In the context of increasing emphasis on compliance, security, and trust in Web3 infrastructure, Japan has become the next strategic high ground for the global crypto industry. As one of the most influential crypto conferences in Asia, IVS Crypto Japan 2025 successfully concluded last week in Kyoto, attracting over a hundred projects and thousands of practitioners.

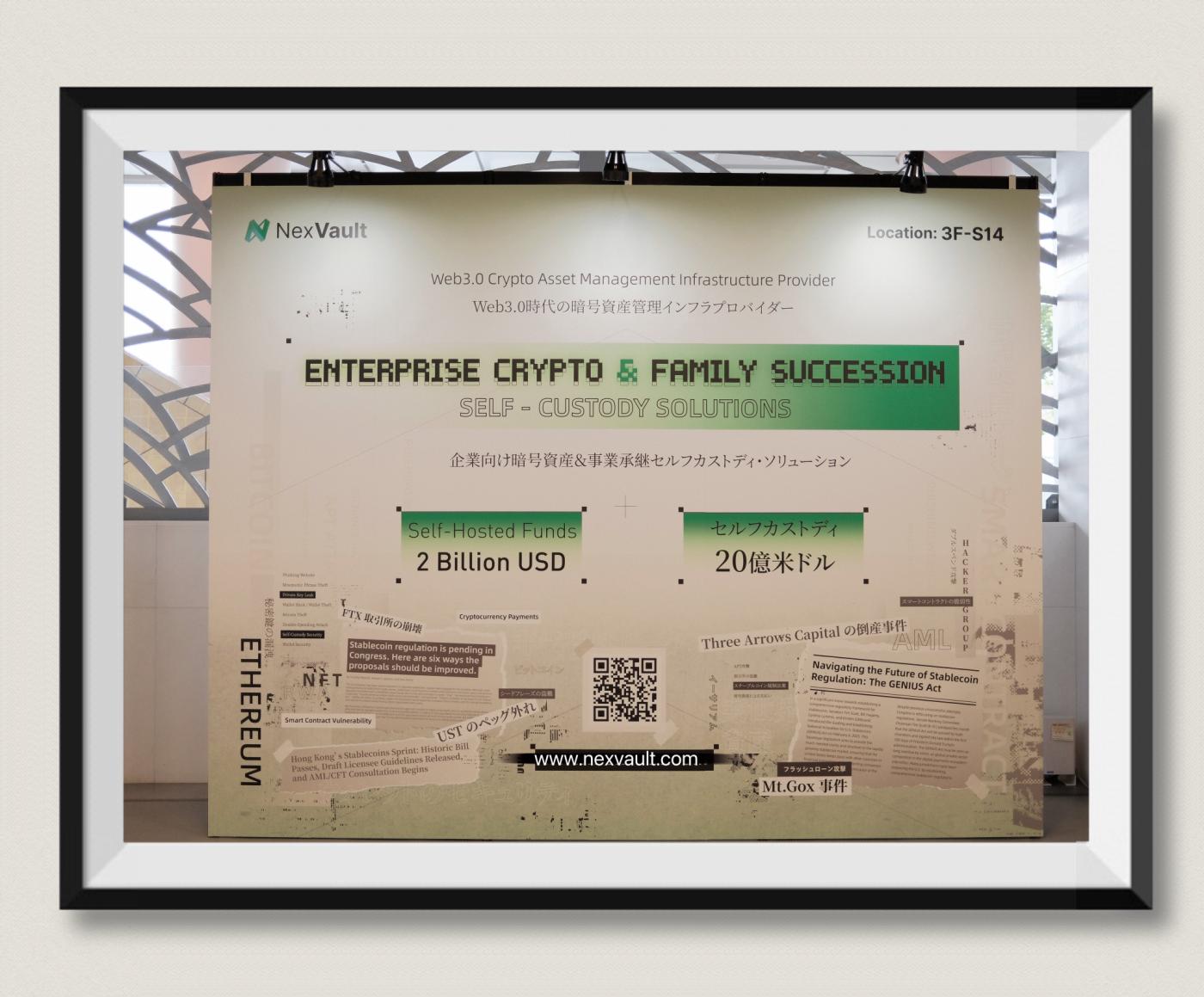

In this conference, viewed as the "Asian Crypto Davos", NexVault, an infrastructure project focusing on Web3 asset self-custody and family inheritance, became one of the most attention-grabbing enterprise-level solution providers on-site.

Can "Legacy" Also Be Chained? We Saw a New Trust Logic in Japan

At NexVault's booth, many participants seriously considered for the first time: If my crypto assets need to be inherited one day, how can I ensure they won't be lost or easily stolen?

We demonstrated NexVault's "Self-Custody Multi-Signature Inheritance Mechanism", which allows users to safely manage and long-term transfer enterprise or family assets by flexibly configuring signature permissions and recovery paths, without relying on CEX or third-party verification, truly making on-chain assets controllable, transferable, and uninterrupted.

During this exhibition, we primarily presented two solution usage scenarios:

High Net Worth Families: Multi-signature inheritance, making estate planning no longer dependent on traditional legal pathways;

Enterprise Multi-Signature Collaboration: Preventing asset permanent freezing due to employee departure, disconnection, or key loss.

Real Feedback from Overseas Web3 Projects: "We've Needed Such a Tool for a Long Time"

During three days of exchanges, we received project teams and investors from Singapore, Japan, South Korea, Hong Kong, the United States, and other countries/regions, who generally focused on:

How to achieve "emergency recovery" in a "non-custodial" form?

Whether it supports integration with systems like Gnosis?

Our multiple inheritance stages of "Multi-Signature Inheritance + Conditional Inheritance + Legal Compatibility Support" received extremely high recognition.

Many teams immediately scheduled subsequent product demos and expressed hope to integrate NexVault into their asset account systems.

Why NexVault? We Focus on Certainty in "Moments of Loss of Control"

NexVault has always adhered to the design philosophy of "preventing loss of control and ensuring inheritance". This is not a wallet product, nor a CEX alternative, but rather:

The "Last Mile Infrastructure" for Web3 Asset Custody and Inheritance

We solve the following problems:

If asset private keys are lost, can there be a "verifiable" recovery method?

If family asset planning crosses borders, can delayed release or trigger mechanisms be designed?

If enterprise operators suddenly become unreachable, how can employees' and shareholders' legitimate rights be guaranteed?

All of these can be solved through NexVault's conditional logic, on-chain signatures, and permission strategies.

Where Are We Heading Next?

Following the conclusion of IVS, we have already begun in-depth exchanges with several Japanese manufacturers and multinational family offices. NexVault will launch more versions of "inheritance templates", "enterprise recovery logic", and "cross-border asset allocation solutions" in Q3 2025, and continue to participate in:

WebX Tokyo (August)

Bitcoin 2025 HK (August)

Multiple overseas private exchange dinner parties (Shenzhen, Hangzhou, Chengdu, etc.)

We hope to appear beside those who truly need security, not just at the crest of market enthusiasm.

To learn about NexVault's latest product progress and industry application solutions, please follow our official website and Twitter accounts:

Website: www.nexvault.com X: @NexVaultGlobal, @NexVault