Hackers have returned 90% of the recently stolen assets in the GMX hack. Accordingly, the GMX token increased by 15%, recovering most of the losses from the incident.

However, GMX has not yet clearly described how the attack occurred. Hopefully, the team can address the security vulnerabilities and restore user trust.

The GMX hack has mostly been resolved

Two days ago, the GMX hack surprised the entire community, stealing $42 million from this famous decentralized exchange.

After the incident, developers encoded a message to the attacker, proposing a 10% white hat bounty if they return 90% of the funds. In return, GMX would not take legal action. Clearly, the hackers accepted this proposal:

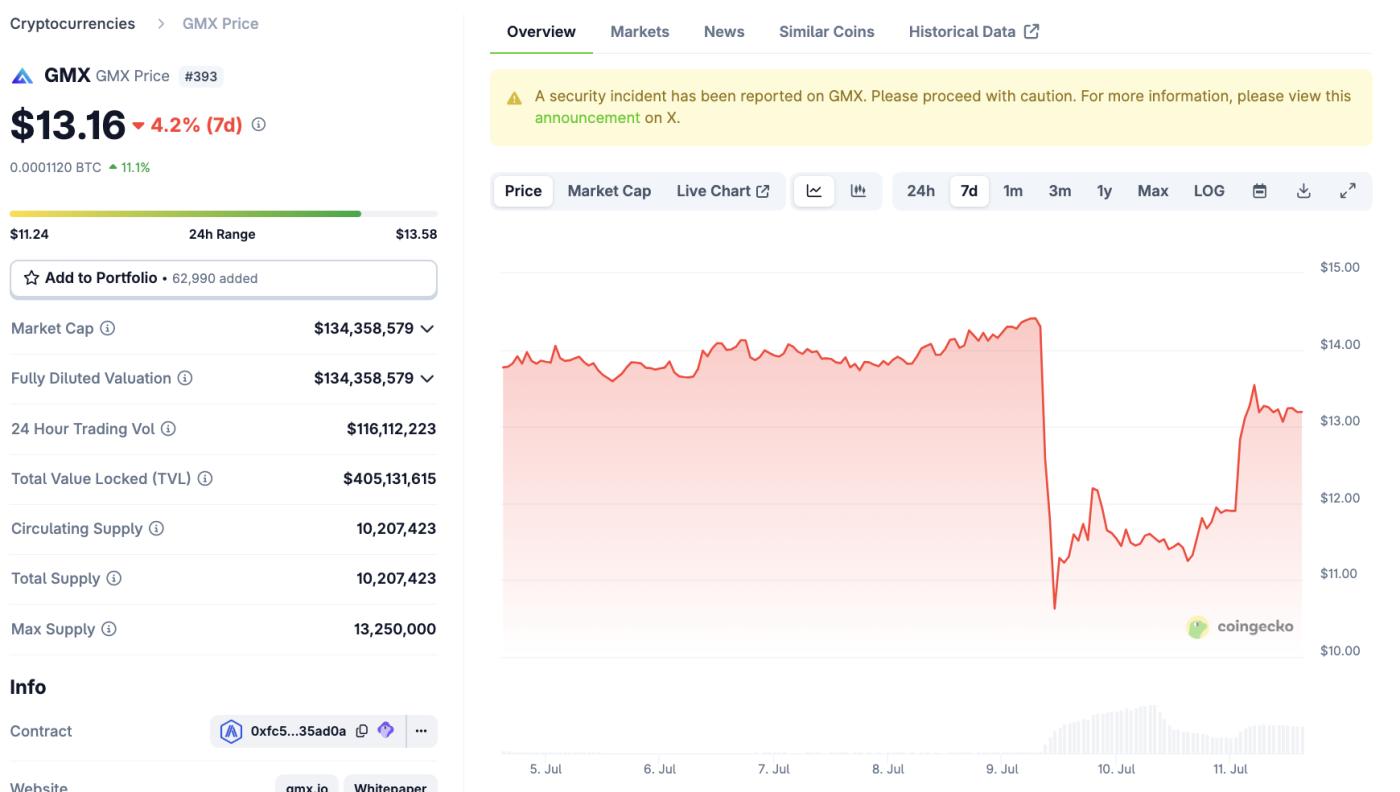

At the time of writing, most of the funds from the GMX hack have been returned. The GMX token had dropped over 35% after the incident but increased 15% after the attacker began returning funds to the exchange.

This was not enough to reverse all token losses, but the community still felt relieved by the news.

GMX price performance. Source: CoinGecko

GMX price performance. Source: CoinGeckoMoreover, although the attacker returned most of the funds, they still had an opportunity to profit. Specifically, they used Ethereum to launder money after the hack, becoming one of the largest ETH transactions of the week.

Ethereum's price has risen strongly since the incident. In other words, because it was converted to ETH, the 10% of stolen GMX funds now have a significantly higher value compared to before the hack.

Although there was some speculation that the attacker might try to sell this ETH and return cash to GMX, they kept everything on chain.

Unfortunately, one point remains unclear. We still do not have a clear idea of how the GMX hack occurred. Since crypto crime is very prevalent today, this could be very valuable information.

If GMX can reassure users that the vulnerability has been addressed, they may be able to partially restore trust.