Analysts fear that MicroStrategy, the largest Bitcoin (BTC) holding company, may be sitting on a financial bomb that could spread across the entire cryptocurrency market.

With over 597,000 BTC, equivalent to 3% of the total Bitcoin supply, this business intelligence company - now a Bitcoin representative - is being called by some as the "largest liquidation risk in cryptocurrency".

MicroStrategy's $71 billion Bitcoin bet raises concerns about systemic risk

Bitcoin reached another All-Time-High (ATH) on Sunday, gradually approaching the $120,000 threshold. However, this growth comes from institutional interest rather than buying momentum from small investors.

Leading this is MicroStrategy (now Strategy), a company holding 597,325 BTC, valued at over $71 billion at the time of writing.

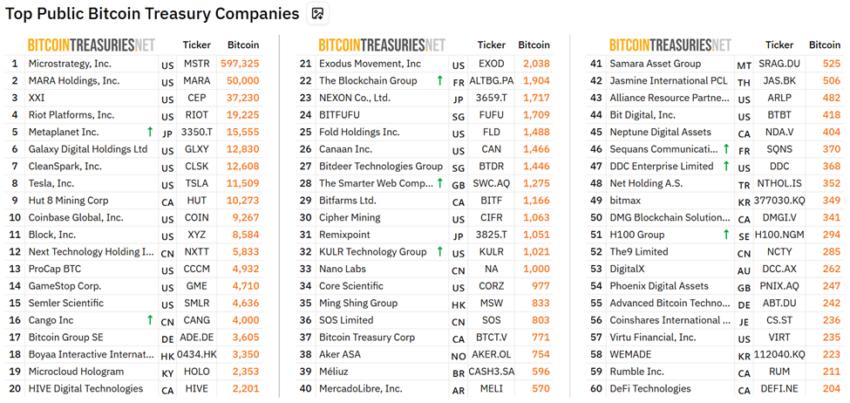

Top public companies holding Bitcoin. Source: Bitcoin Treasuries.

Top public companies holding Bitcoin. Source: Bitcoin Treasuries.Leshka.eth, an investment strategist and KOL, pointed out the scale and fragility of MicroStrategy's Bitcoin investment.

"Everyone is celebrating while this creates the largest liquidation risk in cryptocurrency," Leshka wrote.

The analyst noted that MicroStrategy's $71 billion Bitcoin position was built on $7.2 billion in convertible debt raised since 2020. Their average BTC purchase price is around $70,982.

If Bitcoin drops below that level, paper losses could start putting real pressure on their balance sheet.

Unlike spot ETFs, MicroStrategy has no cash buffer or redemption mechanism.

This means any Bitcoin price drop will directly affect the company's valuation and, in extreme cases, could force asset sales to cover debts.

"This is not just a high-beta Bitcoin game—it's a leveraged bet with very little margin for error," Leshka warned.

The fragile feedback loop behind MicroStrategy's Bitcoin strategy

While many small and institutional investors view MicroStrategy (MSTR) stock as a liquidation method to access Bitcoin, it carries risks far beyond regulated ETFs.

Leshka explained that MSTR trades at a price higher than its net asset value (NAV), sometimes up to 100%. This "premium" feedback loop—where rising stock prices fund additional BTC purchases—could quickly collapse during a downturn.

If investor sentiment changes and MSTR's NAV premium disappears, the company's ability to access new capital will be exhausted.

Such a result could force difficult decisions about MicroStrategy's Bitcoin holdings.

The article references the 2022 Terra-LUNA collapse, where a $40 billion market capitalization evaporated due to a similar leverage spiral. This comparison highlights a real precedent for systemic risk.

The collapse of MicroStrategy's core business adds to the fragility. Software revenue dropped to a 15-year low of $463 million in 2024, and employee numbers have decreased by over 20% since 2020.

The company is essentially a Bitcoin fund with minimal diversification, meaning its fortune rises and falls with the cryptocurrency market.

Elsewhere, critics argue that this concentration poses a threat to Bitcoin's decentralized spirit.

Leshka agreed, noting that Bitcoin was built to avoid central control, making MicroStrategy's holding of 3% of total BTC a single point of failure.

However, not all analysts see this situation as apocalyptic. Convertible bonds mature from 2027 to 2031, with minimal short-term interest obligations. If Bitcoin avoids collapsing below $30,000, forced liquidations are unlikely.

Additionally, in financial stress, MicroStrategy could dilute shares instead of directly selling BTC, providing flexibility.

However, the core concern remains a system dependent on continuous optimism and capital raising based on an inherently fragile premium.