Title: 'EigenLayer and Ether.fi Transform, Is the reStaking Track Becoming Unsustainable?'

Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

In the first half of 2024, the concept of secondary earnings sparked market excitement, and "reStaking" momentarily became the core topic sweeping the crypto ecosystem. EigenLayer rose, with projects like Ether.fi and Renzo emerging successively, and reStaking tokens (LRT) blooming everywhere.

However, the two leading projects in the track have now chosen to transform:

Ether.fi announced a transformation into a crypto neobank, planning to launch a cash card and staking services for US users;

Eigen Labs announced layoffs of about 25% and will reorganize resources, focusing comprehensively on the new product EigenCloud.

Once hot "reStaking" now faces a turning point. Do the strategic adjustments of these two leaders signal that this track is becoming ineffective?

Emergence, Boom, and Clearing

In the past few years, the reStaking track has experienced a cycle from conceptual testing to capital-intensive influx.

According to RootData, over 70 projects have been born in the reStaking track. EigenLayer in the Ethereum ecosystem was the first to push the ReStaking model to market, triggering a collective explosion of liquidity reStaking protocols like Ether.fi, Renzo, and Kelp DAO. Subsequently, new architectural projects like Symbiotic and Karak also emerged.

In 2024, financing events surged to 27, attracting nearly $230 million, becoming one of the hottest tracks in the crypto market. Entering 2025, the financing pace began to slow, and the track's overall heat gradually cooled.

Meanwhile, track reshuffling accelerated. 11 projects, including Moebius Finance, goTAO, and FortLayer, have ceased operations, gradually clearing early bubbles.

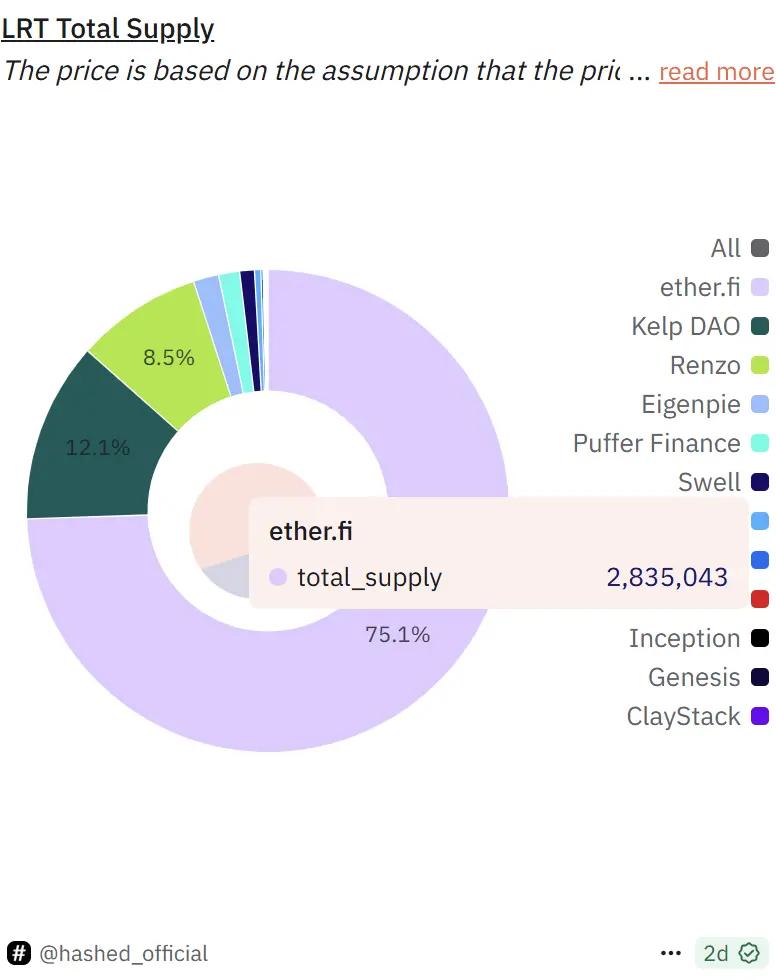

Currently, EigenLayer remains the track's leader, with a TVL of about $14.2 billion, occupying over 63% of the industry's market share. In its ecosystem, Ether.fi holds about 75% share, with Kelp DAO and Renzo at 12% and 8.5% respectively.

Narrative Losing Weight: Cooling Signals Behind the Data

Currently, the total TVL of reStaking protocols is about $22.4 billion, down 22.7% from the historical peak in December 2024 (about $29 billion). Although the overall lock-up volume remains high, reStaking's growth momentum has shown signs of slowing.

Image source: defillama

User activity has declined more significantly. According to The Block, daily active deposit users for Ethereum liquidity reStaking have plummeted from the July 2024 peak (over a thousand) to just thirty-odd currently, with EigenLayer's daily independent deposit addresses even dropping to single digits.

Image source: The Block

From a validator perspective, reStaking's attractiveness is also weakening. Currently, daily active reStaking validators are less than 3% compared to regular staking validators.

Additionally, token prices for Ether.fi, EigenLayer, Puffer, and others have pulled back over 70% from their peaks. Overall, while the reStaking track maintains some volume, user activity and participation enthusiasm have significantly declined, with the ecosystem falling into a "weightless" state. The narrative-driven effect has weakened, and track growth has entered a bottleneck period.

Top Projects Transforming: Is the ReStaking Business Unsustainable?

As "airdrop period dividends" fade and track heat dissipates, with expected return curves flattening, reStaking projects must now face the question: How can platforms achieve long-term growth?

Taking Ether.fi as an example, it achieved over $3.5 million in revenue for two consecutive months in late 2024, but by April 2025, revenue dropped to $2.4 million. In the reality of slowing growth momentum, a single reStaking function might struggle to support a complete business narrative.

In April, Ether.fi began expanding its product boundaries, transforming into a "crypto neobank" by building a closed loop of financial operations through real-world scenarios like "bill payment, salary distribution, savings, and consumption". The "cash card + reStaking" dual-track combination became its new engine to activate user stickiness and retention.

Unlike Ether.fi's "application layer breakthrough", EigenLayer chose a more infrastructure-strategic level reconstruction.

On July 9th, Eigen Labs announced layoffs of about 25% and concentrated resources on the new developer platform EigenCloud, attracting a new $70 million investment from a16z. EigenCloud integrates EigenDA, EigenVerify, and EigenCompute, attempting to provide a universal trust infrastructure for on-chain and off-chain applications.

The transformations of Ether.fi and EigenLayer, though different in path, essentially point to two solutions of the same logic: turning "reStaking" from an end-point narrative to a "starting module", transforming from a purpose itself to a means of building more complex application systems.

ReStaking is not dead, but its "single-thread growth mode" may be difficult to continue. Only when embedded in a more scale-effect application narrative can it maintain the ability to continuously attract users and capital.

The mechanism design of the reStaking track that ignited market enthusiasm with "secondary earnings" is now seeking new landing points and vitality in a more complex application map.