Welcome to the US Crypto News Morning Brief—where we provide the most important cryptocurrency information for today.

Let's brew a cup of coffee and understand why this moment is different. A silent change is occurring as Bitcoin (BTC) reaches new heights. This is not just about charts and emphasis, but also highlights deeper changes in how major investors perceive this pioneering cryptocurrency.

Cryptocurrency News of the Day: Bitcoin's Growth Reflects Institutional Shift, Erald Ghoos of OKX Says

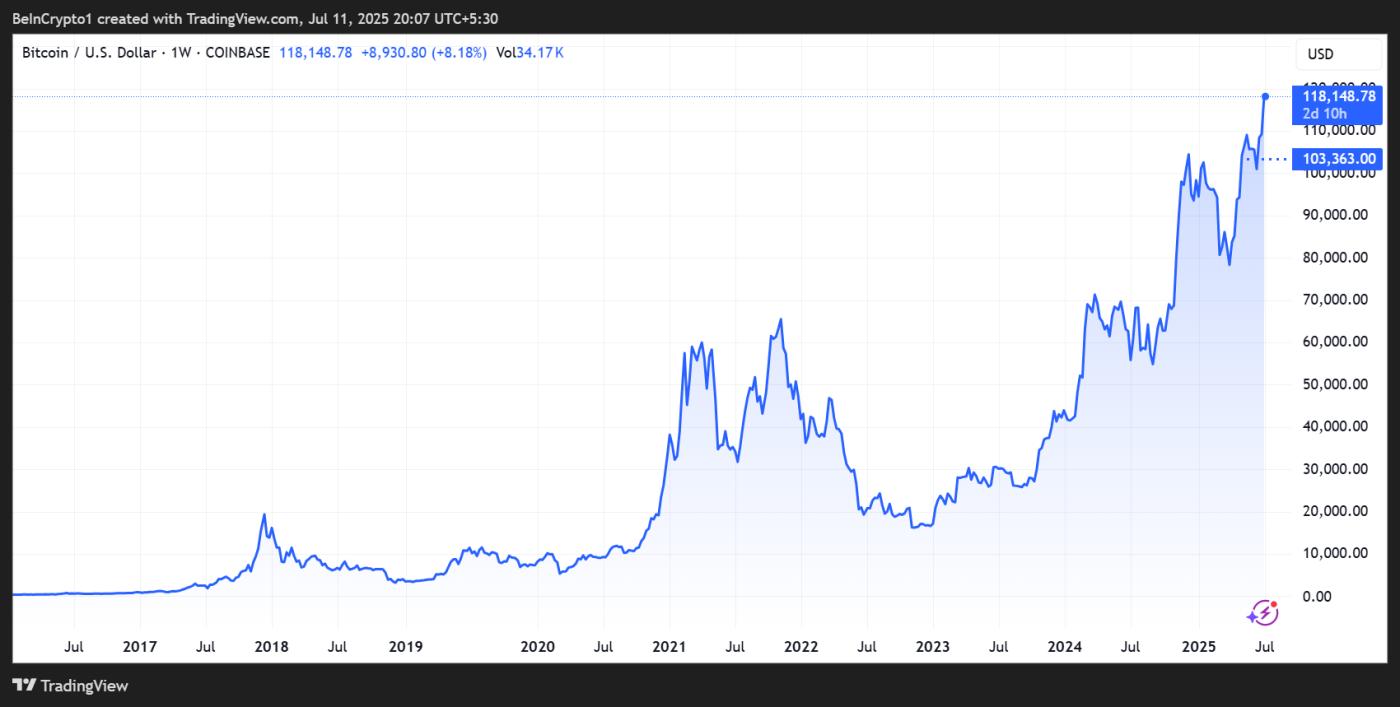

Bitcoin has reached a new All-Time-High (ATH), peaking at $118,909 on the Coinbase exchange. Although this move caused record liquidations, with thousands of short positions being wiped out, this latest ATH is more than just a market milestone.

According to OKX Europe's CEO, Erald Ghoos, this is a strategic turning point in how digital assets are perceived by institutions.

"Bitcoin's surge to a new All-Time-High is not just noise, it reflects its emergence as the optimal digital protection barrier," Ghoos said in an exclusive comment.

He noted that increasing global trade tensions, upcoming tax levels, and a liquidity-based policy environment are driving a range of institutions to adopt Bitcoin as "digital gold."

As recently highlighted in a US Crypto News publication, these institutions range from corporate treasuries to sovereign asset funds.

Meanwhile, with volatility at its lowest in a decade and ETF inflows accelerating, July is shaping up to be a "decisive moment" for Bitcoin.

"Bitcoin seems to be purposely built for this," Ghoos added.

Despite the ECB remaining cautious about the digital euro in Europe, interest in Bitcoin is accelerating. Ghoos emphasized that European institutional investors are increasingly turning to BTC as a portfolio diversification tool beyond traditional crypto investors. This includes entities seeking non-fiat protection barriers amid increasing macroeconomic uncertainty.

"The convergence of global trade instability, policy changes, and structured ETF access is elevating BTC beyond speculation; it's becoming a mainstream trend," Ghoos said.

His statement aligns with comments from Marcin Kazmierczak, co-founder and COO of RedStone. As mentioned in a recent US Crypto News publication, this crypto executive emphasized Bitcoin as a portfolio diversification tool.

"Bitcoin can add diversity to an investment portfolio but will not reliably protect against stock market collapse because it does not consistently move in the opposite direction," Kazmierczak told BeInCrypto.

As market conditions support hard assets, Bitcoin seems to be entering a broader economic role.

What was once a marginal asset for small investors is now recognized as a core protection barrier against fiat value depreciation and geopolitical instability.

For many institutional allocators, Bitcoin's breakthrough is an intentional move, adjusting risks during the digital macro investment period.

Chart of the Day

Bitcoin (BTC) Price Performance. Source: TradingView

Bitcoin (BTC) Price Performance. Source: TradingViewByte Size Alpha

Here is additional summary of US cryptocurrency news to watch today: