Author: Cynic, CGV Research

As the Trump administration fully embraces crypto assets, the scale of crypto reserves of listed companies is about to exceed the $100 billion mark. This article systematically sorts out the global corporate crypto reserve map, deeply analyzes the capital operation model centered on MicroStrategy, and explores the differentiated paths and potential risks of Altcoin reserve companies - this "digital assetization" experiment led by traditional companies is reshaping the future paradigm of corporate financial management.

Global Crypto Reserve Enterprise Panorama

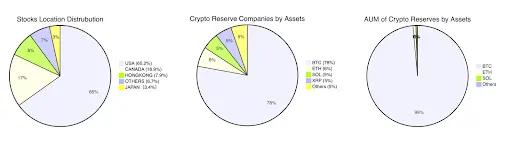

In terms of the distribution of listed companies, the United States accounts for 65.2%, Canada accounts for 16.9%, Hong Kong accounts for 7.9%, Japan also has a small number of companies in reserve (3.4%), and the rest of the world accounts for 6.7%.

In terms of the types of crypto assets held by listed companies, BTC accounts for 78%, while ETH, SOL, XRP, etc. have similar proportions, all at the level of 5%-6%, while companies that hold other crypto assets account for the remaining 5%.

Judging from the value of crypto assets held by listed companies, BTC is in an absolute leading position, accounting for 99% of the value, and other assets account for the remaining 1%.

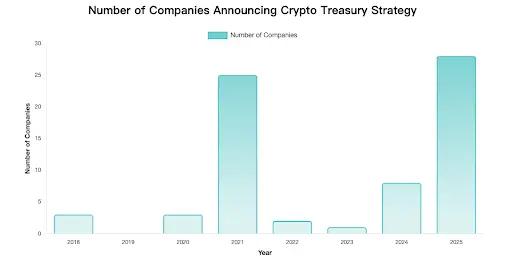

Based on the statistical analysis of the time when companies first announced their crypto strategic reserves, the results are shown in the figure below.

Note: Only some of the data disclosed accurately are included

From the chart we can observe obvious peaks and troughs, which coincide with the bull and bear cycles of the cryptocurrency market itself.

Two significant peaks :

- 2021 : 25 companies announced strategic reserves, mainly driven by the rise in Bitcoin prices and the MicroStrategy demonstration effect

- 2025 : 28 companies, the highest number in history, showing further acceptance of cryptocurrencies as corporate reserve assets

Characteristics of the low period :

- 2022-2023 : Only 3 companies enter the market, reflecting the impact of the crypto market bear market and regulatory uncertainty

Recently, more and more companies have announced their crypto reserves. It is expected that the number of listed companies with crypto reserves will exceed 200 this year, and the adoption of cryptocurrencies in traditional industries continues to increase.

Strategic reserves, capital operations and stock price performance

Judging from the current capital operation models of various digital asset reserve companies, they can be summarized into the following models:

- Leveraged coin hoarding model: The main business is relatively weak, and the funds raised through debt and financing are used to purchase crypto assets. After the crypto assets rise, the net assets are promoted, the stock price is promoted and further financing is carried out, forming a positive feedback flywheel effect. In essence, the company's stock is turned into a spot leverage of crypto assets. If operated properly, the stock price and net assets can be leveraged to rise simultaneously at a low cost. Typical cases: MicroStrategy ($MSTR BTC reserve), SharpLink Gaming ($SBET ETH reserve), DeFi Development Corp ($DFDV SOL reserve), Nano Labs ($NA BNB reserve), Eyenovia ($EYEN HYPE reserve)

- Cash investment model: companies with excellent main business (main business has nothing to do with crypto), when the cash flow on the account is sufficient, they obtain investment returns by purchasing high-quality crypto assets. Usually there is no significant impact on the stock price, and it may even cause a decline due to investors' concerns that the company is neglecting its main business. Typical cases: Tesla ($TSLA BTC reserve), Boyaa Interactive (HK0403 BTC reserve), Meitu (HK1357 BTC+ETH reserve).

- Business reserve model: The direct or indirect reserve behavior of a company due to its main business related to cryptocurrencies. For example, exchanges need to do business, and mining companies keep the mined bitcoins as reserves to deal with possible business risks. Typical cases: Coinbase ($COIN various crypto asset reserves), Marathon Digital ($MARA BTC reserves)

Company (Market) | Reserve Currency | Position size | Stock price impact | Capital operation model |

MicroStrategy (US) | BTC | 592,345 BTC (about $63.4 billion) | The stock price rose by more than 3000% after the announcement of the strategy, and the stock price fluctuated by 2-3% after the latest purchase | Leveraged Coin Hoarding |

Marathon Digital (US) | BTC | 49,179 BTC (about $5.3 billion) | The stock price fluctuated significantly after the announcement | Business Operations |

Metaplanet (JP) | BTC | 12,345 BTC (about $1.3 billion) | The stock price fell 0.94% after the latest purchase, and the overall strategy received a positive response | Leveraged Coin Hoarding |

Tesla (US) | BTC | 11,509 BTC (about $1.2 billion) | The stock price has risen sharply after the purchase in 2021, and the stock price is relatively stable if it is held unchanged | Cash Management |

Coinbase Global (US) | BTC, ETH, etc. | 9,267 BTC (about $990 million) | As an exchange holding, the impact on stock prices is relatively small | Business Operations |

SharpLink Gaming (US) | ETH | 188,478 ETH (about $470 million) | After rising more than ten times, it plummeted 70% in a single day | Leveraged Coin Hoarding |

DeFi Development Corp (US) | SOL | 609,190 SOL (approximately $107 million) | Since the announcement, the stock price has risen by as much as 6,000% and has retreated 70% from its high point. | Leveraged Coin Hoarding |

Trident Digital (SG) | XRP | 2025.06.12 Announced plans to raise $500 million to purchase XRP | The stock fluctuated greatly on the day and eventually closed down 3%. | Leveraged Coin Hoarding |

Nano Labs (US) | BNB | Target reserve: $1 billion BNB | The stock price doubled after the announcement, reaching its highest level in two years | Leveraged Coin Hoarding |

Eyenovia→Hyperion DeFi (US) | HYPE | Target 1 million HYPE (50 million US dollars) | The stock price rose 134% that day and continued to hit new highs. The increase was more than 380% from the day the news was released. | Leveraged Coin Hoarding |

Meitu (HK) | Bitcoin + Ethereum | All cashed out (original holdings: 940 BTC + 31,000 ETH) | The stock price rose 4% after the sale of all crypto assets at the end of 2024 for a profit of US$80 million | Cash Management |

Among many companies, MicroStrategy flexibly used leverage to transform from a software service provider that had been losing money for many years into a Bitcoin whale with a market value of hundreds of billions. Its operating model deserves in-depth study.

MicroStrategy: A textbook example of how crypto reserve leverage works

Thirty-fold increase in five years: Bitcoin leverage proxy

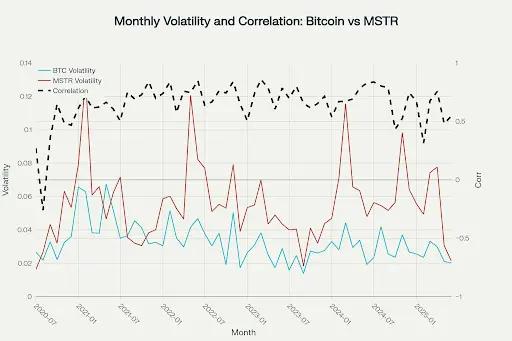

Since MicroStrategy announced the implementation of the Bitcoin strategic reserve in 2020, the stock price has been highly correlated with the price of Bitcoin, and the volatility is much higher than that of Bitcoin itself, which can be intuitively felt from the figure below. From August 2020 to date, MSTR has accumulated a nearly 30-fold increase, while the price of Bitcoin has only increased 10 times during the same period.

By analyzing the volatility and correlation of Bitcoin and MSTR by month, we can see that the price correlation between MSTR and Bitcoin is in the range of 0.6-0.8 most of the time, showing a strong correlation ; at the same time, the volatility of MSTR is several times higher than that of Bitcoin most of the time . From the results, MSTR can be called a spot leveraged security of Bitcoin. On the other hand, the Bitcoin leverage attribute of MSTR can also be verified: the implied volatility of the MSTR 1-month call option in June 2025 is 110%, 40 percentage points higher than the spot price of Bitcoin, indicating that the market has given it a leverage premium .

Precision capital operation machine

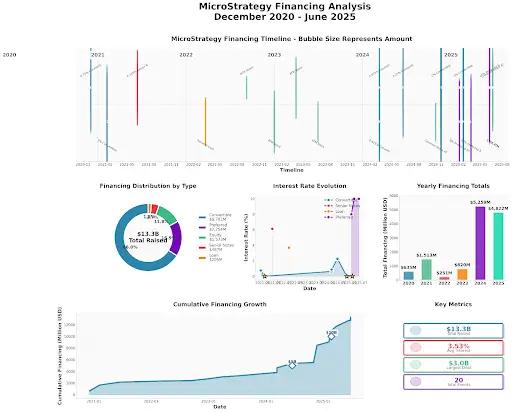

The core of the MicroStrategy model is to use lower financing costs to obtain funds for purchasing Bitcoin. As long as the expected rate of return on Bitcoin is higher than the actual financing cost, the model can continue to exist.

MicroStrategy has created a set of capital tool matrices to transform the volatility of Bitcoin into structured financing advantages. Its capital operations use a variety of financing strategies to form a self-reinforcing capital cycle. VanEck analysts have described it as a "pioneering experiment in combining digital currency economics with traditional corporate finance."

MicroStrategy's capital operations have two core goals: controlling debt ratio and increasing the amount of BTC per share . Assuming BTC rises in the long term and the two core goals are achieved, the value of MicroStrategy's stock will also increase.

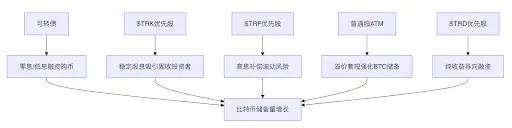

For MicroStrategy, mortgage lending has hidden costs and limitations such as insufficient capital efficiency (requiring a 150% excess mortgage ratio), uncontrollable liquidation risk, and limited financing scale.

Compared with mortgage loans, convertible bonds, preferred stocks and other financing methods with implicit options can further reduce costs and have less impact on the asset-liability structure. The sale of ATM common stock can quickly and flexibly obtain cash. In accounting treatment, preferred stocks are included in equity rather than debt, which can further reduce the debt ratio compared with convertible bonds.

Tool Type | mechanism | investor | enterprise | Risk characteristics |

Convertible bonds | Under certain conditions, the bonds can be converted into the company's common stock at a predetermined conversion ratio, thereby participating in the appreciation of equity; if the conversion conditions are not met, the holder can receive interest according to the terms of the bond and redeem the principal at maturity. | Low-risk Bitcoin call options | Low-cost financing and optimized capital structure after equity conversion | High priority debt repayment + equity conversion income |

Common Stock ATM | A mechanism for gradually selling common stock to the public at market prices through a registered securities dealer agreement; there is no minimum fundraising amount requirement, and the company can decide the timing, size and price of the offering based on its funding needs and market conditions; the funds obtained from the sale of shares are directly included in the company's books, without the need to set up a custodial or trust account | Largest Bitcoin Exposure | Highly flexible financing channels | Full exposure to BTC volatility |

STRK | Annual interest rate is 8.00%, paid cumulatively, liquidation preference is $100 per share, and each share of preferred stock can be converted into common stock at 0.10 times the initial conversion rate on any trading day. | Stable dividend + call option + hedging tool | Dividend payment is flexible, supporting mixed payment of cash and common stock, and tax deductible | Dividend + equity protection |

STRF | Annual interest rate is 10.00%, similar to cumulative preferred stock, unpaid dividends will be compounded; in the event of major changes (such as mergers, sales), the company can be required to repurchase shares at par value; no conversion rights | Fixed Income + Hedging | Dividend payments are flexible and tax deductible | High interest rate compensates for volatility risk |

STRK | Annual interest rate of 10.00%, but non-cumulative , payable in cash; major changes may require the company to repurchase shares at the original offering price ($100); no conversion rights | Fixed income + hedging tools | Dividend payments are flexible and tax deductible | Pure dividend cash flow |

This complex matrix of capital tools is popular among professional investors, allowing them to arbitrage differences in realized volatility, implied volatility and other components of option pricing models, which also lays a solid foundation for loyal buying of MicroStrategy's financing tools.

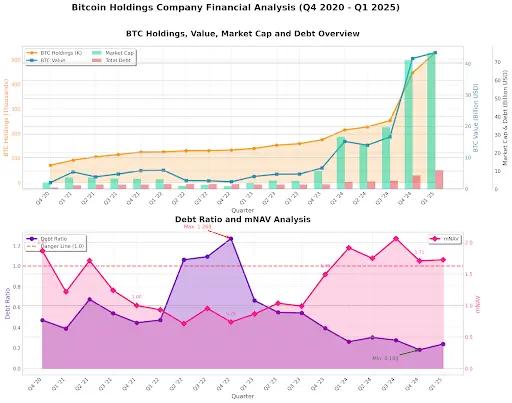

Combining the quarterly Bitcoin holdings and liabilities, as well as important capital operation events, we can observe that:

Through the combination of various financing tools, MicroStrategy issues convertible bonds and preferred stocks in the bull market when Bitcoin volatility is high and stocks have a positive premium to expand its Bitcoin holdings, and sells common stocks through ATMs in the bear market when Bitcoin volatility is low and stocks have a negative premium to prevent the risk of chain liquidation caused by excessive debt ratio.

Convertible bonds and preferred stocks are preferred during high premium periods. The possible reasons are as follows:

- Dilution delay effect

Direct issuance of common stock (ATM) will immediately dilute existing shareholders. Convertible bonds and preferred stocks, on the other hand, have embedded conversion options that postpone dilution to the future. - Tax efficient structure

Preferred stock dividends can be deducted from 30% of taxable income, reducing the actual cost of STRK with an 8% dividend rate to 5.6%, which is lower than the 7.2% interest rate of comparable corporate bonds. Common stock financing does not generate tax deduction benefits - Avoid reflexive risks

Large-scale ATMs are seen as a signal that management believes the stock price is overvalued and could trigger programmatic selling.

- Debt ratio* = Total debt ÷ Total BTC value held

- mNAV = Market value ÷ Total BTC value held

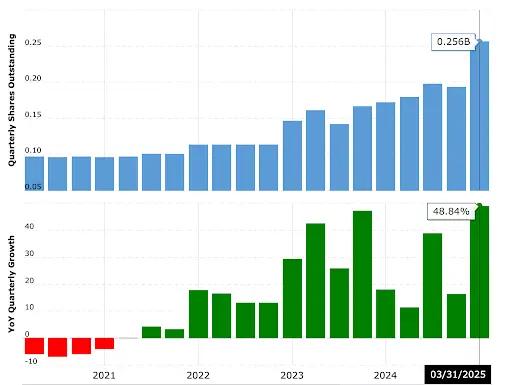

Because of its unique financing structure, when Bitcoin rises, MSTR rises at a higher rate, and a large amount of debt will be converted into equity. In fact, since MicroStrategy announced the purchase of Bitcoin, MicroStrategy's total equity has risen from 100M to 256M, an increase of 156%.

Will a large amount of additional shares dilute shareholders' equity? From the data, from Q4 2020 to now, MicroStrategy's share capital has increased by 156%, but the stock price has only increased by 30 times. Shareholders' equity has not been diluted but increased significantly. In order to better characterize shareholders' equity, MicroStrategy proposed the BTC per Share indicator, and the goal of capital operation is to continuously increase BTC per Share. As can be seen from the figure, in the long run, BTC per Share has always been on an upward trend, and has increased tenfold from the initial 0.0002 BTC per Share.

Mathematically speaking, when MSTR's stock price has a high positive premium to Bitcoin (mNAV>1), potential equity dilution to finance the purchase of Bitcoin can continue to push up BTC pre Share. mNAV > 1 means that the BTC that can be purchased with each share of raised funds is greater than the current BTC per Share. Although the original shares are diluted, the BTC value contained in each share after dilution is still rising.

MicroStrategy's Future

I think there are three key factors for the success of the micro-strategy model: regulatory arbitrage, correct betting on the rise of Bitcoin, and excellent capital operation capabilities. At the same time, risks are also hidden in it.

Legal and regulatory changes

- The abundance of Bitcoin investment tools squeezed MicroStrategy's buying : When MicroStrategy first announced its strategic reserve of Bitcoin, the Bitcoin spot ETF had not yet been approved, and a large number of investment institutions were unable to directly obtain Bitcoin risk exposure under the compliance framework, so they purchased through MicroStrategy as a proxy asset. After Trump came to power, the government vigorously promoted cryptocurrency, and a large number of compliant crypto-related investment tools are emerging, and the space for regulatory arbitrage is gradually narrowing.

- SEC restricts excessive debt of "non-productive assets" : Although MicroStrategy has maintained its debt ratio at a controllable level through sophisticated debt management, and its current debt ratio is significantly lower than that of a large number of listed companies with the same market value, the debt of listed companies is usually used for business expansion. MicroStrategy's debt is entirely used for investment, and it may be reclassified as an investment company by the SEC, which will increase its capital adequacy ratio by more than 30% and reduce leverage space.

- Capital Gains Tax : If the unrealized capital gains held by the company are taxed, MicroStrategy will face a lot of cash tax pressure. (The current OBBB bill stipulates that taxes are only levied when selling)

Bitcoin Market Dependency Risk

- Volatility amplifier : MicroStrategy currently holds 2.84% of the total Bitcoin. When the volatility of Bitcoin rises, the volatility of MicroStrategy's stock price will also increase several times that of Bitcoin. In the downward cycle, the stock price will be under great pressure.

- Irrational premium : MicroStrategy’s market value has long been over 70% higher than the net value of its Bitcoin holdings. This premium is largely due to the market’s irrational expectations of Bitcoin’s rise.

The risk of Ponzi-like structure of debt leverage

- Convertible bonds rely on circular financing: the cycle of "borrowing new bonds → buying BTC → pushing up stock prices → issuing more bonds" has double Ponzi characteristics. When large bonds mature, if the price of Bitcoin fails to continue to rise to support the stock price, the issuance of new bonds will be blocked, triggering a liquidity crisis (debt continuation risk); if the price of BTC falls and the stock price falls below the convertible bond conversion threshold, the company will be forced to repay the debt in cash (conversion price inversion)

- Lack of stable cash flow: Since the company has no stable source of cash flow and cannot sell Bitcoin, MicroStrategy's way of repaying debts is basically through issuing additional shares (debt-for-equity swaps, ATMs). When the stock price or Bitcoin price falls, the financing cost increases significantly, and there may be a risk of closure of financing channels or significant dilution, making it difficult to continue to increase holdings or maintain operating cash flow.

In the long run, when risk assets enter a downward cycle, the superposition of multiple risks may trigger a chain reaction, forming a technical risk transmission mechanism and triggering a death spiral:

Another possibility is that regulators actively intervene to convert MicroStrategy into a Bitcoin ETF or similar financial product. MicroStrategy currently holds 2.88% of the total BTC. If it really falls into a sell-off and liquidation trend, it may directly lead to the collapse of the crypto market. It is much safer to convert it into an ETF or other type. Although MicroStrategy holds a large amount of Bitcoin, it is not outstanding when compared with other ETFs. In addition, on July 2, 2025, the SEC approved the conversion of Grayscale Digital Large Cap Fund into an ETF holding a portfolio of assets such as BTC, ETH, XRP, SOL, ADA, etc., which indirectly illustrates the possibility.

Altcoin Reserve Experiment: Taking $SBET and $DFDV as Examples

Valuation regression analysis: sentiment-driven shift to fundamental pricing

$SBET's volatility path and stabilization signals

Causes of sharp rise and fall:

In May 2025, $SBET announced that it would acquire 176,271 ETH (worth $463 million at the time) with $425 million PIPE financing, becoming the world's largest ETH holder by a listed company, and its stock price soared 400% in a single day. Subsequently, SEC documents showed that PIPE investors could resell their shares, triggering a panic sell-off in the market due to dilution, and the stock price plummeted 70%. Ethereum co-founder Joseph Lubin (Chairman of the $SBET Board of Directors) clarified that "there was no shareholder selling", but market sentiment had been frustrated.

Signs of valuation recovery:

As of July 2025, $SBET stock price stabilizes at around $10, and mNAV is about 1.2 (about 2.67 after taking into account PIPE issuance)

The driving force for stabilization comes from:

- ETH holdings increased in value : an additional $30.6 million was spent to purchase 12,207 ETH, bringing total holdings to 188,478 ETH (approximately $470 million), accounting for 80% of the market value.

- Staking income cashing : 120 ETH has been earned through liquid staking derivatives (LSD);

- Liquidity improved : average daily trading volume was 12.6 million shares, and the short ratio dropped to 8.53%.

$DFDV’s Ecosystem Integration Premium

Compared with $SBET, although $DFDV's volatility is also very high, its stock price has a stronger support for decline. Despite a 36% drop in a single day, $DFDV has a stock price return of 30 times that before the transformation. This is partly due to the company's low market value before the transformation, and partly due to the diversity of its business, especially its investment in infrastructure, which gives it more valuation support.

Valuation support for SOL reserves:

$DFDV holds 621,313 SOL (approximately $107 million) and has three sources of income:

- SOL price appreciation (accounting for 90% of the holding value);

- Staking rewards (5%-7% annualized);

- Validator commission (charged to ecological projects such as $BONK).

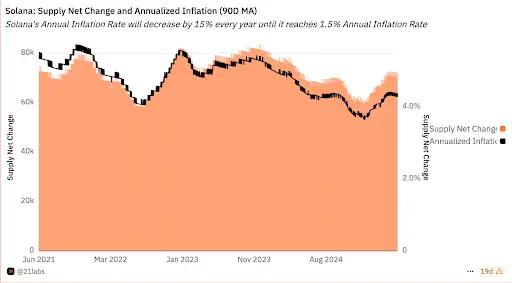

PoW vs. PoS: The Impact of Staking Rewards

The annualized returns from native staking of POS-type cryptocurrencies such as ETH and SOL may not directly affect the valuation model, but circulating staking is expected to enhance the flexibility of capital operations.

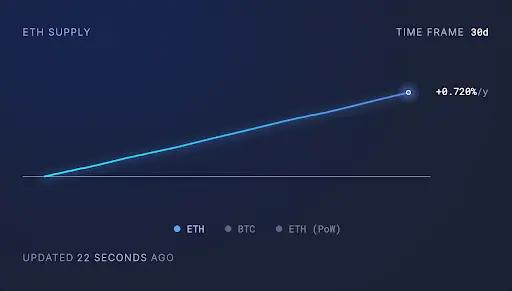

- As a POW token, Bitcoin has no interest-bearing mechanism, but the total amount is fixed, the inflation rate continues to decline (currently 1.8%), and the asset is scarce. PoS tokens can be rewarded through staking. When the staking return rate is higher than the token inflation rate, the pledged assets gain nominal value. The current SOL staking annualized return is 7%-13%, and the inflation rate is 5%; the ETH staking annualized return is 3%-5%, and the inflation rate is less than 1%. The current ETH/SOL staking can generate additional income, but it is necessary to pay attention to the changes in the inflation rate and staking returns.

- The income generated by staking is based on currency and cannot be converted into purchasing power in the secondary market to drive further increases in currency prices.

- Liquidity staking not only allows you to obtain staking income, but also allows you to use liquid assets for DeFi activities, such as mortgage lending, to increase the flexibility of capital operations. (For example, DFDV has issued its own liquid asset DFDVSOL)

$MSTR Success Factors Applicability Verification in Altcoin Reserve Companies

Regulatory arbitrage: narrowing space

The speed of ETF application approval has been significantly accelerated recently. Many institutions are applying for ETFs of different cryptocurrencies. It is only a matter of time before they are approved. Before more complex financial instruments related to specific cryptocurrencies emerge, the stock and bond instruments of the Altcoin Reserve Company can still meet the needs of some investors, but the space for regulatory arbitrage is gradually shrinking.

Tokens | 30-day volatility | Institutional holdings | ETF Catalyst Progress |

BTC | 45% | 63% | Approved Spot ETFs |

ETH | 68% | 28% | Approved |

SOL | 82% | 12% | Multiple applications awaiting approval |

Token Rise Bet: Future Performance of Altcoin in Doubt

Bitcoin has global liquidity consensus as "digital gold", while ETH/SOL lacks the same status. BTC has reserve asset attributes, but ETH/SOL is mostly regarded as a utility asset.

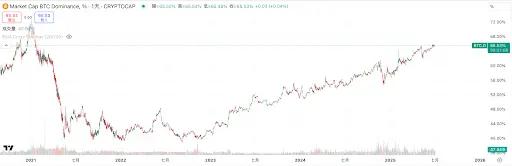

Altcoin underperform relative to Bitcoin during 2024-2025:

- Bitcoin dominance continues to rise in 2024, reaching a high of around 65%

- Historically, the altcoin season usually starts after Bitcoin reaches its peak, but in this cycle, altcoins lag behind

When Bitcoin hit a new high this time, ETH and SOL were still less than 50% of their historical highs.

Capital operation capability: enhanced flexibility

Compared with the strategic reserve of Bitcoin, the strategic reserve companies of Altcoin can participate more deeply in the public chain ecological business to generate cash income, and at the same time can use DeFi to improve capital utilization.

For example:

- $SBET is chaired by the founder of Consensys and is expected to expand into cash flow businesses such as wallets, public chains, and staking services in the future

- $DFDV joins hands with Solana’s largest Meme coin $BONK to acquire a validator network, with commission income accounting for 34% of Q2 revenue.

- $DFDV packages the staking income into DeFi tradable assets through dfdvSOL to attract on-chain capital;

- $HYPD (formerly Eyenovia $EYEN) will use the reserved $HYPE for staking, lending, and expanding node operations and referral rebate business;

- $BTCS (Ethereum node and staking service provider) will use $ETH for staking and use LST and BTC as collateral to obtain low-cost funds through AAVE

In summary, the narrowing of regulatory arbitrage space and the uncertainty of token appreciation space will force Altcoin reserve companies to innovate their operating models, deeply participate in the on-chain ecology, and build cash flow through ecological business to improve risk resistance.

While MicroStrategy uses sophisticated capital tools to convert Bitcoin into "volatility leverage", the Altcoin reserve company is trying to solve the valuation dilemma through DeFi operations. However, the shrinking regulatory arbitrage window, the difference in token consensus strength, and the inflation concerns of the POS mechanism make this experiment still full of variables. It is foreseeable that as more traditional companies enter the market, the strategic reserve of crypto assets will move from aggressive bets to rational allocation - its ultimate significance may not lie in short-term arbitrage, but in pushing corporate balance sheets into the programmable era .

As Michael Saylor said: "We are not buying Bitcoin, we are building a financial system for the digital age." The ultimate test of this experiment will be whether the balance sheet can withstand a double squeeze when Bitcoin enters a bear market - this is also a proposition that traditional companies must answer before entering the market.

Disclaimer: This article is a CGV research report and does not constitute any investment advice. It is for reference only.

CGV (Cryptogram Venture) is a crypto investment institution headquartered in Tokyo, Japan. Since 2017, its fund and predecessor funds have participated in more than 200 projects. Since 2022, CGV has invested in and incubated the licensed Japanese yen stablecoin JPYW, and has laid out the crypto stablecoin field in advance. Since 2024, CGV has laid out the coin stock and RWA markets, and participated in the private placement of projects such as Nabit (NA) and Victory Securities (8540.HK). At present, CGV also has branches in Hong Kong, Silicon Valley and other places.