, and technology.

For traditional financial institutions: This wave is both a challenge and an opportunity. On the one hand, the efficient model of blockchain direct-connected securities trading has impacted existing stock exchanges and intermediary systems, forcing traditional institutions to embrace new technologies to enhance their competitiveness; on the other hand, the chaining of real assets has also brought innovation opportunities to Wall Street, and many large institutions have begun to test the waters. For example, JPMorgan Chase developed a blockchain-based digital securities settlement network as early as 2020, and in 2023, Credit Suisse and Citi participated in a pilot to settle European bonds on Ethereum. Now, with the acceleration of stock tokenization, traditional investment banks and exchanges may accelerate the launch of their own on-chain trading platforms to avoid being preempted by emerging technology companies.

For investors and the market as a whole: The positive significance of stock tokenization is significant: the threshold for global investors to obtain securities in various countries is lowered, and the diversified options for investment portfolios are increased; the efficiency of market operation is improved, and old problems such as T+2 delivery delays and cross-border exchange costs are expected to be alleviated.

2. Risks and challenges of stock tokenization

As a new market, stock tokenization still faces many challenges and concerns to achieve long-term development:

Uncertainty of regulatory compliance: This is still the sword of Damocles hanging over our heads. Although a few platforms such as Dinari have taken the compliance path, looking at the world, most countries have not yet clarified the legal nature of stock tokens and lack unified regulatory standards. In the early days, exchanges such as Binance and FTX tried to provide US stock tokens, but they were forced to close related businesses one after another due to regulatory pressure. Before the compliance framework matures, some stock token platforms may wander in the gray area and have compliance risks. In this regard, the KYC/AML threshold is also a double-edged sword: completely anonymous transactions with no threshold are difficult to obtain regulatory approval, and the highly strict real-name system discourages crypto users who are accustomed to anonymity. How to strike a balance between convenience for users and satisfying supervision is an issue that platforms need to explore for a long time.

Market liquidity and user demand challenges: As of now, the overall scale of on-chain real-world assets (RWA) is about US$23 billion, of which stock tokens account for only about US$313 million. In other words, stock tokenization is still at a very early stage and is far from the expected "disruptive" volume. The figure below shows some key data of the current on-chain stock token market (total market value of about US$313 million, monthly trading volume of about US$71 million, etc.), which shows that this scale is a drop in the bucket compared to the global stock market.

Most stock tokenization platforms themselves are not mature yet: some platforms may lack transparency or necessary qualifications, which makes investors doubtful and afraid to invest heavily. The traditional stock market itself is already quite mature and efficient. For investors who really want to trade US stocks, the threshold and cost of participating through traditional channels (opening accounts with overseas brokerages, Shanghai-Hong Kong Stock Connect, etc.) are not unacceptably high. On the contrary, some compliant platforms have more cumbersome processes for on-chain transactions. More importantly, for crypto-native users who prefer high volatility and high returns, the price volatility of stocks is relatively limited. Compared with the Altcoin or DeFi tokens that rise and fall dozens of times within a day, the volatility range of stocks such as Apple and Microsoft seems "too mild" and cannot provide the same excitement as the "crypto".

It can be seen that for stock tokenization to truly detonate the market, it is still necessary to find new product-market fit points, explore differentiated value-added services and unique on-chain financial gameplay. For example, stock tokens can be integrated into DeFi income strategies, used as collateral to participate in lending, and form LPs with other tokens to obtain income, so that on-chain stock trading is not just a gimmick, but will become an organic bridge connecting the global capital market and the Web3 world.

V. Conclusion

From stablecoins to stock tokens, the on-chaining of real assets is gradually changing the landscape of the crypto industry. As regulation is gradually loosening and technology is becoming more mature, stock tokenization shows great potential to leverage trillions of traditional assets. As Kraken executives said, "We are not launching new things, but unlocking a fundamental change." Stock tokenization carries the vision of financial democratization: allowing individuals in any corner of the world to participate in wealth creation fairly, without being restricted by geographical and financial barriers. However, the road to achieving this vision is still long and tortuous. Regulatory compliance, market liquidity, user education and other issues require the concerted efforts of all parties in the industry to solve. But what is certain is that the tide has begun to change direction-when leading players such as Robinhood and Coinbase are fully committed, the era of on-chain securities may have begun.

Looking ahead to the next decade, we have reason to remain cautiously optimistic: perhaps stock tokenization will not replace the existing securities market, but it is very likely to coexist with it in parallel, forming a new ecosystem of "on-chain + off-chain" dual-track integration. On the one hand, traditional exchanges and financial institutions will embrace blockchain to improve efficiency and reduce costs; on the other hand, crypto-native platforms will continue to innovate and provide more diverse and interesting investment products. The two forces are driving the evolution of the financial industry in competition, bringing more innovative and efficient financial investment experience to global investors.

The current wave of stock tokenization is the prelude to the integration of Wall Street and the crypto world. Perhaps it won’t be long before we will witness the embryonic form of a truly “all-weather, borderless, and intermediary-free” global capital market taking shape on the chain. The era of on-chain stock trading is coming to us.

about Us

As the core investment and research center of the Hotcoin ecosystem, Hotcoin Research focuses on providing professional in-depth analysis and forward-looking insights for global crypto asset investors. We have built a three-in-one service system of "trend analysis + value mining + real-time tracking". Through in-depth analysis of cryptocurrency industry trends, multi-dimensional evaluation of potential projects, and 24-hour market volatility monitoring, combined with the weekly "Hotcoin Selection" strategy live broadcast and "Blockchain Today's Headlines" daily news delivery, we provide investors at different levels with accurate market interpretation and practical strategies. Relying on cutting-edge data analysis models and industry resource networks, we continue to empower novice investors to establish a cognitive framework, help professional institutions capture alpha returns, and jointly seize value growth opportunities in the Web3 era.