This article is machine translated

Show original

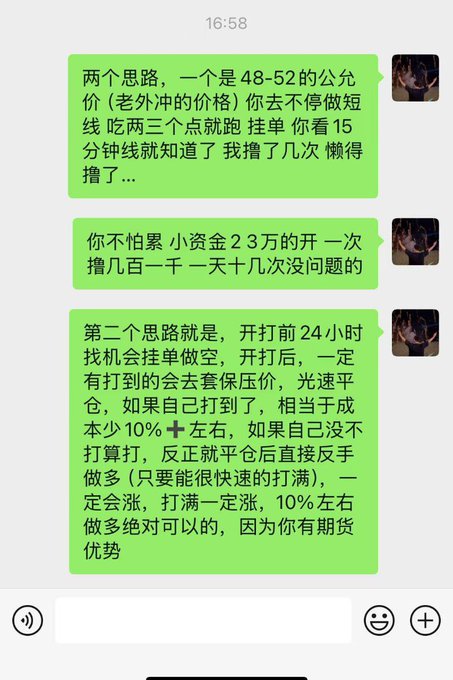

My strategy shared with group members yesterday followed exactly the same script, which made me laugh. I shorted before the market opened, ran near the opening, and after the market opened, I used the massive volume to hedge liquidity and then went long again, making another wave of profit. This lowered my cost basis.

Now I'm just waiting to see if they'll settle my trade. I wanted to trade 50, but due to FOMO, I traded 1M.

The issue is that I traded on the exchange, and it was completed in 3 seconds and locked in, but I don't know if it will be settled or if it was successful.

This wave of pulling and bursting the void hedge might make me rich.

Hedging seems... quite dangerous? hyper Some people are pushing orders up to $1 million, $1 million 😳 and it's no longer about the tokens 😂 Now it's just about who has more money between bulls and bears

And although there is a price difference, I still recommend that you go to Binance for hedging. It will be safer in case something goes wrong.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content